Credit card debt often carries high interest rates and fees, making it a costly option for short-term borrowing. In contrast, crypto-backed loans typically offer lower interest rates by using digital assets as collateral, reducing reliance on credit scores. However, market volatility in cryptocurrencies can increase risk, requiring careful consideration before choosing a crypto-backed loan over traditional credit cards.

Table of Comparison

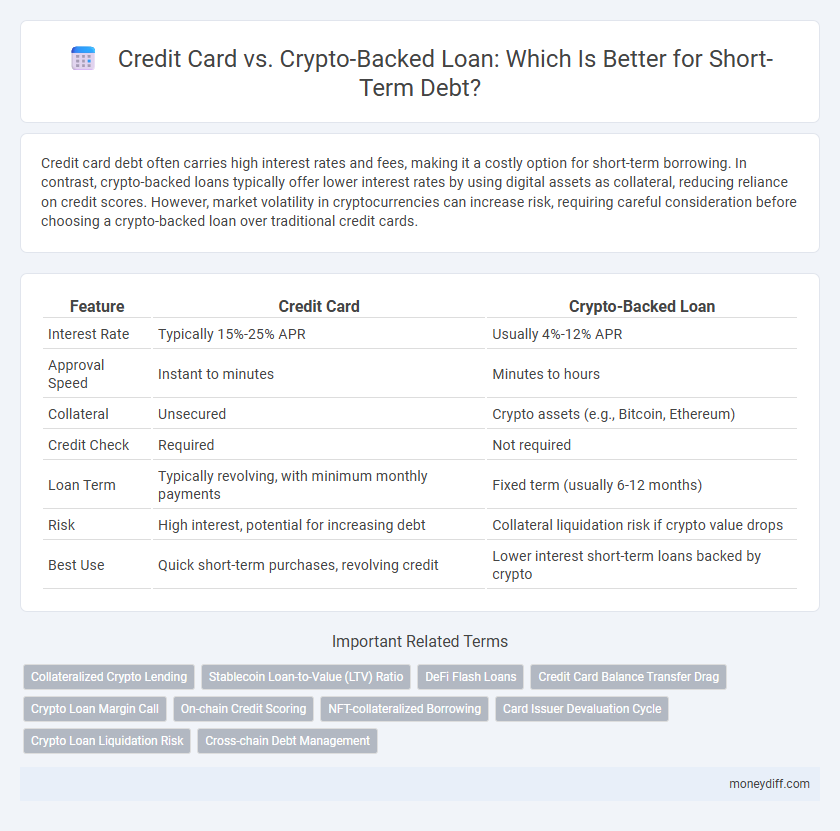

| Feature | Credit Card | Crypto-Backed Loan |

|---|---|---|

| Interest Rate | Typically 15%-25% APR | Usually 4%-12% APR |

| Approval Speed | Instant to minutes | Minutes to hours |

| Collateral | Unsecured | Crypto assets (e.g., Bitcoin, Ethereum) |

| Credit Check | Required | Not required |

| Loan Term | Typically revolving, with minimum monthly payments | Fixed term (usually 6-12 months) |

| Risk | High interest, potential for increasing debt | Collateral liquidation risk if crypto value drops |

| Best Use | Quick short-term purchases, revolving credit | Lower interest short-term loans backed by crypto |

Understanding Short-Term Debt Solutions

Credit card debt offers immediate access to funds with flexible repayment options but typically carries high interest rates and potential fees that increase short-term cost. Crypto-backed loans leverage digital assets as collateral, often providing lower interest rates and quicker approval times, yet involve volatility risk inherent in cryptocurrency markets. Evaluating interest rates, repayment terms, and asset volatility is essential when choosing between credit card debt and crypto-backed loans for managing short-term financial needs.

Credit Cards: Traditional Short-Term Borrowing

Credit cards offer a widely accessible and flexible short-term borrowing option with established credit limits and rewards programs, making them a convenient tool for managing immediate expenses. Interest rates on credit cards typically range from 15% to 25% APR, which can lead to high-cost debt if balances are not paid off promptly. Unlike crypto-backed loans, credit cards do not require collateral but may affect credit scores based on usage and payment history.

What Is a Crypto-Backed Loan?

A crypto-backed loan is a type of short-term debt where borrowers use their cryptocurrency assets as collateral to secure a loan, allowing them to access funds without liquidating their digital holdings. These loans typically offer lower interest rates compared to credit cards due to the reduced lender risk from the secured collateral. Unlike credit card debt, crypto-backed loans often provide flexible repayment terms and protect users from the high volatility associated with selling cryptocurrencies.

Comparing Interest Rates: Credit Card vs Crypto-Loan

Credit card interest rates typically range between 15% and 25% APR, often resulting in high costs for short-term debt. Crypto-backed loans usually offer significantly lower interest rates, ranging from 6% to 12% APR, leveraging digital assets as collateral. Borrowers with sufficient crypto holdings can access cheaper financing through crypto-backed loans compared to traditional credit card debt.

Approval Process and Eligibility Requirements

Credit card approval generally requires a good credit score, steady income, and a thorough credit check, making it accessible for many borrowers with established credit histories. Crypto-backed loans leverage blockchain assets as collateral, allowing faster approval with minimal credit evaluation but require significant crypto holdings and secure wallet access. Both options cater to different risk profiles: credit cards depend on creditworthiness, while crypto loans hinge on cryptocurrency value and ownership verification.

Credit Impact: Score Considerations

Credit card debt typically impacts credit scores through high utilization ratios and timely payments, influencing creditworthiness more directly and frequently. Crypto-backed loans often do not report to credit bureaus, minimizing immediate credit score effects but posing risks if default leads to asset liquidation. Borrowers prioritizing credit score maintenance should weigh the transparent impact of credit cards against the less visible but potentially severe consequences of crypto-backed loans.

Accessibility and Convenience

Credit card debt offers widespread accessibility with instant approval and flexible spending limits accepted at millions of merchants worldwide, making it highly convenient for short-term borrowing. Crypto-backed loans provide quick access to funds without credit checks, leveraging digital assets as collateral, but their usage is limited by platform availability and cryptocurrency volatility. Both options cater to different user preferences, with credit cards excelling in everyday convenience and crypto loans appealing to those with digital asset portfolios seeking alternative liquidity.

Risks: Volatility vs Fixed Debt

Credit card debt carries fixed interest rates and predictable repayment schedules, which allows for structured debt management but often comes with high interest costs. Crypto-backed loans offer potentially lower interest rates but expose borrowers to significant market volatility, risking liquidation if cryptocurrency values drop sharply. The choice hinges on balancing the security of fixed debt against the risk of asset depreciation in volatile crypto markets.

Repayment Flexibility and Terms

Credit card debt typically demands minimum monthly payments with high interest rates, limiting repayment flexibility and often resulting in prolonged debt periods. Crypto-backed loans offer more customizable repayment terms, allowing borrowers to repay principal and interest according to agreed schedules without mandatory monthly minimums. The ability to retain asset collateral in crypto loans can provide lower interest rates and tailored durations, making them advantageous for managing short-term debt compared to traditional credit cards.

Which Option is Right for Your Situation?

Choosing between a credit card and a crypto-backed loan for short-term debt depends on factors such as interest rates, repayment flexibility, and risk tolerance. Credit cards often have higher interest rates but provide instant access and widespread acceptance, while crypto-backed loans may offer lower rates and longer terms but carry volatility risks linked to cryptocurrency market fluctuations. Assess your financial stability, asset liquidity, and ability to manage potential market dips before deciding the most suitable option for your debt needs.

Related Important Terms

Collateralized Crypto Lending

Collateralized crypto lending offers lower interest rates and flexible repayment terms compared to traditional credit card debt, leveraging cryptocurrency assets as collateral to secure loans. This method reduces credit risk while providing immediate liquidity without the high fees and compounded interest typical of credit card borrowing.

Stablecoin Loan-to-Value (LTV) Ratio

Credit card debt typically carries high-interest rates with no collateral requirements, while crypto-backed loans use stablecoins as collateral, allowing for lower interest rates due to a controlled Loan-to-Value (LTV) ratio, often between 50-70%, which mitigates risk and helps maintain liquidity. Managing the Stablecoin LTV ratio is crucial in crypto-backed loans to prevent liquidation during market volatility, offering a more secure and potentially cost-effective option for short-term debt compared to traditional credit cards.

DeFi Flash Loans

Credit card debt typically incurs high-interest rates and rigid repayment terms, whereas DeFi flash loans offer instant, unsecured short-term borrowing within blockchain ecosystems, enabling users to leverage crypto assets without collateral. Flash loans uniquely execute and settle within a single transaction block, minimizing risk but requiring technical expertise unlike traditional credit options.

Credit Card Balance Transfer Drag

Credit card balance transfers often incur fees up to 5% and higher interest rates after introductory periods, causing significant cost drag on short-term debt management. In contrast, crypto-backed loans typically offer lower interest rates and flexible terms, reducing the financial burden and improving repayment efficiency.

Crypto Loan Margin Call

Crypto-backed loans offer lower interest rates compared to credit cards but carry the risk of a margin call if cryptocurrency collateral value falls sharply. A margin call requires borrowers to add more crypto or repay part of the loan immediately, posing liquidity challenges absent in traditional credit card debt.

On-chain Credit Scoring

On-chain credit scoring leverages blockchain transparency to assess creditworthiness for crypto-backed loans, often enabling lower interest rates and faster approval compared to traditional credit card debt, which relies on centralized credit bureaus. This decentralized approach reduces risk for lenders by providing real-time, immutable financial data, making crypto-backed loans a more efficient option for managing short-term debt.

NFT-collateralized Borrowing

NFT-collateralized borrowing offers a cutting-edge alternative to traditional credit card debt by allowing short-term loans secured with valuable digital assets, often resulting in lower interest rates and faster approval processes. Unlike credit cards that rely on credit scores, NFT-backed loans leverage blockchain-verified ownership, providing borrowers with a transparent and flexible debt solution tailored for digital asset holders.

Card Issuer Devaluation Cycle

Credit card debt often triggers the card issuer devaluation cycle due to rising interest rates and fees, making repayments expensive and reducing credit limits over time. In contrast, crypto-backed loans offer stable collateral value and lower interest rates, minimizing issuer-imposed devaluation risks during short-term borrowing.

Crypto Loan Liquidation Risk

Crypto-backed loans offer lower interest rates compared to credit cards but carry significant liquidation risk if cryptocurrency values drop sharply, potentially resulting in the loss of collateral. In contrast, credit card debt has fixed repayment terms and predictable fees, avoiding the volatility and forced asset liquidation inherent in crypto loans.

Cross-chain Debt Management

Credit card debt typically incurs high-interest rates and limited repayment flexibility, whereas crypto-backed loans offer lower rates and customizable terms, leveraging cross-chain protocols to optimize asset liquidity and collateral management. Cross-chain debt management enhances risk diversification and seamless asset transfers across multiple blockchain networks, improving short-term debt solutions for borrowers seeking efficient and transparent financial options.

Credit card vs Crypto-backed loan for short-term debt. Infographic

moneydiff.com

moneydiff.com