Traditional credit cards allow users to carry a balance and incur interest on unpaid debt, making them suitable for managing ongoing expenses with flexible repayment options. Charge cards require full payment each month, eliminating interest charges but demanding disciplined budgeting to avoid late fees and penalties. Understanding the differences in repayment terms and fees is crucial for effectively managing debt and maintaining financial health.

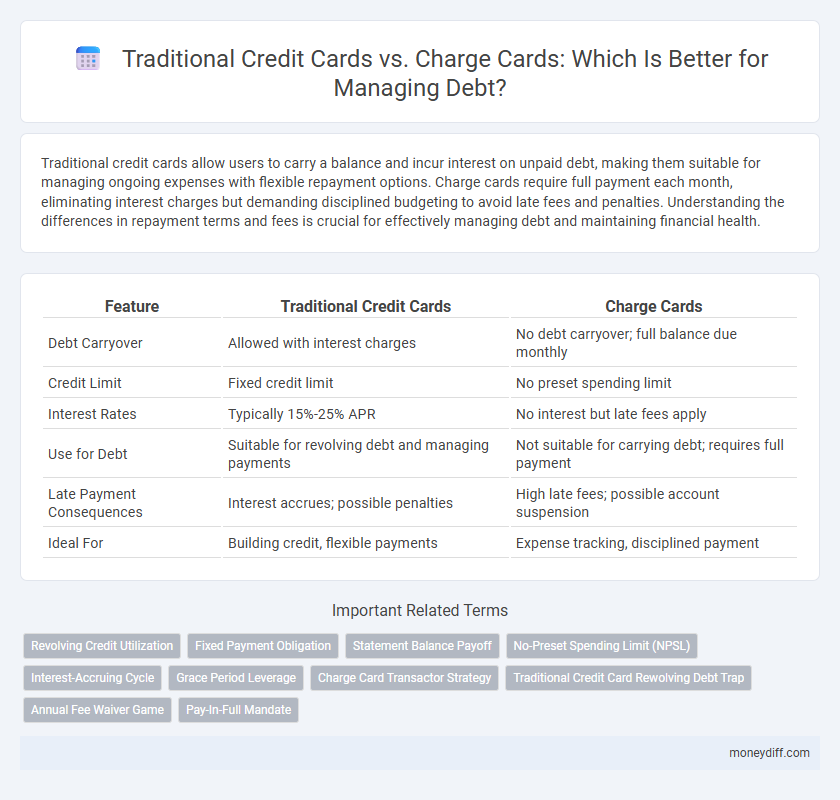

Table of Comparison

| Feature | Traditional Credit Cards | Charge Cards |

|---|---|---|

| Debt Carryover | Allowed with interest charges | No debt carryover; full balance due monthly |

| Credit Limit | Fixed credit limit | No preset spending limit |

| Interest Rates | Typically 15%-25% APR | No interest but late fees apply |

| Use for Debt | Suitable for revolving debt and managing payments | Not suitable for carrying debt; requires full payment |

| Late Payment Consequences | Interest accrues; possible penalties | High late fees; possible account suspension |

| Ideal For | Building credit, flexible payments | Expense tracking, disciplined payment |

Understanding Traditional Credit Cards

Traditional credit cards allow users to carry a balance month-to-month, accumulating interest on outstanding debt based on the card's annual percentage rate (APR). They offer a revolving credit line with minimum monthly payments, enabling flexible debt repayment but potentially leading to long-term interest costs. This credit structure supports ongoing borrowing but requires careful management to avoid escalating debt and high-interest fees.

What Are Charge Cards?

Charge cards require full payment of the balance each month, eliminating the option to carry debt unlike traditional credit cards that allow revolving balances. They often come with no preset spending limit, offering flexibility but requiring disciplined financial management to avoid high fees. Charge cards are ideal for users who want to avoid interest charges and maintain clear control over debt repayment.

Credit Limits: Key Differences

Traditional credit cards offer predefined credit limits that allow users to carry balances and pay over time, often with interest accumulating on outstanding debt. Charge cards, by contrast, usually have no predetermined spending limit but require full payment of the balance each billing cycle, minimizing long-term debt accumulation. Understanding these credit limit distinctions is crucial for managing debt risk and optimizing payment strategies.

Interest Rates and Fees Comparison

Traditional credit cards typically charge variable interest rates averaging 15% to 25% APR on carried balances and often include annual fees ranging from $0 to $95. Charge cards usually do not have preset spending limits and require full payment each month, eliminating interest charges but potentially imposing late payment fees upwards of $38. Comparing fees, traditional credit cards may accumulate significant interest debt over time, while charge cards emphasize disciplined repayment without interest but may involve higher penalty fees.

Repayment Terms and Flexibility

Traditional credit cards offer revolving credit with minimum monthly payments, allowing users to carry balances and pay interest over time, providing flexibility in managing debt. Charge cards require full balance repayment each billing cycle, eliminating interest charges but offering less flexibility for carrying debt long-term. Understanding these repayment terms helps consumers choose the best option for their debt management needs.

Impact on Credit Scores

Traditional credit cards allow revolving balances with minimum payments, which can impact credit utilization ratios and potentially lower credit scores if balances remain high. Charge cards require full payment each month, preventing revolving debt and often leading to more consistent on-time payments that positively influence credit history. Both types affect credit scores but using charge cards responsibly may demonstrate stronger payment behavior and lower credit risk over time.

Rewards and Benefits Comparison

Traditional credit cards offer flexible repayment options with interest charges on carried balances, typically featuring cash back, travel points, and store-specific rewards. Charge cards require full payment each billing cycle, often providing premium perks like higher reward points rates, exclusive access to events, and no preset spending limits. Comparing rewards, charge cards generally yield greater value for frequent travelers or high spenders, while credit cards suit individuals prioritizing manageable debt with standard incentives.

Debt Accumulation Risks

Traditional credit cards allow users to carry a revolving balance, which can lead to high debt accumulation due to interest charges on unpaid balances. Charge cards require full payment each billing cycle, minimizing the risk of long-term debt but potentially causing financial strain if payments cannot be met in full. Understanding the difference between these payment methods is crucial for managing debt and avoiding excessive interest payments.

Suitability for Different Financial Profiles

Traditional credit cards offer revolving credit with flexible payment options, making them suitable for individuals who prefer managing debt over time and building credit scores gradually. Charge cards require full payment each month, appealing to disciplined spenders with stable cash flow who want to avoid interest charges and maintain strict budget control. High-income professionals often favor charge cards for rewards and status benefits, while credit cards better serve those seeking gradual debt repayment and lower upfront financial commitment.

Choosing the Right Card for Debt Management

Traditional credit cards offer revolving credit with flexible repayment options and minimum monthly payments, making them suitable for managing ongoing debt with variable interest rates. Charge cards require full payment each month, preventing debt accumulation but necessitating disciplined financial management to avoid penalties. Selecting the right card depends on individual spending habits, ability to repay balances, and long-term debt management goals.

Related Important Terms

Revolving Credit Utilization

Traditional credit cards offer revolving credit utilization, allowing users to carry a balance and make minimum monthly payments, which can impact credit scores based on utilization ratios. Charge cards require full balance payment each billing cycle, eliminating revolving debt but limiting usage for managing ongoing debt levels.

Fixed Payment Obligation

Traditional credit cards offer revolving credit with flexible minimum payments, allowing users to carry a balance and accrue interest over time. Charge cards require full payment of the balance each month, enforcing a fixed payment obligation that helps avoid recurring debt and interest charges.

Statement Balance Payoff

Traditional credit cards allow carrying a statement balance with minimum payments and interest accrual, making them suitable for managing revolving debt over time. Charge cards require full statement balance payoff each month, eliminating interest but demanding disciplined cash flow to avoid penalties.

No-Preset Spending Limit (NPSL)

Charge cards with No-Preset Spending Limit (NPSL) offer flexible purchasing power based on creditworthiness and account history rather than a fixed credit line, contrasting with traditional credit cards that impose predetermined credit limits. This flexibility can aid in managing high-value transactions without immediate debt accumulation but requires disciplined repayment to avoid potential financial strain.

Interest-Accruing Cycle

Traditional credit cards allow users to carry a balance and accumulate interest during the billing cycle if the full amount is not paid, leading to ongoing debt accrual. Charge cards require full payment each month, eliminating interest charges but increasing the risk of late fees and potential negative impact on credit if payment is missed.

Grace Period Leverage

Traditional credit cards offer a grace period that allows users to pay off their balance without interest if the full amount is settled by the due date, providing effective leverage for short-term debt management. Charge cards lack a grace period as the balance must be paid in full each billing cycle, limiting debt accumulation but reducing flexibility in leveraging grace periods for cash flow.

Charge Card Transactor Strategy

Charge card transactor strategy involves paying off the full balance each billing cycle to avoid interest charges, making it ideal for managing debt without accruing interest. Unlike traditional credit cards, charge cards do not allow carrying a balance, which enforces disciplined spending and timely payments to maintain financial stability.

Traditional Credit Card Rewolving Debt Trap

Traditional credit cards often lead to a revolving debt trap due to their minimum payment options and high interest rates, causing balances to grow indefinitely. Charge cards require full monthly repayment, preventing debt accumulation but necessitating strict cash flow management.

Annual Fee Waiver Game

Traditional credit cards often waive annual fees after a minimum spending threshold, enabling users to avoid upfront costs and manage debt more flexibly, whereas charge cards typically impose higher annual fees without waive options but offer robust rewards and spending limits that reset monthly. Understanding these fee structures can optimize debt management strategies by balancing cost savings with credit utilization benefits.

Pay-In-Full Mandate

Traditional credit cards allow users to carry a balance with interest charges, increasing overall debt if not paid monthly. Charge cards require full payment each billing cycle, preventing revolving debt but imposing strict pay-in-full mandates to avoid penalties.

Traditional credit cards vs Charge cards for debt usage Infographic

moneydiff.com

moneydiff.com