Personal loans offer fixed interest rates and predictable monthly payments, making them a suitable option for borrowers seeking long-term financing with transparent repayment terms. Buy now pay later (BNPL) services provide short-term, interest-free installments that appeal to consumers wanting immediate gratification without upfront costs, but they often carry higher fees or penalties if payments are missed. Evaluating the total cost, repayment flexibility, and credit impact is essential when choosing between personal loans and BNPL for consumer borrowing.

Table of Comparison

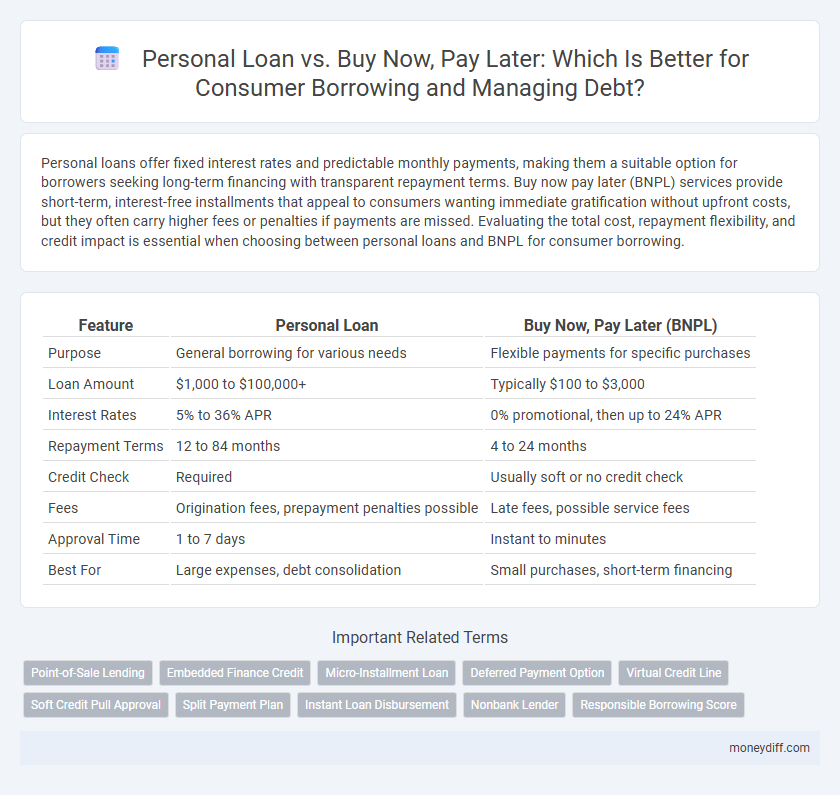

| Feature | Personal Loan | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Purpose | General borrowing for various needs | Flexible payments for specific purchases |

| Loan Amount | $1,000 to $100,000+ | Typically $100 to $3,000 |

| Interest Rates | 5% to 36% APR | 0% promotional, then up to 24% APR |

| Repayment Terms | 12 to 84 months | 4 to 24 months |

| Credit Check | Required | Usually soft or no credit check |

| Fees | Origination fees, prepayment penalties possible | Late fees, possible service fees |

| Approval Time | 1 to 7 days | Instant to minutes |

| Best For | Large expenses, debt consolidation | Small purchases, short-term financing |

Understanding Personal Loans and Buy Now Pay Later

Personal loans offer fixed interest rates and structured repayment terms, making them a predictable borrowing option for consumers needing funds. Buy Now Pay Later (BNPL) services provide short-term, interest-free installments but often lack comprehensive credit checks and can lead to overspending. Understanding the differences in cost, credit impact, and repayment flexibility helps consumers make informed borrowing decisions.

Key Differences Between Personal Loans and BNPL

Personal loans typically offer fixed interest rates, longer repayment terms, and larger borrowing amounts, making them suitable for significant expenses or debt consolidation. Buy Now Pay Later (BNPL) services provide short-term, interest-free repayment options with smaller purchase limits, ideal for immediate consumer goods and manageable budgets. Unlike personal loans, BNPL often involves minimal credit checks and faster approval, but can lead to higher overall costs if payments are missed.

Eligibility Criteria for Personal Loan vs BNPL

Eligibility criteria for a personal loan typically include a stable income, good credit score, and proof of employment, with lenders often requiring detailed financial documentation. Buy Now Pay Later (BNPL) services generally have more lenient requirements, focusing on minimal credit checks and simpler verification processes, making them accessible to a broader range of consumers. Personal loans demand a more rigorous assessment of creditworthiness compared to BNPL options, which prioritize quick approval and ease of use over extensive eligibility screening.

Interest Rates: Personal Loan vs Buy Now Pay Later

Personal loans typically have fixed interest rates ranging from 6% to 36% APR, providing predictable monthly payments over a set term. Buy Now Pay Later (BNPL) services often offer low or zero interest if payments are made within the promotional period but can charge rates exceeding 20% APR for missed or late payments. Consumers should compare the effective interest rates and repayment terms to assess the true cost of borrowing between personal loans and BNPL options.

Application Process and Approval Speed

Personal loans typically require a comprehensive application process involving credit checks, income verification, and documentation, leading to approval times ranging from a few days to over a week. Buy now pay later (BNPL) services offer a streamlined, often instant approval process with minimal credit checks, enabling consumers to access funds immediately at the point of sale. The faster approval and simpler application for BNPL make it appealing for short-term borrowing, while personal loans suit consumers seeking larger amounts with longer repayment terms.

Impact on Credit Score: Comparing Both Options

Personal loans typically have a more significant impact on credit scores due to their installment loan nature, involving regular monthly payments reported to credit bureaus. Buy Now Pay Later (BNPL) options may have a limited or no immediate effect on credit scores if payments are made on time, as many BNPL providers do not report to credit agencies unless defaults occur. Borrowers seeking to build credit might prefer personal loans, while those prioritizing convenience and lower credit impact may opt for BNPL, keeping in mind the risk of missed payments and potential subsequent credit damage.

Fees and Hidden Charges to Watch Out For

Personal loans typically have transparent interest rates and fixed fees clearly stated in the loan agreement, making it easier for consumers to budget repayments without unexpected costs. Buy Now Pay Later (BNPL) services may appear interest-free but often include hidden charges such as late fees, account management fees, or high penalty rates if payments are missed. Consumers should scrutinize BNPL terms for potential fees that can escalate the overall borrowing cost compared to traditional personal loan options.

Flexibility of Repayment Terms

Personal loans offer flexible repayment terms with fixed monthly installments over a predetermined period, providing borrowers with predictable budgeting and lower risk of overspending. Buy now, pay later (BNPL) services typically require payments in shorter intervals, often interest-free if paid on time, but may lead to higher costs and less control if missed deadlines occur. Consumers seeking long-term, stable repayment schedules generally benefit more from personal loans compared to the variable and often restrictive terms of BNPL options.

Which Option is Safer for Managing Debt?

Personal loans typically offer fixed interest rates and repayment schedules, making them a safer option for managing debt by providing predictable monthly payments and a clear payoff timeline. Buy Now Pay Later (BNPL) services can lead to overspending and accumulate multiple short-term debts without interest, increasing the risk of missing payments and damaging credit scores. Choosing a personal loan helps maintain financial discipline and reduces the likelihood of falling into unmanageable debt compared to the flexible but potentially costly BNPL option.

Choosing the Right Option for Your Financial Situation

Personal loans typically offer fixed interest rates and set repayment terms, providing predictable monthly payments that help in budgeting and long-term financial planning. Buy Now Pay Later (BNPL) services often come with zero or low-interest promotional periods but can lead to higher overall costs if payments are deferred beyond these terms or if multiple BNPL agreements overlap. Evaluating your ability to manage consistent monthly payments versus short-term deferrals can guide you to select the borrowing option that aligns best with your income stability and debt management goals.

Related Important Terms

Point-of-Sale Lending

Personal loans typically offer fixed interest rates and longer repayment terms, making them suitable for larger expenses or debt consolidation, while Buy Now Pay Later (BNPL) services provide interest-free or low-cost installments at the point of sale, enhancing immediate purchasing power but often with shorter repayment periods. Consumers should evaluate factors such as total cost, repayment flexibility, and impact on credit scores when choosing point-of-sale lending options.

Embedded Finance Credit

Personal loans typically offer lower interest rates and fixed repayment schedules, making them suitable for larger, planned expenses, while Buy Now Pay Later (BNPL) services leverage embedded finance to provide instant, short-term credit often integrated directly at checkout. Embedded finance credit in BNPL enhances consumer borrowing convenience but may carry higher overall costs and less stringent credit checks compared to traditional personal loans.

Micro-Installment Loan

Micro-installment loans offer flexible repayment terms with fixed monthly payments, making them a practical alternative to buy now pay later (BNPL) options that often involve deferred interest or fees. Unlike BNPL, micro-installment loans provide clear loan agreements and potential credit building, which support responsible consumer borrowing and financial planning.

Deferred Payment Option

Personal loans offer fixed interest rates and structured repayment terms, providing clear timelines and predictable costs for borrowers choosing deferred payment options. Buy now pay later (BNPL) plans often feature interest-free periods but may impose high fees or interest rates after deferment, making them riskier for long-term debt management.

Virtual Credit Line

Virtual credit line options offer flexible borrowing limits and typically lower interest rates compared to buy now pay later plans, making them a cost-effective choice for managing personal loan repayments. Consumers benefit from immediate access to funds with virtual credit lines, avoiding the deferred payment fees and potential credit score impacts commonly associated with buy now pay later services.

Soft Credit Pull Approval

Personal loans typically require a soft credit pull during pre-approval, which does not impact credit scores, unlike some buy now pay later (BNPL) services that may perform hard credit inquiries. Soft credit pull approval enhances consumer borrowing flexibility by allowing users to assess loan options without risking credit score damage.

Split Payment Plan

Split payment plans offer a flexible alternative to traditional personal loans by enabling consumers to divide purchases into manageable installments without incurring high-interest rates commonly associated with personal loans. This approach often includes transparent fees and fixed repayment schedules, making it easier for borrowers to budget and avoid long-term debt accumulation compared to buy now, pay later services that may impose late fees and variable interest.

Instant Loan Disbursement

Personal loans offer higher loan amounts with instant disbursement typically within 24 hours, making them suitable for larger consumer borrowing needs. Buy Now Pay Later (BNPL) provides quick access to smaller funds at checkout but may have limited approval criteria and shorter repayment terms.

Nonbank Lender

Nonbank lenders offering personal loans typically provide fixed interest rates and structured repayment terms, making them a more predictable borrowing option compared to buy now pay later (BNPL) services, which often entail variable fees and shorter repayment periods. Consumers opting for BNPL through nonbank platforms may face higher overall costs due to late fees and accelerated payment demands, whereas personal loans from these lenders can improve credit scores with consistent on-time payments.

Responsible Borrowing Score

Personal loans typically offer lower interest rates and fixed repayment schedules, contributing positively to a higher Responsible Borrowing Score by encouraging disciplined repayment habits. Buy Now Pay Later options, while convenient, often lead to fragmented debt and higher risk of missed payments, which can negatively impact the consumer's Responsible Borrowing Score over time.

Personal loan vs buy now pay later for consumer borrowing. Infographic

moneydiff.com

moneydiff.com