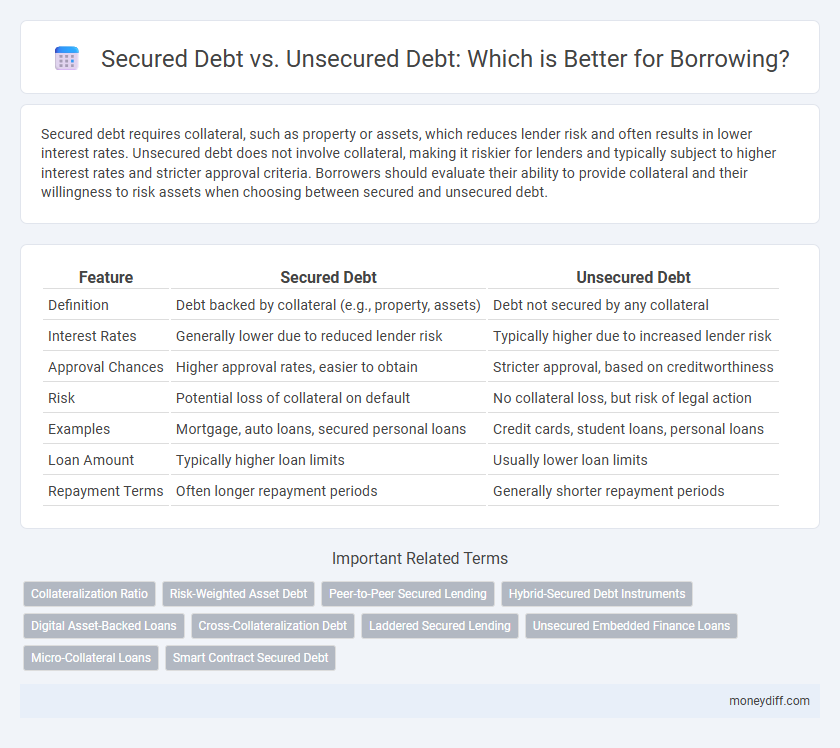

Secured debt requires collateral, such as property or assets, which reduces lender risk and often results in lower interest rates. Unsecured debt does not involve collateral, making it riskier for lenders and typically subject to higher interest rates and stricter approval criteria. Borrowers should evaluate their ability to provide collateral and their willingness to risk assets when choosing between secured and unsecured debt.

Table of Comparison

| Feature | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Debt backed by collateral (e.g., property, assets) | Debt not secured by any collateral |

| Interest Rates | Generally lower due to reduced lender risk | Typically higher due to increased lender risk |

| Approval Chances | Higher approval rates, easier to obtain | Stricter approval, based on creditworthiness |

| Risk | Potential loss of collateral on default | No collateral loss, but risk of legal action |

| Examples | Mortgage, auto loans, secured personal loans | Credit cards, student loans, personal loans |

| Loan Amount | Typically higher loan limits | Usually lower loan limits |

| Repayment Terms | Often longer repayment periods | Generally shorter repayment periods |

Understanding Secured and Unsecured Debt

Secured debt requires collateral, such as property or assets, reducing the lender's risk and often resulting in lower interest rates compared to unsecured debt. Unsecured debt relies solely on the borrower's creditworthiness without collateral, typically carrying higher interest rates due to increased lender risk. Understanding the differences helps borrowers choose appropriate financing options based on risk tolerance and borrowing needs.

Key Differences Between Secured and Unsecured Loans

Secured loans require collateral such as property or assets, reducing lender risk and often resulting in lower interest rates and higher borrowing limits. Unsecured loans do not necessitate collateral, making them more accessible but typically coming with higher interest rates and stricter credit requirements. The key differences include risk exposure for the borrower, loan approval criteria, and the potential consequences of default, where secured loans may lead to asset forfeiture.

Common Types of Secured Debt

Common types of secured debt include mortgages, auto loans, and secured personal loans, where the borrower pledges assets as collateral, reducing lender risk and often lowering interest rates. Home equity loans and secured credit cards are other frequent examples, providing borrowers with access to credit against the value of owned property or assets. Secured debt offers stronger creditor claims in case of default, making it distinct from unsecured debt, which relies solely on the borrower's creditworthiness.

Common Types of Unsecured Debt

Common types of unsecured debt include credit card balances, medical bills, personal loans, and student loans, all of which do not require collateral for borrowing. These debts typically carry higher interest rates compared to secured debts like mortgages or auto loans, reflecting the increased risk lenders face. Unsecured debt repayment relies heavily on the borrower's creditworthiness and income stability rather than asset backing.

Pros and Cons of Secured Debt

Secured debt requires collateral, reducing lender risk and often offering lower interest rates and higher borrowing limits, making it a cost-effective option for large loans like mortgages or auto financing. However, the risk of losing the pledged asset, such as a home or vehicle, poses significant financial consequences if payments are missed. Secured debt can also limit borrower flexibility since the asset tied to the loan becomes a legal obligation subject to repossession or foreclosure.

Pros and Cons of Unsecured Debt

Unsecured debt, such as credit cards and personal loans, does not require collateral, offering borrowers greater flexibility and faster access to funds. However, it typically carries higher interest rates and stricter credit score requirements compared to secured debt, increasing the overall cost of borrowing. The risk of default can lead to severe credit damage and potential legal actions, as lenders rely solely on the borrower's creditworthiness rather than asset backing.

Interest Rates: Secured vs Unsecured Debt

Secured debt typically offers lower interest rates due to the lender's reduced risk, as the loan is backed by collateral such as property or assets. Unsecured debt usually commands higher interest rates because it lacks collateral, increasing the lender's risk of default. Borrowers with secured loans benefit from more favorable borrowing costs compared to the elevated rates associated with unsecured borrowing options.

Risk Factors for Borrowers

Secured debt involves borrowing backed by collateral, reducing lender risk but increasing borrower risk of asset loss upon default. Unsecured debt carries higher interest rates due to lack of collateral but puts personal assets at lower immediate risk. Borrowers must evaluate the potential impact on credit scores and financial stability when choosing between secured and unsecured loans.

How to Choose Between Secured and Unsecured Debt

Choosing between secured and unsecured debt depends on factors such as interest rates, repayment terms, and risk tolerance. Secured debt, backed by collateral like a home or car, generally offers lower interest rates but carries the risk of asset loss upon default. Unsecured debt, including credit cards and personal loans, presents higher interest rates and fewer guarantees but no collateral requirement, making it suitable for borrowers without assets to pledge.

Impact on Credit Score and Financial Health

Secured debt, backed by collateral like a home or car, typically results in lower interest rates and positively influences credit scores when payments are timely, reducing overall financial risk. Unsecured debt, such as credit cards or personal loans, carries higher interest rates and greater risk of negative credit score impact if payments are missed or late, potentially damaging financial health. Managing secured debt responsibly can improve credit utilization ratios and payment history, while mishandling unsecured debt often leads to higher credit utilization and increased debt-to-income ratios, harming creditworthiness.

Related Important Terms

Collateralization Ratio

Secured debt requires borrowers to provide collateral, reflected in a collateralization ratio that compares the value of the asset to the loan amount, reducing lender risk and often resulting in lower interest rates. Unsecured debt lacks collateral, leading to higher interest rates due to increased lender risk and typically involves no collateralization ratio.

Risk-Weighted Asset Debt

Secured debt involves borrowing backed by collateral, leading to lower risk-weighted asset (RWA) values and reduced capital requirements for lenders compared to unsecured debt, which lacks collateral and typically carries higher RWAs due to increased default risk. Financial institutions assign higher risk weights to unsecured debt, reflecting its greater potential loss, impacting the overall capital adequacy ratio and influencing lending strategies.

Peer-to-Peer Secured Lending

Peer-to-peer secured lending involves borrowers offering collateral, such as real estate or vehicles, to secure loans, reducing risk for lenders and typically resulting in lower interest rates compared to unsecured debt. Unlike unsecured debt, which relies solely on borrower creditworthiness, secured debt in P2P lending provides a tangible asset, enhancing borrower credibility and improving loan approval chances.

Hybrid-Secured Debt Instruments

Hybrid-secured debt instruments blend features of secured and unsecured debt by using collateral with conditional security interests, offering lenders protection while providing borrowers flexible credit terms. This structure reduces borrowing costs compared to unsecured debt and mitigates risk exposure more effectively than traditional secured loans.

Digital Asset-Backed Loans

Digital asset-backed loans represent a form of secured debt where cryptocurrencies or tokenized assets serve as collateral, significantly lowering lending risk and interest rates compared to unsecured debt. Unsecured debt lacks collateral, leading to higher interest rates and stricter credit requirements, whereas asset-backed loans leverage blockchain technology to enable faster, transparent borrowing with potentially larger credit lines.

Cross-Collateralization Debt

Secured debt involves borrowing backed by collateral, offering lower interest rates and reduced lender risk, while unsecured debt relies solely on creditworthiness without asset backing. Cross-collateralization debt uses multiple assets as collateral for a single loan, effectively increasing borrowing capacity but raising the risk of losing several assets if default occurs.

Laddered Secured Lending

Laddered secured lending strategically staggers loan maturities using collateral-backed debt to minimize risk and enhance liquidity compared to unsecured debt, which lacks asset backing and typically carries higher interest rates due to increased lender risk. This approach optimizes borrowing costs and cash flow management by exploiting the lower default risk and improved credit terms inherent in secured debt structures.

Unsecured Embedded Finance Loans

Unsecured embedded finance loans offer borrowers simplified access to credit without collateral, leveraging real-time data and digital integration within existing platforms to assess risk more efficiently. These loans typically carry higher interest rates than secured debts due to increased risk for lenders but improve financial inclusion by enabling quicker approvals and broader accessibility.

Micro-Collateral Loans

Micro-collateral loans typically involve secured debt, where small-value assets like electronics or personal vehicles act as collateral, reducing lender risk and allowing borrowers easier access to credit. In contrast, unsecured debt lacks collateral, often resulting in higher interest rates and stricter borrowing criteria due to increased lender exposure.

Smart Contract Secured Debt

Smart contract secured debt leverages blockchain technology to provide transparent, automatic enforcement of loan terms, reducing the risk for lenders and offering borrowers lower interest rates compared to traditional unsecured debt, which lacks collateral and relies solely on creditworthiness. This innovation enhances trust and efficiency in borrowing by embedding security features directly into programmable contracts, mitigating default risks through real-time collateral management.

Secured debt vs Unsecured debt for borrowing Infographic

moneydiff.com

moneydiff.com