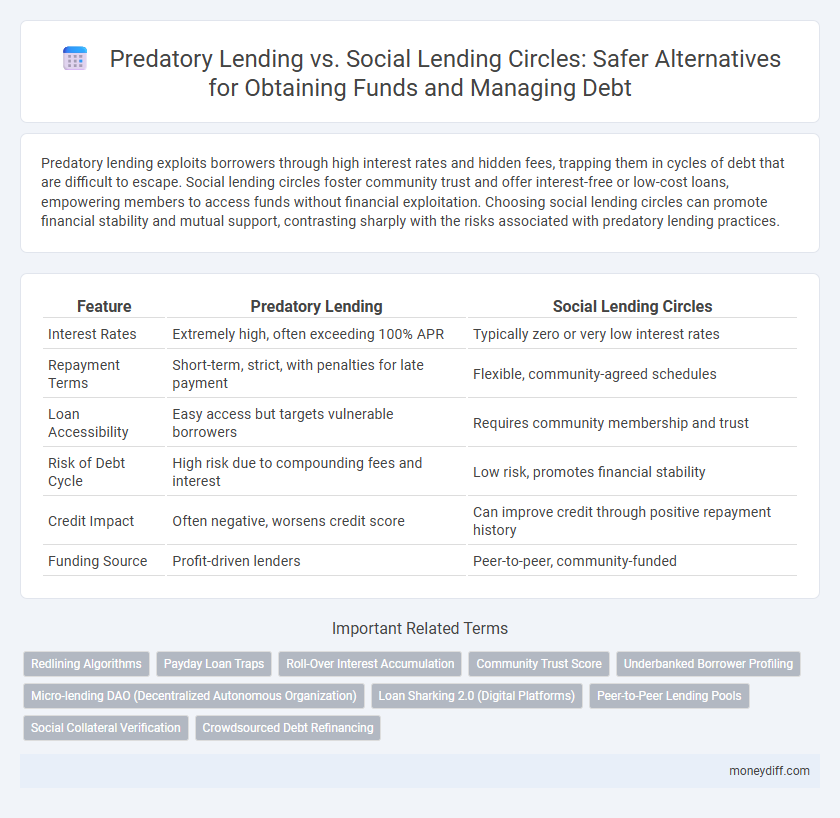

Predatory lending exploits borrowers through high interest rates and hidden fees, trapping them in cycles of debt that are difficult to escape. Social lending circles foster community trust and offer interest-free or low-cost loans, empowering members to access funds without financial exploitation. Choosing social lending circles can promote financial stability and mutual support, contrasting sharply with the risks associated with predatory lending practices.

Table of Comparison

| Feature | Predatory Lending | Social Lending Circles |

|---|---|---|

| Interest Rates | Extremely high, often exceeding 100% APR | Typically zero or very low interest rates |

| Repayment Terms | Short-term, strict, with penalties for late payment | Flexible, community-agreed schedules |

| Loan Accessibility | Easy access but targets vulnerable borrowers | Requires community membership and trust |

| Risk of Debt Cycle | High risk due to compounding fees and interest | Low risk, promotes financial stability |

| Credit Impact | Often negative, worsens credit score | Can improve credit through positive repayment history |

| Funding Source | Profit-driven lenders | Peer-to-peer, community-funded |

Understanding Predatory Lending: Definition and Practices

Predatory lending involves exploitative loan terms that trap borrowers in cycles of debt through high interest rates, hidden fees, and aggressive collection tactics. These loans often target vulnerable populations lacking access to traditional credit, leading to financial instability and reduced economic mobility. In contrast, social lending circles foster community-based peer lending with transparent agreements, promoting trust and responsible borrowing without exorbitant costs.

What Are Social Lending Circles?

Social lending circles are community-based financial groups where members pool funds and lend money to each other without interest, fostering trust and mutual support. Unlike predatory lending, which often involves high interest rates and exploitative terms, social lending circles emphasize transparency, affordability, and collective responsibility. These circles provide a viable alternative for individuals with limited access to traditional credit, promoting financial inclusion and reducing debt burdens.

Key Differences: Predatory Lending vs Social Lending Circles

Predatory lending involves high interest rates and exploitative terms that trap borrowers in cycles of debt, often targeting vulnerable individuals with poor credit or limited financial options. Social lending circles, on the other hand, are community-based, interest-free funding groups that promote mutual trust and financial empowerment without risk of excessive fees or penalties. While predatory loans prioritize lender profits at borrowers' expense, social lending circles emphasize collective support and long-term financial stability.

Risks Associated with Predatory Lending

Predatory lending exposes borrowers to exorbitant interest rates, hidden fees, and aggressive collection practices that can lead to crippling debt and damaged credit scores. Unlike social lending circles, which foster community-based trust and transparent repayment terms, predatory lenders often exploit vulnerable individuals, resulting in a cycle of financial instability. Recognizing these risks is critical to avoiding debt traps and promoting sustainable financial health.

Benefits of Social Lending Circles for Borrowers

Social lending circles offer borrowers lower interest rates and more flexible repayment terms compared to predatory lending, significantly reducing the financial burden. They foster community trust and accountability, which helps members avoid exploitative fees and hidden charges commonly seen in predatory loans. This collaborative approach enhances credit-building opportunities and promotes financial literacy, empowering borrowers to achieve long-term economic stability.

Typical Borrower Profiles: Who Uses Each Option?

Predatory lending typically targets low-income individuals with poor credit scores who lack access to traditional banking services, exploiting their financial vulnerabilities through high-interest rates and hidden fees. Social lending circles attract community members with stable but modest incomes seeking affordable, interest-free loans based on mutual trust and collective responsibility. Borrowers in social lending circles often value social capital and peer accountability over credit history, contrasting sharply with predatory lending clients driven by urgent financial crises.

Impact on Financial Health and Credit Scores

Predatory lending imposes exorbitant interest rates and hidden fees that trap borrowers in cycles of debt, severely damaging credit scores and undermining long-term financial health. Social lending circles offer interest-free or low-interest loans within trusted communities, fostering responsible borrowing and timely repayments that enhance credit profiles and build financial stability. The contrast in outcomes highlights social lending as a sustainable alternative that supports creditworthiness and reduces the risk of financial distress.

Legal Protections and Consumer Rights

Predatory lending often involves deceptive terms, high-interest rates, and minimal legal protections, leading to increased consumer vulnerability and potential financial harm. Social lending circles operate within community-based frameworks, emphasizing transparency, mutual trust, and stronger consumer rights backed by collective oversight. Legal protections in lending circles typically include clear agreements and regulated interest structures, reducing the risk of exploitation compared to predatory lenders.

Community Empowerment Through Social Lending

Social lending circles foster community empowerment by enabling group members to pool funds and provide interest-free loans based on mutual trust, which contrasts sharply with predatory lending practices characterized by exorbitant interest rates and exploitative terms. These lending circles enhance financial inclusion by leveraging social capital, improving credit access, and promoting responsible borrowing habits within underserved communities. The collective accountability and transparent framework of social lending reduce the risk of debt spirals common in predatory lending scenarios.

Choosing Safely: Tips for Navigating Loan Options

Evaluate interest rates, repayment terms, and lender transparency when choosing between predatory lending and social lending circles, ensuring the loan aligns with your financial capacity. Predatory loans often carry exorbitant fees and hidden clauses, while social lending circles foster trust, community support, and clearer terms. Prioritize lenders with verifiable credentials and seek advice from financial counselors to avoid debt traps and make informed borrowing decisions.

Related Important Terms

Redlining Algorithms

Predatory lending relies heavily on redlining algorithms that systematically deny credit to marginalized communities, perpetuating cycles of debt and financial exclusion. In contrast, social lending circles bypass these biased algorithms by fostering community-based trust and collective credit-building, providing equitable access to funds without discriminatory barriers.

Payday Loan Traps

Predatory lending, particularly payday loan traps, imposes exorbitant interest rates and short repayment terms that trap borrowers in cycles of debt, draining financial resources and damaging credit scores. Social lending circles offer an ethical alternative by providing low or no-interest loans within a trusted community framework, promoting financial inclusion and mutual support without exploitative fees.

Roll-Over Interest Accumulation

Predatory lending often involves roll-over interest accumulation, causing borrowers to incur exponentially growing debt due to repeated refinancing of unpaid balances. In contrast, social lending circles offer transparent, fixed contributions without hidden roll-over fees, fostering sustainable debt management and community trust.

Community Trust Score

Predatory lending exploits borrowers with exorbitant interest rates and hidden fees, eroding financial stability and community trust scores, while social lending circles foster mutual support and transparency, enhancing community trust and enabling fair access to funds. Community trust scores in social lending circles incentivize responsible borrowing and repayment, creating a sustainable financial ecosystem absent in predatory lending.

Underbanked Borrower Profiling

Underbanked borrowers engaging with predatory lending often face exorbitant interest rates and hidden fees, exploiting their limited access to traditional financial services and exacerbating financial instability. In contrast, social lending circles provide a community-based funding alternative that leverages trust and collective responsibility, offering underbanked individuals affordable credit options and opportunities for financial inclusion.

Micro-lending DAO (Decentralized Autonomous Organization)

Micro-lending DAOs utilize blockchain technology to facilitate transparent, low-interest lending within social lending circles, contrasting sharply with predatory lending practices that impose exorbitant fees and harsh repayment terms. These decentralized platforms empower communities by providing equitable access to funds through collective credit pooling, eliminating intermediaries and fostering financial inclusion.

Loan Sharking 2.0 (Digital Platforms)

Loan Sharking 2.0 leverages digital platforms to impose exorbitant interest rates and exploit vulnerable borrowers through predatory lending tactics masked as convenient online services. Social lending circles, in contrast, utilize community-based peer-to-peer funding with transparent terms and mutual trust, offering a safer and more ethical alternative for obtaining funds.

Peer-to-Peer Lending Pools

Peer-to-peer lending pools through social lending circles offer borrowers lower interest rates and transparent terms by leveraging community trust, contrasting with predatory lending that imposes exorbitant fees and aggressive repayment conditions. These social lending platforms promote financial inclusion and cooperative support, reducing risks of debt traps often associated with predatory lenders targeting vulnerable individuals.

Social Collateral Verification

Social lending circles utilize social collateral verification, leveraging trust and mutual accountability within a community to secure loans without traditional credit checks, reducing the risk of predatory lending practices. This peer-based model offers affordable, interest-free or low-interest funds, fostering financial inclusion and empowering marginalized borrowers.

Crowdsourced Debt Refinancing

Predatory lending exploits vulnerable borrowers with excessively high interest rates and hidden fees, trapping them in cycles of debt, whereas social lending circles offer low-interest, community-based loans that promote trust and financial empowerment. Crowdsourced debt refinancing leverages collective contributions from trusted peers to reduce individual debt burdens while avoiding the pitfalls of exploitative financial institutions.

Predatory Lending vs Social Lending Circles for obtaining funds. Infographic

moneydiff.com

moneydiff.com