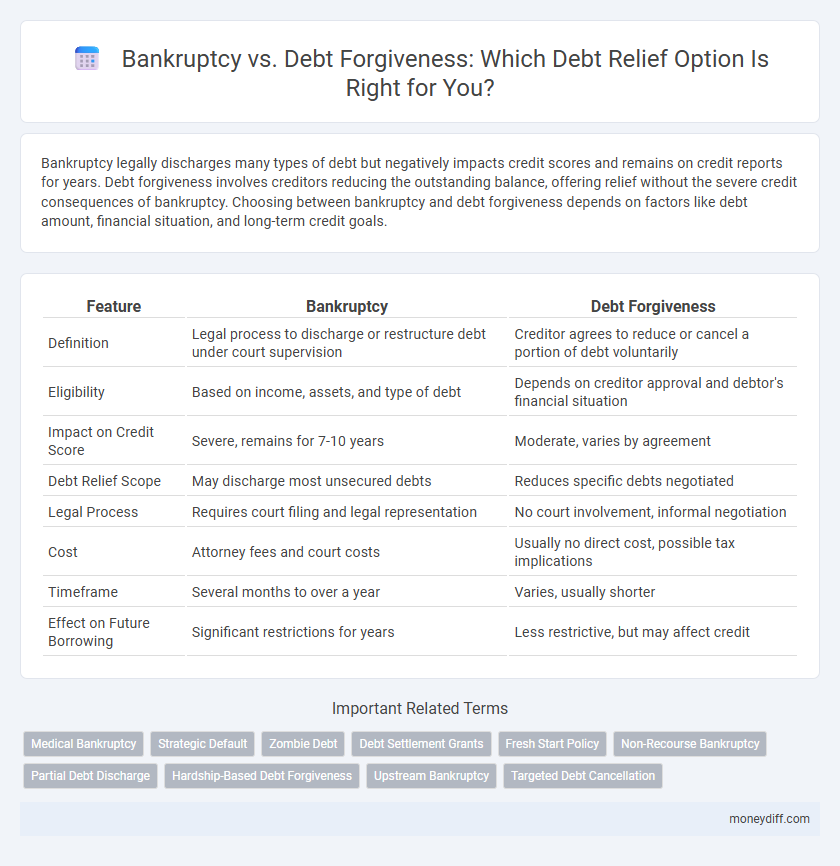

Bankruptcy legally discharges many types of debt but negatively impacts credit scores and remains on credit reports for years. Debt forgiveness involves creditors reducing the outstanding balance, offering relief without the severe credit consequences of bankruptcy. Choosing between bankruptcy and debt forgiveness depends on factors like debt amount, financial situation, and long-term credit goals.

Table of Comparison

| Feature | Bankruptcy | Debt Forgiveness |

|---|---|---|

| Definition | Legal process to discharge or restructure debt under court supervision | Creditor agrees to reduce or cancel a portion of debt voluntarily |

| Eligibility | Based on income, assets, and type of debt | Depends on creditor approval and debtor's financial situation |

| Impact on Credit Score | Severe, remains for 7-10 years | Moderate, varies by agreement |

| Debt Relief Scope | May discharge most unsecured debts | Reduces specific debts negotiated |

| Legal Process | Requires court filing and legal representation | No court involvement, informal negotiation |

| Cost | Attorney fees and court costs | Usually no direct cost, possible tax implications |

| Timeframe | Several months to over a year | Varies, usually shorter |

| Effect on Future Borrowing | Significant restrictions for years | Less restrictive, but may affect credit |

Understanding Bankruptcy: An Overview

Bankruptcy is a legal process that provides individuals or businesses overwhelmed by debt with a structured way to eliminate or repay liabilities under court supervision. It involves the liquidation of assets or the creation of a repayment plan, often resulting in a significant impact on credit scores and financial standing. Unlike debt forgiveness, which is an agreement between creditor and debtor to reduce or cancel debt without legal proceedings, bankruptcy offers a formal resolution that protects debtors from collection actions while addressing outstanding obligations.

What is Debt Forgiveness?

Debt forgiveness is a debt relief strategy where a lender agrees to reduce or eliminate a portion or the entirety of a borrower's outstanding debt, alleviating financial burden without requiring repayment in full. Unlike bankruptcy, which is a legal process involving court supervision and potential asset liquidation, debt forgiveness is often negotiated directly between the borrower and creditor, aiming to provide immediate relief and improve the borrower's financial stability. Debt forgiveness can involve loans, credit card balances, or medical bills, and its impact on credit scores and tax obligations varies depending on the terms agreed upon.

Key Differences: Bankruptcy vs Debt Forgiveness

Bankruptcy is a legal process that provides debt relief by liquidating or reorganizing assets under court supervision, significantly impacting credit scores and financial standing for years. Debt forgiveness involves a creditor voluntarily canceling a portion or all of the debt without court involvement, often resulting in tax implications for the debtor. Key differences include the formal legal framework and long-term credit consequences of bankruptcy versus the negotiated, potentially tax-deductible nature of debt forgiveness.

Eligibility Criteria for Bankruptcy

Eligibility criteria for bankruptcy typically require individuals or businesses to demonstrate insolvency, meaning their liabilities exceed their assets or they cannot meet debt obligations as they come due. Courts often mandate a means test to assess the debtor's income level relative to state median income to determine if bankruptcy is a viable option. Chapter 7 bankruptcy demands passing the means test, while Chapter 13 requires a regular income stream to propose a repayment plan.

Qualifying for Debt Forgiveness

Qualifying for debt forgiveness typically requires demonstrating financial hardship and meeting specific criteria set by lenders or government programs, unlike bankruptcy which involves a legal process to discharge debts. Debt forgiveness often targets particular types of debt, such as student loans or medical bills, where borrowers must provide evidence of income limits or hardship status. Lenders may require detailed documentation and proof of inability to repay before approving debt forgiveness, making qualification more restrictive than bankruptcy filings.

Pros and Cons of Filing Bankruptcy

Filing bankruptcy provides immediate protection from creditors and can discharge most unsecured debts, offering a fresh financial start, but it significantly impacts credit scores and stays on credit reports for up to 10 years, making future borrowing difficult. It often involves court fees and legal complexities, requiring strict adherence to repayment plans or asset liquidation, which can result in the loss of property. Unlike debt forgiveness programs that negotiate reduced balances, bankruptcy offers a legal framework for comprehensive debt elimination but carries long-term financial and reputational consequences.

Advantages and Disadvantages of Debt Forgiveness

Debt forgiveness offers immediate relief by reducing or eliminating the outstanding balance, often improving credit scores faster than bankruptcy. It avoids the public stigma and lengthy legal procedures associated with bankruptcy but may involve tax implications since forgiven debt can be considered taxable income. However, debt forgiveness can negatively impact credit scores and might require stringent negotiation with creditors, limiting eligibility and potentially delaying financial recovery.

Impact on Credit Score: Bankruptcy vs Debt Forgiveness

Bankruptcy significantly lowers credit scores by marking the account as a major derogatory event for up to 10 years, severely limiting future credit access. Debt forgiveness may have a moderate impact, as forgiven debt is often reported as settled for less than the full amount, which can reduce credit scores but typically less drastically than bankruptcy. Both options affect creditworthiness, but debt forgiveness generally allows a faster recovery compared to bankruptcy's prolonged negative impact.

Legal and Tax Implications

Bankruptcy involves a legal process that discharges many types of debt but can severely impact credit scores and remains on credit reports for up to 10 years, while debt forgiveness often results in taxable income recognized by the IRS, creating potential tax liabilities. Legal implications of bankruptcy include court-mandated repayment plans or asset liquidation, whereas debt forgiveness agreements usually require creditor consent without court intervention. Understanding the nuances in tax treatment and long-term credit consequences is crucial for selecting the best debt relief option in compliance with federal and state regulations.

Choosing the Right Debt Relief Option

Choosing the right debt relief option depends on individual financial situations, with bankruptcy offering a legal discharge of most debts but significantly impacting credit scores for up to 10 years. Debt forgiveness, often negotiated through creditors or debt settlement programs, reduces the total amount owed without the long-term credit repercussions of bankruptcy. Evaluating factors like debt amount, income stability, and future financial goals is crucial to determine whether bankruptcy or debt forgiveness provides the most effective and sustainable relief.

Related Important Terms

Medical Bankruptcy

Medical bankruptcy occurs when overwhelming healthcare costs lead individuals to file for bankruptcy as a debt relief option, wiping out most or all medical debt. Debt forgiveness, in contrast, involves creditors voluntarily canceling medical debt, providing financial relief without the severe credit consequences associated with bankruptcy.

Strategic Default

Strategic default involves deliberately ceasing debt payments despite having the financial ability, often as a tactic to negotiate better terms or pursue debt forgiveness without the legal consequences of bankruptcy. Bankruptcy provides a formal legal framework for debt relief, discharging unsecured debts but significantly impacting credit scores and future borrowing ability, whereas debt forgiveness through negotiated settlements may preserve credit standing but requires creditor agreement and potential tax liabilities.

Zombie Debt

Zombie debt refers to old, often long-forgotten debts that debt collectors pursue aggressively, sometimes after the statute of limitations has expired. Bankruptcy offers legal protection by discharging many types of debt, including some zombie debts, while debt forgiveness relies on creditor agreement and may leave consumers vulnerable to continued collection efforts.

Debt Settlement Grants

Debt settlement grants provide targeted financial assistance to reduce outstanding debt, often serving as an alternative to bankruptcy by negotiating creditor forgiveness without the severe credit impact. These grants can help individuals avoid the long-term consequences of bankruptcy while achieving significant debt relief and improved financial stability.

Fresh Start Policy

Bankruptcy offers a legal process to discharge most debts, providing a fresh start policy designed to relieve debtors from overwhelming financial obligations while protecting essential assets. Debt forgiveness, by contrast, involves creditors voluntarily reducing or eliminating debt, but may not provide the comprehensive legal protections and automatic stays against collections that bankruptcy ensures.

Non-Recourse Bankruptcy

Non-recourse bankruptcy limits a debtor's liability to the collateral securing the loan, allowing discharge of unsecured debt without personal asset forfeiture, unlike debt forgiveness which often involves creditor concessions without court involvement. This bankruptcy type provides a structured legal framework to alleviate debt burden while safeguarding personal finances from further claims.

Partial Debt Discharge

Partial debt discharge offers a tailored alternative to bankruptcy by allowing creditors to forgive a portion of the outstanding debt, reducing the debtor's financial burden without the total asset liquidation mandated in bankruptcy. This approach improves credit recovery prospects and preserves some financial stability compared to the more severe consequences of full bankruptcy declarations.

Hardship-Based Debt Forgiveness

Hardship-based debt forgiveness offers a tailored solution by reducing or eliminating debt for individuals facing financial distress due to disability, unemployment, or medical emergencies, providing relief without the severe credit impact of bankruptcy. Unlike bankruptcy, which involves legal proceedings and often long-term credit damage, hardship-based debt forgiveness negotiates directly with creditors to adjust payment terms or debt amounts based on verified hardship criteria.

Upstream Bankruptcy

Upstream bankruptcy involves a parent company filing for bankruptcy to manage the debts of its subsidiaries, offering a structured approach to debt relief by reorganizing liabilities under one entity. This contrasts with debt forgiveness, where creditors voluntarily reduce or cancel debt without formal legal proceedings, often providing quicker but less comprehensive relief.

Targeted Debt Cancellation

Targeted debt cancellation eliminates specific portions of debt for eligible borrowers, providing immediate financial relief without the long-term credit damage associated with bankruptcy. Unlike bankruptcy, which can severely impact credit scores and access to future loans, targeted debt forgiveness focuses on reducing burdens on vulnerable populations while preserving financial stability and creditworthiness.

Bankruptcy vs Debt forgiveness for debt relief Infographic

moneydiff.com

moneydiff.com