Good debt involves borrowing money for assets that appreciate in value or generate long-term income, such as student loans or mortgages, which can improve financial stability. Bad debt is typically high-interest borrowing like credit card balances or payday loans that do not build wealth and often lead to financial strain. Understanding the difference helps individuals make informed borrowing decisions that support their financial goals.

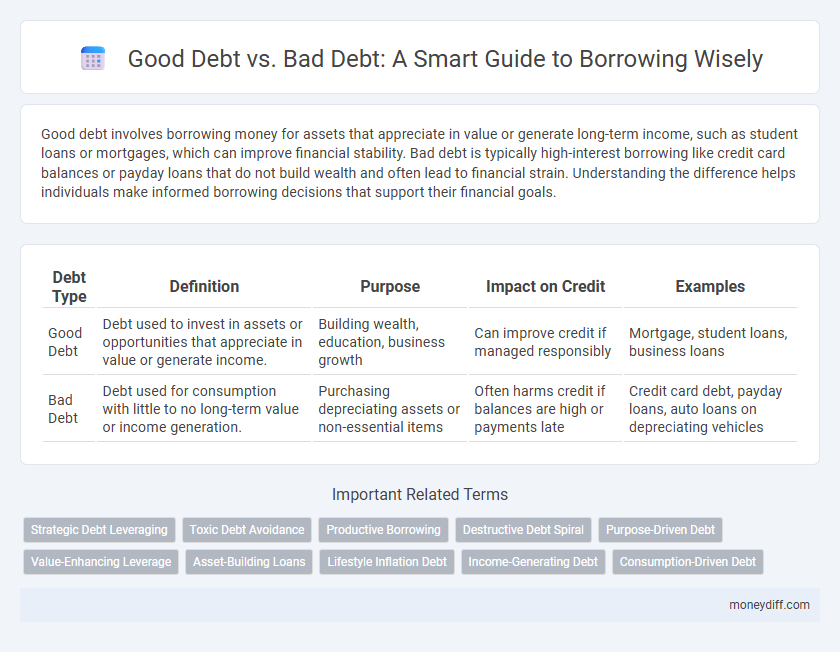

Table of Comparison

| Debt Type | Definition | Purpose | Impact on Credit | Examples |

|---|---|---|---|---|

| Good Debt | Debt used to invest in assets or opportunities that appreciate in value or generate income. | Building wealth, education, business growth | Can improve credit if managed responsibly | Mortgage, student loans, business loans |

| Bad Debt | Debt used for consumption with little to no long-term value or income generation. | Purchasing depreciating assets or non-essential items | Often harms credit if balances are high or payments late | Credit card debt, payday loans, auto loans on depreciating vehicles |

Understanding Good Debt vs Bad Debt

Good debt refers to borrowing that leads to asset creation or income generation, such as student loans or mortgages, which can improve financial stability over time. Bad debt involves borrowing for depreciating assets or consumption, like credit card debt for non-essential purchases, which often results in high-interest costs and financial strain. Understanding the difference enhances responsible borrowing decisions and supports long-term financial health.

Key Differences Between Good and Bad Debt

Good debt typically refers to borrowing that generates long-term value, such as student loans or mortgages, which enhance earning potential or asset ownership. Bad debt involves borrowing for depreciating assets or non-essential items, often with high-interest rates like credit card debt that erodes financial stability. Key differences include interest rates, repayment terms, and the debt's impact on future financial growth and creditworthiness.

Common Examples of Good Debt

Good debt typically includes student loans, mortgages, and business loans, which are investments that can increase long-term value and financial stability. Mortgages enable homeownership and potential property appreciation, while student loans can enhance earning potential through education. Business loans provide capital for growth and expansion, often generating higher future income streams.

Types of Bad Debt to Avoid

High-interest credit card balances, payday loans, and unsecured personal loans exemplify types of bad debt to avoid due to their costly interest rates and potential to spiral out of control. Auto loans for depreciating vehicles and borrowing to fund a lifestyle beyond one's means also undermine financial stability. Prioritizing low-interest, investment-oriented debt while steering clear of these expensive liabilities enhances long-term wealth building and credit health.

How Good Debt Can Build Wealth

Good debt, such as mortgages and student loans, can build wealth by enabling investments that appreciate over time or increase earning potential. When borrowed funds are used to acquire assets that generate income or grow in value, the return often exceeds the interest cost, leading to net financial gain. Leveraging good debt strategically enhances credit history and opens opportunities for further investment, creating a foundation for long-term wealth accumulation.

Risks Associated with Bad Debt

Bad debt carries significant financial risks, including high interest rates that escalate repayment amounts and damage credit scores, limiting future borrowing capacity. It often results from borrowing for non-essential or depreciating assets, increasing the likelihood of default and financial instability. In contrast, good debt, such as student loans or mortgages, typically supports asset growth or income generation, posing lower risk when managed responsibly.

Criteria for Evaluating Debt Quality

Good debt typically involves borrowing with low interest rates, fixed repayment terms, and the potential to increase net worth, such as student loans or mortgages. Bad debt often includes high-interest credit card balances or payday loans that erode financial stability without long-term benefits. Key criteria for evaluating debt quality include interest rate, repayment flexibility, impact on credit score, and the asset or value generated from the borrowed funds.

Borrowing Strategies for Smart Money Management

Good debt, such as low-interest mortgages or student loans, can build long-term wealth by leveraging borrowed funds for assets that appreciate or generate income. Bad debt, often associated with high-interest credit cards and payday loans, depletes financial resources without creating value and should be minimized. Effective borrowing strategies prioritize low-interest, purpose-driven loans and disciplined repayment plans to enhance credit scores and financial stability.

Impact of Good and Bad Debt on Credit Score

Good debt, such as mortgages or student loans, typically improves credit scores by demonstrating responsible borrowing and timely payments, which lenders favor. Bad debt, including high-interest credit card balances or payday loans, often harms credit scores due to increased credit utilization and missed or late payments. Maintaining a low debt-to-income ratio and making consistent on-time payments are crucial factors in leveraging good debt for positive credit score impact.

Tips to Minimize Bad Debt and Maximize Good Debt

Focus on borrowing for appreciating assets like education or real estate to maximize good debt benefits, as these investments can generate future income or value. Minimize bad debt by avoiding high-interest consumer loans and credit card balances, prioritizing timely repayments to reduce interest costs and improve credit scores. Regularly reviewing your debt portfolio and refinancing high-rate obligations can further control bad debt and enhance long-term financial health.

Related Important Terms

Strategic Debt Leveraging

Strategic debt leveraging involves using good debt, such as low-interest loans or mortgages, to invest in assets that generate long-term value and income, enhancing financial growth and stability. In contrast, bad debt typically includes high-interest consumer loans or credit card debt that depletes resources without creating wealth, undermining financial health and increasing risk.

Toxic Debt Avoidance

Good debt, such as low-interest student loans or mortgage financing that builds equity, supports long-term financial growth, while bad debt typically involves high-interest credit cards or payday loans that deplete resources and hinder stability. Avoiding toxic debt, characterized by excessive interest rates and unsustainable repayment terms, is crucial for maintaining credit health and preventing financial distress.

Productive Borrowing

Good debt involves borrowing funds for productive investments such as education, real estate, or business growth, which can generate future income or appreciate in value, enhancing long-term financial stability. Bad debt typically consists of borrowing for non-essential consumer expenses or depreciating assets, leading to financial strain without adding economic value or increasing net worth.

Destructive Debt Spiral

Good debt, such as low-interest loans for education or investing in property, can build wealth and improve credit scores, while bad debt from high-interest credit cards or payday loans often triggers a destructive debt spiral, increasing financial stress and leading to mounting unpaid balances. Managing debt responsibly requires prioritizing repayment of high-interest liabilities to avoid escalating interest charges and potential default.

Purpose-Driven Debt

Purpose-driven debt strategically finances investments that generate long-term value, such as education, real estate, or business expansion, enhancing financial growth and stability. In contrast, bad debt typically funds depreciating assets or consumption, leading to increased financial strain without improving net worth.

Value-Enhancing Leverage

Good debt leverages value-enhancing borrowing by financing investments that generate higher returns than the cost of debt, such as real estate or education, thereby increasing net worth and cash flow. Bad debt often involves high-interest consumer loans that do not improve financial standing or produce income, leading to negative equity and reduced creditworthiness.

Asset-Building Loans

Asset-building loans, such as mortgages and student loans, are considered good debt because they typically appreciate in value or increase earning potential over time. In contrast, bad debt, like high-interest credit card balances, depletes financial resources without contributing to long-term wealth accumulation.

Lifestyle Inflation Debt

Good debt, such as mortgages or student loans, typically contributes to long-term asset building and income potential, while bad debt often stems from lifestyle inflation--borrowing to finance non-essential purchases that depreciate in value. Managing lifestyle inflation debt requires disciplined budgeting to prevent escalating interest costs and financial strain that undermine long-term wealth accumulation.

Income-Generating Debt

Income-generating debt refers to borrowed funds used to invest in assets that produce a steady cash flow, such as rental properties or business expansion, classifying it as good debt. This type of debt enhances financial stability by generating returns that exceed borrowing costs, unlike bad debt which typically finances consumption without income potential.

Consumption-Driven Debt

Consumption-driven debt often falls under bad debt as it finances non-essential items that typically do not appreciate in value, leading to long-term financial strain. Good debt, in contrast, involves borrowing for investments like education or property, which can generate future income or increase net worth.

Good debt vs Bad debt for borrowing Infographic

moneydiff.com

moneydiff.com