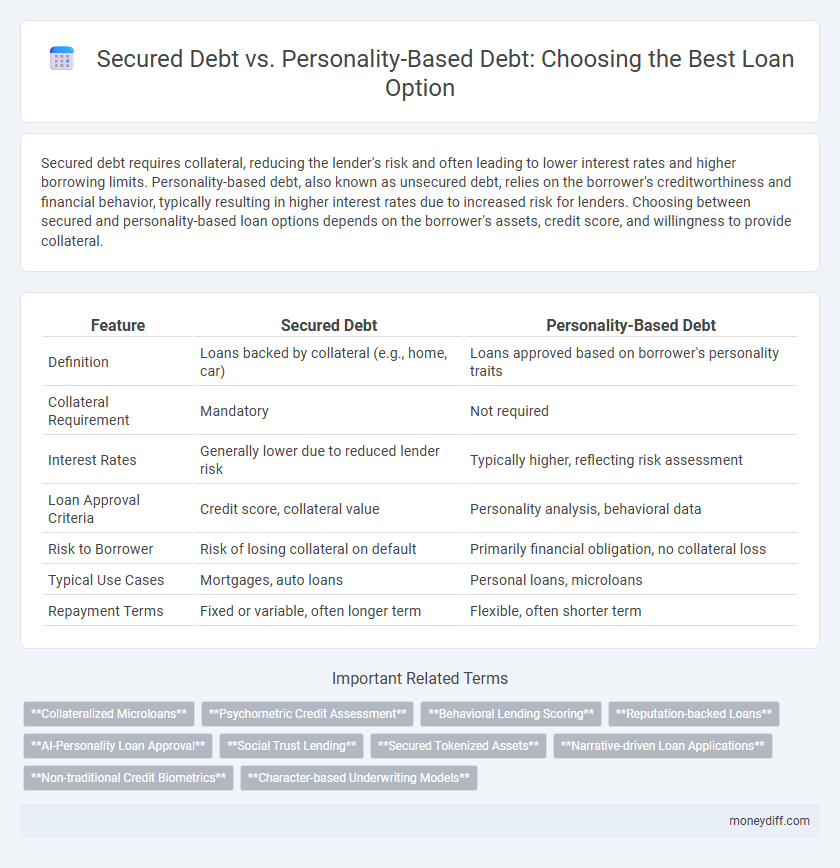

Secured debt requires collateral, reducing the lender's risk and often leading to lower interest rates and higher borrowing limits. Personality-based debt, also known as unsecured debt, relies on the borrower's creditworthiness and financial behavior, typically resulting in higher interest rates due to increased risk for lenders. Choosing between secured and personality-based loan options depends on the borrower's assets, credit score, and willingness to provide collateral.

Table of Comparison

| Feature | Secured Debt | Personality-Based Debt |

|---|---|---|

| Definition | Loans backed by collateral (e.g., home, car) | Loans approved based on borrower's personality traits |

| Collateral Requirement | Mandatory | Not required |

| Interest Rates | Generally lower due to reduced lender risk | Typically higher, reflecting risk assessment |

| Loan Approval Criteria | Credit score, collateral value | Personality analysis, behavioral data |

| Risk to Borrower | Risk of losing collateral on default | Primarily financial obligation, no collateral loss |

| Typical Use Cases | Mortgages, auto loans | Personal loans, microloans |

| Repayment Terms | Fixed or variable, often longer term | Flexible, often shorter term |

Understanding Secured Debt: Definition and Features

Secured debt is a type of loan backed by collateral, such as property or assets, which reduces the lender's risk and often results in lower interest rates. Key features include asset pledging, priority in repayment during default, and typically larger loan amounts compared to personality-based debt. Understanding these elements helps borrowers assess loan options based on risk tolerance and repayment capacity.

What Is Personality-Based Debt? An Overview

Personality-based debt refers to loan options where approval and terms are influenced by an individual's creditworthiness, behavioral credit scoring, and financial habits rather than collateral. Unlike secured debt, which relies on assets like property or vehicles as security, personality-based debt emphasizes personal financial responsibility and trustworthiness. This type of debt often applies to unsecured loans, credit cards, and lines of credit, utilizing credit scores and personal data to assess risk.

Key Differences Between Secured and Personality-Based Debt

Secured debt requires collateral, such as property or assets, which reduces lender risk and often results in lower interest rates, while personality-based debt relies on the borrower's creditworthiness and personal reputation without collateral. Loan approval for secured debt is typically faster due to tangible asset backing, whereas personality-based debt depends heavily on credit scores, income stability, and financial history. The key difference lies in risk allocation: secured debt minimizes lender risk through collateral, whereas personality-based debt places higher risk on lenders, often leading to stricter eligibility criteria and higher costs for borrowers.

Pros and Cons of Secured Debt for Borrowers

Secured debt offers borrowers lower interest rates and higher borrowing limits due to collateral backing, reducing lender risk. However, the risk of asset forfeiture in case of default poses a significant downside, potentially leading to loss of property or valuable assets. Despite these risks, secured loans often provide more favorable terms compared to personality-based debt options, which rely solely on creditworthiness without collateral.

Pros and Cons of Personality-Based Debt in Money Management

Personality-based debt, such as unsecured personal loans or credit cards, offers flexibility without requiring collateral, making it accessible for individuals with limited assets but often comes with higher interest rates and stricter approval criteria based on creditworthiness. This type of debt can empower borrowers to manage financial emergencies quickly but increases risk of higher overall debt due to variable terms and potential for accumulating expensive interest. Effective money management with personality-based debt requires disciplined budgeting to avoid default and protect credit scores, as missed payments can severely impact financial health.

Eligibility Criteria: Secured Loans vs Personality-Based Loans

Secured loans require collateral such as property or assets, ensuring eligibility is largely dependent on the borrower's ability to provide and maintain that collateral, which reduces lender risk. Personality-based loans, often referred to as unsecured loans, rely heavily on creditworthiness, income stability, and personal credit history to determine eligibility since no physical assets back the loan. Lenders assess secured loan applicants on asset value and equity, while personality-based loan eligibility hinges on credit scores, debt-to-income ratio, and overall financial reliability.

Impact on Credit Score: How Each Debt Type Affects You

Secured debt, backed by collateral such as a mortgage or car loan, generally has a more positive impact on your credit score when payments are made on time, as it demonstrates reliability and reduces lender risk. Personality-based debt, often referring to unsecured loans like credit cards or personal loans, tends to carry higher interest rates and stricter credit requirements, and missed payments can significantly harm your credit score due to the absence of collateral. Consistently managing both debt types responsibly is crucial for maintaining a strong credit profile and accessing favorable loan options in the future.

Collateral Requirements: Secured vs Personality-Based Loan Options

Secured debt requires borrowers to provide collateral such as property or assets, reducing lender risk and often resulting in lower interest rates. Personality-based debt relies on the borrower's creditworthiness and income without the need for collateral, typically leading to higher interest rates due to increased lender risk. Understanding collateral requirements is crucial when choosing between secured loans, which offer security to lenders, and personality-based loans, which are based on personal financial profiles.

Risk Factors: Comparing Default Consequences

Secured debt carries lower risk for lenders due to collateral backing, often resulting in smaller financial consequences for borrowers upon default, such as asset repossession. Personality-based debt relies heavily on creditworthiness and personal guarantee, leading to higher risk of severe credit score damage and potential legal action if payments are missed. Understanding these default consequences is crucial when choosing loan options, as they directly impact borrower liability and long-term financial health.

Choosing the Right Loan Option for Your Financial Goals

Secured debt, backed by collateral like property or assets, typically offers lower interest rates and higher borrowing limits, making it ideal for long-term financial goals such as home purchases. Personality-based debt relies on creditworthiness and personal reputation, often without requiring collateral but may come with higher interest rates and stricter eligibility criteria. Evaluating your financial goals, credit score, and risk tolerance helps determine the best loan option to maximize benefits and minimize costs.

Related Important Terms

Collateralized Microloans

Collateralized microloans offer a secured debt option where borrowers pledge assets as collateral, reducing lender risk and often resulting in lower interest rates compared to personality-based loans, which rely solely on creditworthiness and personal guarantees. This form of secured debt enhances access to credit for small businesses and individuals with limited credit history by leveraging tangible assets.

Psychometric Credit Assessment

Psychometric credit assessment evaluates borrowers' behavioral traits and personality characteristics to predict loan repayment ability, offering an alternative to traditional secured debt options requiring collateral. This innovative approach enables lenders to extend credit based on personality-based debt metrics, expanding access for individuals lacking tangible assets.

Behavioral Lending Scoring

Behavioral lending scoring evaluates borrowers based on spending habits, repayment patterns, and financial behaviors, offering a nuanced alternative to traditional credit scores used in secured and personality-based debt assessments. This method enhances loan options by predicting creditworthiness more accurately, reducing reliance on collateral for secured debt or subjective personality traits in unsecured lending.

Reputation-backed Loans

Reputation-backed loans leverage an individual's social standing and creditworthiness instead of physical collateral, offering a form of personality-based debt that prioritizes trust and relational capital. These loans provide flexible financing options for borrowers with strong reputations but limited assets, contrasting traditional secured debt which requires tangible collateral.

AI-Personality Loan Approval

AI-personality loan approval leverages behavioral data and psychometric analysis to assess creditworthiness beyond traditional secured debt metrics, enabling personalized loan options without collateral requirements. This innovative approach reduces reliance on conventional credit scores by evaluating character traits and repayment likelihood, expanding access to financing for individuals lacking secured assets.

Social Trust Lending

Social Trust Lending leverages personal reputation and community relationships to facilitate personality-based debt options, often bypassing traditional collateral requirements seen in secured debt. This innovative approach enhances loan accessibility by prioritizing trust and social capital over tangible assets, reducing barriers for borrowers with limited collateral.

Secured Tokenized Assets

Secured tokenized assets represent a transformative approach to secured debt by converting tangible collateral into digital tokens, enhancing liquidity and transparency in loan options. Unlike personality-based debt, which relies on creditworthiness and personal guarantees, secured tokenized assets provide lenders with verifiable, blockchain-backed ownership rights, reducing risk and enabling faster, more flexible financing solutions.

Narrative-driven Loan Applications

Narrative-driven loan applications leverage personalized storytelling to enhance the approval process for personality-based debt by illustrating borrowers' unique financial behaviors, whereas secured debt relies on tangible collateral to reduce lender risk. This approach emphasizes character and financial history, creating a holistic view that can improve access to unsecured credit options.

Non-traditional Credit Biometrics

Non-traditional credit biometrics assess secured debt and personality-based debt by analyzing behavioral and physiological data such as voice patterns, typing rhythms, and facial recognition to enhance loan approval accuracy beyond traditional credit scores. This innovative approach provides lenders with a deeper understanding of borrower reliability and creditworthiness, especially for individuals lacking conventional credit history.

Character-based Underwriting Models

Character-based underwriting models evaluate loan applicants primarily on their credit behavior, integrity, and repayment history rather than collateral assets, distinguishing personality-based debt from secured debt options that rely on tangible guarantees. These models leverage data analytics and psychometric assessments to predict creditworthiness, enabling lenders to extend credit to individuals with limited or no physical collateral, thereby expanding access to financing.

Secured debt vs personality-based debt for loan options. Infographic

moneydiff.com

moneydiff.com