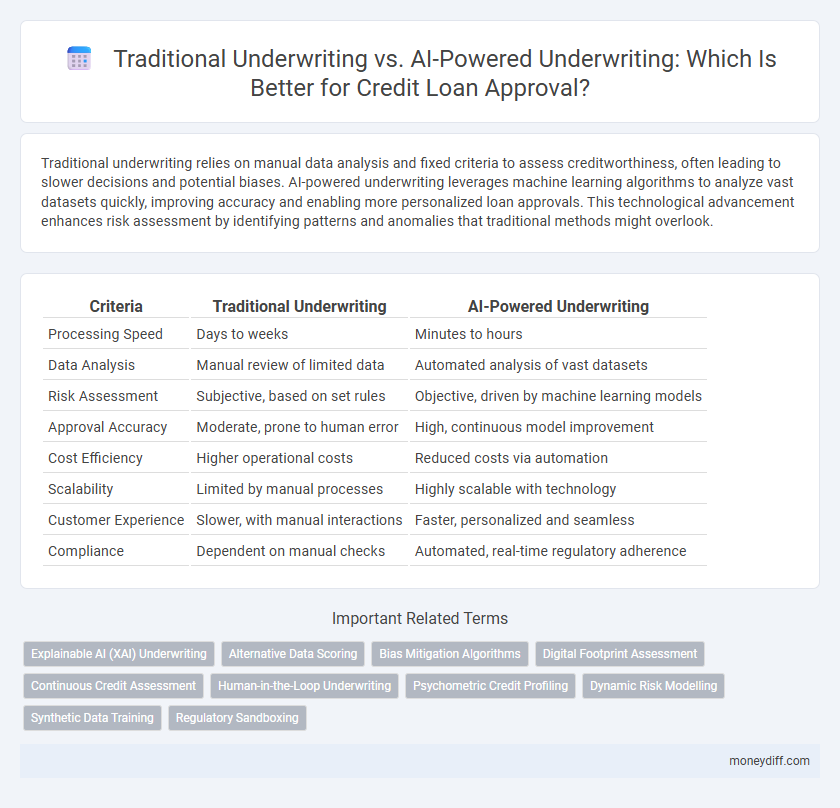

Traditional underwriting relies on manual data analysis and fixed criteria to assess creditworthiness, often leading to slower decisions and potential biases. AI-powered underwriting leverages machine learning algorithms to analyze vast datasets quickly, improving accuracy and enabling more personalized loan approvals. This technological advancement enhances risk assessment by identifying patterns and anomalies that traditional methods might overlook.

Table of Comparison

| Criteria | Traditional Underwriting | AI-Powered Underwriting |

|---|---|---|

| Processing Speed | Days to weeks | Minutes to hours |

| Data Analysis | Manual review of limited data | Automated analysis of vast datasets |

| Risk Assessment | Subjective, based on set rules | Objective, driven by machine learning models |

| Approval Accuracy | Moderate, prone to human error | High, continuous model improvement |

| Cost Efficiency | Higher operational costs | Reduced costs via automation |

| Scalability | Limited by manual processes | Highly scalable with technology |

| Customer Experience | Slower, with manual interactions | Faster, personalized and seamless |

| Compliance | Dependent on manual checks | Automated, real-time regulatory adherence |

Introduction to Loan Underwriting

Loan underwriting involves assessing a borrower's creditworthiness to determine loan approval and terms. Traditional underwriting relies on manual evaluation of financial documents and credit history, emphasizing human judgment and established criteria. AI-powered underwriting leverages machine learning algorithms and big data analytics to enhance accuracy, speed, and risk prediction in credit decisions.

Traditional Underwriting: An Overview

Traditional underwriting in loan approval relies on manual evaluation of applicants' financial documents, credit history, income, and debt-to-income ratios to assess creditworthiness. This process often involves human judgment to interpret complex financial situations and identify risk factors but can be time-consuming and prone to inconsistencies. Despite its limitations, traditional underwriting remains a trusted method due to its thorough review standards and regulatory compliance.

How AI-Powered Underwriting Works

AI-powered underwriting leverages machine learning algorithms to analyze vast datasets, including credit scores, transaction history, employment records, and alternative data such as social media behavior, for more accurate risk assessment. This technology processes real-time data to identify patterns and predict borrower creditworthiness with greater speed and precision compared to traditional rule-based methods. By continuously learning from new data, AI models improve decision-making, reduce human bias, and enhance loan approval efficiency.

Key Differences Between Traditional and AI Underwriting

Traditional underwriting relies on manual evaluation of credit history, income verification, and debt-to-income ratios, making the process time-consuming and subjective. AI-powered underwriting utilizes machine learning algorithms to analyze vast datasets, including alternative credit data, enabling faster, more accurate risk assessment and personalized loan approvals. This advanced automation also reduces human bias, increasing consistency and expanding access to credit for underbanked populations.

Speed and Efficiency in Loan Processing

Traditional underwriting relies on manual review, leading to slower loan processing times and increased possibilities for human error. AI-powered underwriting utilizes machine learning algorithms to analyze borrower data rapidly, significantly accelerating decision-making and improving accuracy. This automation reduces operational costs while enhancing efficiency, enabling lenders to approve loans faster and serve more customers effectively.

Accuracy and Risk Assessment Comparison

Traditional underwriting relies heavily on manual data analysis and borrower history, often resulting in slower decision-making and potential biases that affect accuracy. AI-powered underwriting utilizes machine learning algorithms to analyze vast datasets in real-time, improving risk assessment precision by identifying patterns and predicting default probabilities more effectively. Enhanced accuracy in AI models leads to better credit risk management and reduces loan approval errors compared to traditional methods.

Impact on Borrower Experience

Traditional underwriting often involves lengthy manual processes that can delay loan approval and frustrate borrowers. AI-powered underwriting streamlines credit evaluation by quickly analyzing vast datasets, resulting in faster decisions and a more seamless borrower experience. Enhanced accuracy and personalized risk assessment through AI reduce unnecessary rejections, improving borrower satisfaction and trust in financial institutions.

Data Sources and Analysis Methods

Traditional underwriting relies heavily on historical credit scores, income statements, and manual document verification to assess loan eligibility, often leading to slower decision-making. AI-powered underwriting integrates diverse data sources such as social media behavior, transaction patterns, and real-time financial data, employing machine learning algorithms to deliver faster, more accurate risk assessments. This advanced analysis method enhances predictive accuracy and expands credit access to underserved borrowers by evaluating non-traditional data points overlooked by conventional processes.

Regulatory and Ethical Considerations

Traditional underwriting relies heavily on manual review and established regulatory frameworks ensuring transparency and compliance with fair lending laws. AI-powered underwriting introduces challenges related to algorithmic bias, data privacy, and the need for explainability to meet regulatory standards such as the Equal Credit Opportunity Act (ECOA). Ethical considerations demand continuous monitoring and validation of AI models to prevent discriminatory practices and ensure accountability in automated loan approval decisions.

The Future of Loan Underwriting

AI-powered underwriting enhances loan approval by analyzing vast datasets and identifying patterns beyond traditional models, leading to more accurate credit risk assessments. Traditional underwriting relies heavily on manual credit scoring and financial documents, often resulting in slower decision-making and potential biases. The future of loan underwriting is shaped by AI-driven automation, enabling faster approvals, improved risk management, and increased financial inclusion.

Related Important Terms

Explainable AI (XAI) Underwriting

Explainable AI (XAI) underwriting enhances traditional loan approval by providing transparent, interpretable reasons behind credit decisions, enabling better regulatory compliance and increased borrower trust. This approach integrates advanced machine learning models with clear explanations, improving accuracy while maintaining the accountability essential in credit risk assessment.

Alternative Data Scoring

Traditional underwriting relies heavily on credit scores, income verification, and employment history to assess loan eligibility, often excluding potential borrowers with limited credit history. AI-powered underwriting utilizes alternative data scoring, analyzing unconventional data such as utility payments, social media activity, and mobile phone usage to provide a more comprehensive and inclusive risk assessment.

Bias Mitigation Algorithms

Traditional underwriting relies heavily on historical credit data and manual judgment, which can reinforce existing biases leading to unfair loan approval decisions. AI-powered underwriting incorporates bias mitigation algorithms that analyze diverse data sets and detect patterns of discrimination, enabling more equitable and inclusive lending practices.

Digital Footprint Assessment

Traditional underwriting relies heavily on credit scores, income verification, and historical financial data, often overlooking the broader digital footprint of applicants. AI-powered underwriting integrates diverse digital signals such as social media activity, online behavior, and alternative data sources to enhance risk assessment accuracy and streamline loan approval processes.

Continuous Credit Assessment

Traditional underwriting relies on fixed credit scores and periodic evaluations, resulting in delayed risk detection and slower loan approval processes. AI-powered underwriting enables continuous credit assessment by analyzing real-time financial data and behavioral patterns, improving accuracy in risk prediction and accelerating decision-making for lenders.

Human-in-the-Loop Underwriting

Human-in-the-Loop underwriting combines traditional expertise with AI-powered data analysis to enhance loan approval accuracy and reduce bias. This hybrid approach leverages machine learning algorithms to assess credit risk while allowing human underwriters to validate and interpret complex cases, ensuring balanced decision-making and improved credit outcomes.

Psychometric Credit Profiling

Psychometric credit profiling enhances traditional underwriting by analyzing behavioral traits and decision-making patterns, enabling more accurate risk assessment for loan approval. AI-powered underwriting leverages advanced algorithms and machine learning models to process psychometric data efficiently, reducing bias and improving credit access for underserved populations.

Dynamic Risk Modelling

Traditional underwriting relies on static criteria and historical data, often resulting in less adaptive risk assessments, whereas AI-powered underwriting utilizes dynamic risk modeling to continuously analyze real-time financial behavior and market trends, enhancing loan approval accuracy. Dynamic risk modeling in AI systems improves predictive capabilities by integrating multifaceted data sources, reducing default rates and enabling personalized credit decisions.

Synthetic Data Training

Synthetic data training enhances AI-powered underwriting by generating vast, diverse loan application scenarios that improve model accuracy and reduce bias. Traditional underwriting relies heavily on historical data with limited variability, while AI systems trained on synthetic datasets enable more robust risk assessment and faster, more inclusive loan approvals.

Regulatory Sandboxing

Regulatory sandboxing facilitates the testing of AI-powered underwriting models by allowing lenders to experiment within controlled environments, ensuring compliance with credit regulations while assessing risk and fairness. Traditional underwriting relies on fixed regulatory frameworks, limiting innovation, whereas sandboxing enables adaptation to evolving guidelines and promotes the integration of advanced algorithms in loan approval processes.

Traditional Underwriting vs AI-Powered Underwriting for loan approval. Infographic

moneydiff.com

moneydiff.com