Credit history evaluates a borrower's past payment behavior and debt management to assess loan eligibility, while cash flow underwriting focuses on the borrower's current income and expenses to determine their ability to repay. Lenders relying on credit history primarily consider credit scores and past delinquencies, whereas cash flow underwriting analyzes real-time financial statements and cash inflows. Combining both methods provides a comprehensive view of creditworthiness, enhancing the accuracy of loan approval decisions.

Table of Comparison

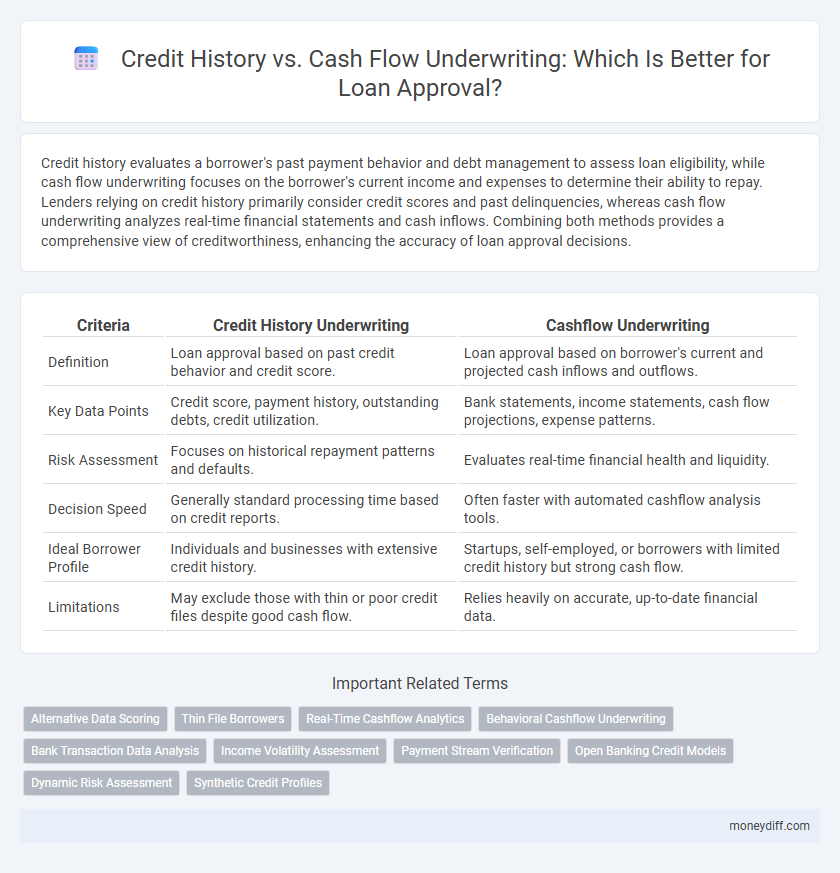

| Criteria | Credit History Underwriting | Cashflow Underwriting |

|---|---|---|

| Definition | Loan approval based on past credit behavior and credit score. | Loan approval based on borrower's current and projected cash inflows and outflows. |

| Key Data Points | Credit score, payment history, outstanding debts, credit utilization. | Bank statements, income statements, cash flow projections, expense patterns. |

| Risk Assessment | Focuses on historical repayment patterns and defaults. | Evaluates real-time financial health and liquidity. |

| Decision Speed | Generally standard processing time based on credit reports. | Often faster with automated cashflow analysis tools. |

| Ideal Borrower Profile | Individuals and businesses with extensive credit history. | Startups, self-employed, or borrowers with limited credit history but strong cash flow. |

| Limitations | May exclude those with thin or poor credit files despite good cash flow. | Relies heavily on accurate, up-to-date financial data. |

Understanding Credit History: Definition and Importance

Credit history refers to the record of a borrower's past borrowing and repayment behavior, encompassing credit cards, loans, and other credit accounts reported to credit bureaus. It plays a crucial role in loan approval as it helps lenders assess the risk of default by evaluating factors like payment punctuality, credit utilization, and length of credit history. A strong credit history typically leads to better loan terms and higher approval chances, reflecting a borrower's reliability and financial responsibility.

What is Cashflow Underwriting?

Cashflow underwriting evaluates a borrower's ability to repay a loan based on their income streams and expense patterns rather than relying solely on credit history. This method analyzes cash inflows and outflows to assess financial stability and predict future repayment behavior, offering a more dynamic and real-time approach to loan approval. Lenders using cashflow underwriting can better accommodate self-employed individuals or those with fluctuating incomes who might have limited or poor credit history.

Key Differences Between Credit History and Cashflow Underwriting

Credit history underwriting evaluates a borrower's past repayment behavior through credit scores, credit reports, and debt levels to assess creditworthiness, while cashflow underwriting focuses on analyzing current and projected income streams, expenses, and cash inflows to determine loan repayment ability. Credit history emphasizes long-term financial discipline and past liabilities, whereas cashflow underwriting prioritizes real-time liquidity and business sustainability. Lenders relying on credit history may favor borrowers with strong credit scores, while those using cashflow underwriting give weight to ongoing financial performance and cash management.

Traditional Loan Approval: The Role of Credit Scores

Traditional loan approval heavily relies on credit scores as a primary indicator of borrower reliability, reflecting past payment behavior and credit utilization. Credit history provides lenders with measurable data to assess risk, influencing interest rates and loan terms. This method often excludes applicants with limited or poor credit histories, despite potentially strong cashflow indicators.

Cashflow Underwriting: A Modern Approach to Loan Assessment

Cashflow underwriting analyzes a borrower's real-time income and expenses to determine loan eligibility, offering a dynamic alternative to traditional credit history assessments. This method relies on bank statements, payroll data, and transaction records, providing lenders with a more accurate picture of financial health and repayment capacity. By focusing on actual cash inflows and outflows, cashflow underwriting reduces reliance on past credit scores, enabling access to credit for self-employed individuals and those with limited credit histories.

Advantages of Credit History-Based Loan Approval

Credit history-based loan approval leverages comprehensive credit reports to assess an applicant's past repayment behavior, offering lenders a reliable indicator of creditworthiness and reducing default risk. This method provides a standardized evaluation framework, enabling quicker decision-making and improving the efficiency of the loan approval process. Borrowers with strong credit histories can access better loan terms, including lower interest rates and higher credit limits, compared to cashflow-based assessments that may overlook long-term financial discipline.

Benefits of Cashflow-Based Underwriting for Borrowers

Cashflow-based underwriting evaluates a borrower's actual income and expenses, offering a more accurate representation of financial health compared to traditional credit history checks. This method benefits borrowers with limited or poor credit history by focusing on their current ability to repay loans, reducing reliance on past credit mistakes. As a result, it increases access to credit for self-employed individuals and those with irregular income streams while promoting responsible lending practices.

Challenges and Limitations of Each Method

Credit history underwriting often faces challenges such as outdated or incomplete credit reports, leading to inaccurate risk assessments and potential exclusion of creditworthy borrowers. Cashflow underwriting is limited by the variability and unpredictability of income streams, making it difficult to establish consistent repayment capacity, especially for self-employed or seasonal workers. Both methods struggle with data reliability issues and may inadvertently introduce bias, affecting loan approval fairness and accuracy.

Which Approach is Better for Small Business Owners?

Credit history offers a traditional measure of financial reliability by evaluating past loan repayments, but cashflow underwriting provides a real-time assessment of a small business's ability to meet loan obligations based on current income and expenses. Small business owners with limited or fluctuating credit records benefit more from cashflow underwriting, as it captures the ongoing financial health and operational realities better than static credit scores. Lenders adopting cashflow analysis can extend credit more accurately to emerging businesses, supporting growth and sustainability.

The Future of Loan Approval: Integrating Credit History and Cashflow Analysis

Loan approval is increasingly driven by integrating credit history and cashflow analysis to create a more comprehensive risk profile. Traditional credit history offers insights into past borrowing behavior, while cashflow underwriting provides real-time data on income stability and repayment capacity. This integration enhances predictive accuracy, supports more inclusive lending decisions, and reduces default rates.

Related Important Terms

Alternative Data Scoring

Alternative data scoring in loan approval leverages non-traditional credit history indicators such as utility payments, rental records, and social media activity to assess borrower reliability more comprehensively. Cashflow underwriting prioritizes real-time income and expense analysis, offering a dynamic evaluation that complements historical credit data, improving access to credit for individuals with limited traditional credit history.

Thin File Borrowers

Thin file borrowers often face challenges in traditional credit history evaluations due to limited credit data, making cashflow underwriting a crucial alternative that assesses real-time income and expenses to determine loan eligibility. Cashflow underwriting leverages bank statements and transaction data to provide a more accurate risk profile for borrowers with sparse credit records, improving access to credit for underserved populations.

Real-Time Cashflow Analytics

Real-time cashflow analytics offer lenders dynamic insights into a borrower's financial behavior by continuously monitoring income and expenses, providing a more accurate assessment than traditional credit history alone. This approach enhances loan approval decisions by capturing current cash inflows and outflows, reducing dependency on outdated credit reports and improving risk evaluation accuracy.

Behavioral Cashflow Underwriting

Behavioral cashflow underwriting assesses loan applicants by analyzing real-time income patterns, spending habits, and transaction behaviors, providing a more dynamic and accurate picture of creditworthiness compared to traditional credit history methods that rely on past credit scores and repayment records. This approach enables lenders to approve loans based on current financial behavior, improving access for individuals with limited or poor credit history but stable cashflow.

Bank Transaction Data Analysis

Bank transaction data analysis offers a dynamic approach to loan approval by evaluating real-time cash flow patterns, providing deeper insights beyond traditional credit history scores. This method enhances risk assessment accuracy by identifying consistent income streams and spending behaviors, thereby improving underwriting decisions in modern financial institutions.

Income Volatility Assessment

Income volatility assessment plays a crucial role in cashflow underwriting by analyzing fluctuations in borrowers' earnings over time to predict their ability to sustain loan repayments, contrasting with traditional credit history which primarily reviews past credit behaviors and payment patterns. Lenders using cashflow underwriting evaluate detailed income streams and expense variances to better accommodate self-employed individuals and seasonal workers, enhancing loan approval accuracy in scenarios where credit scores alone may not represent true repayment capacity.

Payment Stream Verification

Payment stream verification plays a critical role in cashflow underwriting by directly assessing real-time income flows rather than relying solely on past credit history reports, enabling lenders to more accurately evaluate a borrower's ability to repay. This method reduces dependency on traditional credit scores and highlights consistent cash inflows, improving loan approval decisions for applicants with limited or fluctuating credit history.

Open Banking Credit Models

Open Banking credit models leverage real-time transaction data to assess cash flow patterns, offering a dynamic alternative to traditional credit history evaluations in loan approvals. These models enhance underwriting accuracy by analyzing income consistency and spending behavior, enabling lenders to better predict repayment capacity beyond static credit scores.

Dynamic Risk Assessment

Credit history provides a static snapshot of a borrower's past financial behavior, while cashflow underwriting enables dynamic risk assessment by analyzing real-time income and expenses to predict future repayment capacity. Lenders leveraging cashflow data can more accurately assess creditworthiness, adapting to changes in financial conditions and reducing default risk.

Synthetic Credit Profiles

Synthetic credit profiles combine alternative data such as utility payments, rent history, and cashflow patterns to build a more inclusive credit assessment, especially for borrowers with limited traditional credit history. This approach enhances loan approval accuracy by integrating cashflow underwriting metrics with traditional credit history, reducing reliance on conventional credit scores and enabling access to credit for underserved segments.

Credit History vs Cashflow Underwriting for loan approval. Infographic

moneydiff.com

moneydiff.com