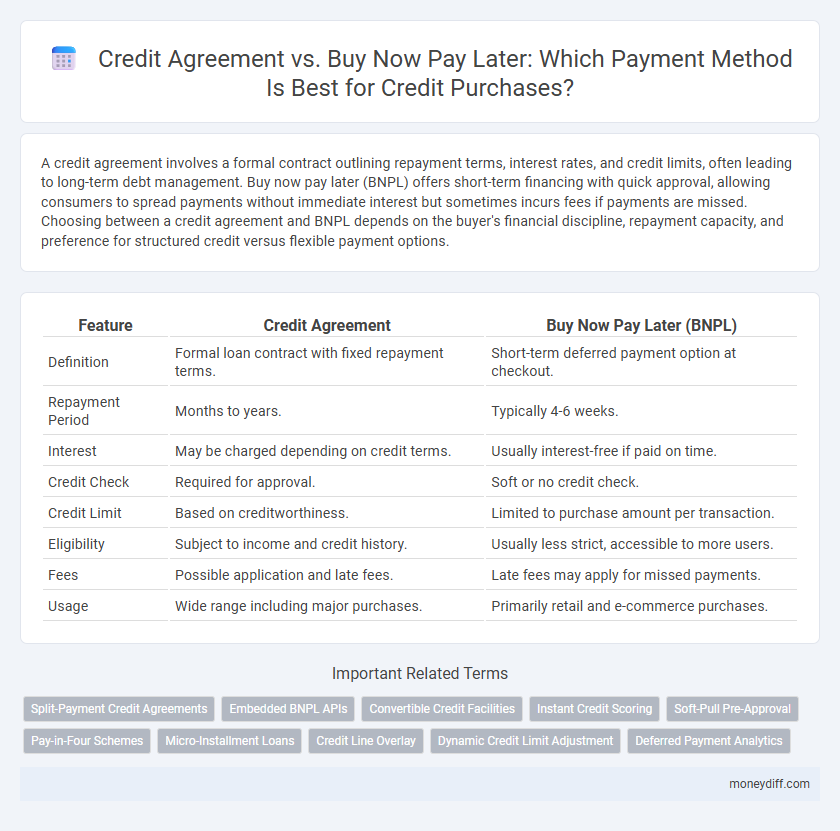

A credit agreement involves a formal contract outlining repayment terms, interest rates, and credit limits, often leading to long-term debt management. Buy now pay later (BNPL) offers short-term financing with quick approval, allowing consumers to spread payments without immediate interest but sometimes incurs fees if payments are missed. Choosing between a credit agreement and BNPL depends on the buyer's financial discipline, repayment capacity, and preference for structured credit versus flexible payment options.

Table of Comparison

| Feature | Credit Agreement | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Formal loan contract with fixed repayment terms. | Short-term deferred payment option at checkout. |

| Repayment Period | Months to years. | Typically 4-6 weeks. |

| Interest | May be charged depending on credit terms. | Usually interest-free if paid on time. |

| Credit Check | Required for approval. | Soft or no credit check. |

| Credit Limit | Based on creditworthiness. | Limited to purchase amount per transaction. |

| Eligibility | Subject to income and credit history. | Usually less strict, accessible to more users. |

| Fees | Possible application and late fees. | Late fees may apply for missed payments. |

| Usage | Wide range including major purchases. | Primarily retail and e-commerce purchases. |

Understanding Credit Agreements: Key Features

Credit agreements are formal contracts outlining the terms and conditions between a borrower and lender, including interest rates, repayment schedules, and penalties for late payments. Unlike buy now pay later (BNPL) services, credit agreements often involve longer repayment periods and detailed credit checks, providing a structured framework for borrowing significant amounts. Understanding these key features helps consumers make informed decisions about responsible borrowing and managing debt effectively.

What Is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a payment option that allows consumers to split purchases into interest-free installments, making it easier to manage cash flow without immediate full payment. Unlike traditional credit agreements that involve credit checks and interest rates, BNPL services often offer quick approvals and transparent repayment schedules. This method is increasingly popular for online and in-store shopping, providing flexibility while avoiding the long-term debt obligations associated with credit cards.

Credit Agreement vs BNPL: A Comparative Overview

Credit agreements involve a formal contract between borrower and lender outlining repayment terms, interest rates, and duration, offering structured financing for large or planned purchases. Buy Now Pay Later (BNPL) provides short-term, interest-free installments without traditional credit checks, appealing to consumers seeking quick and flexible payment options for smaller purchases. While credit agreements build credit history and include regulatory protections, BNPL attracts users with ease of use but may carry higher late fees and limited consumer safeguards.

Eligibility and Approval Processes

Credit agreements require a thorough eligibility assessment involving credit checks, income verification, and debt-to-income ratios to approve borrowers, ensuring long-term repayment capability. Buy Now Pay Later (BNPL) services typically offer faster approval with minimal credit checks, focusing on recent purchase behavior rather than comprehensive credit history. Consequently, BNPL appeals to consumers with limited credit profiles, while credit agreements cater to borrowers seeking structured, extended financing options.

Interest Rates and Hidden Fees: What to Watch For

Credit agreements often involve fixed or variable interest rates that can significantly impact the total repayment amount, while buy now pay later (BNPL) plans typically advertise interest-free periods but may impose high fees for late or missed payments. Consumers should carefully review the terms of credit agreements to understand potential interest charges over time, whereas BNPL services may include hidden fees such as late payment penalties or account reinstatement costs. Comparing the effective annual percentage rates (APR) and fee structures between these payment methods is essential to avoid unexpected financial burdens.

Flexibility and Repayment Schedules Compared

Credit agreements typically offer more structured repayment schedules with fixed monthly installments over an agreed period, providing predictable payments that suit long-term financing needs. Buy Now Pay Later (BNPL) options often allow greater flexibility with shorter repayment windows and the possibility of interest-free installments, attracting consumers seeking immediate purchases without long-term commitments. While credit agreements may involve credit checks and interest rates, BNPL services generally emphasize convenience and quick approvals, but can lead to higher costs if payments are missed or extended.

Credit Score Impact: BNPL vs Traditional Credit

Buy Now Pay Later (BNPL) services generally have a minimal impact on credit scores since they often do not report to credit bureaus unless payments are missed, whereas traditional credit agreements consistently influence credit scores through regular reporting of payment history and credit utilization. Traditional credit agreements can build or damage credit scores over time based on timely payments and account management, while BNPL usage typically lacks this long-term credit-building feature. Consumers relying on BNPL may miss opportunities to improve their credit profiles compared to those actively managing traditional credit accounts.

Consumer Protections and Legal Safeguards

Credit agreements often provide stronger consumer protections and legal safeguards, including clear disclosure of interest rates, repayment terms, and rights to dispute charges under laws like the Truth in Lending Act. Buy Now Pay Later (BNPL) services may lack similar regulatory oversight, potentially exposing consumers to less transparent terms, higher fees for missed payments, and limited dispute resolution options. Consumers should carefully review the protections available in credit agreements versus BNPL offerings to ensure informed and secure payment decisions.

Common Risks and Pitfalls to Avoid

Credit agreements often involve long-term financial commitments with fixed interest rates that can lead to escalating debt if payments are missed, while Buy Now Pay Later (BNPL) services may encourage impulsive spending due to their short-term, interest-free periods that can suddenly become costly. Both payment methods carry risks such as hidden fees, negative impacts on credit scores, and potential for overborrowing beyond one's repayment capacity. Consumers should carefully review terms, monitor repayment schedules, and ensure transparent communication with lenders to avoid default and financial strain.

Which Is Best for You: Choosing the Right Payment Method

A credit agreement typically involves formal borrowing with set interest rates and repayment terms, making it suitable for larger purchases or long-term financing. Buy Now Pay Later (BNPL) offers interest-free short-term installments, ideal for smaller or immediate purchases without impacting credit scores. Evaluating your financial situation, purchase size, and repayment capability helps determine which method best aligns with your payment preferences and credit goals.

Related Important Terms

Split-Payment Credit Agreements

Split-payment credit agreements enable consumers to divide their purchase amount into fixed installments over a set period, offering structured repayment terms and often lower interest rates compared to traditional credit agreements. Unlike buy now pay later options that typically defer payment without interest for a short period, split-payment agreements provide a predictable payment schedule, reducing financial risk and improving credit management.

Embedded BNPL APIs

Embedded BNPL APIs seamlessly integrate buy now pay later options within credit agreements, enabling real-time approval and flexible installment payments without traditional credit checks. This innovation streamlines customer financing, reduces checkout friction, and enhances merchants' conversion rates by offering immediate, interest-free credit tailored to user spending profiles.

Convertible Credit Facilities

Convertible credit facilities offer flexible financing solutions allowing borrowers to convert outstanding debt into equity, unlike buy now pay later (BNPL) plans which provide short-term installment payments without equity options. Credit agreements governing convertible credit facilities typically include detailed covenants and conversion terms, contrasting with BNPL's straightforward, consumer-focused repayment schedules.

Instant Credit Scoring

Instant credit scoring accelerates approval processes in credit agreements by utilizing real-time data analytics and machine learning algorithms, enabling lenders to assess borrower risk instantly and offer tailored credit limits. In contrast, buy now pay later services often rely on simplified or soft credit checks, prioritizing user convenience and short-term payment plans over comprehensive credit assessment.

Soft-Pull Pre-Approval

Soft-pull pre-approval in credit agreements allows consumers to check eligibility without impacting their credit score, offering a safer option compared to buy now pay later (BNPL) services, which often bypass traditional credit checks. This pre-approval process provides transparency and reduces the risk of overextension by enabling lenders to assess creditworthiness before finalizing payment terms.

Pay-in-Four Schemes

Pay-in-Four schemes, a popular form of Buy Now Pay Later (BNPL), allow consumers to split purchases into four interest-free installments, enhancing affordability and cash flow management without the complexity of traditional credit agreements. Unlike conventional credit agreements that often involve credit checks and interest accrual, Pay-in-Four plans typically require no credit history verification, offering a simpler, more accessible payment method while encouraging timely repayments through automatic deductions.

Micro-Installment Loans

Micro-installment loans provide a structured repayment plan with fixed monthly payments over a set term, offering predictability and affordability compared to buy now pay later (BNPL) options, which typically require full payment within short intervals without interest. Credit agreements for micro-installment loans often undergo more rigorous credit checks and formal contracting, ensuring clear terms and consumer protections that BNPL services may lack.

Credit Line Overlay

Credit agreements typically involve a predetermined credit limit with fixed terms and interest rates, while Buy Now Pay Later (BNPL) services offer flexible short-term installment plans without traditional credit checks. Credit Line Overlay enhances these options by integrating real-time credit limit assessments, enabling seamless approval processes and reducing default risk for both credit agreements and BNPL transactions.

Dynamic Credit Limit Adjustment

Credit agreements offer dynamic credit limit adjustments based on real-time assessment of a borrower's repayment behavior, income changes, and credit score updates, enabling tailored financial flexibility. Buy Now Pay Later (BNPL) services typically provide fixed spending limits per transaction or short-term plans without continuous credit limit evaluations, limiting adaptability to users' evolving financial situations.

Deferred Payment Analytics

Credit agreements provide structured repayment schedules with interest rates and formal contracts, enabling detailed deferred payment analytics through transaction tracking and credit risk assessment. Buy Now Pay Later (BNPL) services offer short-term, interest-free deferred payments with simplified approval, but present challenges for precise deferred payment analytics due to fragmented data and varied repayment behaviors.

Credit agreement vs Buy now pay later for payment methods. Infographic

moneydiff.com

moneydiff.com