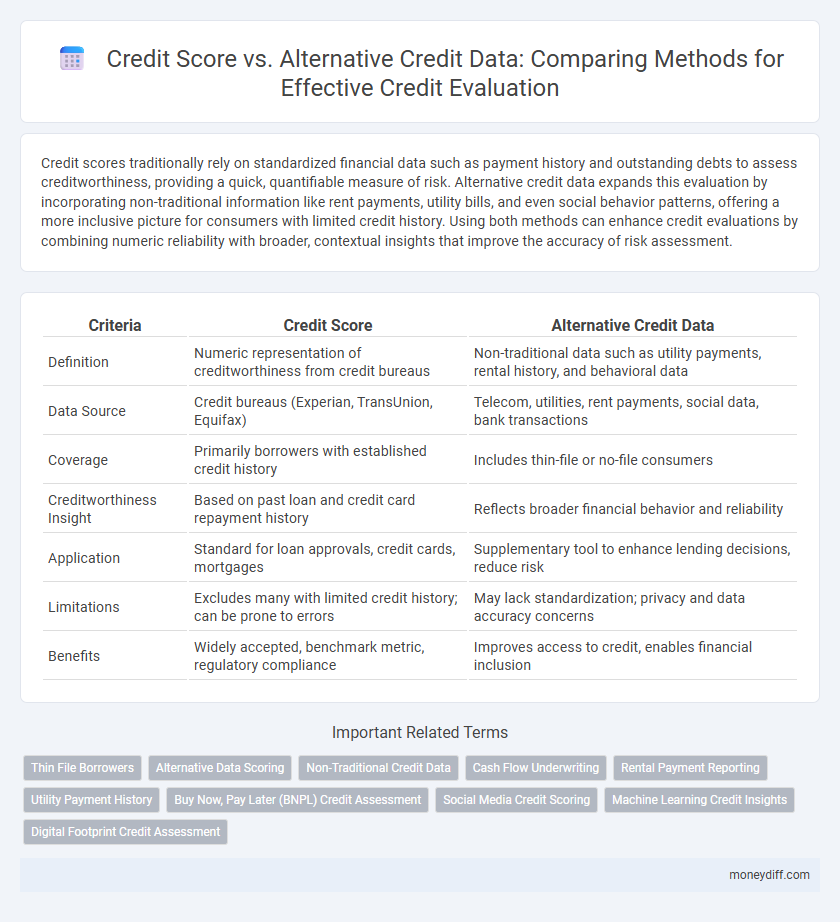

Credit scores traditionally rely on standardized financial data such as payment history and outstanding debts to assess creditworthiness, providing a quick, quantifiable measure of risk. Alternative credit data expands this evaluation by incorporating non-traditional information like rent payments, utility bills, and even social behavior patterns, offering a more inclusive picture for consumers with limited credit history. Using both methods can enhance credit evaluations by combining numeric reliability with broader, contextual insights that improve the accuracy of risk assessment.

Table of Comparison

| Criteria | Credit Score | Alternative Credit Data |

|---|---|---|

| Definition | Numeric representation of creditworthiness from credit bureaus | Non-traditional data such as utility payments, rental history, and behavioral data |

| Data Source | Credit bureaus (Experian, TransUnion, Equifax) | Telecom, utilities, rent payments, social data, bank transactions |

| Coverage | Primarily borrowers with established credit history | Includes thin-file or no-file consumers |

| Creditworthiness Insight | Based on past loan and credit card repayment history | Reflects broader financial behavior and reliability |

| Application | Standard for loan approvals, credit cards, mortgages | Supplementary tool to enhance lending decisions, reduce risk |

| Limitations | Excludes many with limited credit history; can be prone to errors | May lack standardization; privacy and data accuracy concerns |

| Benefits | Widely accepted, benchmark metric, regulatory compliance | Improves access to credit, enables financial inclusion |

Understanding Credit Scores: Traditional Evaluation Methods

Credit scores are numerical representations derived from traditional data sources such as payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. These scores provide lenders with a standardized method to assess borrower risk based on historical financial behaviors documented in credit bureaus. Understanding credit scores is fundamental for evaluating creditworthiness, though they may not capture the full financial profile of individuals lacking extensive credit history.

What Is Alternative Credit Data?

Alternative credit data includes non-traditional financial information such as utility payments, rental history, phone bills, and subscription services used to assess creditworthiness. This data provides a broader view of an individual's financial behavior, especially for those with limited or no traditional credit history. Incorporating alternative credit data improves credit evaluation accuracy and increases access to credit for underserved populations.

Key Differences: Credit Score vs. Alternative Credit Data

Credit scores primarily rely on traditional financial data such as payment history, credit utilization, and length of credit history to evaluate creditworthiness. Alternative credit data incorporates non-traditional information like utility payments, rental history, and mobile phone bills, providing a broader view of an individual's financial behavior. This approach can enhance credit evaluation for those with limited or no conventional credit history, enabling a more inclusive lending process.

Benefits of Traditional Credit Scoring

Traditional credit scoring leverages established financial data such as payment history, credit utilization, and length of credit history, providing lenders with a reliable and standardized assessment of borrower risk. This method offers predictive accuracy based on extensive historical data and widespread acceptance across financial institutions. Its benefits include faster credit decisions, regulatory compliance, and easier integration into existing credit evaluation systems.

Advantages of Using Alternative Credit Data

Alternative credit data enhances credit evaluation by incorporating non-traditional financial information such as utility payments, rental history, and mobile phone bills, providing a more comprehensive view of creditworthiness. This approach benefits individuals with limited or no traditional credit history by offering lenders additional insights to assess risk accurately. Utilizing alternative credit data improves financial inclusion and reduces credit access disparities for underbanked populations.

Impact of Alternative Data on Financial Inclusion

Alternative credit data, such as utility payments, rent history, and mobile phone usage, significantly enhances credit evaluation by providing a more comprehensive financial profile for individuals lacking traditional credit scores. This expanded data set improves financial inclusion by enabling lenders to assess creditworthiness more accurately for underserved populations, reducing reliance on conventional credit reports that often exclude low-income or thin-file borrowers. Incorporating alternative data increases access to credit, promotes economic empowerment, and supports broader participation in the financial system.

Challenges in Integrating Alternative Credit Data

Integrating alternative credit data into credit evaluation faces significant challenges due to inconsistent data quality, lack of standardized reporting formats, and privacy concerns from consumers and regulators. Traditional credit scoring models rely heavily on well-established financial history, while alternative data sources, such as utility payments or rental records, vary widely in accuracy and availability. Financial institutions must develop robust algorithms and compliance frameworks to effectively incorporate alternative data without compromising credit assessment reliability.

Regulatory Considerations for Credit Evaluation

Regulatory considerations for credit evaluation increasingly emphasize transparency, fairness, and non-discrimination when using both traditional credit scores and alternative credit data. Compliance with laws such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA) mandates that lenders ensure alternative data, including utility payments and rental histories, do not introduce bias or violate consumer privacy rights. Regulators encourage validation of alternative data models to promote responsible lending while expanding credit access to underserved populations.

How Lenders Use Both Credit Score and Alternative Data

Lenders combine traditional credit scores with alternative credit data, such as utility payments, rental history, and social media activity, to gain a comprehensive view of a borrower's creditworthiness. Integrating alternative data helps identify credit risk for individuals with limited or no credit history, enhancing the accuracy of lending decisions. This dual approach reduces default rates and expands access to credit for underserved populations.

The Future of Credit Evaluation: Hybrid Approaches

Credit evaluation is progressing towards hybrid approaches that integrate traditional credit scores with alternative credit data such as utility payments, rental history, and social media behavior to create a more comprehensive borrower profile. This fusion enhances predictive accuracy, especially for thin-file or credit-invisible consumers, by capturing financial behaviors often missed by conventional scoring models. Financial institutions adopting these hybrid models can reduce default risks and promote financial inclusion by extending credit to a broader demographic.

Related Important Terms

Thin File Borrowers

Thin file borrowers often face challenges due to limited traditional credit history, making credit scores less effective for accurate risk assessment. Leveraging alternative credit data such as utility payments, rental history, and mobile phone bills enhances credit evaluation by providing a more comprehensive financial profile.

Alternative Data Scoring

Alternative data scoring leverages non-traditional information such as utility payments, rental history, and social behavior to provide a more inclusive credit evaluation, especially for individuals with thin or no credit files. This method enhances credit accessibility and risk assessment accuracy by incorporating diverse financial indicators beyond conventional credit scores.

Non-Traditional Credit Data

Non-traditional credit data, such as utility payments, rent history, and mobile phone bills, provide a broader view of financial behavior that traditional credit scores often overlook. Incorporating alternative credit data enhances credit evaluation accuracy for individuals with limited or no conventional credit history, improving their access to loans and financial services.

Cash Flow Underwriting

Cash flow underwriting integrates alternative credit data such as bank transactions, utility payments, and subscription services to provide a more comprehensive credit evaluation than traditional credit scores. This method enhances risk assessment accuracy by analyzing real-time income and expense patterns, offering lenders deeper insights into borrowers' financial behavior beyond credit history.

Rental Payment Reporting

Rental payment reporting enhances credit evaluation by incorporating alternative credit data, allowing lenders to assess creditworthiness beyond traditional credit scores. This method captures consistent rental payment history, improving access to credit for individuals with limited or no credit records.

Utility Payment History

Utility payment history offers a valuable alternative credit data point, boosting credit evaluation accuracy for consumers with limited traditional credit scores. Incorporating utility bill payments such as electricity, water, and phone services into credit assessments enhances lender risk prediction and broadens credit access.

Buy Now, Pay Later (BNPL) Credit Assessment

Buy Now, Pay Later (BNPL) credit assessment leverages alternative credit data such as transaction history, utility payments, and rental records to provide a more comprehensive evaluation of creditworthiness beyond traditional credit scores. This approach enhances risk prediction accuracy for consumers typically underserved by conventional credit scoring models, enabling lenders to offer more inclusive credit options.

Social Media Credit Scoring

Social media credit scoring leverages alternative credit data such as online behavior, social interactions, and digital footprints to enhance credit evaluation beyond traditional credit scores. Integrating social media analytics provides lenders with a more comprehensive risk assessment, especially for individuals with limited credit history.

Machine Learning Credit Insights

Machine learning models enhance credit evaluation by integrating traditional credit scores with alternative credit data such as utility payments, rental history, and social behavior, improving prediction accuracy for underserved borrowers. Leveraging big data and AI algorithms uncovers hidden patterns, enabling lenders to assess creditworthiness more inclusively and reduce default risk.

Digital Footprint Credit Assessment

Digital footprint credit assessment leverages alternative credit data such as online transaction history, social media activity, and digital behavior patterns to evaluate creditworthiness beyond traditional credit scores. This method enhances credit evaluation accuracy by incorporating real-time, diverse data points that reflect an individual's financial reliability and risk profile more comprehensively.

Credit score vs alternative credit data for credit evaluation Infographic

moneydiff.com

moneydiff.com