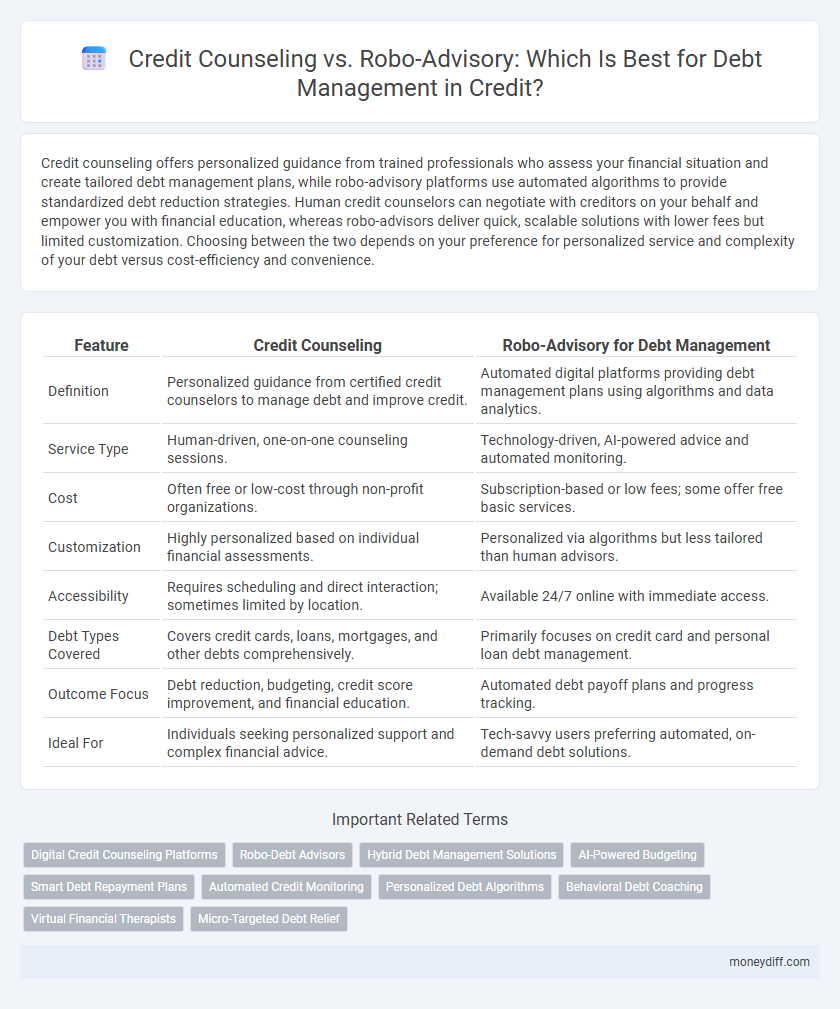

Credit counseling offers personalized guidance from trained professionals who assess your financial situation and create tailored debt management plans, while robo-advisory platforms use automated algorithms to provide standardized debt reduction strategies. Human credit counselors can negotiate with creditors on your behalf and empower you with financial education, whereas robo-advisors deliver quick, scalable solutions with lower fees but limited customization. Choosing between the two depends on your preference for personalized service and complexity of your debt versus cost-efficiency and convenience.

Table of Comparison

| Feature | Credit Counseling | Robo-Advisory for Debt Management |

|---|---|---|

| Definition | Personalized guidance from certified credit counselors to manage debt and improve credit. | Automated digital platforms providing debt management plans using algorithms and data analytics. |

| Service Type | Human-driven, one-on-one counseling sessions. | Technology-driven, AI-powered advice and automated monitoring. |

| Cost | Often free or low-cost through non-profit organizations. | Subscription-based or low fees; some offer free basic services. |

| Customization | Highly personalized based on individual financial assessments. | Personalized via algorithms but less tailored than human advisors. |

| Accessibility | Requires scheduling and direct interaction; sometimes limited by location. | Available 24/7 online with immediate access. |

| Debt Types Covered | Covers credit cards, loans, mortgages, and other debts comprehensively. | Primarily focuses on credit card and personal loan debt management. |

| Outcome Focus | Debt reduction, budgeting, credit score improvement, and financial education. | Automated debt payoff plans and progress tracking. |

| Ideal For | Individuals seeking personalized support and complex financial advice. | Tech-savvy users preferring automated, on-demand debt solutions. |

Understanding Credit Counseling: A Traditional Approach

Credit counseling involves personalized guidance from certified counselors who analyze an individual's financial situation to create tailored debt management plans. This traditional approach emphasizes human interaction, providing emotional support and educational resources to improve budgeting and credit habits. Credit counseling agencies often negotiate with creditors directly, aiming to reduce interest rates and consolidate payments for manageable debt relief.

What Is Robo-Advisory for Debt Management?

Robo-advisory for debt management utilizes automated algorithms to analyze a borrower's financial situation and create personalized repayment plans. These digital platforms offer continuous monitoring and real-time adjustments to optimize debt reduction strategies without human intervention. Robo-advisors provide scalable, low-cost solutions compared to traditional credit counseling services by leveraging data-driven insights and machine learning.

Comparing Personalization: Human vs. Algorithm

Credit counseling offers personalized debt management plans crafted by experienced advisors who consider individual financial situations, emotional factors, and unique spending habits. Robo-advisory employs advanced algorithms to analyze financial data rapidly, providing efficient, data-driven suggestions but may lack the nuanced understanding and empathy of human counselors. Choosing between the two depends on the need for tailored human insight versus scalable, automated recommendations in debt management.

Accessibility and Convenience: Digital vs. Face-to-Face

Credit counseling offers personalized, face-to-face guidance that caters to individual financial situations, fostering trust and enabling tailored debt management strategies. Robo-advisory platforms provide high accessibility through automated, 24/7 digital interfaces, allowing users to manage debt conveniently without scheduling appointments. The choice between traditional credit counseling and robo-advisory hinges on users' preference for human interaction versus on-demand digital convenience in debt management.

Cost Structure: Fees and Affordability

Credit counseling typically involves fixed or sliding-scale fees that are often waived based on income, providing affordable access to personalized debt management plans. Robo-advisory for debt management leverages algorithm-driven services with lower overhead, resulting in minimal or subscription-based fees that enhance cost efficiency. Evaluating the fee structures reveals credit counseling offers tailored support at variable costs, while robo-advisors present scalable affordability with reduced human intervention.

Impact on Credit Scores: Counseling vs. Robo-Advisors

Credit counseling offers personalized debt management plans that can improve credit scores by negotiating lower interest rates and setting realistic repayment goals, leading to steady, positive credit behavior. Robo-advisors use algorithms to automate debt reduction strategies but may lack the tailored approach needed to address unique credit issues, potentially resulting in slower credit score improvement. Both methods assist in managing debt, but credit counseling typically has a more significant, measurable impact on credit score recovery due to direct human intervention.

Confidentiality and Data Security in Debt Solutions

Credit counseling services prioritize confidentiality by offering personalized, human-guided sessions that ensure sensitive financial information is safeguarded under strict privacy protocols. Robo-advisory platforms implement advanced encryption and automated security measures to protect user data while providing scalable, algorithm-driven debt management solutions. Both methods emphasize data security, but credit counseling often involves more direct human oversight, whereas robo-advisors rely on sophisticated technology to maintain confidentiality.

Financial Education: Guidance Methods Compared

Credit counseling offers personalized financial education through expert advisors who assess individual debt situations, creating tailored repayment plans and teaching budgeting skills. Robo-advisory platforms use algorithms to provide automated, cost-effective debt management recommendations, emphasizing self-directed learning and digital tools for tracking progress. Both methods improve financial literacy but differ in human interaction and customization levels, catering to diverse preferences in debt management guidance.

Suitability for Different Debt Types

Credit counseling offers personalized guidance tailored to various debt types such as credit card balances, medical bills, and unsecured loans, making it suitable for individuals seeking comprehensive debt management. Robo-advisory platforms use algorithm-driven recommendations primarily geared towards optimizing investment portfolios and may lack customized strategies for complex debt situations. For managing diverse and complicated debts, credit counseling provides more targeted solutions compared to the automated nature of robo-advisors.

Making the Right Choice: Factors to Consider

Evaluating credit counseling versus robo-advisory for debt management requires analyzing personalized financial assessment, human expertise, and cost-effectiveness. Credit counseling offers tailored guidance from certified counselors, ideal for complex debt situations and emotional support, whereas robo-advisory provides algorithm-driven strategies with lower fees and 24/7 accessibility. Key factors to consider include the severity of debt, need for customized solutions, user comfort with technology, and budget constraints.

Related Important Terms

Digital Credit Counseling Platforms

Digital credit counseling platforms leverage advanced algorithms to provide personalized debt management plans, combining human expertise with automation for improved financial outcomes. Robo-advisory services offer real-time, data-driven credit advice and budgeting tools, enhancing accessibility and efficiency in managing outstanding debt.

Robo-Debt Advisors

Robo-debt advisors leverage advanced algorithms and AI technology to provide personalized debt management plans, optimizing repayment schedules and interest savings with minimal human intervention. These platforms offer real-time financial tracking, automated budgeting tools, and predictive analytics, making them cost-effective and accessible alternatives to traditional credit counseling services.

Hybrid Debt Management Solutions

Hybrid debt management solutions combine the personalized guidance of credit counseling with the efficiency and data-driven strategies of robo-advisory platforms, offering tailored repayment plans and automated budgeting tools. This integration enhances debt resolution outcomes by leveraging human insight alongside algorithmic optimization for more effective financial decision-making.

AI-Powered Budgeting

AI-powered budgeting in robo-advisory platforms leverages advanced algorithms to analyze spending patterns and create personalized debt management plans, offering real-time adjustments and predictive financial insights. Credit counseling, while effective for personalized advice, lacks the continuous data-driven optimization found in robo-advisory tools, making AI budgeting a scalable and efficient option for managing debt.

Smart Debt Repayment Plans

Credit counseling offers personalized strategies and human insight to create smart debt repayment plans tailored to individual financial situations, while robo-advisory leverages algorithms for automated, data-driven debt management solutions that optimize repayment schedules efficiently. Both methods aim to improve credit health, but credit counseling provides emotional support and negotiation assistance, whereas robo-advisors focus on precision and cost-effectiveness in debt reduction.

Automated Credit Monitoring

Automated credit monitoring through robo-advisors provides real-time alerts on credit score changes, helping users manage debt proactively with data-driven insights and personalized recommendations. Credit counseling offers human expertise for tailored financial strategies, but lacks the instant, automated tracking capabilities that enhance timely debt management decisions.

Personalized Debt Algorithms

Credit counseling offers personalized guidance based on human assessment, while robo-advisory utilizes advanced debt algorithms to tailor automated repayment plans dynamically adjusting to individual financial behavior. These AI-driven solutions analyze spending patterns, income, and debt levels to optimize strategies for faster debt reduction and improved credit scores.

Behavioral Debt Coaching

Behavioral debt coaching emphasizes personalized guidance and emotional support to change spending habits and improve financial decision-making, which credit counseling typically provides through human interaction. Robo-advisory for debt management offers algorithm-driven recommendations and automated budgeting tools but often lacks the nuanced behavioral insights critical for lasting debt reduction.

Virtual Financial Therapists

Virtual financial therapists combine personalized debt assessment with emotional support, offering tailored credit counseling through AI-driven platforms. This hybrid approach enhances traditional robo-advisory models by addressing both financial behaviors and psychological barriers to effective debt management.

Micro-Targeted Debt Relief

Credit counseling provides personalized debt management plans with tailored advice from certified counselors, focusing on individual financial situations to optimize repayment strategies. Robo-advisory platforms leverage algorithms and automation to offer micro-targeted debt relief solutions, delivering efficient, scalable, and data-driven guidance for managing diverse debt portfolios.

Credit counseling vs Robo-advisory for debt management. Infographic

moneydiff.com

moneydiff.com