Credit bureaus centralize consumer credit data, enabling lenders to assess creditworthiness through established reporting standards but often limiting transparency and user control. Decentralized credit protocols leverage blockchain technology to create a transparent and tamper-resistant ledger, giving individuals greater ownership of their credit information while enhancing data security. This shift promotes more equitable credit access and reduces dependency on traditional reporting intermediaries.

Table of Comparison

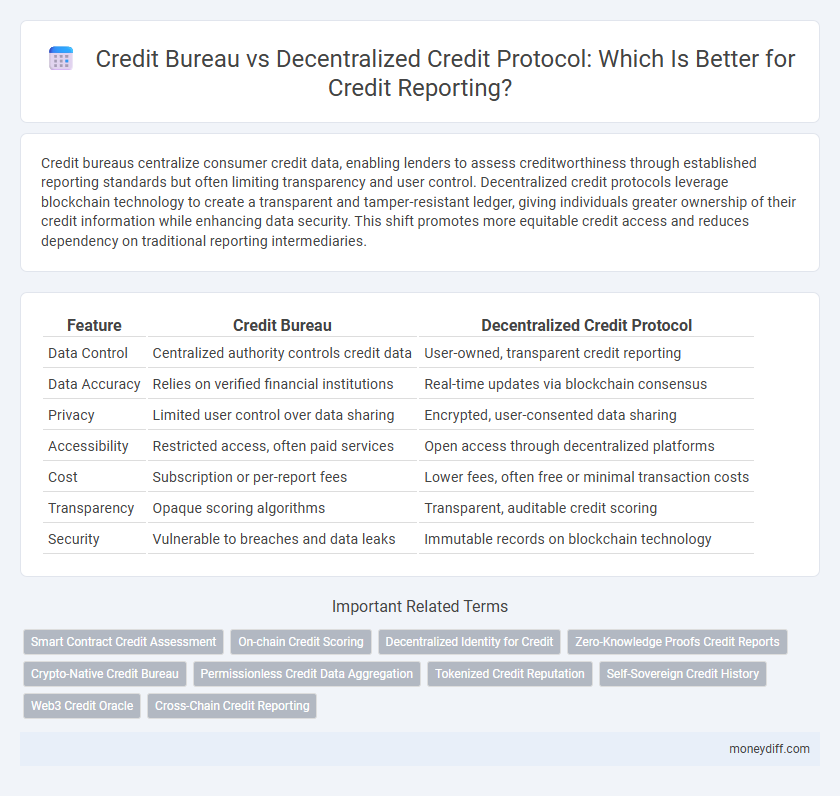

| Feature | Credit Bureau | Decentralized Credit Protocol |

|---|---|---|

| Data Control | Centralized authority controls credit data | User-owned, transparent credit reporting |

| Data Accuracy | Relies on verified financial institutions | Real-time updates via blockchain consensus |

| Privacy | Limited user control over data sharing | Encrypted, user-consented data sharing |

| Accessibility | Restricted access, often paid services | Open access through decentralized platforms |

| Cost | Subscription or per-report fees | Lower fees, often free or minimal transaction costs |

| Transparency | Opaque scoring algorithms | Transparent, auditable credit scoring |

| Security | Vulnerable to breaches and data leaks | Immutable records on blockchain technology |

Overview of Credit Reporting Systems

Credit bureaus operate as centralized entities that collect, store, and provide credit information to lenders, enabling standardized credit reporting and risk assessment. Decentralized credit protocols leverage blockchain technology to create transparent, tamper-resistant credit histories controlled by users, enhancing privacy and data security. These systems differ fundamentally in data ownership, accessibility, and the potential for real-time updates in credit reporting processes.

What Is a Credit Bureau?

A credit bureau is a centralized agency that collects, maintains, and provides consumer credit information to lenders, enabling them to assess creditworthiness and make informed lending decisions. It aggregates data from various financial institutions, such as banks and credit card companies, to generate credit reports and scores used in traditional credit reporting systems. Unlike decentralized credit protocols, credit bureaus operate under regulated frameworks and rely on centralized data repositories to maintain accuracy and compliance.

Introduction to Decentralized Credit Protocols

Decentralized credit protocols leverage blockchain technology to enable transparent, tamper-proof credit reporting without relying on traditional credit bureaus. These protocols facilitate peer-to-peer verification of creditworthiness, reducing dependence on centralized entities and lowering risks of data breaches and corruption. By integrating smart contracts and distributed ledgers, decentralized systems empower users with control over their financial data and improve access to credit for underbanked populations.

Data Collection: Centralized vs Decentralized Approaches

Credit bureaus rely on centralized data collection methods, aggregating credit information from banks, lenders, and financial institutions into a single database, enabling standardized credit reporting and risk assessment. Decentralized credit protocols utilize blockchain technology to collect and verify credit data directly from multiple peer-to-peer sources, enhancing transparency and reducing data manipulation risks. This decentralized approach empowers users with greater control over their credit information and promotes real-time data updates without relying on intermediaries.

Privacy and Security Considerations

Credit bureaus centralize sensitive financial data, increasing the risk of large-scale data breaches and unauthorized access, which raises privacy concerns for consumers. Decentralized credit protocols use blockchain technology to enhance security by distributing data across multiple nodes, reducing the likelihood of single-point failures and providing greater control over personal information. Privacy-preserving cryptographic techniques, such as zero-knowledge proofs, enable decentralized systems to verify creditworthiness without exposing raw financial details.

Accuracy and Transparency of Credit Reporting

Credit bureaus aggregate and verify data from multiple financial institutions, ensuring standardized accuracy through centralized reporting but often lack transparency in data usage and decision algorithms. Decentralized credit protocols leverage blockchain technology to provide immutable, transparent transaction records, enhancing data accuracy by reducing errors and enabling real-time updates accessible to all participants. This transparency fosters greater trust and accountability, empowering consumers with more control over their credit information compared to traditional bureau models.

Accessibility for Consumers and Lenders

Traditional credit bureaus centralize consumer data, often limiting accessibility due to strict reporting guidelines and delayed updates, which can hinder timely credit assessments. Decentralized credit protocols enhance accessibility by enabling real-time data sharing across multiple platforms, allowing consumers greater control over their credit information and lenders faster, more transparent access to comprehensive credit profiles. This dynamic system supports improved credit decision-making and fosters financial inclusion by overcoming the limitations of centralized reporting infrastructure.

Cost and Efficiency of Reporting Solutions

Credit bureaus operate centralized databases that often involve higher operational costs due to infrastructure, data management, and compliance expenses, resulting in slower updates and limited transparency. Decentralized credit protocols leverage blockchain technology to reduce intermediary fees, enhance real-time data sharing, and improve cost efficiency by automating reporting processes. This distributed ledger approach increases transparency and reduces errors, enabling faster and more reliable credit reporting solutions.

Regulatory and Compliance Aspects

Credit bureaus operate under strict regulatory frameworks such as the Fair Credit Reporting Act (FCRA) in the United States, ensuring standardized data collection, accuracy, and consumer dispute resolution. Decentralized credit protocols, leveraging blockchain technology, face emerging regulatory challenges due to their distributed nature and lack of centralized control, which complicates compliance with data privacy laws like GDPR and KYC/AML requirements. Regulatory bodies are increasingly scrutinizing decentralized systems to establish governance mechanisms that provide transparency and accountability comparable to traditional credit bureaus.

The Future of Credit Reporting: Centralized or Decentralized?

Credit bureaus currently dominate the credit reporting landscape by aggregating consumer credit data into centralized databases, enabling lenders to assess creditworthiness efficiently. Decentralized credit protocols leverage blockchain technology to create transparent, tamper-resistant credit records that empower consumers with greater control over their data and improve data accuracy. Emerging trends indicate a shift towards decentralized models that enhance privacy, reduce fraud, and foster financial inclusion, potentially redefining the future of credit reporting.

Related Important Terms

Smart Contract Credit Assessment

Smart Contract Credit Assessment leverages blockchain technology to automate transparent and tamper-proof credit evaluations, contrasting with traditional credit bureaus that rely on centralized, often opaque data repositories. Decentralized credit protocols enhance data privacy and enable real-time, immutable credit reporting, reducing fraud risk and increasing borrower access to credit opportunities.

On-chain Credit Scoring

On-chain credit scoring leverages decentralized credit protocols to provide transparent, immutable, and real-time credit reporting, reducing reliance on traditional credit bureaus that aggregate data through centralized means. This shift enhances data accuracy and borrower privacy while enabling seamless verification across blockchain networks.

Decentralized Identity for Credit

Decentralized credit protocols leverage blockchain technology and decentralized identity (DID) frameworks to provide transparent, tamper-proof credit reporting, enhancing user control over personal financial data compared to traditional credit bureaus. By integrating DID, these protocols enable secure, verifiable credentials that reduce reliance on centralized institutions, improve data accuracy, and empower consumers with greater privacy and interoperability across financial services.

Zero-Knowledge Proofs Credit Reports

Zero-Knowledge Proofs enable decentralized credit protocols to report credit histories without revealing sensitive personal data, enhancing privacy compared to traditional credit bureaus that aggregate and share detailed consumer information. This cryptographic approach allows verifiable creditworthiness assessments while minimizing data exposure and reducing risks associated with centralized data breaches.

Crypto-Native Credit Bureau

A Crypto-Native Credit Bureau leverages blockchain technology to provide transparent, immutable credit reporting, enhancing data privacy and reducing reliance on centralized authorities compared to traditional credit bureaus. Decentralized credit protocols enable peer-to-peer credit assessments and real-time updates, fostering greater financial inclusion and resilience within the crypto economy.

Permissionless Credit Data Aggregation

Permissionless credit data aggregation in decentralized credit protocols enables real-time, transparent credit reporting by leveraging blockchain technology, eliminating reliance on centralized credit bureaus. This approach enhances data accuracy and privacy while allowing seamless integration of diverse data sources, fostering a more inclusive and efficient credit ecosystem.

Tokenized Credit Reputation

Credit bureaus centralize credit reporting by aggregating consumer credit data, whereas decentralized credit protocols leverage blockchain technology to enable tokenized credit reputation systems that enhance transparency and user control over personal credit information. Tokenized credit reputation provides immutable, verifiable credit history on a decentralized ledger, reducing reliance on traditional bureaus and fostering more inclusive access to credit.

Self-Sovereign Credit History

Credit bureaus centralize credit reporting, controlling consumer credit histories and limiting individual control over personal data. Decentralized credit protocols enable Self-Sovereign Credit History by allowing users to securely manage and share their credit information directly, enhancing privacy, transparency, and data ownership.

Web3 Credit Oracle

Web3 Credit Oracles leverage decentralized credit protocols to provide real-time, transparent credit reporting by aggregating on-chain data, enhancing accuracy and borrower privacy compared to traditional credit bureaus that rely on centralized, often outdated financial records. This shift enables more inclusive credit assessments and reduces reliance on opaque intermediaries, driving innovation in decentralized finance (DeFi) lending ecosystems.

Cross-Chain Credit Reporting

Cross-chain credit reporting leverages decentralized credit protocols to enhance transparency and security beyond traditional credit bureaus, enabling real-time, tamper-resistant credit data sharing across multiple blockchain networks. This innovation reduces reporting delays and credit fraud by integrating credit histories from diverse chains, fostering a more comprehensive and accessible credit evaluation ecosystem.

Credit bureau vs decentralized credit protocol for reporting Infographic

moneydiff.com

moneydiff.com