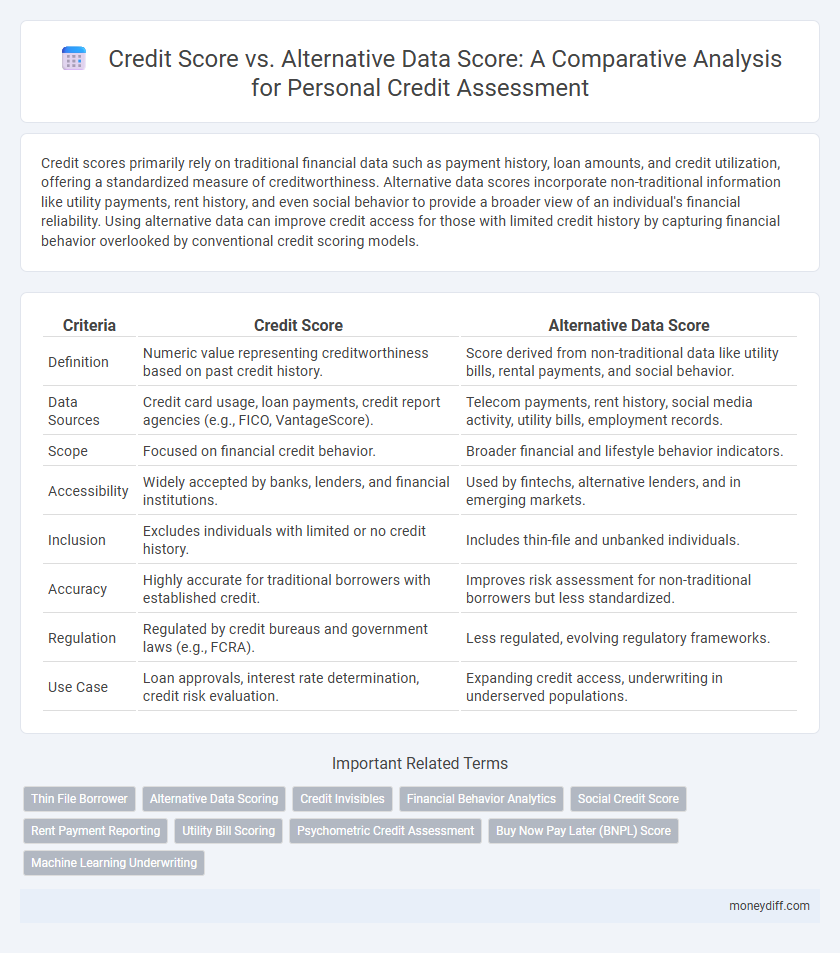

Credit scores primarily rely on traditional financial data such as payment history, loan amounts, and credit utilization, offering a standardized measure of creditworthiness. Alternative data scores incorporate non-traditional information like utility payments, rent history, and even social behavior to provide a broader view of an individual's financial reliability. Using alternative data can improve credit access for those with limited credit history by capturing financial behavior overlooked by conventional credit scoring models.

Table of Comparison

| Criteria | Credit Score | Alternative Data Score |

|---|---|---|

| Definition | Numeric value representing creditworthiness based on past credit history. | Score derived from non-traditional data like utility bills, rental payments, and social behavior. |

| Data Sources | Credit card usage, loan payments, credit report agencies (e.g., FICO, VantageScore). | Telecom payments, rent history, social media activity, utility bills, employment records. |

| Scope | Focused on financial credit behavior. | Broader financial and lifestyle behavior indicators. |

| Accessibility | Widely accepted by banks, lenders, and financial institutions. | Used by fintechs, alternative lenders, and in emerging markets. |

| Inclusion | Excludes individuals with limited or no credit history. | Includes thin-file and unbanked individuals. |

| Accuracy | Highly accurate for traditional borrowers with established credit. | Improves risk assessment for non-traditional borrowers but less standardized. |

| Regulation | Regulated by credit bureaus and government laws (e.g., FCRA). | Less regulated, evolving regulatory frameworks. |

| Use Case | Loan approvals, interest rate determination, credit risk evaluation. | Expanding credit access, underwriting in underserved populations. |

Understanding Credit Scores: Traditional Metrics

Traditional credit scores primarily rely on credit history, payment patterns, outstanding debts, and length of credit use to assess personal creditworthiness. These metrics are derived from data collected by major credit bureaus, emphasizing timely payments, credit utilization ratios, and credit inquiries. Alternative data scores incorporate non-traditional information such as rent payments, utility bills, and mobile phone transactions, offering a broader view but traditional scores remain the benchmark for lending decisions.

What Is Alternative Data Score?

Alternative Data Score evaluates creditworthiness by using non-traditional information such as utility payments, rental history, and social behavior, complementing or substituting traditional credit scores. This approach provides a more inclusive assessment for individuals with limited or no credit history, capturing financial reliability beyond conventional credit bureau data. Lenders utilize alternative data scores to enhance risk assessment and expand credit access to underserved populations.

Key Differences Between Credit Score and Alternative Data Score

Credit scores primarily rely on traditional financial data such as payment history, credit utilization, and length of credit history, which provides a standardized risk assessment for lenders. Alternative data scores incorporate non-traditional information like utility payments, rental history, and social data, offering a broader view of an individual's financial behavior, especially for those with limited credit history. These key differences impact loan accessibility and risk evaluation by including individuals who might be overlooked by traditional credit scoring models.

How Credit Scores Impact Personal Finance

Credit scores primarily influence access to traditional financial products like loans, mortgages, and credit cards by quantifying creditworthiness based on payment history, credit utilization, and credit age. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and digital footprints, offering a broader view of financial behavior for consumers with limited credit history. Leveraging both credit scores and alternative data can enhance personal finance management by improving loan approval chances and securing better interest rates through a more comprehensive risk assessment.

Advantages of Alternative Data Scores in Credit Assessment

Alternative Data Scores enhance credit assessment by incorporating non-traditional financial information such as utility payments, rental history, and mobile phone usage, offering a more comprehensive view of an individual's creditworthiness. These scores improve access to credit for thin-file or no-file consumers who lack sufficient traditional credit history, reducing reliance on limited data points. By utilizing diverse data sources, lenders can achieve greater accuracy in risk prediction and promote financial inclusion for underserved populations.

Limitations of Relying Solely on Credit Scores

Credit scores primarily measure past borrowing behavior, often excluding individuals with limited credit history, leading to incomplete assessments. Alternative data scores incorporate non-traditional information, such as utility payments and rental history, providing a broader view of financial reliability. Relying solely on credit scores risks overlooking creditworthy individuals who use alternative financial services or maintain consistent financial habits outside conventional credit systems.

The Role of Alternative Data in Financial Inclusion

Alternative data plays a crucial role in financial inclusion by providing a broader picture of personal creditworthiness beyond traditional credit scores, especially for individuals with limited credit history. This data includes utility payments, rental payments, and mobile phone usage, which help lenders assess the risk of underserved populations more accurately. Incorporating alternative data in credit assessment enhances access to financial services, enabling more people to obtain loans and build credit profiles.

How Lenders Use Credit vs. Alternative Data Scores

Lenders primarily rely on traditional credit scores, such as FICO or VantageScore, to evaluate an individual's creditworthiness by assessing payment history, outstanding debts, and credit utilization. Alternative data scores incorporate non-traditional information like utility payments, rental history, and social behavior, allowing lenders to access credit profiles for individuals with limited or no credit history. Employing both credit scores and alternative data enables lenders to make more inclusive and accurate lending decisions, reducing risk and expanding credit access to underserved populations.

Improving Your Personal Assessment with Alternative Data

In personal credit assessment, incorporating alternative data such as rental payments, utility bills, and employment history enhances the accuracy of your credit profile beyond traditional credit scores. This holistic approach allows lenders to evaluate financial responsibility more comprehensively, especially for individuals with limited credit history. Utilizing alternative data can improve credit accessibility and provide a clearer picture of your creditworthiness.

Future Trends: Credit Scoring and Alternative Data Evolution

Emerging trends in credit scoring emphasize the integration of alternative data sources such as utility payments, rental history, and social behavior to enhance personal credit assessments. Machine learning algorithms process these diverse data points, improving predictive accuracy and enabling more inclusive credit evaluations for underserved populations. Future credit models will increasingly blend traditional credit scores with alternative data scores, shaping a more comprehensive and dynamic risk profiling landscape.

Related Important Terms

Thin File Borrower

Credit scores traditionally rely on credit history and payment behavior, often disadvantaging thin file borrowers with limited credit data. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and employment records, providing a more comprehensive assessment for individuals with sparse credit files.

Alternative Data Scoring

Alternative Data Scoring leverages non-traditional information such as rental payments, utility bills, and social media activity to assess creditworthiness, providing a more inclusive evaluation for individuals with limited or no credit history. This approach enhances personal credit assessment by capturing a broader financial behavior profile beyond conventional credit scores, improving access to credit for underserved populations.

Credit Invisibles

Credit scores traditionally rely on limited financial data like loan repayment history and credit card usage, which often exclude credit invisibles--individuals lacking sufficient credit history. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and telecom bills, providing a more inclusive and accurate assessment of creditworthiness for credit invisibles.

Financial Behavior Analytics

Financial Behavior Analytics enhance personal assessment by integrating Credit Score with Alternative Data Score, offering a comprehensive view of an individual's creditworthiness beyond traditional credit history. Utilizing alternative data such as utility payments, rental history, and spending patterns improves accuracy in predicting repayment behavior and financial risk.

Social Credit Score

Social Credit Scores incorporate alternative data such as social behavior, online activity, and community engagement to provide a more comprehensive personal credit assessment beyond traditional credit scores based on financial history. Leveraging social data enables lenders to evaluate creditworthiness for individuals with limited or no conventional credit records, enhancing financial inclusion and risk prediction accuracy.

Rent Payment Reporting

Rent payment reporting enhances alternative data scores by providing consistent, positive credit behavior that traditional credit scores often overlook; incorporating rent payments can significantly improve creditworthiness for individuals with limited or no credit history. This method leverages timely rent payments to create a more comprehensive personal credit assessment, bridging gaps left by conventional credit scoring models.

Utility Bill Scoring

Credit scores primarily rely on traditional financial data like loan repayment history and credit card usage, whereas alternative data scores incorporate utility bill payments, rent, and other non-traditional payments to assess creditworthiness. Utility bill scoring enhances personal credit assessments by capturing timely payments on electric, water, and phone bills, thus providing a more comprehensive view of financial responsibility for individuals with limited credit history.

Psychometric Credit Assessment

Psychometric credit assessment leverages behavioral data and personality traits to evaluate creditworthiness, offering a more inclusive alternative to traditional credit scores that primarily rely on financial history. This method enhances predictive accuracy by incorporating alternative data such as spending habits, social behavior, and cognitive abilities, enabling lenders to assess individuals with limited or no credit history.

Buy Now Pay Later (BNPL) Score

Buy Now Pay Later (BNPL) Score leverages alternative data such as utility payments, rental history, and mobile phone bills to provide a more inclusive personal credit assessment, especially for consumers with limited or no traditional credit history. Unlike conventional credit scores that rely heavily on credit card and loan repayment records, BNPL scores enable lenders to evaluate borrower reliability through diverse financial behaviors, enhancing access to credit while managing risk effectively.

Machine Learning Underwriting

Machine learning underwriting enhances personal credit assessment by integrating traditional credit scores with alternative data scores, analyzing non-traditional information such as utility payments, rental history, and social behavior to improve accuracy and inclusivity. This fusion of datasets enables more nuanced risk modeling, reducing bias and expanding credit access to underserved populations.

Credit Score vs Alternative Data Score for personal assessment. Infographic

moneydiff.com

moneydiff.com