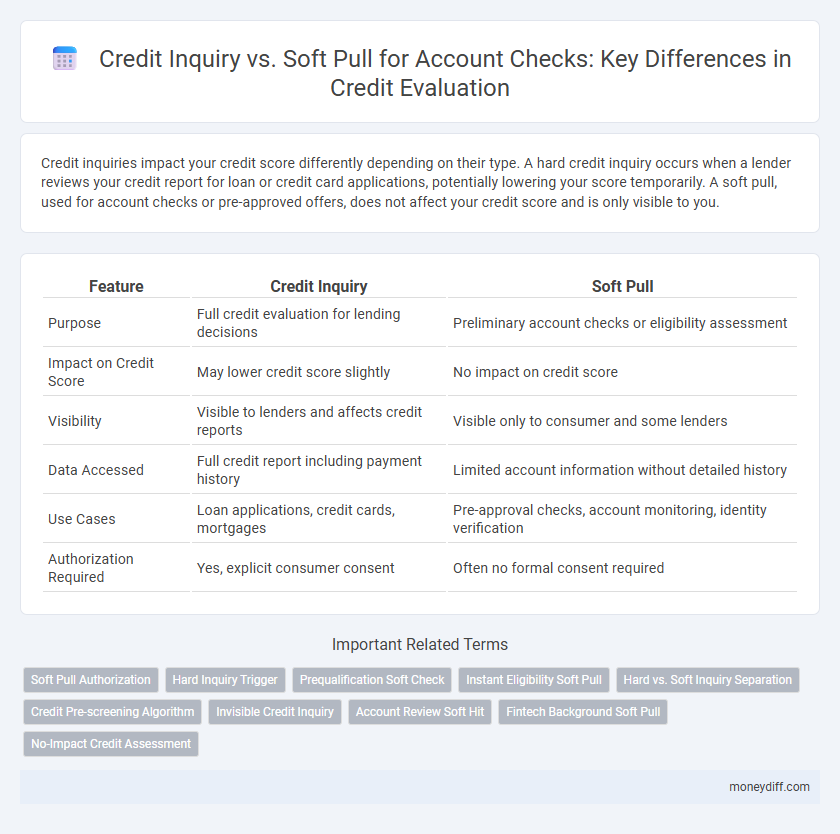

Credit inquiries impact your credit score differently depending on their type. A hard credit inquiry occurs when a lender reviews your credit report for loan or credit card applications, potentially lowering your score temporarily. A soft pull, used for account checks or pre-approved offers, does not affect your credit score and is only visible to you.

Table of Comparison

| Feature | Credit Inquiry | Soft Pull |

|---|---|---|

| Purpose | Full credit evaluation for lending decisions | Preliminary account checks or eligibility assessment |

| Impact on Credit Score | May lower credit score slightly | No impact on credit score |

| Visibility | Visible to lenders and affects credit reports | Visible only to consumer and some lenders |

| Data Accessed | Full credit report including payment history | Limited account information without detailed history |

| Use Cases | Loan applications, credit cards, mortgages | Pre-approval checks, account monitoring, identity verification |

| Authorization Required | Yes, explicit consumer consent | Often no formal consent required |

Understanding Credit Inquiries: Hard vs. Soft Pulls

Credit inquiries distinguish between hard pulls and soft pulls, each affecting credit reports differently; hard pulls occur when lenders check credit for loan approval, potentially lowering credit scores. Soft pulls happen during account checks or pre-approval offers and do not impact credit scores, allowing consumers to review their credit without risk. Understanding this difference is crucial for managing credit health and minimizing unnecessary score reductions.

What Is a Credit Inquiry?

A credit inquiry occurs when a lender or financial institution requests your credit report to evaluate your creditworthiness, impacting your credit score based on the inquiry type. Hard inquiries, typically from credit applications, can lower your score temporarily, while soft inquiries, such as account checks by existing creditors, do not affect your credit rating. Understanding the difference between credit inquiry types ensures better management of your credit profile and financial health.

Soft Pulls: How They Work and When They Occur

Soft pulls, also known as soft inquiries, occur when a lender or company checks your credit report without affecting your credit score. These inquiries typically happen during pre-approval offers, background checks, or account reviews and are not visible to potential lenders reviewing your credit. Understanding soft pulls helps consumers monitor credit activity without risking negative impacts on their credit health.

Hard Pulls: Impact on Your Credit Score

Hard pulls, also known as hard inquiries, occur when a lender reviews your credit report to make a lending decision, which can temporarily lower your credit score by a few points. These inquiries remain on your credit report for up to two years and may influence your creditworthiness, especially if multiple hard pulls occur within a short period. Unlike soft pulls, hard inquiries are visible to future lenders, signaling active credit-seeking behavior that could affect your chances of approval.

Account Checks: Why Lenders Use Soft Pulls

Lenders use soft pulls for account checks because they provide a non-intrusive way to review a consumer's credit information without impacting their credit score. Soft credit inquiries allow lenders to verify account status, payment history, and credit utilization quickly, aiding in risk assessment and pre-approval decisions. Unlike hard pulls, soft inquiries do not require borrower authorization and do not appear on credit reports visible to other lenders.

Credit Card Applications: Hard Pull vs. Soft Pull

Credit card applications involve either a hard pull or a soft pull on your credit report, significantly impacting your credit score. A hard pull, also known as a hard inquiry, occurs when lenders review your full credit report to assess creditworthiness, often lowering your credit score slightly. Soft pulls, used for account checks and pre-approval offers, do not affect your credit score and only provide limited information to the creditor.

How Soft Pulls Affect Your Credit Report

Soft pulls, also known as soft inquiries, occur when a lender or company checks your credit report without your permission for account reviews or pre-approved offers, and these do not impact your credit score. Unlike hard inquiries, soft pulls are visible only to you and do not affect your creditworthiness in the eyes of creditors. Regular soft pulls for account checks help lenders monitor your credit activity without lowering your credit score or influencing future credit decisions.

When Do Hard Inquiries Show Up on Your Credit?

Hard inquiries show up on your credit report when a lender or financial institution checks your credit as part of a loan, credit card, or mortgage application process. These inquiries typically occur during account openings or credit limit increases and can impact your credit score for up to 12 months. Soft pulls, used for account checks or pre-approvals, do not affect your credit score and are not visible to other lenders.

Protecting Your Credit Score During Account Checks

Credit inquiries come in two types: hard pulls and soft pulls, with hard pulls potentially lowering your credit score while soft pulls do not impact it. Soft pulls are used for account checks, pre-approvals, and background verifications, allowing lenders to review your credit without affecting your score. Protecting your credit score involves understanding when a soft pull is sufficient to evaluate your creditworthiness without triggering a hard inquiry.

Tips to Minimize Damage from Credit Inquiries

Limit the number of credit inquiries by spacing out loan or credit card applications over several months to reduce impact on your credit score. Regularly check your credit report for inaccuracies and dispute any unauthorized hard inquiries promptly to protect your credit health. Utilize soft pulls when possible for account checks, as they do not affect your credit score and allow for prequalification without a hard inquiry.

Related Important Terms

Soft Pull Authorization

Soft pull authorization occurs when a lender or service provider requests a credit report to review an individual's creditworthiness without impacting their credit score. This type of credit inquiry is typically used for pre-approval offers, account reviews, and background checks, as it provides essential credit information without the negative effects of a hard inquiry.

Hard Inquiry Trigger

A hard inquiry, or hard pull, occurs when a lender examines your credit report as part of a formal loan or credit application process, directly impacting your credit score by slightly lowering it. Soft pulls, on the other hand, are credit checks that do not affect your credit score and typically happen during preliminary account reviews or promotional credit offers.

Prequalification Soft Check

A credit inquiry involves a hard pull that impacts your credit score when lenders review your full credit report for loan approval, while a soft pull, such as a prequalification soft check, allows account holders and lenders to assess creditworthiness without affecting the credit score. Prequalification soft checks enable consumers to explore loan or credit card offers with minimal impact, preserving credit health during initial account checks.

Instant Eligibility Soft Pull

Instant Eligibility Soft Pull allows lenders to quickly assess a consumer's creditworthiness without impacting their credit score, unlike a traditional credit inquiry which can temporarily lower scores. This nondisruptive method provides real-time account checks by accessing limited credit information, facilitating faster loan approvals and financial product eligibility decisions.

Hard vs. Soft Inquiry Separation

Hard inquiries, triggered by applications for credit like loans or credit cards, can temporarily lower credit scores and remain on reports for up to two years, signaling active credit-seeking behavior. Soft inquiries, used for account checks or pre-approvals, do not affect credit scores and are only visible to the individual, providing a risk-free way for lenders and consumers to review credit information.

Credit Pre-screening Algorithm

Credit inquiries involve hard pulls that impact credit scores by accessing detailed credit reports for lending decisions. Soft pulls, used in credit pre-screening algorithms, check limited information without affecting scores, enabling targeted marketing and risk assessment without consumer impact.

Invisible Credit Inquiry

Invisible credit inquiries, often resulting from soft pulls, do not impact credit scores and remain unseen by lenders during standard credit evaluations. These soft pulls are typically used for account checks, pre-approved offers, or background screenings, ensuring privacy while allowing access to credit information without lowering creditworthiness.

Account Review Soft Hit

Account review soft hits occur during credit inquiries that do not impact credit scores, allowing lenders to evaluate existing accounts without affecting creditworthiness. These soft pulls provide a non-intrusive method for ongoing account monitoring, ensuring accurate risk assessment while maintaining consumer credit integrity.

Fintech Background Soft Pull

Soft pull credit inquiries are commonly used in fintech for account checks as they do not impact credit scores, allowing seamless verification of a user's financial information. Unlike hard pulls, which affect credit ratings, soft pulls facilitate real-time risk assessment and customer onboarding without compromising credit integrity.

No-Impact Credit Assessment

A credit inquiry occurs when a lender or creditor requests access to your detailed credit report, potentially affecting your credit score, while a soft pull allows account checks without impacting your credit standing by only retrieving limited information. Soft pulls enable no-impact credit assessments, ideal for pre-approval offers and background verifications, preserving the consumer's credit health.

Credit inquiry vs Soft pull for account checks. Infographic

moneydiff.com

moneydiff.com