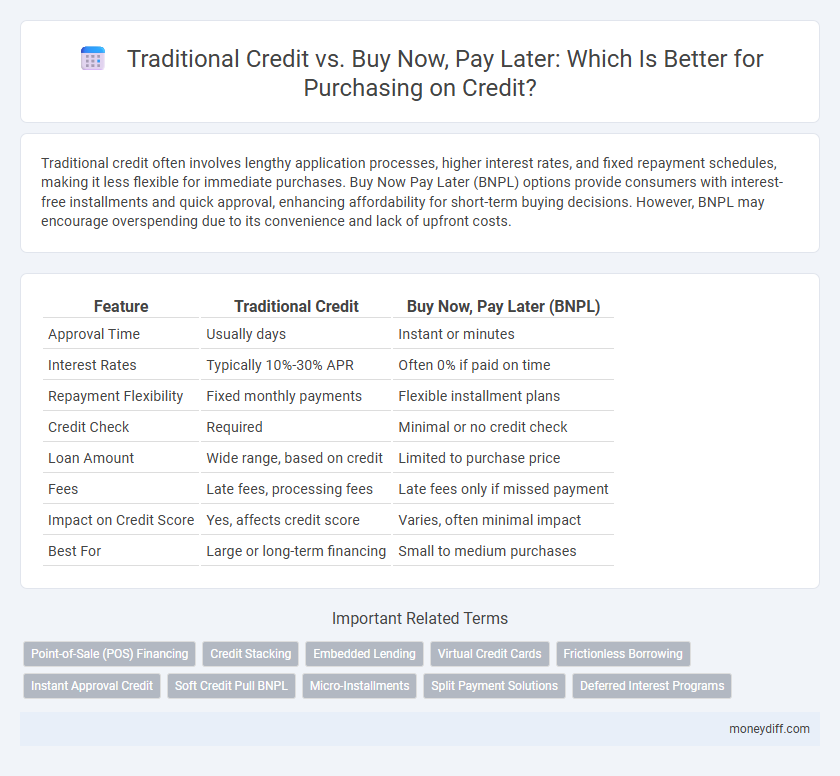

Traditional credit often involves lengthy application processes, higher interest rates, and fixed repayment schedules, making it less flexible for immediate purchases. Buy Now Pay Later (BNPL) options provide consumers with interest-free installments and quick approval, enhancing affordability for short-term buying decisions. However, BNPL may encourage overspending due to its convenience and lack of upfront costs.

Table of Comparison

| Feature | Traditional Credit | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Approval Time | Usually days | Instant or minutes |

| Interest Rates | Typically 10%-30% APR | Often 0% if paid on time |

| Repayment Flexibility | Fixed monthly payments | Flexible installment plans |

| Credit Check | Required | Minimal or no credit check |

| Loan Amount | Wide range, based on credit | Limited to purchase price |

| Fees | Late fees, processing fees | Late fees only if missed payment |

| Impact on Credit Score | Yes, affects credit score | Varies, often minimal impact |

| Best For | Large or long-term financing | Small to medium purchases |

Understanding Traditional Credit Systems

Traditional credit systems rely on fixed monthly payments and interest rates determined by credit scores, requiring thorough credit checks for approval. These systems often involve longer-term repayment plans with established financial institutions, emphasizing credit history and financial responsibility. Understanding these mechanisms helps buyers evaluate the cost and commitment compared to flexible options like Buy Now Pay Later (BNPL) services.

What Is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is a financing option allowing consumers to purchase goods and defer payments in installments without immediate interest. Unlike traditional credit cards, BNPL typically offers interest-free periods and simplified approval processes, making it attractive for short-term purchases. This method enhances budgeting flexibility by splitting payments over weeks or months while minimizing upfront costs.

Approval Process: Credit Checks vs Instant Approvals

Traditional credit requires thorough credit checks, often leading to longer approval times and potential denials based on credit scores and financial history. Buy Now Pay Later (BNPL) services offer instant approvals by using simplified or alternative credit assessments, making them accessible to a broader range of consumers. This streamlined process boosts purchasing convenience but may carry higher risk due to limited credit vetting.

Interest Rates and Fees: A Comparative Analysis

Traditional credit often involves higher interest rates and fixed monthly fees, making long-term repayments costly for consumers. Buy Now Pay Later (BNPL) services typically offer interest-free periods or lower fees but may charge late payment fees or higher rates after the promotional period ends. Evaluating the total cost of credit, including hidden fees and penalty charges, is essential when comparing these purchasing options.

Impact on Credit Score and Financial Health

Traditional credit involves borrowing funds with interest and fixed monthly payments, which, when managed responsibly, can positively impact credit scores by showcasing timely repayments and reducing credit utilization ratios. Buy Now Pay Later (BNPL) services often lack regular reporting to credit bureaus, resulting in minimal direct influence on credit scores but carry the risk of late fees and potential debt accumulation that can indirectly harm financial health. Consumers using BNPL must remain vigilant about payment schedules to avoid negative consequences, whereas traditional credit provides clearer credit-building opportunities through consistent account activity.

Payment Schedules: Flexibility and Structure

Traditional credit often requires fixed monthly payments with interest over a predetermined period, imposing structured repayment schedules that can limit flexibility. Buy Now Pay Later (BNPL) options typically offer shorter, interest-free installments spread across weeks or months, providing adaptable payment plans that cater to immediate affordability. Consumers seeking varied payment timing without long-term debt commitments frequently prefer BNPL for its flexible scheduling and transparent terms.

Consumer Protections and Dispute Resolution

Traditional credit typically offers robust consumer protections regulated by federal laws like the Truth in Lending Act, ensuring transparent terms and clear dispute resolution processes through formal channels. Buy Now Pay Later (BNPL) services often lack equivalent regulatory oversight, resulting in less stringent consumer safeguards and more limited recourse options when disputes arise. Consumers using BNPL should carefully review terms and rely on merchant or platform policies for dispute resolution, as legal protections are generally weaker compared to traditional credit products.

Spending Habits: Psychological Impacts

Traditional credit often encourages higher spending due to the perceived flexibility of revolving credit limits, which can lead to increased financial stress and impulsive purchases. Buy now, pay later (BNPL) services create a sense of affordability by breaking payments into smaller installments, potentially reducing immediate financial anxiety but risking overspending through deferred debt. Both methods influence consumer behavior differently, impacting budgeting habits and long-term financial well-being based on how payment obligations are psychologically framed.

Accessibility: Who Can Use Each Option?

Traditional credit typically requires a strong credit history and proof of income, limiting accessibility to consumers with established financial backgrounds. Buy Now Pay Later (BNPL) services offer greater accessibility by allowing users with limited or no credit history to make purchases through simpler application processes. BNPL platforms often approve customers based on alternative data points, expanding purchasing options to younger and underserved demographics.

Which Option Is Right for You?

Traditional credit offers structured repayment schedules and typically higher credit limits, making it suitable for larger or long-term purchases. Buy Now Pay Later (BNPL) provides flexible, interest-free installments ideal for budgeting smaller, immediate expenses without impacting credit scores. Choosing the right option depends on your financial discipline, purchase size, and preference for managing repayment timelines.

Related Important Terms

Point-of-Sale (POS) Financing

Traditional credit often requires a thorough credit check and longer approval times at the Point-of-Sale (POS), whereas Buy Now Pay Later (BNPL) options provide instant financing with minimal credit impact, enhancing consumer purchasing power. BNPL solutions typically offer flexible payment plans directly at checkout, increasing conversion rates and average order value for merchants.

Credit Stacking

Credit stacking with traditional credit involves managing multiple credit cards or loans simultaneously, often increasing debt risk and affecting credit scores negatively. Buy Now Pay Later (BNPL) services offer a streamlined alternative by splitting payments without immediate credit impact, reducing the complexity and potential pitfalls associated with traditional credit stacking.

Embedded Lending

Traditional credit often involves lengthy application processes and fixed repayment schedules, whereas buy now pay later (BNPL) offers streamlined, flexible payment options embedded directly within the purchase experience. Embedded lending technology enhances BNPL by integrating credit access seamlessly into digital platforms, improving user convenience and driving higher conversion rates for merchants.

Virtual Credit Cards

Virtual credit cards enhance security and convenience for both traditional credit and buy now pay later (BNPL) purchases by generating unique, temporary card numbers linked to the primary account, reducing fraud risk. While traditional credit relies on fixed credit limits and monthly billing, virtual cards enable safer transactions across BNPL platforms, improving consumer control over spending and payment schedules.

Frictionless Borrowing

Traditional credit often involves rigid approval processes, high-interest rates, and lengthy paperwork that create friction in the borrowing experience, while Buy Now Pay Later (BNPL) offers a seamless, instant approval system with minimal credit checks and flexible repayment options, significantly enhancing frictionless borrowing during purchases. BNPL solutions integrate directly at checkout, reducing buyer hesitation and promoting smoother access to credit without the complexities associated with traditional loans.

Instant Approval Credit

Traditional credit often involves lengthy approval processes, extensive credit checks, and fixed repayment schedules, which can delay purchases and impact cash flow. Buy Now Pay Later (BNPL) services offer instant approval credit with minimal credit checks, enabling consumers to make immediate purchases and spread payments over time without high-interest rates.

Soft Credit Pull BNPL

Soft credit pulls used by Buy Now Pay Later (BNPL) services allow consumers to access financing with minimal impact on their credit scores, unlike traditional credit checks that often involve hard inquiries and can lower credit ratings. This feature makes BNPL an attractive option for short-term purchasing without the risk of credit score degradation typically associated with traditional credit applications.

Micro-Installments

Micro-installments in buy now pay later plans offer flexible, interest-free payments spread over short periods, providing affordability without affecting credit scores, unlike traditional credit which often involves high interest rates and rigid repayment terms. This structure enhances purchasing power for consumers seeking manageable cash flow solutions while minimizing financial risk.

Split Payment Solutions

Traditional credit often involves interest-bearing loans with fixed repayment schedules, while Buy Now Pay Later (BNPL) offers interest-free split payment solutions that enhance purchasing flexibility. BNPL platforms optimize cash flow by dividing payments into smaller, manageable installments, appealing to consumers seeking short-term credit without traditional credit checks or high interest rates.

Deferred Interest Programs

Traditional credit typically involves immediate interest accrual and monthly payments, whereas Buy Now Pay Later (BNPL) with Deferred Interest Programs offers interest-free periods contingent on full payment by a specified date, enabling consumers to defer costs without initial interest charges. Deferred Interest Programs pose risks if balances are not cleared timely, as accrued interest from the purchase date may then apply retroactively, impacting credit scores and overall repayment amounts.

Traditional credit vs buy now pay later for purchasing. Infographic

moneydiff.com

moneydiff.com