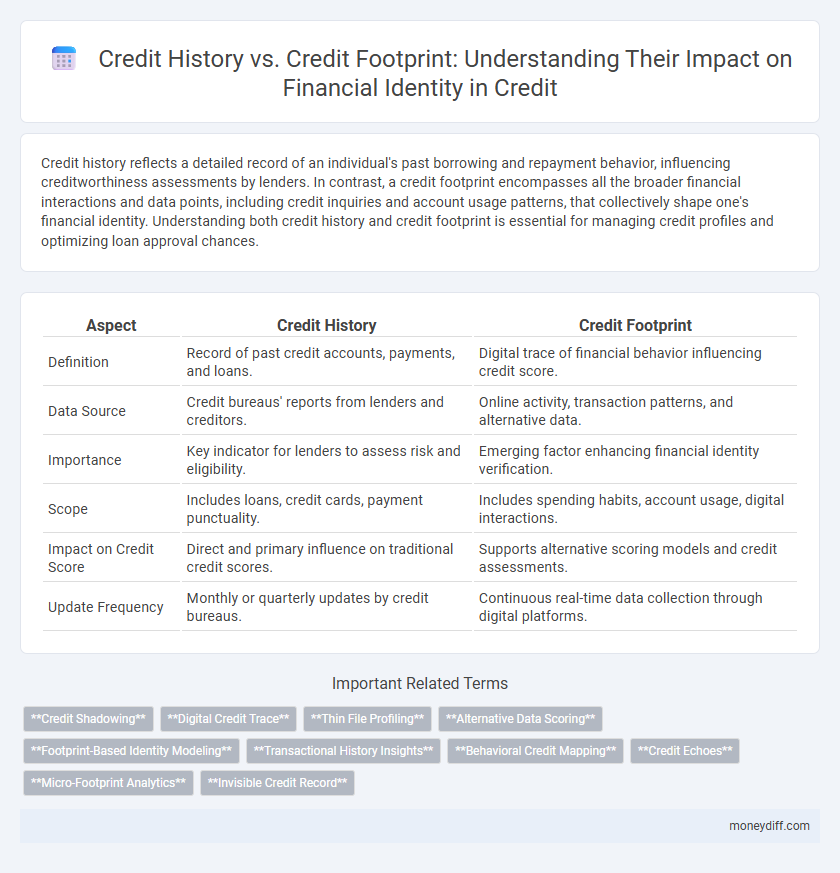

Credit history reflects a detailed record of an individual's past borrowing and repayment behavior, influencing creditworthiness assessments by lenders. In contrast, a credit footprint encompasses all the broader financial interactions and data points, including credit inquiries and account usage patterns, that collectively shape one's financial identity. Understanding both credit history and credit footprint is essential for managing credit profiles and optimizing loan approval chances.

Table of Comparison

| Aspect | Credit History | Credit Footprint |

|---|---|---|

| Definition | Record of past credit accounts, payments, and loans. | Digital trace of financial behavior influencing credit score. |

| Data Source | Credit bureaus' reports from lenders and creditors. | Online activity, transaction patterns, and alternative data. |

| Importance | Key indicator for lenders to assess risk and eligibility. | Emerging factor enhancing financial identity verification. |

| Scope | Includes loans, credit cards, payment punctuality. | Includes spending habits, account usage, digital interactions. |

| Impact on Credit Score | Direct and primary influence on traditional credit scores. | Supports alternative scoring models and credit assessments. |

| Update Frequency | Monthly or quarterly updates by credit bureaus. | Continuous real-time data collection through digital platforms. |

Understanding Credit History: The Backbone of Financial Identity

Credit history serves as the backbone of financial identity by providing a detailed record of past borrowing, repayment behavior, and credit utilization patterns that lenders use to assess creditworthiness. Unlike a credit footprint, which includes broader data such as online interactions and payment habits, credit history specifically tracks credit accounts, payment timeliness, and outstanding debts reported to credit bureaus. A strong, positive credit history builds trust with financial institutions and directly influences access to loans, interest rates, and financial opportunities.

What is a Credit Footprint? Defining Your Credit Trail

A credit footprint represents the detailed digital trail created by your financial activities, including loan applications, payment histories, and credit inquiries that collectively define your credit identity. Unlike a traditional credit history that summarizes your past credit performance, the credit footprint captures real-time data points and patterns influencing creditworthiness assessments. Understanding your credit footprint helps lenders predict future financial behavior and establishes a dynamic profile essential for personalized credit decisions.

Key Differences Between Credit History and Credit Footprint

Credit history documents a consumer's past borrowing and repayment behavior, reflecting credit accounts, loans, and payment timeliness reported to credit bureaus. Credit footprint encompasses a broader range of financial activities, including inquiries, credit applications, and new account openings, showcasing ongoing credit-related behavior beyond just repayment records. Understanding the key differences between credit history and credit footprint is essential for managing financial identity and improving creditworthiness effectively.

How Credit History Shapes Your Financial Opportunities

Credit history serves as a detailed record of your past borrowing and repayment behavior, impacting credit scores used by lenders to assess risk. A strong credit history with timely payments, low credit utilization, and diverse credit types enhances financial opportunities like loan approvals and better interest rates. Consistently positive credit history signals reliability and financial responsibility, making it a crucial factor in building and maintaining a solid financial identity.

The Role of Credit Footprint in Modern Money Management

Credit footprint encompasses all digital and financial interactions that contribute to an individual's financial identity, extending beyond traditional credit history by including non-credit data such as utility payments and rental records. This broader dataset enables more accurate risk assessment and personalized lending decisions, enhancing modern money management strategies. Leveraging credit footprints supports financial inclusion by offering a more comprehensive view of creditworthiness, especially for those with limited or no formal credit history.

Building Strong Credit History: Essential Strategies

Building a strong credit history requires consistent on-time payments, low credit utilization, and a diverse mix of credit accounts to demonstrate responsible financial behavior to lenders. Monitoring your credit reports regularly helps identify errors and prevent identity theft, ensuring your credit footprint accurately reflects your financial habits. Establishing a solid credit history over time improves your credit score, which enhances your access to favorable loan terms and financial opportunities.

Credit Footprint: Best Practices for Responsible Borrowing

Maintaining a positive credit footprint involves consistently making timely payments, keeping credit utilization low, and regularly monitoring credit reports to detect errors or fraud. Responsible borrowing practices such as limiting the number of credit inquiries and avoiding excessive debt help build a robust financial identity. A healthy credit footprint enhances loan approval chances and secures better interest rates, reflecting responsible credit behavior over time.

Credit History vs. Credit Footprint: Impact on Loan Approval

Credit history documents past borrowing and repayment behavior, directly influencing loan approval by showcasing creditworthiness over time. Credit footprint includes all digital traces related to financial activity, such as credit inquiries and account usage patterns, providing lenders with a broader view of an applicant's financial habits. Lenders analyze both credit history and credit footprint to assess risk more accurately, improving the precision of loan approval decisions.

Protecting and Monitoring Your Credit Data

Protecting and monitoring your credit data requires understanding the difference between credit history and credit footprint. Credit history tracks your past borrowing and repayment behavior reported by lenders, while your credit footprint includes all digital traces of your credit activity, such as inquiries and account interactions. Regularly reviewing your credit reports and using credit monitoring services helps detect unauthorized activity, preventing fraud and maintaining a strong financial identity.

Crafting a Positive Financial Identity Through Smart Credit Use

Credit history and credit footprint both shape your financial identity by reflecting your borrowing and repayment behaviors, with credit history detailing past credit accounts and payment patterns, while credit footprint encompasses all digital traces related to credit activity. Crafting a positive financial identity requires timely payments, maintaining low credit utilization, and regularly monitoring credit reports from bureaus like Experian, Equifax, and TransUnion. Smart credit use strengthens trustworthiness for lenders, ultimately enhancing access to favorable interest rates and financial products.

Related Important Terms

Credit Shadowing

Credit shadowing occurs when limited or insufficient credit history results in an incomplete credit footprint, making it difficult for financial institutions to accurately assess an individual's financial identity. This phenomenon obscures true creditworthiness and can hinder access to loans, credit cards, and other financial products despite responsible financial behavior.

Digital Credit Trace

Digital credit trace captures the detailed, real-time data of a consumer's financial transactions and borrowing behaviors, offering a broader and more dynamic picture than traditional credit history. Leveraging digital footprints from online payments, loan applications, and financial interactions enhances the accuracy of credit assessments and strengthens financial identity verification.

Thin File Profiling

Thin file profiling refers to individuals with limited credit history or minimal borrowing activity, making it challenging for lenders to assess their creditworthiness accurately. Distinguishing between credit history, which tracks past loan repayments, and credit footprint, which encompasses all financial behaviors including account inquiries and utility payments, is crucial for evaluating thin files effectively.

Alternative Data Scoring

Alternative data scoring enhances credit history analysis by incorporating non-traditional financial behaviors like utility payments and rental records, offering a broader view of an individual's creditworthiness beyond standard credit scores. This expanded credit footprint enables lenders to assess financial identity more accurately, especially for those with limited or no formal credit history.

Footprint-Based Identity Modeling

Footprint-Based Identity Modeling leverages a comprehensive analysis of an individual's credit footprint, including transaction patterns, payment behaviors, and digital interactions, to create a dynamic and holistic financial identity. Unlike traditional credit history that relies solely on past credit accounts and repayment records, this approach captures real-time data and broader financial behaviors, enhancing credit risk assessment and personalized financial services.

Transactional History Insights

Transactional history insights reveal that credit history comprises detailed records of past loan repayments and credit utilization, while credit footprint extends to digital behaviors, payment patterns, and broader financial interactions. This differentiation enables a comprehensive understanding of financial identity by analyzing both traditional credit data and emerging transactional behaviors across multiple platforms.

Behavioral Credit Mapping

Behavioral Credit Mapping analyzes patterns in credit usage and payment habits, enhancing the understanding of an individual's financial identity beyond traditional credit history. This approach captures real-time behavioral data to build a dynamic credit footprint, improving credit risk assessment and personalized lending decisions.

Credit Echoes

Credit Echoes represent the lasting imprints left by your financial behavior, serving as subtle indicators within your credit history that influence lenders' perception of your creditworthiness. Unlike a traditional credit footprint, Credit Echoes capture ongoing patterns and nuanced signals from past transactions, providing a deeper, dynamic layer to your financial identity assessment.

Micro-Footprint Analytics

Micro-Footprint Analytics enhances financial identity assessment by analyzing granular transaction patterns and behavioral data beyond traditional credit history, capturing a detailed credit footprint that reflects real-time financial habits. This approach provides lenders with deeper insights into creditworthiness, enabling more accurate risk profiling and personalized credit solutions.

Invisible Credit Record

An invisible credit record refers to financial activities that do not appear in traditional credit history but still impact credit footprint, such as utility payments, rent, and alternative lending data. These hidden data points are increasingly used by lenders and credit scoring models to create a more comprehensive financial identity, especially for individuals with limited or no formal credit history.

Credit history vs Credit footprint for financial identity. Infographic

moneydiff.com

moneydiff.com