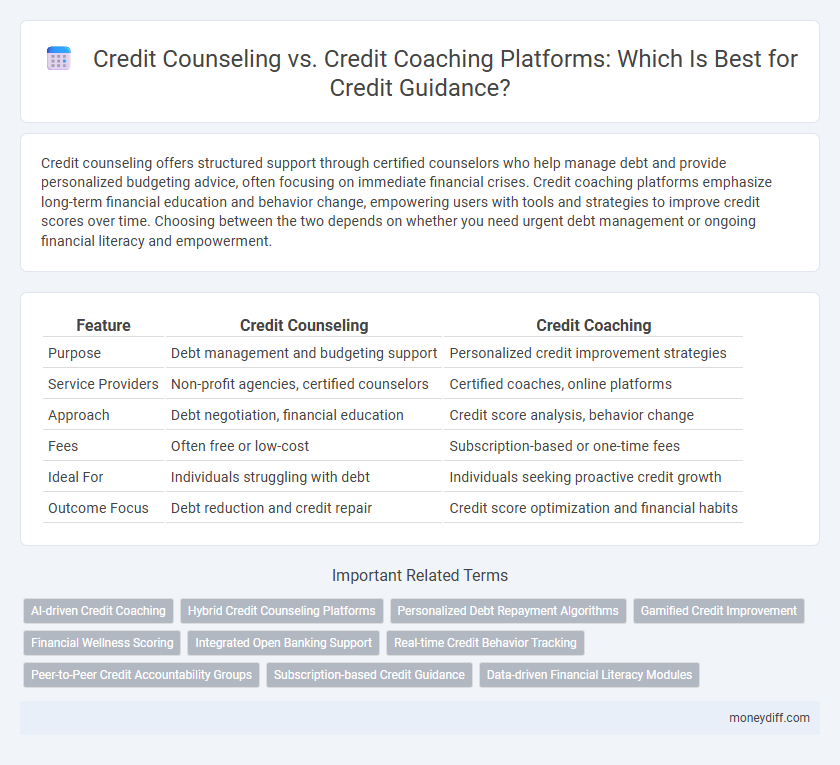

Credit counseling offers structured support through certified counselors who help manage debt and provide personalized budgeting advice, often focusing on immediate financial crises. Credit coaching platforms emphasize long-term financial education and behavior change, empowering users with tools and strategies to improve credit scores over time. Choosing between the two depends on whether you need urgent debt management or ongoing financial literacy and empowerment.

Table of Comparison

| Feature | Credit Counseling | Credit Coaching |

|---|---|---|

| Purpose | Debt management and budgeting support | Personalized credit improvement strategies |

| Service Providers | Non-profit agencies, certified counselors | Certified coaches, online platforms |

| Approach | Debt negotiation, financial education | Credit score analysis, behavior change |

| Fees | Often free or low-cost | Subscription-based or one-time fees |

| Ideal For | Individuals struggling with debt | Individuals seeking proactive credit growth |

| Outcome Focus | Debt reduction and credit repair | Credit score optimization and financial habits |

Credit Counseling vs Credit Coaching: Key Differences

Credit counseling offers structured guidance through nonprofit agencies to help consumers manage debt by creating repayment plans and negotiating with creditors. Credit coaching emphasizes personalized education and skills development to improve financial habits and credit management over time. Both approaches address credit challenges, but counseling focuses on immediate debt resolution while coaching aims for long-term credit behavior improvement.

Understanding Credit Counseling Services

Credit counseling services provide personalized guidance to manage debt, create budgets, and develop long-term financial plans, often involving certified credit counselors. These services focus on negotiating with creditors to reduce interest rates or set up debt management plans, improving credit score over time. Credit coaching platforms, by contrast, emphasize education and skill-building on credit management without direct creditor negotiation, allowing individuals to make informed financial decisions independently.

What Is Credit Coaching?

Credit coaching is a personalized guidance service designed to improve financial habits and credit management through actionable strategies tailored to individual credit profiles. Unlike credit counseling, which often addresses debt reduction and crisis solutions, credit coaching emphasizes proactive education, accountability, and long-term credit building techniques. Key components include budgeting support, credit report analysis, and goal-setting to enhance credit scores and financial stability.

Platform Features: Counseling vs Coaching

Credit counseling platforms typically offer personalized debt management plans, financial education, and assistance with negotiating creditor payments to improve credit standing. Credit coaching platforms focus on behavioral change, providing goal-setting tools, credit score monitoring, and ongoing support to build healthier financial habits. Both platforms use secure, user-friendly interfaces but differ in approach: counseling prioritizes debt resolution, while coaching emphasizes long-term credit improvement strategies.

Pros and Cons of Credit Counseling Platforms

Credit counseling platforms offer professional guidance to help individuals manage debt and create budgets, often providing access to debt management plans and creditor negotiations, which can lead to lower interest rates and reduced monthly payments. However, they may charge fees, require strict adherence to payment plans, and sometimes negotiate only with specific creditors, potentially limiting flexibility. Some users might experience mixed results depending on the counselor's expertise, and credit counseling can impact credit scores temporarily during debt management programs.

Benefits of Credit Coaching Platforms

Credit coaching platforms offer personalized guidance tailored to individual financial situations, fostering long-term credit improvement and responsible money management. These platforms leverage data-driven strategies and continuous support, enhancing credit scores more effectively than standard credit counseling services. Users benefit from interactive tools and real-time feedback, empowering them to make informed financial decisions and achieve sustainable credit health.

Suitability: Which Platform Works for Your Financial Needs?

Credit counseling platforms offer professional guidance tailored for individuals facing debt challenges, typically providing debt management plans and negotiating with creditors, making them suitable for those struggling with overwhelming debt. Credit coaching platforms focus on personalized financial education, helping individuals build healthy money habits and improve credit scores over time, ideal for clients seeking long-term financial empowerment. Choosing the right platform depends on your current financial situation and goals, with counseling best for immediate debt relief and coaching for ongoing credit improvement.

Cost Comparison: Counseling and Coaching Services

Credit counseling services typically charge lower fees or offer free sessions funded by nonprofit organizations, making them more accessible for consumers seeking debt management plans. Credit coaching platforms often require subscription fees or hourly rates, reflecting personalized guidance and ongoing financial education tailored to individual goals. Evaluating cost differences alongside service features helps users select the most affordable and effective solution for improving their credit health.

Success Rates and User Experiences

Credit counseling platforms typically offer structured debt management plans with a success rate averaging 60-70%, providing users with formal guidance on debt reduction and budgeting. Credit coaching platforms focus on personalized financial education and behavior change, driving higher user satisfaction and long-term financial improvement, reflected in success rates of 75% or more. User experiences often highlight counseling's emphasis on immediate debt relief, while coaching excels in empowering clients with sustainable credit-building strategies.

How to Choose the Right Credit Guidance Platform

Selecting the right credit guidance platform requires evaluating the services offered; credit counseling focuses on debt management and budgeting advice, whereas credit coaching provides personalized strategies for credit improvement and long-term financial health. Consider the platform's accreditation, user reviews, and whether it offers tailored plans that align with your financial goals. Prioritize options with transparent fees, licensed counselors or certified coaches, and tools that empower you to track your credit progress effectively.

Related Important Terms

AI-driven Credit Coaching

AI-driven credit coaching platforms leverage advanced algorithms to provide personalized financial guidance, helping users improve credit scores through tailored action plans and real-time monitoring. Unlike traditional credit counseling, these platforms offer interactive tools and predictive insights, enabling proactive management of debt and optimized credit behaviors for sustainable financial growth.

Hybrid Credit Counseling Platforms

Hybrid credit counseling platforms combine personalized credit counseling with interactive credit coaching tools to provide comprehensive financial guidance tailored to individual credit profiles. These platforms leverage expert advice alongside automated budgeting, debt management, and credit score monitoring features to enhance user engagement and improve credit health outcomes effectively.

Personalized Debt Repayment Algorithms

Credit counseling platforms offer structured support by analyzing individual financial situations through personalized debt repayment algorithms that optimize payment schedules and prioritize debt elimination effectively. Credit coaching platforms emphasize ongoing education and behavior modification but may lack the algorithm-driven, tailored repayment plans found in advanced credit counseling services.

Gamified Credit Improvement

Credit counseling platforms offer structured advice and debt management plans typically regulated by nonprofit organizations, while credit coaching platforms emphasize personalized guidance with gamified credit improvement tools to engage users in tracking progress and achieving financial goals. Gamified credit coaching enhances motivation and learning through interactive elements such as quizzes, rewards, and milestone tracking, leading to more sustained credit behavior change compared to traditional credit counseling methods.

Financial Wellness Scoring

Credit counseling platforms provide structured debt management plans and personalized advice to address immediate debt issues, often focusing on credit repair and budgeting strategies. Credit coaching platforms emphasize ongoing financial wellness scoring by tracking behavioral patterns and improving long-term financial habits to enhance credit health and overall financial stability.

Integrated Open Banking Support

Credit counseling platforms offer personalized debt management plans and negotiate with creditors, while credit coaching platforms emphasize financial education and behavior change; integrated Open Banking support allows both to access real-time financial data securely, enhancing tailored guidance and actionable insights. This integration streamlines account aggregation, improves spending analysis, and enables proactive credit strategy adjustments based on up-to-date credit utilization and transaction histories.

Real-time Credit Behavior Tracking

Credit coaching platforms offer real-time credit behavior tracking by monitoring spending patterns, payment habits, and credit utilization, enabling personalized guidance to improve credit scores. Credit counseling services typically provide periodic advice and debt management plans without continuous behavioral tracking, limiting their ability to adapt strategies based on real-time financial activity.

Peer-to-Peer Credit Accountability Groups

Credit counseling typically offers professional advice and debt management plans, while credit coaching platforms emphasize personalized guidance and skill-building for long-term financial habits; Peer-to-Peer Credit Accountability Groups on these platforms enhance success by fostering community support and shared accountability among members. These groups provide real-time feedback, motivation, and practical strategies, helping individuals stay committed to their credit improvement goals through collective experience and encouragement.

Subscription-based Credit Guidance

Subscription-based credit guidance platforms offer ongoing credit counseling and credit coaching services focused on personalized debt management and credit score improvement strategies. These platforms provide regular access to certified credit experts and tailored action plans, combining credit counseling's debt resolution with credit coaching's educational support for sustainable financial behavior.

Data-driven Financial Literacy Modules

Credit counseling platforms provide personalized debt management plans and negotiate with creditors, while credit coaching platforms emphasize empowering users through data-driven financial literacy modules that enhance budgeting, saving, and credit-building strategies. Data analytics in credit coaching enable tailored guidance by identifying spending patterns and credit behaviors to improve long-term financial health.

Credit counseling vs credit coaching platform for guidance Infographic

moneydiff.com

moneydiff.com