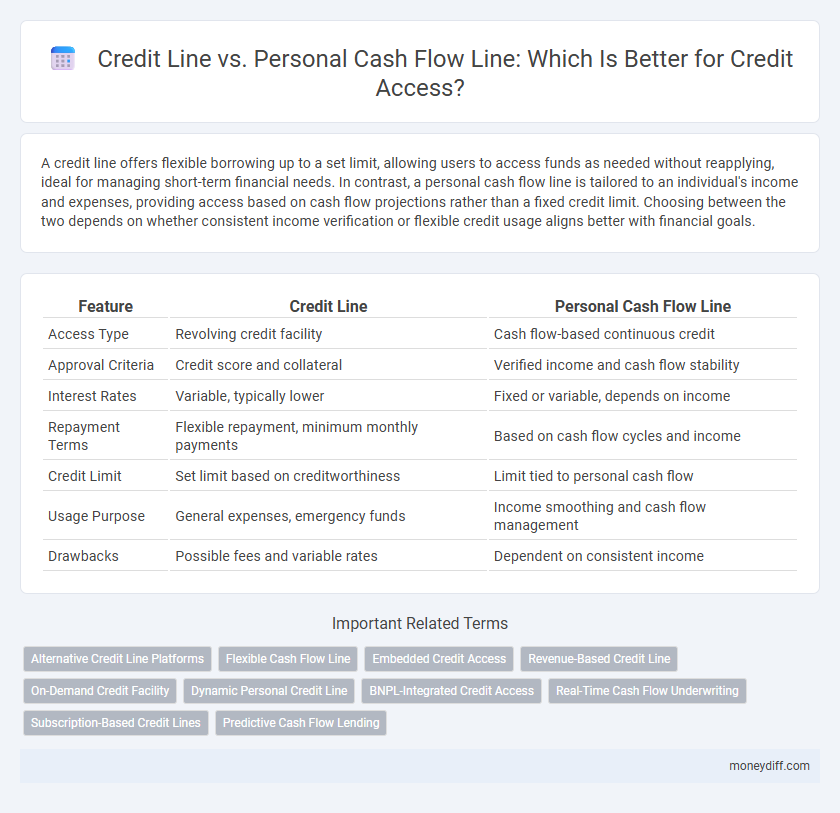

A credit line offers flexible borrowing up to a set limit, allowing users to access funds as needed without reapplying, ideal for managing short-term financial needs. In contrast, a personal cash flow line is tailored to an individual's income and expenses, providing access based on cash flow projections rather than a fixed credit limit. Choosing between the two depends on whether consistent income verification or flexible credit usage aligns better with financial goals.

Table of Comparison

| Feature | Credit Line | Personal Cash Flow Line |

|---|---|---|

| Access Type | Revolving credit facility | Cash flow-based continuous credit |

| Approval Criteria | Credit score and collateral | Verified income and cash flow stability |

| Interest Rates | Variable, typically lower | Fixed or variable, depends on income |

| Repayment Terms | Flexible repayment, minimum monthly payments | Based on cash flow cycles and income |

| Credit Limit | Set limit based on creditworthiness | Limit tied to personal cash flow |

| Usage Purpose | General expenses, emergency funds | Income smoothing and cash flow management |

| Drawbacks | Possible fees and variable rates | Dependent on consistent income |

Understanding Credit Lines and Personal Cash Flow Lines

Credit lines offer a predetermined borrowing limit that can be accessed as needed, providing flexible financial resources without requiring immediate repayment. Personal cash flow lines, on the other hand, are directly tied to an individual's income stream and are designed to manage short-term liquidity by leveraging predictable earnings. Understanding the structural differences between these credit options helps individuals and businesses optimize their access to funds based on repayment capacity and financial goals.

Key Differences Between Credit Lines and Cash Flow Lines

Credit lines provide a flexible borrowing limit based on creditworthiness, enabling users to draw funds up to a set amount and repay over time, often with variable interest rates. Personal cash flow lines, however, are directly tied to an individual's income and expenditure patterns, offering credit that fluctuates with cash inflows to ensure liquidity matches financial needs. Key differences include credit line stability versus cash flow line variability, interest rate structures, and qualification criteria based on credit score versus income consistency.

Eligibility Criteria for Credit Lines vs Personal Cash Flow Lines

Credit line eligibility primarily depends on credit score, debt-to-income ratio, and overall credit history, ensuring borrowers demonstrate reliable repayment capacity. Personal cash flow lines require detailed proof of consistent income streams and cash flow statements, emphasizing the ability to generate sufficient cash to cover drawdowns. Lenders of credit lines generally prioritize creditworthiness, while cash flow lines focus more on the stability and predictability of income sources.

Interest Rates: Credit Line vs Cash Flow Line

Interest rates on a credit line typically fluctuate based on prime rates, often resulting in variable interest costs that can impact monthly payments. In contrast, a personal cash flow line usually offers fixed or more stable interest rates tied to the borrower's income consistency, providing predictable repayment terms. Understanding these rate structures is crucial for borrowers seeking cost-effective credit access tailored to their financial situation.

Application Process Comparison

The credit line application process typically requires a detailed credit evaluation and proof of income, often leading to faster approval for borrowers with strong credit profiles. In contrast, a personal cash flow line demands a thorough assessment of monthly income and expenses to verify consistent cash flow, which may result in a more comprehensive but lengthier review. Both options require documentation such as bank statements and tax returns, but credit lines prioritize credit history while cash flow lines emphasize ongoing earnings stability.

Flexibility of Access: Which Option Wins?

Credit lines offer flexible access to funds with variable limits and repayment schedules, ideal for managing unpredictable expenses. Personal cash flow lines provide consistent, steady access to cash based on income stability, ensuring reliability but with less adaptability. The credit line wins in flexibility due to its ability to adjust borrowing amounts and timing according to borrower needs.

Repayment Terms: Credit Line vs Cash Flow Line

Credit lines typically offer flexible repayment terms allowing borrowers to repay and redraw funds up to a set limit, with interest charged only on the amount used. Personal cash flow lines often have repayment terms tied closely to the borrower's income cycles, requiring regular payments that align with cash inflows to ensure sustainable debt servicing. Understanding these differences helps borrowers choose between revolving credit flexibility and structured repayment aligned with cash liquidity.

Risk Factors and Financial Impact

Credit lines offer flexible borrowing with variable interest rates, but carry the risk of fluctuating payments and potential overuse impacting credit scores. Personal cash flow lines leverage consistent income streams for repayment, reducing default risk yet may limit borrowing capacity tied to income stability. Both options affect financial health differently, as credit lines can quickly increase debt burden while cash flow lines emphasize manageable, income-based obligations.

Situational Suitability: When to Choose Each Option

A credit line suits businesses with fluctuating capital needs, offering flexible borrowing and repayment options to manage irregular expenses or opportunities. Personal cash flow lines work best for individuals or small businesses with predictable income, providing a steady source of funds linked directly to their regular cash inflows. Choosing between the two depends on whether access to funds requires adaptability for varying financial cycles or consistent liquidity aligned with stable cash flow.

Tips for Responsible Money Management

Choosing a credit line over a personal cash flow line can impact financial flexibility and interest costs, so monitor usage to avoid overspending and maintain good credit health. Set clear repayment goals and track monthly balances to ensure timely payments, which helps improve credit scores and reduces debt burden. Use available credit strategically by prioritizing low-interest options and maintaining a debt-to-income ratio below 30% for optimal money management.

Related Important Terms

Alternative Credit Line Platforms

Alternative credit line platforms offer flexible credit solutions by providing access through personal cash flow lines, which are often more adaptable than traditional credit lines. These platforms leverage real-time income data to approve credit faster and tailor limits based on consistent cash flow rather than credit history alone.

Flexible Cash Flow Line

A flexible cash flow line offers a more adaptable credit solution by tying the borrowing limit directly to personal income fluctuations, unlike a traditional credit line which provides a fixed limit regardless of cash flow variations. This structure allows for dynamic access to funds based on real-time earnings, enhancing liquidity management and reducing the risk of overextension.

Embedded Credit Access

Embedded credit access through a credit line offers flexible borrowing limits tied to specific accounts, allowing users to draw funds up to a pre-approved amount without repeated approvals. In contrast, a personal cash flow line is directly linked to income streams, enabling automatic adjustments based on real-time earnings and enhancing liquidity management.

Revenue-Based Credit Line

A Revenue-Based Credit Line provides flexible access to funds by linking credit limits directly to business income, allowing repayments to fluctuate with cash flow and reducing pressure during low-revenue periods. Unlike traditional personal cash flow lines, it offers scalable financing aligned with earnings, ideal for businesses seeking adaptable credit solutions tied to their revenue performance.

On-Demand Credit Facility

An On-Demand Credit Facility offers flexible access to funds by allowing borrowers to draw and repay credit as needed, unlike a traditional credit line which often has fixed limits and stricter terms. This type of credit is ideal for managing personal cash flow fluctuations, providing immediate liquidity without long-term commitments or penalties.

Dynamic Personal Credit Line

Dynamic Personal Credit Lines offer flexible access to funds based on real-time evaluation of income and spending patterns, unlike traditional Credit Lines which typically rely on fixed credit limits. Utilizing a Dynamic Personal Credit Line enhances financial agility by adjusting borrowing capacity in alignment with ongoing personal cash flow fluctuations.

BNPL-Integrated Credit Access

BNPL-integrated credit access leverages a credit line for flexible spending limits, while personal cash flow lines provide dynamic borrowing capacity based on income and spending patterns. Credit lines offer preset borrowing limits ideal for planned purchases, whereas cash flow lines adapt in real-time, enhancing purchasing power and repayment alignment in buy-now-pay-later transactions.

Real-Time Cash Flow Underwriting

Real-time cash flow underwriting enables dynamic assessment of a borrower's financial health, making personal cash flow lines more adaptable and accurately priced compared to traditional credit lines. This approach leverages continuous transaction data, reducing risk by aligning credit access directly with income patterns and expenditures.

Subscription-Based Credit Lines

Subscription-based credit lines offer flexible access to funds by leveraging predictable recurring revenue streams, making them more suitable for businesses with stable cash flow than traditional personal cash flow lines. Unlike personal credit lines that rely on individual income verification, subscription-based options prioritize recurring subscription payments to determine credit limits and repayment schedules.

Predictive Cash Flow Lending

Predictive Cash Flow Lending leverages real-time financial data to assess creditworthiness more accurately than traditional credit lines, offering tailored access that aligns with fluctuating personal cash flow patterns. Unlike standard credit lines, personal cash flow lines dynamically adjust borrowing limits based on predictive analytics, reducing default risk and optimizing liquidity management.

Credit line vs personal cash flow line for access. Infographic

moneydiff.com

moneydiff.com