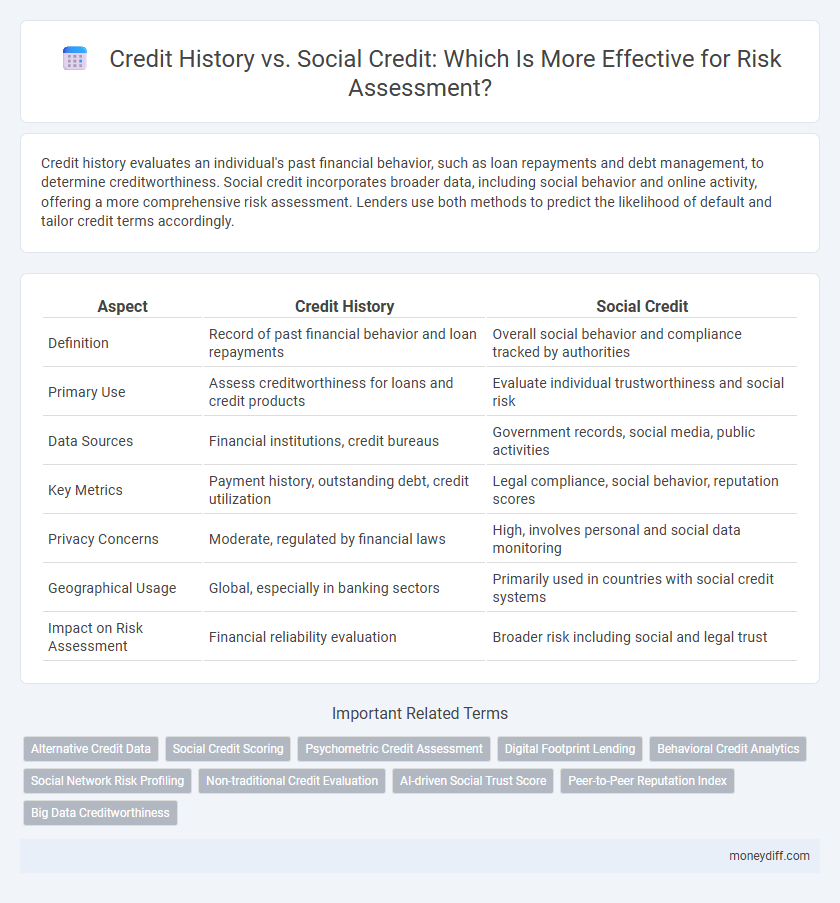

Credit history evaluates an individual's past financial behavior, such as loan repayments and debt management, to determine creditworthiness. Social credit incorporates broader data, including social behavior and online activity, offering a more comprehensive risk assessment. Lenders use both methods to predict the likelihood of default and tailor credit terms accordingly.

Table of Comparison

| Aspect | Credit History | Social Credit |

|---|---|---|

| Definition | Record of past financial behavior and loan repayments | Overall social behavior and compliance tracked by authorities |

| Primary Use | Assess creditworthiness for loans and credit products | Evaluate individual trustworthiness and social risk |

| Data Sources | Financial institutions, credit bureaus | Government records, social media, public activities |

| Key Metrics | Payment history, outstanding debt, credit utilization | Legal compliance, social behavior, reputation scores |

| Privacy Concerns | Moderate, regulated by financial laws | High, involves personal and social data monitoring |

| Geographical Usage | Global, especially in banking sectors | Primarily used in countries with social credit systems |

| Impact on Risk Assessment | Financial reliability evaluation | Broader risk including social and legal trust |

Understanding Credit History: Definition and Importance

Credit history is a detailed record of an individual's past borrowing and repayment behavior, including loans, credit cards, and payment punctuality, which financial institutions analyze to assess creditworthiness. This historical data helps lenders predict future risk by evaluating patterns such as repayment consistency, outstanding debt, and credit utilization rates. Unlike social credit systems that incorporate broader social behaviors, credit history remains a focused financial metric crucial for making informed lending decisions.

Social Credit Systems: An Emerging Framework

Social credit systems represent an emerging framework for risk assessment by integrating diverse data points, including financial behavior, social interactions, and compliance with laws, beyond traditional credit history. Unlike conventional credit scores that primarily rely on financial transactions and repayment records, social credit incorporates real-time data from government databases, social media, and public records to generate a comprehensive risk profile. This holistic approach facilitates more dynamic and predictive evaluations of individuals' trustworthiness and potential risk in lending and other financial services.

Traditional Credit Assessment: How It Works

Traditional credit assessment relies on analyzing an individual's credit history, including payment timeliness, outstanding debt, and credit utilization, to evaluate financial risk. This method uses data from credit bureaus and financial institutions to calculate credit scores, which lenders use to predict the likelihood of default. Unlike social credit systems, traditional credit assessment focuses primarily on financial behavior and historical repayment patterns rather than social or behavioral metrics.

Social Credit Metrics: What’s Included?

Social credit metrics for risk assessment typically include behavioral data, social relationships, online activities, and compliance with laws or social norms. These factors complement traditional credit history by incorporating non-financial data points such as social media presence, reputation scores, and community engagement. This broader scope aims to provide a more comprehensive risk profile beyond conventional financial indicators.

Comparing Data Sources: Financial Behavior vs. Social Behavior

Credit history primarily relies on financial behavior data such as loan repayments, credit card usage, and payment timeliness to assess risk accurately. Social credit, on the other hand, integrates social behavior indicators including online activity, social networks, and personal conduct, offering a broader but less standardized risk profile. Evaluating risk through financial behavior provides quantifiable metrics, while social behavior introduces qualitative factors that can complement traditional credit assessments.

Accuracy and Fairness in Risk Assessment

Credit history provides a quantifiable record of an individual's past borrowing and repayment behavior, offering accurate and objective data for risk assessment in lending decisions. In contrast, social credit systems incorporate broader behavioral and social factors, which may introduce biases and reduce fairness due to subjective or non-financial criteria. Ensuring accuracy and fairness in risk assessment requires prioritizing transparent, relevant financial data while rigorously validating alternative social metrics to avoid discriminatory outcomes.

Potential Biases in Credit and Social Credit Systems

Credit history primarily reflects an individual's financial behavior and repayment patterns, while social credit systems assess broader social behavior and community interactions, potentially incorporating subjective data. Biases in credit history can arise from socioeconomic factors and limited financial access, whereas social credit systems risk amplifying discrimination through algorithmic opacity and cultural prejudices. Both systems require transparency and fairness to mitigate potential biases impacting risk assessment outcomes.

Privacy Concerns: Data Security and Surveillance

Credit history relies on financial data to assess risk, whereas social credit systems incorporate a broader range of personal behaviors, raising significant privacy concerns. The extensive data collection in social credit systems poses risks of surveillance and misuse, potentially exposing sensitive information without explicit consent. Ensuring robust data security measures is crucial to protect individuals' privacy while balancing the need for accurate risk assessment.

Implications for Lenders and Borrowers

Credit history provides lenders with a detailed record of a borrower's financial behavior, enabling precise risk assessment based on past loan repayments and financial reliability. Social credit systems incorporate broader social and behavioral data, which may offer lenders additional insights but raise concerns about privacy and fairness for borrowers. For borrowers, reliance on social credit can affect access to credit in ways that extend beyond traditional financial factors, potentially impacting loan approval and terms.

The Future of Risk Assessment: Integration or Separation?

Credit history remains a cornerstone in traditional risk assessment by quantifying an individual's past financial behavior through credit scores and payment records. Social credit systems, emerging in some regions, incorporate broader behavioral data such as social interactions and compliance with societal norms, offering alternative insights into risk profiles. The future of risk assessment may see either an integrated approach combining financial and social data to enhance predictive accuracy or a distinct separation to preserve the privacy and objectivity of credit evaluations.

Related Important Terms

Alternative Credit Data

Alternative credit data, including utility payments, rental history, and social media behavior, enhances credit risk assessment by providing a broader view beyond traditional credit history. Incorporating social credit indicators allows lenders to evaluate borrower reliability in underserved populations, reducing reliance solely on credit bureau scores.

Social Credit Scoring

Social credit scoring evaluates individuals based on a wide range of behavioral data, including social interactions, online activity, and community involvement, offering a broader risk assessment than traditional credit history, which primarily relies on financial transactions and payment records. This method enables more dynamic and real-time evaluation of trustworthiness but raises significant privacy and ethical concerns due to its extensive data collection and potential biases.

Psychometric Credit Assessment

Psychometric credit assessment leverages behavioral data and psychological traits to evaluate credit risk beyond traditional credit history, offering a nuanced understanding of borrower reliability. Unlike social credit systems that use broad societal metrics, psychometric models provide predictive insights by analyzing individual decision-making patterns and personality factors directly related to financial behavior.

Digital Footprint Lending

Credit history provides a traditional financial track record based on past loan repayments, while social credit evaluates broader behavioral data, including online activities and social interactions, to assess risk. Digital footprint lending integrates social credit metrics with credit history to create a more comprehensive risk profile, enabling lenders to extend credit to individuals with limited financial records.

Behavioral Credit Analytics

Behavioral Credit Analytics leverages traditional credit history and social credit data to provide a more comprehensive risk assessment by analyzing patterns of financial behavior, repayment trends, and social interactions. Integrating these data sources enhances predictive accuracy in credit scoring models, enabling lenders to better identify high-risk borrowers and tailor credit offerings accordingly.

Social Network Risk Profiling

Social Network Risk Profiling enhances traditional credit history by analyzing behavioral patterns and social connections to predict creditworthiness more accurately. This approach leverages data from online interactions and relationships, offering a dynamic and holistic risk assessment beyond conventional financial records.

Non-traditional Credit Evaluation

Credit history primarily relies on traditional financial data such as payment records, loan balances, and credit card usage, while social credit incorporates alternative, non-traditional data including social behavior, online activities, and network relationships for risk assessment. Non-traditional credit evaluation leverages machine learning algorithms and big data analytics to analyze diverse data points beyond conventional credit reports, enabling more inclusive and predictive risk profiling for individuals with limited or no formal credit history.

AI-driven Social Trust Score

AI-driven Social Trust Scores analyze vast social behavior data, including online interactions and real-world activities, to complement traditional credit history in assessing financial risk. This innovative approach enhances risk prediction accuracy by integrating dynamic social signals beyond conventional credit bureau reports.

Peer-to-Peer Reputation Index

Credit history provides a financial track record based on loan repayments and credit utilization, while social credit systems integrate broader behavioral data to assess trustworthiness and risk. The Peer-to-Peer Reputation Index enhances risk assessment by quantifying individual reliability within a community, leveraging social interactions and transaction feedback for more dynamic and nuanced credit evaluations.

Big Data Creditworthiness

Credit history provides a record of an individual's past financial behavior, including loan repayments and credit utilization, which traditional lenders use to gauge creditworthiness. Social credit systems leverage big data analytics by incorporating diverse social behaviors and digital footprints to create a more comprehensive risk assessment model beyond conventional financial metrics.

Credit history vs social credit for risk assessment Infographic

moneydiff.com

moneydiff.com