Credit cards offer physical convenience and wide acceptance for daily spending, allowing easy access to funds and rewards benefits. Virtual credit cards enhance security by generating unique, temporary card numbers for online purchases, reducing fraud risk and unauthorized transactions. Choosing between the two depends on whether physical usage or enhanced online protection is prioritized in managing daily expenses.

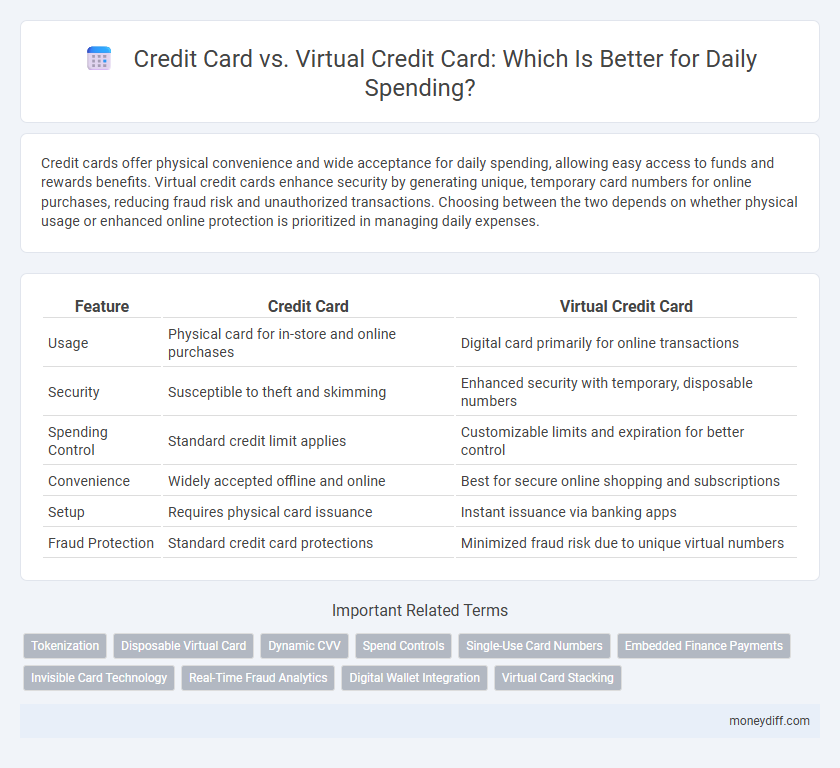

Table of Comparison

| Feature | Credit Card | Virtual Credit Card |

|---|---|---|

| Usage | Physical card for in-store and online purchases | Digital card primarily for online transactions |

| Security | Susceptible to theft and skimming | Enhanced security with temporary, disposable numbers |

| Spending Control | Standard credit limit applies | Customizable limits and expiration for better control |

| Convenience | Widely accepted offline and online | Best for secure online shopping and subscriptions |

| Setup | Requires physical card issuance | Instant issuance via banking apps |

| Fraud Protection | Standard credit card protections | Minimized fraud risk due to unique virtual numbers |

Introduction: Understanding Credit Card Options for Daily Spending

Credit cards offer physical cards linked to credit accounts, enabling in-person purchases and widespread acceptance at retail locations. Virtual credit cards generate unique card numbers for online transactions, enhancing security by limiting exposure of the primary account. Both options provide flexible payment solutions, but virtual cards are ideal for minimizing fraud risk during daily online spending.

What Is a Traditional Credit Card?

A traditional credit card is a physical payment card issued by banks or financial institutions that allows users to borrow funds up to a predetermined credit limit for daily spending and purchases. It enables convenient transactions both in-store and online while offering features like rewards, cashback, and fraud protection. Unlike virtual credit cards, traditional cards provide a tangible form factor that can be used at any payment terminal without requiring digital devices.

What Is a Virtual Credit Card?

A virtual credit card is a digital version of a physical credit card, generated for online transactions to enhance security by using a unique card number that links to your actual credit account. It helps prevent fraud and unauthorized charges by allowing users to set spending limits and expiration dates for each virtual card. Ideal for daily spending, virtual credit cards provide convenience and protection when making purchases on websites or apps without exposing your main credit card details.

Key Differences Between Credit Cards and Virtual Credit Cards

Credit cards offer a physical plastic card linked to a credit account for in-person and online purchases, while virtual credit cards provide a digital-only number generated for specific transactions, enhancing security by reducing fraud risks. Traditional credit cards often come with rewards and physical acceptance, whereas virtual cards limit exposure by using randomized numbers that expire after use or a set period. Both options facilitate daily spending, but virtual cards prioritize privacy and control over transaction-specific payments, ideal for online shopping and subscription management.

Security Features: Physical vs. Virtual Cards

Physical credit cards carry risks such as loss, theft, and skimming, exposing users to potential fraud. Virtual credit cards generate unique card numbers for each transaction, limiting exposure and enhancing security against unauthorized use. This dynamic number system reduces the risk linked to compromised data in daily spending activities.

Ease of Use: In-Store and Online Transactions

Physical credit cards offer quick and straightforward use for in-store purchases with widespread acceptance at point-of-sale terminals, making them convenient for everyday transactions. Virtual credit cards enhance online shopping security by generating unique card numbers for each purchase, reducing the risk of fraud while maintaining compatibility with most e-commerce platforms. Both options support ease of use, but virtual credit cards provide an extra layer of safety for digital payments without sacrificing convenience.

Rewards and Cashback Programs Compared

Credit cards often offer robust rewards and cashback programs with higher earning potential on everyday purchases like groceries, dining, and fuel. Virtual credit cards provide similar cashback benefits linked to the primary account but may lack exclusive rewards or bonus categories available to physical cardholders. Consumers maximizing daily spending should evaluate the specific rewards structures and promotional offers associated with each card type to optimize return on expenditures.

Managing Spending Limits and Budget Control

Virtual credit cards offer enhanced spending limits and budget control by allowing users to set customized transaction amounts and expiration dates, reducing the risk of overspending. Physical credit cards often come with fixed credit limits that are harder to adjust on a daily basis, making it more challenging to manage daily expenses effectively. Utilizing virtual credit cards for daily spending promotes better financial discipline by providing precise control over individual transactions and preventing unauthorized charges.

Fraud Protection and Consumer Safety

Virtual credit cards offer enhanced fraud protection by generating temporary, unique card numbers for each transaction, significantly reducing the risk of unauthorized use compared to traditional credit cards. Traditional credit cards often expose consumers to greater risk if card details are stolen, whereas virtual cards limit exposure by allowing users to set spending limits and expiration dates for each virtual number. Both options provide consumer safety features, but virtual credit cards are especially effective in mitigating fraud during daily spending activities.

Which Card Is Best for Your Daily Spending Needs?

A traditional credit card offers widespread acceptance and rewards programs suitable for frequent in-store and online purchases, while a virtual credit card enhances security by generating temporary card numbers that minimize fraud risk during online transactions. Virtual cards are ideal for controlling spending limits and preventing unauthorized use, making them preferred for digital subscriptions or one-time purchases. Choosing between the two depends on whether convenience and broad usability or enhanced security and spending control align better with your daily spending habits.

Related Important Terms

Tokenization

Credit cards store sensitive payment information on physical chips or magnetic strips, while virtual credit cards leverage tokenization to replace card details with unique digital tokens, enhancing security during daily spending. Tokenization reduces the risk of fraud by ensuring that actual card data is never exposed during online or contactless transactions.

Disposable Virtual Card

Disposable virtual credit cards provide enhanced security by generating unique, single-use card numbers for daily spending, minimizing the risk of fraud compared to traditional credit cards that use static information. These virtual cards simplify online transactions, offer instant issuance, and allow precise control over spending limits, making them ideal for frequent digital purchases and subscription management.

Dynamic CVV

Dynamic CVV technology enhances virtual credit cards by generating a unique security code for each transaction, significantly reducing the risk of fraud compared to traditional credit cards with static CVVs. This feature makes virtual credit cards particularly advantageous for daily spending, providing increased security and control over online purchases.

Spend Controls

Credit cards offer limited spend controls, often restricted to preset limits and alerts, while virtual credit cards provide enhanced spend controls through customizable transaction limits, merchant-specific usage, and real-time monitoring, improving security and budget management for daily spending. Virtual cards enable tighter oversight and reduce fraud risk by generating unique numbers per transaction or vendor, making them ideal for precise financial control.

Single-Use Card Numbers

Single-use card numbers, a key feature of virtual credit cards, enhance security by generating unique card details for each transaction, minimizing fraud risk during daily spending. Traditional credit cards lack this dynamic number generation, making virtual cards a safer choice for everyday online purchases.

Embedded Finance Payments

Credit cards offer traditional physical payment options widely accepted for in-store and online purchases, whereas virtual credit cards provide enhanced security and convenience through digitized transactions without exposing the primary card details. Embedded finance payments integrate these virtual credit solutions directly into apps and platforms, streamlining the spending experience while reducing fraud risk and enabling real-time transaction tracking for daily expenses.

Invisible Card Technology

Virtual credit cards leverage invisible card technology to generate unique, temporary card numbers for each transaction, enhancing security and reducing fraud risk in daily spending. Traditional credit cards lack this dynamic masking, making virtual cards a preferred choice for safer online and in-store payments.

Real-Time Fraud Analytics

Credit cards offer comprehensive fraud protection but are more vulnerable to physical theft and unauthorized use, whereas virtual credit cards generate unique, temporary numbers that enhance security for daily spending and provide superior real-time fraud analytics to immediately detect and prevent unauthorized transactions. Real-time fraud analytics integrated with virtual credit cards leverage machine learning algorithms to monitor spending patterns and flag anomalies, significantly reducing the risk of fraud and financial loss during online and in-store purchases.

Digital Wallet Integration

Virtual credit cards offer enhanced security by generating unique card numbers for each transaction, seamlessly integrating with digital wallets like Apple Pay and Google Pay for convenient daily spending. Unlike traditional credit cards, virtual cards minimize fraud risks while providing instant control through mobile apps, optimizing budget management and real-time transaction tracking.

Virtual Card Stacking

Virtual credit card stacking enhances daily spending flexibility by allowing users to combine multiple virtual cards tied to different funding sources, optimizing budgets and minimizing fraud risks. This method provides seamless expense management and increased security compared to traditional credit cards, making it ideal for digitally savvy consumers.

Credit card vs Virtual credit card for daily spending. Infographic

moneydiff.com

moneydiff.com