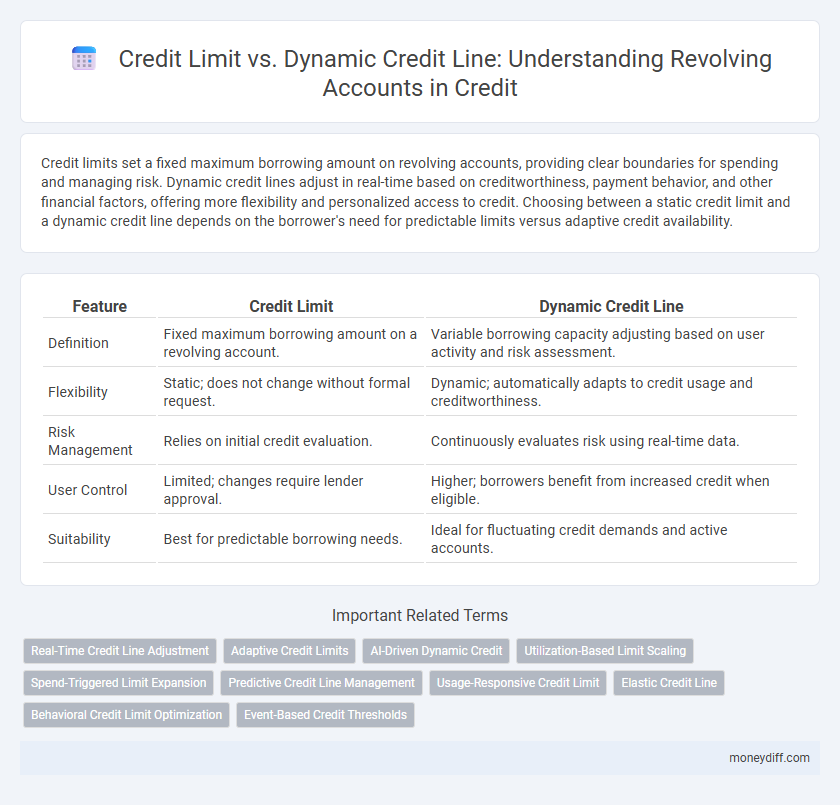

Credit limits set a fixed maximum borrowing amount on revolving accounts, providing clear boundaries for spending and managing risk. Dynamic credit lines adjust in real-time based on creditworthiness, payment behavior, and other financial factors, offering more flexibility and personalized access to credit. Choosing between a static credit limit and a dynamic credit line depends on the borrower's need for predictable limits versus adaptive credit availability.

Table of Comparison

| Feature | Credit Limit | Dynamic Credit Line |

|---|---|---|

| Definition | Fixed maximum borrowing amount on a revolving account. | Variable borrowing capacity adjusting based on user activity and risk assessment. |

| Flexibility | Static; does not change without formal request. | Dynamic; automatically adapts to credit usage and creditworthiness. |

| Risk Management | Relies on initial credit evaluation. | Continuously evaluates risk using real-time data. |

| User Control | Limited; changes require lender approval. | Higher; borrowers benefit from increased credit when eligible. |

| Suitability | Best for predictable borrowing needs. | Ideal for fluctuating credit demands and active accounts. |

Understanding Credit Limits: Foundations and Functions

Credit limits define the maximum amount a borrower can access on a revolving account, serving as a fixed cap set by the lender based on creditworthiness and risk assessment. Dynamic credit lines adjust in real-time according to changes in the borrower's financial behavior, account utilization, and payment history, offering more flexibility and responsiveness. Understanding these mechanisms enables consumers and lenders to manage risk while optimizing credit availability and financial health.

What Is a Dynamic Credit Line? Key Concepts Explained

A dynamic credit line is a flexible credit limit that adjusts based on the borrower's credit usage, payment history, and overall credit risk, unlike a fixed credit limit which remains constant. This adaptive feature allows lenders to increase or decrease the available credit in real-time, optimizing risk management and providing consumers with more personalized borrowing capacity. Key concepts include real-time assessment, credit utilization monitoring, and automated credit adjustments to align with the borrower's financial behavior.

Credit Limit vs Dynamic Credit Line: Core Differences

Credit limit represents a fixed maximum amount a borrower can utilize on a revolving account, offering predictable borrowing capacity. Dynamic credit line adjusts in real-time based on factors like credit utilization, payment history, and account activity, providing flexible access to funds. While credit limit enforces a static borrowing cap, dynamic credit line optimizes credit availability according to changing financial behaviors and risk assessments.

Advantages of Fixed Credit Limits in Revolving Accounts

Fixed credit limits in revolving accounts provide predictability and enhanced budgeting control, allowing consumers to manage expenses within a defined borrowing capacity. These limits reduce the risk of overspending and help maintain a stable credit utilization ratio, which positively impacts credit scores. Unlike dynamic credit lines, fixed limits simplify debt management by offering consistent borrowing parameters and minimizing unexpected changes in available credit.

Benefits of Dynamic Credit Lines for Modern Consumers

Dynamic credit lines adapt to spending habits and income fluctuations, offering consumers personalized borrowing limits that reduce the risk of overspending. Unlike fixed credit limits, these flexible credit lines enhance financial agility, enabling users to access higher credit during peak needs and avoid unnecessary interest charges during slower periods. This adaptive approach promotes better credit management and improves overall financial wellness for modern consumers.

How Lenders Determine Your Credit Limit

Lenders determine your credit limit based on factors such as your credit score, income, debt-to-income ratio, and payment history to manage risk effectively. A static credit limit offers a fixed maximum borrowing amount, while a dynamic credit line adjusts based on real-time credit behavior and financial changes, providing more flexibility. Understanding these factors helps borrowers optimize credit utilization and maintain healthy credit profiles.

The Mechanics Behind Dynamic Credit Line Adjustments

Dynamic credit line adjustments automatically modify the available credit based on real-time account activity, payment behavior, and credit utilization patterns. Unlike a static credit limit, which remains fixed until manually changed, dynamic lines respond to fluctuating financial conditions, optimizing borrowing capacity while mitigating risk. This adaptive mechanism helps lenders balance credit availability with creditworthiness, enhancing both customer flexibility and portfolio health.

Impact of Each System on Credit Utilization Scores

Credit limit provides a fixed maximum amount that directly influences credit utilization ratios, often leading to more stable but potentially less flexible credit scores. Dynamic credit lines adjust based on account activity and repayment behavior, which can optimize credit utilization scores by reducing the credit utilization percentage during high repayment periods. Lenders may prefer dynamic credit lines for their potential to enhance credit scores through adaptive borrowing capacity and improved debt management signals.

Choosing the Right Option: Factors to Consider

Evaluating credit limit versus dynamic credit line for revolving accounts involves assessing spending patterns, financial stability, and repayment capacity. A fixed credit limit offers predictable spending boundaries, while a dynamic credit line adjusts based on credit behavior and income changes, providing greater flexibility. Consider credit utilization ratio, risk tolerance, and potential impact on credit score when selecting the optimal option for managing debt efficiently.

Future Trends in Credit Management: The Shift Toward Dynamic Solutions

Future trends in credit management emphasize a shift from static credit limits to dynamic credit lines, offering personalized and real-time credit adjustments based on spending behavior and risk assessment. Dynamic credit lines leverage advanced AI algorithms and big data analytics to provide more flexible and responsive revolving account management, enhancing both customer experience and lender risk control. This approach is expected to drive improved credit utilization rates and reduce default risks as financial institutions adopt technology-driven credit optimization strategies.

Related Important Terms

Real-Time Credit Line Adjustment

Dynamic credit lines enable real-time credit limit adjustments based on current account activity, risk assessments, and spending behavior, enhancing flexibility compared to static credit limits. This adaptive approach improves credit utilization efficiency and helps mitigate credit risk by responding instantly to changing financial conditions.

Adaptive Credit Limits

Adaptive credit limits provide flexible borrowing capacity by adjusting based on real-time credit behavior and payment patterns, enhancing risk management for revolving accounts compared to static credit limits. Dynamic credit lines optimize consumer access to credit by automatically increasing or decreasing limits, improving responsiveness to financial changes without manual intervention.

AI-Driven Dynamic Credit

AI-driven dynamic credit lines for revolving accounts continuously analyze real-time spending patterns, credit risk, and payment behavior to adjust credit limits more accurately than fixed credit limits. This approach enhances credit utilization efficiency and reduces default risk by providing personalized, adaptive credit access aligned with individual financial profiles.

Utilization-Based Limit Scaling

Utilization-Based Limit Scaling in revolving accounts adjusts the credit limit dynamically according to the cardholder's current spending patterns and repayment behavior, enhancing credit flexibility and risk management. Unlike static Credit Limits, Dynamic Credit Lines optimize credit availability by responding in real-time to account utilization, potentially lowering the risk of overspending and improving credit score impact.

Spend-Triggered Limit Expansion

Spend-triggered limit expansion in revolving accounts allows credit lines to adjust dynamically based on real-time spending behavior, enhancing purchasing power while mitigating risk. This adaptive credit model contrasts with static credit limits by providing flexibility that reflects current borrower activity and creditworthiness.

Predictive Credit Line Management

Predictive Credit Line Management leverages real-time data and behavioral analytics to adjust credit limits dynamically, optimizing risk and customer spending capacity for revolving accounts. This approach enhances financial flexibility compared to static credit limits by anticipating credit needs and reducing default probabilities through timely credit line modifications.

Usage-Responsive Credit Limit

Usage-responsive credit limits adjust dynamically based on a borrower's spending and repayment behavior, offering more flexibility than static credit limits by aligning available credit with real-time creditworthiness and usage patterns. This dynamic credit line enhances risk management and customer satisfaction by preventing overextension while maximizing borrowing capacity for revolving accounts.

Elastic Credit Line

Elastic Credit Line adapts credit limits based on real-time customer behavior and risk assessment, providing flexible borrowing capacity for revolving accounts. Unlike fixed credit limits, this dynamic approach maximizes credit utilization while minimizing default risk through continuous creditworthiness evaluation.

Behavioral Credit Limit Optimization

Behavioral credit limit optimization leverages transactional data and repayment patterns to adjust credit limits dynamically, enhancing risk management and customer experience compared to static credit limits. Dynamic credit lines respond in real-time to changes in borrower behavior, promoting responsible usage and reducing default rates in revolving credit accounts.

Event-Based Credit Thresholds

Event-based credit thresholds in dynamic credit lines adjust borrowing capacity in real-time based on account activity, transaction patterns, and creditworthiness changes, providing tailored flexibility unmatched by static credit limits. This approach minimizes risk exposure while optimizing customer spending power by integrating predictive analytics and behavioral triggers into revolving account management.

Credit Limit vs Dynamic Credit Line for revolving accounts. Infographic

moneydiff.com

moneydiff.com