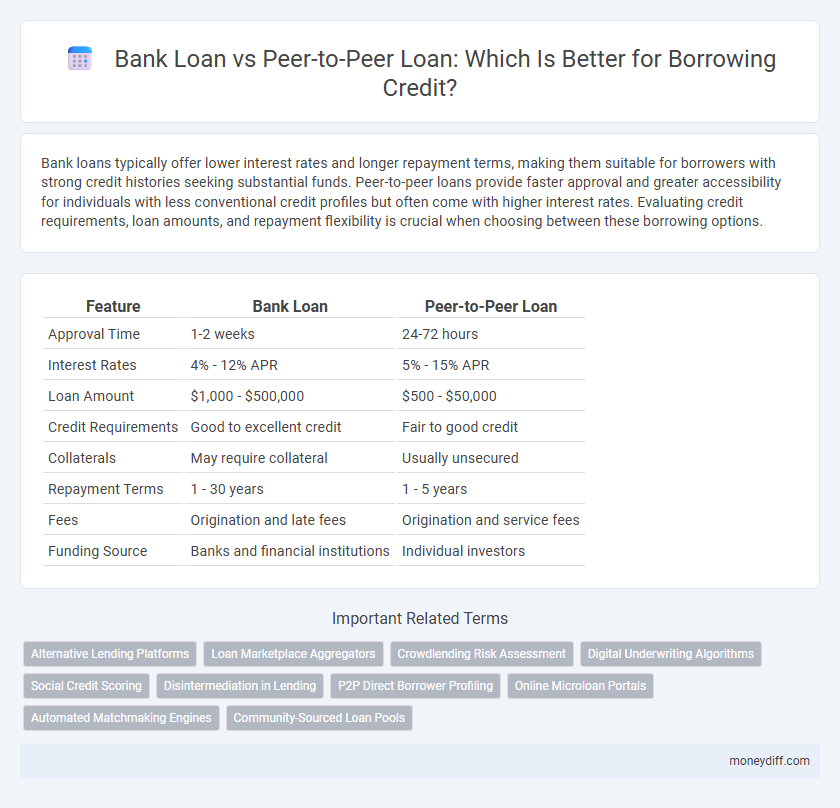

Bank loans typically offer lower interest rates and longer repayment terms, making them suitable for borrowers with strong credit histories seeking substantial funds. Peer-to-peer loans provide faster approval and greater accessibility for individuals with less conventional credit profiles but often come with higher interest rates. Evaluating credit requirements, loan amounts, and repayment flexibility is crucial when choosing between these borrowing options.

Table of Comparison

| Feature | Bank Loan | Peer-to-Peer Loan |

|---|---|---|

| Approval Time | 1-2 weeks | 24-72 hours |

| Interest Rates | 4% - 12% APR | 5% - 15% APR |

| Loan Amount | $1,000 - $500,000 | $500 - $50,000 |

| Credit Requirements | Good to excellent credit | Fair to good credit |

| Collaterals | May require collateral | Usually unsecured |

| Repayment Terms | 1 - 30 years | 1 - 5 years |

| Fees | Origination and late fees | Origination and service fees |

| Funding Source | Banks and financial institutions | Individual investors |

Understanding Bank Loans: Traditional Lending Basics

Bank loans involve borrowing a fixed amount of money from financial institutions, typically requiring collateral and a thorough credit assessment to determine eligibility and interest rates. These loans offer structured repayment plans with predictable monthly payments based on fixed or variable interest rates established by the bank. Understanding the bank's lending criteria, such as credit score thresholds and debt-to-income ratios, is crucial for securing favorable loan terms and ensuring consistent repayment schedules.

What is Peer-to-Peer Lending? An Overview

Peer-to-peer lending is a digital platform that directly connects borrowers with individual investors, bypassing traditional banks. It offers more flexible credit terms and potentially lower interest rates by cutting out intermediaries. This alternative lending method enhances accessibility for borrowers who may not qualify for conventional bank loans.

Qualification Requirements: Bank Loan vs P2P Loan

Bank loans typically require strong credit scores, verified income, and collateral to qualify, reflecting traditional underwriting standards set by financial institutions. Peer-to-peer (P2P) loans have more flexible qualification criteria, often evaluating borrower profiles through alternative data points and offering access to those with lower credit scores. P2P lending platforms expedite approval by leveraging automated algorithms, reducing dependence on stringent documentation compared to conventional banks.

Interest Rates Comparison: Which Offers Better Deals?

Bank loans generally have fixed or variable interest rates set by financial institutions, often ranging from 4% to 12% depending on creditworthiness and loan terms. Peer-to-peer loans can offer more competitive rates, typically between 6% and 10%, influenced by borrower profiles and investor demand on the platform. Evaluating total repayment costs and rate fluctuations is essential to determine the more cost-effective borrowing option.

Application Process: Speed and Simplicity

Bank loans typically involve a structured application process with extensive documentation, leading to longer approval times and more stringent credit checks. Peer-to-peer loans offer a faster, more streamlined application via online platforms, often requiring less paperwork and providing quicker access to funds. This simplicity benefits borrowers seeking rapid financing without the traditional banking bureaucracy.

Credit Score Impact: Bank vs Peer-to-Peer Loans

Bank loans typically require a higher credit score for approval and positively impact credit history through consistent, on-time payments reported to credit bureaus. Peer-to-peer loans may have more flexible credit requirements but can result in greater credit score volatility due to varied reporting practices and higher interest rates. Borrowers with strong credit usually benefit from bank loans' transparency, while those with lower scores might find peer-to-peer loans accessible but with potential risks to credit standing.

Fees and Hidden Costs: Transparency Analysis

Bank loans typically involve a range of fees such as origination, processing, and prepayment penalties that are clearly outlined in the loan agreement, ensuring higher transparency. Peer-to-peer loans often claim lower fees but may include hidden costs like platform service charges and higher interest rates that reduce overall savings. Comparing both, borrowers should scrutinize fee structures and fine print to avoid unexpected expenses and ensure a cost-effective borrowing decision.

Flexibility in Repayment Terms

Bank loans typically offer fixed repayment schedules with limited flexibility, requiring borrowers to adhere to strict monthly payments over a predetermined period. Peer-to-peer loans provide more adaptable repayment options, allowing borrowers to negotiate terms that better fit their financial situations and potentially adjust payment amounts or timing. This flexibility in peer-to-peer lending can ease financial pressure and improve borrower satisfaction compared to conventional bank loan structures.

Risks and Security: Protecting Your Finances

Bank loans offer established regulatory oversight and typically involve credit checks, providing a secure borrowing environment with lower default risks. Peer-to-peer loans, while potentially more accessible, carry higher risks due to less stringent vetting and variable platform security measures. Borrowers must evaluate the reliability of P2P platforms and consider insurance or guarantees to protect their financial interests.

Which Loan Option Suits Your Financial Goals?

Bank loans typically offer structured repayment plans, fixed interest rates, and access to larger sums, making them suitable for borrowers seeking predictable financial commitments and long-term stability. Peer-to-peer loans provide flexible terms and potentially lower rates by connecting borrowers directly with individual investors, ideal for those with good credit scores looking for faster approval and less stringent requirements. Assessing your creditworthiness, loan purpose, and risk tolerance helps determine whether the traditional banking system's reliability or the innovative P2P platform's agility better aligns with your financial goals.

Related Important Terms

Alternative Lending Platforms

Alternative lending platforms like peer-to-peer (P2P) loans offer borrowers competitive interest rates and faster approval times compared to traditional bank loans, leveraging technology to connect individuals directly with investors. P2P lending provides access to credit for those with less-than-perfect credit scores or limited collateral, often filling gaps left by conventional banking institutions.

Loan Marketplace Aggregators

Loan marketplace aggregators provide borrowers with a comprehensive platform to compare bank loans and peer-to-peer (P2P) loans, highlighting key differences such as interest rates, approval speed, and credit requirements. These aggregators leverage extensive data from multiple lenders to optimize borrower choices, often revealing lower costs and more flexible terms available through P2P lending compared to traditional bank loans.

Crowdlending Risk Assessment

Crowdlending risk assessment involves evaluating borrower creditworthiness, loan purpose, and platform reliability to mitigate default risk, contrasting traditional bank loan procedures that rely heavily on established credit scores and collateral. Peer-to-peer loans expose lenders to higher risk due to limited regulatory oversight and borrower data transparency but offer potentially higher returns through diversified crowdfunding pools.

Digital Underwriting Algorithms

Digital underwriting algorithms in bank loans leverage extensive credit histories and regulatory compliance data to assess borrower risk with high accuracy, often resulting in more conservative lending decisions. Peer-to-peer lending platforms utilize alternative data sources and machine learning models to quickly evaluate creditworthiness, enabling faster approvals but sometimes accepting higher risk profiles.

Social Credit Scoring

Bank loans typically rely on traditional credit scores and financial history evaluated by institutional algorithms, while peer-to-peer loans increasingly incorporate social credit scoring methods that analyze borrowers' social behavior and network reputation to assess creditworthiness. Social credit scoring in peer-to-peer lending can provide alternative risk assessment for individuals with limited conventional credit data, potentially increasing loan accessibility and personalized interest rates.

Disintermediation in Lending

Bank loans involve traditional financial institutions acting as intermediaries, often resulting in higher interest rates and longer approval times due to regulatory and operational overhead. Peer-to-peer loans eliminate this disintermediation by directly connecting borrowers with individual lenders, enabling faster access to funds and potentially lower costs through a more efficient, decentralized lending process.

P2P Direct Borrower Profiling

Peer-to-peer (P2P) loan platforms use advanced borrower profiling techniques that analyze social behavior, credit history, and online activity to assess risk more dynamically than traditional bank loans. This direct borrower profiling enables tailored loan terms and faster approval, often resulting in lower interest rates and increased accessibility for individuals with non-traditional credit profiles.

Online Microloan Portals

Online microloan portals offer streamlined access to peer-to-peer loans, often featuring lower interest rates and faster approval than traditional bank loans. Borrowers benefit from flexible terms and less stringent credit requirements, while banks provide more robust regulatory protections and larger loan amounts.

Automated Matchmaking Engines

Automated matchmaking engines in peer-to-peer lending platforms utilize algorithms to efficiently connect borrowers with suitable individual lenders based on credit profiles and risk assessments, often resulting in faster approval and competitive interest rates compared to traditional bank loans. These systems enhance transparency and customization, leveraging real-time data to optimize loan terms and improve borrower-lender alignment beyond the more rigid underwriting processes of conventional banks.

Community-Sourced Loan Pools

Community-sourced loan pools in peer-to-peer lending offer borrowers access to funds pooled from multiple individual investors, often resulting in competitive interest rates and faster approval times compared to traditional bank loans. These decentralized loan structures reduce reliance on banks, enabling personalized lending terms and fostering financial inclusion through direct borrower-lender connections.

Bank Loan vs Peer-to-Peer Loan for borrowing. Infographic

moneydiff.com

moneydiff.com