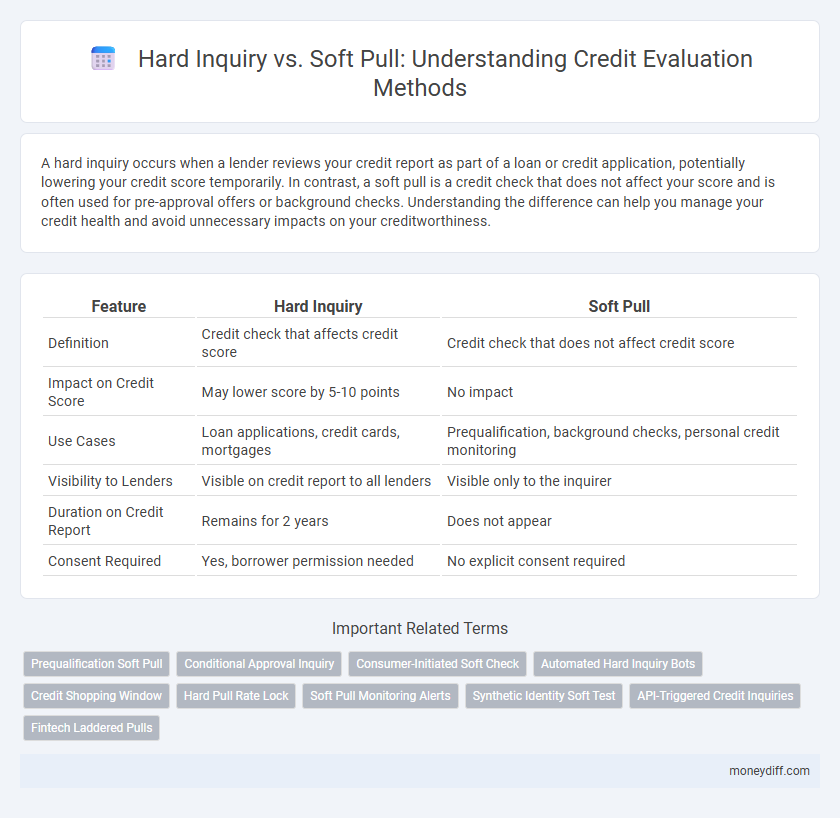

A hard inquiry occurs when a lender reviews your credit report as part of a loan or credit application, potentially lowering your credit score temporarily. In contrast, a soft pull is a credit check that does not affect your score and is often used for pre-approval offers or background checks. Understanding the difference can help you manage your credit health and avoid unnecessary impacts on your creditworthiness.

Table of Comparison

| Feature | Hard Inquiry | Soft Pull |

|---|---|---|

| Definition | Credit check that affects credit score | Credit check that does not affect credit score |

| Impact on Credit Score | May lower score by 5-10 points | No impact |

| Use Cases | Loan applications, credit cards, mortgages | Prequalification, background checks, personal credit monitoring |

| Visibility to Lenders | Visible on credit report to all lenders | Visible only to the inquirer |

| Duration on Credit Report | Remains for 2 years | Does not appear |

| Consent Required | Yes, borrower permission needed | No explicit consent required |

Understanding Hard Inquiry vs Soft Pull in Credit Evaluation

Hard inquiries occur when lenders check your credit report for a lending decision, impacting your credit score slightly and remaining on your report for up to two years. Soft pulls, used for background checks or pre-approval offers, do not affect your credit score and are only visible to you. Understanding the difference helps consumers manage their credit applications strategically to maintain a strong credit profile.

Key Differences Between Hard Inquiries and Soft Pulls

Hard inquiries occur when a lender reviews your credit report as part of a formal application, often impacting your credit score by a few points. Soft pulls do not affect your credit score and happen during background checks or pre-approval offers, where your credit is reviewed without your explicit application. Key differences include the impact on credit scores, the permissions required, and the visibility of the inquiry to other lenders.

Impact of Hard Inquiry on Your Credit Score

A hard inquiry occurs when a lender reviews your credit report to make a lending decision, which can reduce your credit score by a few points temporarily. Multiple hard inquiries within a short period, especially for credit cards or loans, may compound the negative impact and signal higher risk to creditors. Monitoring hard inquiries is essential to maintaining a healthy credit score and ensuring favorable loan approval odds.

How Soft Pulls Affect Your Credit Evaluation

Soft pulls, also known as soft inquiries, have minimal to no impact on your credit score because they do not involve a lender actively reviewing your credit for lending decisions. These inquiries typically occur during background checks, pre-approved credit offers, or when you check your own credit report, allowing lenders to perform a preliminary evaluation without lowering your credit score. Understanding the distinction between soft pulls and hard inquiries is crucial for maintaining a healthy credit profile while managing multiple credit checks.

When do Lenders Use Hard Inquiries?

Lenders use hard inquiries primarily when a borrower applies for new credit, such as a mortgage, auto loan, or credit card, to assess the applicant's creditworthiness comprehensively. This type of credit check allows lenders to review detailed credit reports, which include payment history, outstanding debts, and credit utilization. Hard inquiries can impact credit scores slightly, signaling to lenders that the borrower is actively seeking credit.

Common Scenarios for Soft Pulls in Credit Checks

Soft pulls frequently occur during pre-approved credit card offers, employer background checks, and rental applications, where a full credit report is unnecessary. These inquiries provide a limited credit overview without impacting credit scores, making them ideal for preliminary evaluations. Lenders use soft pulls to screen potential borrowers without signaling active credit seeking, preserving consumer credit integrity.

Pros and Cons: Hard Inquiry vs Soft Pull

Hard inquiries can lower your credit score by a few points and remain on your credit report for up to two years, signaling lenders you are seeking new credit, which may impact your loan approval chances. Soft pulls do not affect your credit score and are used primarily for background checks or pre-approved offers, offering a non-intrusive way to assess creditworthiness without impacting future borrowing potential. However, hard inquiries provide lenders with more detailed credit activity for thorough evaluation, while soft pulls offer limited data, potentially leading to less accurate credit assessments.

Minimizing Damage from Hard Inquiries

Hard inquiries occur when lenders review your credit report during applications for new credit accounts, potentially lowering your credit score by a few points and remaining on your report for up to two years. Soft pulls, used for pre-approved offers or personal credit checks, do not impact your credit score and are invisible to other creditors. To minimize damage from hard inquiries, time multiple credit applications within a short window, typically 14 to 45 days, to ensure they register as a single inquiry, and avoid unnecessary credit checks.

Monitoring Your Credit: Why Soft Pulls Matter

Soft pulls play a crucial role in credit monitoring by allowing consumers to check their credit reports without impacting their credit scores. Unlike hard inquiries, soft pulls do not signal new credit applications and thereby avoid lowering credit scores. Regular use of soft pulls helps individuals stay informed about their credit status and detect potential errors or fraudulent activity early.

Smart Credit Strategies: Navigating Hard and Soft Inquiries

Understanding the difference between hard inquiry and soft pull is essential for smart credit strategies to maintain a healthy credit score. Hard inquiries occur when lenders review your credit for loan approval, potentially lowering your score temporarily, while soft pulls, used for background checks or pre-approved offers, don't impact your credit rating. Navigating these inquiries effectively enables consumers to manage credit applications carefully, avoid unnecessary credit score drops, and optimize opportunities for better financial products.

Related Important Terms

Prequalification Soft Pull

Prequalification soft pulls allow lenders to evaluate a consumer's creditworthiness without impacting their credit score, providing a risk-free way to explore loan or credit card offers. Unlike hard inquiries, soft pulls do not appear on credit reports visible to other creditors, ensuring consumer privacy during the initial credit evaluation process.

Conditional Approval Inquiry

A hard inquiry occurs when a lender accesses your full credit report for approval decisions, often affecting your credit score, while a soft pull checks limited information without impacting your score. Conditional approval inquiries typically involve a soft pull initially, allowing pre-approval based on preliminary data before triggering a hard inquiry for final credit evaluation.

Consumer-Initiated Soft Check

Consumer-initiated soft checks allow individuals to review their own credit reports without affecting their credit score, as these inquiries are not visible to lenders and do not impact credit evaluations. Unlike hard inquiries triggered by lender requests during loan approvals, soft pulls provide a risk-free way for consumers to monitor their credit health and detect inaccuracies.

Automated Hard Inquiry Bots

Automated hard inquiry bots streamline credit evaluation by instantly initiating hard pulls on consumer reports, which directly impact credit scores and appear on credit histories for lenders' review. Unlike soft pulls used for pre-approvals or background checks without affecting scores, these bots efficiently trigger credit inquiries that lenders rely on to assess creditworthiness during loan or credit card applications.

Credit Shopping Window

A hard inquiry occurs when a lender checks your credit report for loan approval, potentially lowering your credit score, while a soft pull does not affect your score and is used for pre-approval or background checks. During a credit shopping window, typically lasting 14 to 45 days, multiple hard inquiries for the same type of credit (e.g., mortgage, auto loan) are treated as a single inquiry, minimizing impact on your credit score.

Hard Pull Rate Lock

Hard pull rate locks occur when a creditor performs a hard inquiry on a borrower's credit report to secure a specific interest rate during loan processing, which temporarily lowers the credit score. This hard pull remains on the credit report for up to two years but typically impacts the score for only about 12 months, influencing a borrower's credit evaluation more significantly than a soft pull.

Soft Pull Monitoring Alerts

Soft pull monitoring alerts provide real-time notifications when a credit inquiry is made without impacting the credit score, enabling consumers and lenders to track authorization-based checks efficiently. These alerts help detect unauthorized credit activities and support proactive credit management by distinguishing soft pulls from hard inquiries that affect credit reports.

Synthetic Identity Soft Test

Synthetic identity soft tests use soft pulls, which do not impact credit scores or appear on credit reports, allowing lenders to evaluate creditworthiness without alerting the applicant. Hard inquiries, by contrast, result from hard pulls that temporarily lower credit scores and indicate active credit seeking.

API-Triggered Credit Inquiries

API-triggered credit inquiries differentiate between hard inquiries, which impact credit scores by signaling active credit applications, and soft pulls, used for pre-approval or background checks without affecting credit scores. Financial institutions leverage these APIs to optimize credit evaluation processes, ensuring compliance while enhancing user experience through real-time data access.

Fintech Laddered Pulls

Hard inquiries, triggered by applications for new credit, can lower credit scores temporarily, while soft pulls, used for background checks or pre-approval offers, do not affect scores. Fintech laddered pulls strategically space multiple inquiries over time to minimize impact and optimize credit evaluation outcomes.

Hard Inquiry vs Soft Pull for credit evaluation. Infographic

moneydiff.com

moneydiff.com