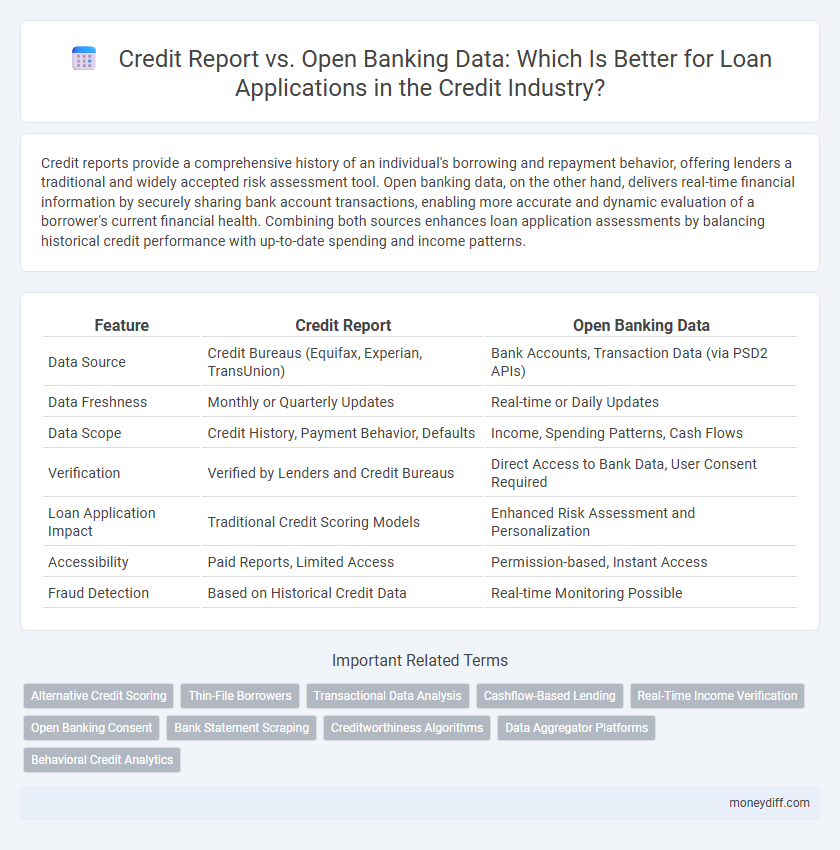

Credit reports provide a comprehensive history of an individual's borrowing and repayment behavior, offering lenders a traditional and widely accepted risk assessment tool. Open banking data, on the other hand, delivers real-time financial information by securely sharing bank account transactions, enabling more accurate and dynamic evaluation of a borrower's current financial health. Combining both sources enhances loan application assessments by balancing historical credit performance with up-to-date spending and income patterns.

Table of Comparison

| Feature | Credit Report | Open Banking Data |

|---|---|---|

| Data Source | Credit Bureaus (Equifax, Experian, TransUnion) | Bank Accounts, Transaction Data (via PSD2 APIs) |

| Data Freshness | Monthly or Quarterly Updates | Real-time or Daily Updates |

| Data Scope | Credit History, Payment Behavior, Defaults | Income, Spending Patterns, Cash Flows |

| Verification | Verified by Lenders and Credit Bureaus | Direct Access to Bank Data, User Consent Required |

| Loan Application Impact | Traditional Credit Scoring Models | Enhanced Risk Assessment and Personalization |

| Accessibility | Paid Reports, Limited Access | Permission-based, Instant Access |

| Fraud Detection | Based on Historical Credit Data | Real-time Monitoring Possible |

Understanding Credit Reports: Traditional Approach to Loan Assessment

Credit reports provide a detailed history of an individual's borrowing and repayment behavior, including credit accounts, payment timeliness, and outstanding debts. This traditional approach to loan assessment relies heavily on standardized credit scores derived from past credit-related activities. Lenders use credit reports to evaluate risk, predict default probability, and determine loan eligibility and interest rates based on historical financial data.

Open Banking Data: A New Frontier in Financial Evaluation

Open Banking data revolutionizes loan applications by providing real-time, detailed insights into applicants' financial behavior beyond traditional credit reports. This dynamic data includes transaction history, income patterns, and spending habits, allowing lenders to assess creditworthiness more accurately and reduce default risks. Integrating Open Banking analytics enhances personalized loan offers and expands access to credit for underserved consumers.

Key Differences Between Credit Reports and Open Banking Data

Credit reports provide a comprehensive history of an individual's borrowing, repayment behavior, and credit scores compiled by credit bureaus, which is essential for assessing creditworthiness in loan applications. Open banking data offers real-time access to detailed financial transactions, income, and cash flow, enabling lenders to evaluate a borrower's current financial health beyond traditional credit metrics. The key differences lie in the scope and timeliness: credit reports focus on historical credit behavior, while open banking data emphasizes up-to-date financial activity and liquidity.

Accuracy and Timeliness: Which Data Source Wins?

Open Banking data offers superior accuracy and timeliness for loan applications by providing real-time transaction information directly from bank accounts, reducing reliance on outdated or incomplete credit report data. Credit reports, while comprehensive, often contain delays due to periodic updates and may miss recent financial activities crucial for assessing current creditworthiness. Financial institutions increasingly prefer Open Banking data to make faster, more accurate lending decisions based on up-to-date financial behavior.

Impact on Loan Eligibility and Approval Rates

Credit reports provide detailed historical data on borrowers' repayment behavior, directly impacting loan eligibility by highlighting past delinquencies and credit utilization. Open banking data offers real-time access to income, spending patterns, and account balances, enabling lenders to assess current financial stability and affordability with greater accuracy. Integrating both sources improves approval rates by combining verified credit history with up-to-date financial information, reducing risk and enabling more personalized lending decisions.

Privacy and Security: Comparing Risk Factors

Credit reports contain detailed financial histories that may expose sensitive personal information if breached, raising concerns about data privacy and identity theft. Open banking data, shared with explicit user consent through secure APIs, offers more controlled access but potential vulnerabilities exist if third-party providers lack robust security measures. Both sources require stringent encryption and compliance with data protection regulations like GDPR to minimize risks during loan application assessments.

User Experience: Consent and Data Accessibility

Credit reports offer a standardized view of a borrower's credit history but often require lengthy consent processes and can delay loan approvals. Open Banking data provides real-time financial information with streamlined user consent flows, enhancing transparency and faster access to comprehensive data. This improves user experience by granting borrowers greater control over their data while enabling lenders to make more informed and timely decisions.

Lender Perspectives: Evaluating Borrower Reliability

Lenders analyze credit reports and open banking data to assess borrower reliability by examining credit history, payment behavior, and real-time financial transactions. Credit reports provide a comprehensive view of past credit performance, while open banking data offers granular insights into current cash flow and spending patterns. Combining both sources enhances risk assessment accuracy, enabling lenders to make more informed loan application decisions.

Regulatory Considerations: Compliance in Data Usage

Regulatory considerations in credit report and open banking data usage for loan applications demand strict adherence to data privacy laws such as GDPR and the Fair Credit Reporting Act (FCRA). Lenders must obtain explicit consent from applicants before accessing open banking data, ensuring transparency and compliance with financial regulations. Non-compliance risks include legal penalties and damage to institutional reputation, emphasizing the necessity for robust data governance frameworks.

Future Trends: Integration of Credit Reports and Open Banking Data

The future of loan applications lies in the seamless integration of credit reports and open banking data, enabling lenders to access a more comprehensive financial profile. Enhanced data analytics driven by this integration improve risk assessment accuracy and offer personalized loan terms. Leveraging both data sources supports real-time decision-making and fosters greater financial inclusion for underserved borrowers.

Related Important Terms

Alternative Credit Scoring

Alternative credit scoring leverages open banking data, including transaction history and real-time financial behavior, to enhance loan application assessments beyond traditional credit reports. This approach provides lenders with a more comprehensive view of creditworthiness, especially for individuals with limited credit history or non-traditional financial profiles.

Thin-File Borrowers

Credit reports traditionally provide historical credit behaviors but often lack sufficient data for thin-file borrowers, making loan approvals challenging. Open banking data offers richer, real-time financial insights by aggregating transaction history and income patterns, enhancing credit risk assessment accuracy for individuals with limited credit history.

Transactional Data Analysis

Transactional data analysis in credit reports provides historical borrowing and repayment patterns, highlighting creditworthiness through credit utilization and payment history metrics. In contrast, open banking data offers real-time insights into income, spending behavior, and cash flow, enabling more dynamic risk assessment for loan applications.

Cashflow-Based Lending

Credit reports provide historical credit behavior and risk assessments while open banking data offers real-time cash flow insights, enhancing the accuracy of cash flow-based lending decisions. Leveraging open banking data enables lenders to assess loan applicants' current financial health and repayment capacity more precisely than traditional credit reports alone.

Real-Time Income Verification

Real-time income verification through open banking data provides lenders with up-to-date and accurate financial information, improving loan approval speed and reducing reliance on outdated credit reports. Integrating open banking data enhances risk assessment by offering a comprehensive view of an applicant's current financial health.

Open Banking Consent

Open Banking consent allows lenders to access real-time financial data directly from applicants' bank accounts, providing a comprehensive and dynamic view of creditworthiness beyond traditional credit reports. This transparent data sharing improves loan application accuracy and speeds up decision-making by verifying income, spending patterns, and existing liabilities more precisely.

Bank Statement Scraping

Bank statement scraping through open banking data provides real-time financial insights, offering lenders a more dynamic and accurate view of an applicant's cash flow compared to traditional credit reports. This method enhances risk assessment by capturing up-to-date transaction details and spending behavior, improving loan approval precision and minimizing default rates.

Creditworthiness Algorithms

Creditworthiness algorithms leverage credit reports that provide detailed historical borrower data, including payment history, credit utilization, and outstanding debts, enabling predictive risk assessments for loan applications. Open banking data enriches these models by integrating real-time transactional information, income patterns, and spending behavior, thereby enhancing the accuracy and timeliness of creditworthiness evaluations.

Data Aggregator Platforms

Data aggregator platforms enhance loan applications by integrating credit reports and open banking data, offering lenders comprehensive insights into applicants' financial behaviors and payment histories. Utilizing both sources improves risk assessment accuracy, enabling tailored loan products and faster approval processes.

Behavioral Credit Analytics

Behavioral credit analytics leverage patterns in Open Banking data, such as transaction history and spending behavior, to provide a more dynamic and real-time assessment of creditworthiness than traditional credit reports. This approach enhances loan application accuracy by incorporating a granular view of financial behaviors, enabling lenders to better predict repayment capacity and reduce default risk.

Credit Report vs Open Banking Data for loan applications. Infographic

moneydiff.com

moneydiff.com