Manual underwriting relies on human expertise to evaluate loan applications, allowing for nuanced judgment in complex cases but often leading to slower decision-making and potential inconsistencies. AI-powered underwriting uses advanced algorithms and machine learning to analyze vast datasets rapidly, improving accuracy and efficiency while reducing bias in loan approvals. Integrating AI in underwriting streamlines workflows and enhances risk assessment, ultimately driving faster and more precise credit decisions.

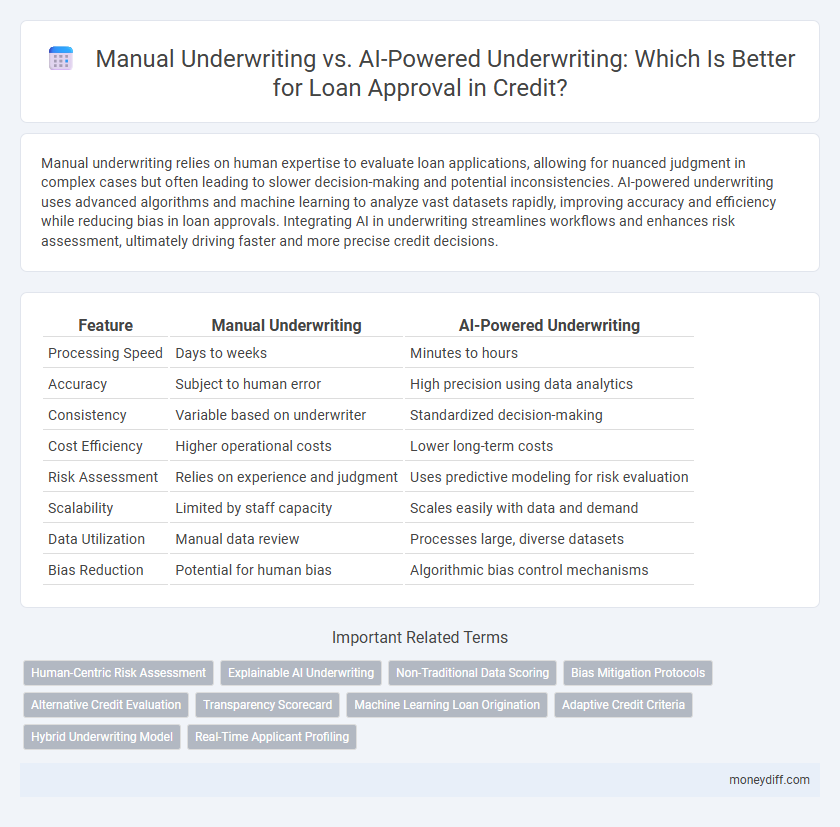

Table of Comparison

| Feature | Manual Underwriting | AI-Powered Underwriting |

|---|---|---|

| Processing Speed | Days to weeks | Minutes to hours |

| Accuracy | Subject to human error | High precision using data analytics |

| Consistency | Variable based on underwriter | Standardized decision-making |

| Cost Efficiency | Higher operational costs | Lower long-term costs |

| Risk Assessment | Relies on experience and judgment | Uses predictive modeling for risk evaluation |

| Scalability | Limited by staff capacity | Scales easily with data and demand |

| Data Utilization | Manual data review | Processes large, diverse datasets |

| Bias Reduction | Potential for human bias | Algorithmic bias control mechanisms |

Introduction to Manual vs AI-Powered Loan Underwriting

Manual underwriting involves human analysts reviewing loan applications based on credit history, income, and financial documents to assess risk, ensuring personalized decision-making but often requiring more time. AI-powered underwriting uses machine learning algorithms to analyze vast datasets, enabling faster, data-driven loan approvals with enhanced accuracy and consistency. This technology reduces human bias while improving efficiency in evaluating borrower creditworthiness.

Key Differences: Manual Underwriting and AI-Powered Underwriting

Manual underwriting involves human analysts reviewing credit applications, focusing on qualitative factors and individual financial circumstances to assess risk, often leading to longer decision times. AI-powered underwriting leverages machine learning algorithms and vast datasets to rapidly analyze credit histories, income, and behavioral patterns, providing faster and potentially more accurate loan approvals. Key differences lie in processing speed, scalability, and reliance on data-driven models versus human judgment and experience.

How Manual Underwriting Works in Credit Evaluation

Manual underwriting in credit evaluation involves a thorough review of a borrower's financial documents, such as credit reports, income statements, and employment history, by expert underwriters to assess creditworthiness. This process emphasizes human judgment to interpret nuanced information, identify potential risks, and accommodate unique financial situations that automated systems might overlook. The detailed analysis ensures personalized decision-making, often crucial for applicants with complex or non-traditional credit profiles.

The Rise of AI-Powered Underwriting in Modern Lending

AI-powered underwriting significantly reduces loan approval times by analyzing vast datasets with advanced machine learning algorithms, enhancing accuracy and minimizing human bias. Financial institutions leverage AI to assess creditworthiness through alternative data sources such as transaction histories, social behavior, and real-time financial activities. This technological advancement improves risk management, boosts approval rates for underserved borrowers, and streamlines the credit evaluation process compared to traditional manual underwriting methods.

Pros and Cons of Manual Underwriting

Manual underwriting allows lenders to evaluate loan applications with personalized judgment and detailed consideration of unique financial circumstances, which can improve approval accuracy for complex cases. However, it is time-consuming, prone to human error, and less scalable compared to AI-powered underwriting systems. This method often results in slower loan processing and higher operational costs, limiting efficiency in high-volume environments.

Advantages and Limitations of AI-Powered Underwriting

AI-powered underwriting accelerates loan approval by analyzing vast datasets with high accuracy, reducing human error and bias. It enhances risk assessment through machine learning models that adapt to new financial behaviors, but may struggle with transparency and regulatory compliance due to complex algorithms. Despite its efficiency, AI underwriting requires substantial data quality and continuous monitoring to prevent discrimination and ensure fair lending practices.

Impact on Loan Approval Speed and Accuracy

AI-powered underwriting significantly accelerates loan approval speed by automating data analysis and risk assessment, reducing processing time from days to minutes. Manual underwriting relies on human judgment, which, while nuanced, often results in slower decisions and increased potential for human error. The integration of AI enhances accuracy by leveraging predictive algorithms and vast data sets, increasing the approval precision compared to traditional manual methods.

Risk Assessment: Human Expertise vs Machine Learning

Manual underwriting relies on human expertise to evaluate credit risk by analyzing qualitative factors such as borrower character and financial nuances, allowing for personalized judgment. AI-powered underwriting employs machine learning algorithms to process vast datasets, identifying patterns and predictive risk factors with high accuracy and speed. While human judgment offers contextual insights, AI provides scalable, data-driven risk assessment that reduces bias and enhances consistency in loan approval decisions.

Borrower Experience: Traditional vs Automated Processes

Manual underwriting involves a detailed, personalized review of each loan application by a human underwriter, often leading to longer processing times and potential delays for borrowers. AI-powered underwriting leverages machine learning algorithms to rapidly analyze vast datasets, delivering faster loan decisions and improving the overall borrower experience with reduced waiting periods. Automated processes also minimize human error and bias, fostering a more consistent and transparent loan approval journey.

The Future of Loan Approval: Hybrid Approaches and Trends

Hybrid loan approval systems combine manual underwriting expertise with AI-powered analytics to enhance credit risk assessment accuracy and efficiency. Leveraging machine learning models alongside human judgment facilitates personalized credit decisions while mitigating biases inherent in automated systems. Emerging trends indicate increasing adoption of such integrative approaches, driven by regulatory compliance requirements and the demand for faster, more transparent loan processing.

Related Important Terms

Human-Centric Risk Assessment

Manual underwriting leverages human expertise to evaluate creditworthiness by considering nuanced financial behaviors and unique borrower circumstances often overlooked by automated systems. This human-centric risk assessment enhances accuracy in loan approval decisions by integrating qualitative insights with quantitative data, reducing biases inherent in AI-powered underwriting.

Explainable AI Underwriting

Explainable AI underwriting leverages transparent algorithms that provide clear reasoning behind credit decisions, enhancing trust and regulatory compliance compared to traditional manual underwriting. This approach improves accuracy in loan approval by combining AI efficiency with interpretable insights, enabling lenders to make informed, fair credit evaluations.

Non-Traditional Data Scoring

Manual underwriting relies heavily on traditional credit reports and personal interviews, which can overlook non-traditional data such as utility payments and rental history. AI-powered underwriting leverages advanced algorithms to analyze diverse non-traditional data sources, improving loan approval accuracy and expanding credit access for underserved applicants.

Bias Mitigation Protocols

Manual underwriting relies heavily on human judgment, which can introduce unconscious biases affecting loan approval consistency, while AI-powered underwriting employs bias mitigation protocols such as algorithmic fairness techniques and transparent data training to reduce discriminatory outcomes. Integrating AI systems with continuous bias audits and diverse data sets enhances equitable credit decisions and compliance with regulatory standards.

Alternative Credit Evaluation

Manual underwriting relies on human judgment to assess creditworthiness, incorporating alternative credit data like utility payments and rental history for a holistic view. AI-powered underwriting leverages machine learning algorithms to analyze vast alternative credit datasets quickly, improving loan approval accuracy and reducing bias in credit evaluations.

Transparency Scorecard

Manual underwriting offers detailed transparency scorecards that clearly outline each decision factor, facilitating borrower understanding and trust. AI-powered underwriting enhances accuracy and speed but often lacks the explicit transparency scorecard, making it harder to interpret individual credit assessments.

Machine Learning Loan Origination

Machine learning loan origination leverages advanced algorithms to analyze vast datasets, improving accuracy and efficiency in risk assessment compared to manual underwriting, which relies heavily on human judgment and static criteria. This AI-powered approach enhances predictive modeling for loan approval, reducing default rates and accelerating decision-making processes in credit evaluation.

Adaptive Credit Criteria

Adaptive credit criteria in manual underwriting rely on human expertise to interpret complex financial situations, allowing personalized judgment for nuanced borrower profiles. AI-powered underwriting uses machine learning algorithms to continuously analyze vast datasets, dynamically adjusting credit criteria for faster, more accurate loan approval decisions.

Hybrid Underwriting Model

The Hybrid Underwriting Model combines Manual Underwriting's human judgment with AI-Powered Underwriting's data-driven precision to optimize loan approval accuracy and efficiency. By integrating predictive analytics and expert review, this approach reduces default risk while ensuring personalized credit assessments.

Real-Time Applicant Profiling

Manual underwriting relies on human judgment to assess loan applications, often resulting in slower decision-making and potential bias, while AI-powered underwriting uses real-time applicant profiling by analyzing vast datasets instantly to improve accuracy and speed. This technology leverages machine learning algorithms to evaluate creditworthiness dynamically, reducing default risk and enhancing the overall efficiency of loan approval processes.

Manual Underwriting vs AI-Powered Underwriting for loan approval. Infographic

moneydiff.com

moneydiff.com