A Credit Freeze restricts access to your credit report, preventing new creditors from viewing it and thus reducing the risk of identity theft, but it requires manual lifting each time you apply for credit. A Virtual Credit Lock offers similar protection with more convenience, allowing instant control over your credit report access through an app or online platform. Both methods enhance identity protection, but a virtual lock provides greater flexibility and ease of use without compromising security.

Table of Comparison

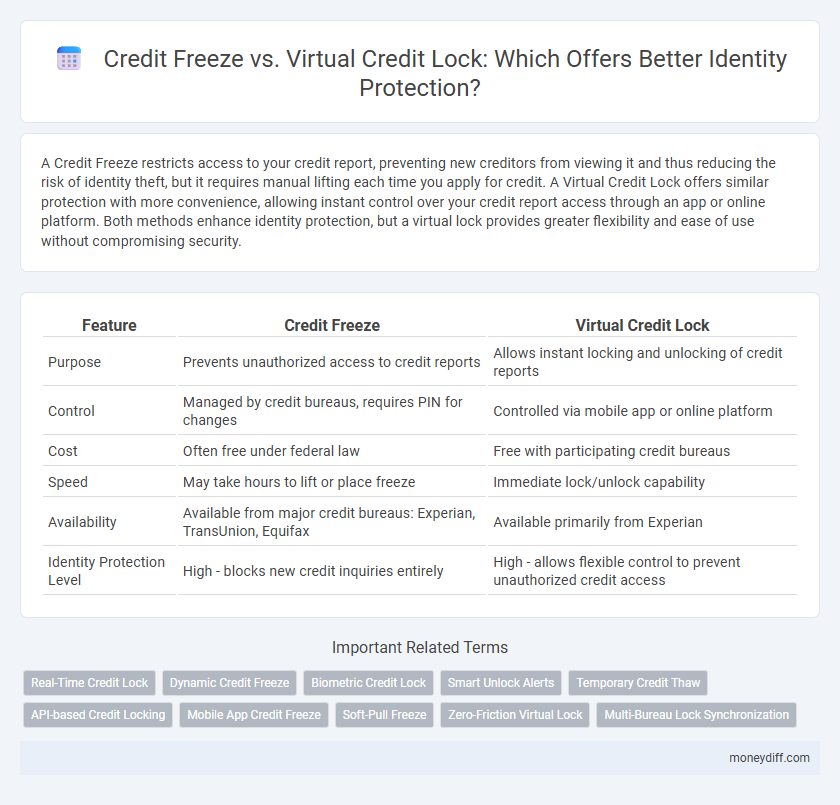

| Feature | Credit Freeze | Virtual Credit Lock |

|---|---|---|

| Purpose | Prevents unauthorized access to credit reports | Allows instant locking and unlocking of credit reports |

| Control | Managed by credit bureaus, requires PIN for changes | Controlled via mobile app or online platform |

| Cost | Often free under federal law | Free with participating credit bureaus |

| Speed | May take hours to lift or place freeze | Immediate lock/unlock capability |

| Availability | Available from major credit bureaus: Experian, TransUnion, Equifax | Available primarily from Experian |

| Identity Protection Level | High - blocks new credit inquiries entirely | High - allows flexible control to prevent unauthorized credit access |

Understanding Credit Freeze and Virtual Credit Lock

A Credit Freeze restricts access to your credit report by lenders, preventing new credit accounts from being opened without your authorization, which is effective in halting identity theft but requires manual lifting for each credit bureau. A Virtual Credit Lock offers a more flexible solution, allowing instant toggling of credit access through online platforms, providing real-time control over who can view your credit report. Both tools enhance identity protection by limiting unauthorized credit inquiries, but Virtual Credit Locks are often favored for convenience and speed in managing credit security.

Key Differences Between Credit Freeze and Virtual Credit Lock

A credit freeze restricts access to your credit report by requiring a PIN or password to lift the freeze, providing strong security but potentially causing delays when applying for credit. Virtual credit locks offer more flexibility, allowing instant locking and unlocking via mobile apps without a PIN, often integrated with credit monitoring services. The key difference lies in control and convenience, where freezes are regulated by law with uniform procedures, while virtual locks depend on service provider platforms with varied features.

How Credit Freezes Protect Your Identity

Credit freezes protect your identity by restricting access to your credit reports, preventing unauthorized lenders from opening new accounts in your name. Unlike virtual credit locks that may require app access and subscriptions, credit freezes are free, legally mandated, and remain in effect until you choose to lift them. This robust barrier significantly reduces the risk of identity theft and fraudulent credit activities by making your credit information inaccessible to potential fraudsters.

Virtual Credit Lock: Modern Solution for Identity Protection

Virtual Credit Lock offers a modern solution for identity protection by instantly restricting access to your credit reports through digital platforms. Unlike traditional credit freezes, virtual locks provide quick toggling capabilities, allowing consumers to grant or block access seamlessly without waiting days for processing. This innovation enhances security and convenience, reducing the risk of identity theft while maintaining control over credit information in real-time.

Activation Process: Credit Freeze vs Virtual Credit Lock

The activation process for a credit freeze typically requires contacting each of the three major credit bureaus--Equifax, Experian, and TransUnion--individually by phone, online, or mail to request the freeze, often involving the creation of a PIN or password for future access. Virtual credit locks offer a streamlined activation via mobile apps or online platforms, enabling instant toggling of credit access without the need for a PIN, providing more user-friendly control. While credit freezes are regulated by federal law under the Economic Growth, Regulatory Relief, and Consumer Protection Act, virtual credit locks depend on the credit bureau's proprietary technology and may offer faster activation and deactivation but lack standardized legal protections.

Pros and Cons of Credit Freeze

A credit freeze offers robust protection by preventing creditors from accessing your credit report, effectively stopping unauthorized account openings and reducing identity theft risks. However, it may cause delays when applying for new credit or services, as you must manually lift the freeze with each creditor. Unlike virtual credit locks that offer more convenience through instant toggling, credit freezes provide a legally guaranteed security layer but can be less flexible and slower to manage.

Pros and Cons of Virtual Credit Lock

Virtual credit locks provide immediate control over credit reporting agencies, allowing consumers to restrict access to their credit files instantly, which lowers the risk of identity theft. Unlike credit freezes, virtual locks can be toggled on and off quickly through mobile apps or websites, offering greater convenience and flexibility without fees in many cases. However, virtual locks may have limitations in universal acceptance among all creditors and potentially less robust security compared to traditional credit freezes mandated by law.

Cost Comparison: Credit Freeze vs Virtual Credit Lock

A Credit Freeze typically incurs a one-time fee ranging from $5 to $10 per bureau, whereas Virtual Credit Locks are usually offered free of charge by most major credit bureaus. Both options effectively restrict unauthorized access to your credit report, but Virtual Credit Locks provide more flexibility with immediate locking and unlocking via mobile apps at no extra cost. Choosing between these two depends largely on the balance between upfront fees and convenience in managing identity protection.

Choosing the Right Option for Your Credit Security

A credit freeze fully restricts access to your credit report, preventing new accounts from being opened without your authorization, while a virtual credit lock offers easier, real-time control through mobile apps or websites with instant locking and unlocking capabilities. For consumers seeking maximum security against identity theft, a credit freeze is often the more robust choice, though it may involve contacting each credit bureau separately. If convenience and quick management are priorities, especially for those who frequently apply for credit or need temporary control, a virtual credit lock provides flexibility without compromising essential protection.

Frequently Asked Questions on Credit Freeze and Virtual Credit Lock

A credit freeze restricts access to your credit reports, preventing new creditors from viewing your credit file without your permission, which helps block unauthorized credit applications. Virtual credit locks offer similar protection but provide more flexibility, allowing instant locking and unlocking of your credit reports via mobile apps or online portals. Both tools are essential for identity protection; however, credit freezes are regulated by federal law and usually free, while virtual credit locks may be controlled by credit bureaus with varying fees and features.

Related Important Terms

Real-Time Credit Lock

Real-time credit lock offers instant control over credit file access, providing immediate protection against identity theft by allowing users to lock and unlock their credit profile on demand. Unlike traditional credit freezes that may require processing time and formal requests to lift restrictions, real-time locks enable seamless, on-the-spot management of credit inquiries to prevent unauthorized activity.

Dynamic Credit Freeze

Dynamic Credit Freeze offers real-time control over credit access, instantly blocking unauthorized inquiries to prevent identity theft more effectively than traditional Credit Freeze methods. Unlike static freezes, this innovative solution adapts to changing risk factors, providing enhanced security and seamless credit management without prolonged account locks.

Biometric Credit Lock

Biometric Credit Lock enhances identity protection by using fingerprint or facial recognition to instantly secure your credit file, offering a faster and more convenient alternative to traditional credit freezes that require phone or online requests to lift or place holds. This technology reduces the risk of fraud by ensuring only the authorized user can lock or unlock access, providing a robust defense against unauthorized credit checks or identity theft.

Smart Unlock Alerts

A Credit Freeze completely restricts access to your credit report, preventing new credit inquiries until you manually lift the freeze, offering robust identity protection but requiring proactive management. Virtual Credit Lock features Smart Unlock Alerts that notify you instantly of any credit activity, enabling real-time monitoring and faster responses to potential fraud without the need for manual freeze and unfreeze processes.

Temporary Credit Thaw

A temporary credit thaw enables consumers to selectively unlock their credit reports for specific lenders or time periods, enhancing control over identity protection without fully exposing their financial data. Unlike a virtual credit lock, which may require continuous app-based management, a credit thaw offers a fixed-duration access, reducing the risk of unauthorized inquiries during crucial transactions.

API-based Credit Locking

API-based credit locking offers real-time control over credit file access, enabling consumers to instantly freeze or unfreeze their credit reports through integrated financial platforms. Unlike traditional credit freezes that may require manual steps with each credit bureau, virtual credit locks provide seamless, programmable security layers, enhancing identity protection by minimizing delays and maximizing user control.

Mobile App Credit Freeze

Mobile app credit freeze allows instant, secure blocking of your credit report to prevent unauthorized access, making identity theft protection more efficient and user-friendly compared to traditional credit freeze methods. Virtual credit locks offer similar protection but may lack the immediacy and seamless mobile management provided by dedicated credit freeze apps linked to major credit bureaus.

Soft-Pull Freeze

Soft-Pull Freeze allows consumers to restrict access to their credit reports without impacting their credit scores, enabling identity protection with minimal disruption to credit checks. Unlike traditional credit freezes, Soft-Pull Freeze offers a more flexible security measure by permitting certain soft inquiries while preventing unauthorized hard pulls that could lead to fraud.

Zero-Friction Virtual Lock

A Zero-Friction Virtual Credit Lock offers immediate, on-demand control over credit report access without the delays or paperwork associated with traditional credit freezes, enhancing identity protection by allowing users to lock and unlock their credit with a simple digital action. Unlike credit freezes that require contacting each credit bureau separately, virtual locks provide seamless integration and real-time security management, making them a superior choice for proactive fraud prevention.

Multi-Bureau Lock Synchronization

Multi-bureau lock synchronization ensures simultaneous credit freeze or virtual credit lock across Experian, TransUnion, and Equifax, preventing unauthorized access to credit reports. This unified approach enhances identity protection by reducing the risk of gaps that could be exploited by identity thieves when locks are managed separately.

Credit Freeze vs Virtual Credit Lock for identity protection. Infographic

moneydiff.com

moneydiff.com