A credit line offers borrowers a pre-approved maximum amount they can draw upon as needed, providing ongoing access to funds with flexible repayment options. Flex credit combines the benefits of a credit line with tailored repayment terms, allowing more personalized borrowing and repayment strategies. Choosing between credit line and flex credit depends on individual financial needs and the desire for either straightforward access or customizable flexibility in borrowing.

Table of Comparison

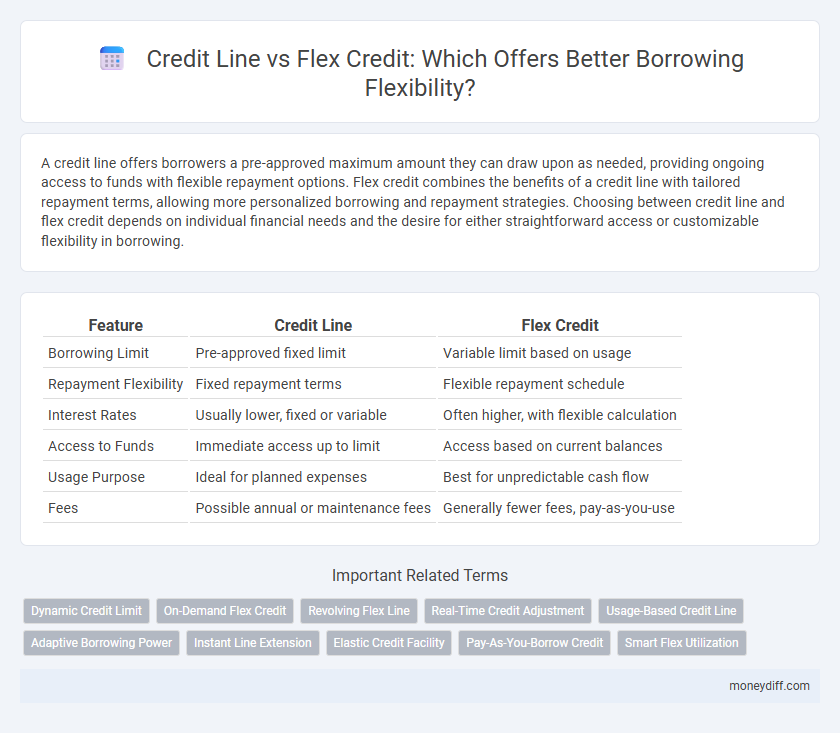

| Feature | Credit Line | Flex Credit |

|---|---|---|

| Borrowing Limit | Pre-approved fixed limit | Variable limit based on usage |

| Repayment Flexibility | Fixed repayment terms | Flexible repayment schedule |

| Interest Rates | Usually lower, fixed or variable | Often higher, with flexible calculation |

| Access to Funds | Immediate access up to limit | Access based on current balances |

| Usage Purpose | Ideal for planned expenses | Best for unpredictable cash flow |

| Fees | Possible annual or maintenance fees | Generally fewer fees, pay-as-you-use |

Understanding Credit Lines: Key Features

Credit lines offer a set borrowing limit that can be accessed repeatedly, with interest charged only on the amount used, providing continuous flexibility for managing expenses. Flex credit, often characterized by adjustable borrowing options and payment terms, allows borrowers to tailor repayment schedules based on cash flow fluctuations. Understanding these features helps individuals and businesses select the most suitable borrowing solution for efficient financial planning and cost management.

What Is Flex Credit? Core Characteristics

Flex Credit is a borrowing facility that allows users to withdraw funds up to a pre-approved limit with flexible repayment terms, enabling better cash flow management. Unlike traditional credit lines, Flex Credit typically offers variable interest rates and tailored repayment schedules, making it suitable for borrowers seeking customizable credit solutions. Key features include quick access to funds, minimal paperwork, and the ability to repay principal and interest at the borrower's convenience.

Credit Line vs Flex Credit: Quick Comparison Table

A credit line offers a pre-approved borrowing limit with variable interest rates, enabling flexible withdrawals as needed, while flex credit provides short-term, fixed borrowing options with typically lower interest rates and structured repayment terms. Credit lines suit ongoing cash flow management, whereas flex credit fits specific, planned expenses requiring upfront financing. Comparing key features such as interest rates, repayment flexibility, and usage terms helps borrowers choose between continuous access credit lines and fixed-duration flex credit products.

Borrowing Limits: Fixed vs Flexible Options

Credit lines offer fixed borrowing limits set by the lender, providing predictable access to funds within a defined amount. Flex credit provides flexible borrowing limits that can adjust based on the borrower's creditworthiness and repayment behavior. This adaptability allows for dynamic access to funds, catering to fluctuating financial needs and improving cash flow management.

Interest Rates and Fee Structures Compared

Credit lines typically offer variable interest rates based on prime rates and flexible repayment options with minimal upfront fees, making them cost-effective for ongoing borrowing needs. Flex credit often involves fixed interest rates, which provide predictability in repayment amounts but usually come with higher origination fees and stricter borrowing limits. Comparing fee structures, credit lines favor lower maintenance fees while flex credit may impose penalty fees for early repayment, affecting overall borrowing flexibility.

Application and Approval Processes

Credit lines typically involve a straightforward application with a focus on creditworthiness, allowing quick access to funds up to a predetermined limit once approved. Flex credit requires a more detailed approval process, often assessing income stability and repayment capacity to offer variable borrowing amounts and flexible repayment terms. Both options emphasize credit score and financial history but differ in the complexity and speed of approval based on the lender's criteria.

Repayment Terms: Credit Line vs Flex Credit

Credit lines typically offer revolving repayment terms, allowing borrowers to repay and redraw funds up to the credit limit repeatedly, providing ongoing access to credit. Flex credit often features fixed repayment schedules with predetermined installments, promoting disciplined debt management but with less borrowing flexibility. Understanding the differences in repayment structures is crucial for selecting the credit option that aligns with cash flow patterns and financial goals.

Borrower Profiles: Who Benefits Most?

Borrowers with fluctuating income or irregular cash flow benefit most from flexible credit options like flex credit, as it offers adaptable repayment terms and variable borrowing limits tailored to their financial needs. Credit lines suit individuals or businesses seeking predictable, ongoing access to funds, providing a consistent borrowing limit with fixed or variable interest rates ideal for planned expenses. Understanding income stability, spending habits, and repayment capacity is crucial in selecting between credit lines and flex credit to maximize borrowing efficiency and financial management.

Risks and Drawbacks of Each Option

Credit lines offer flexible borrowing but carry risks such as fluctuating interest rates and the possibility of overspending, which can lead to increased debt and financial strain. Flex credit provides convenience with preset limits and fixed repayment terms but may involve higher fees or penalties for early repayment, limiting borrower flexibility. Both options require careful management to avoid negative credit impacts, including potential damage to credit scores from missed payments or excessive usage.

Choosing the Right Credit Solution for You

A credit line offers a revolving borrowing limit that allows repeated withdrawals and repayments, ideal for ongoing expenses, while flex credit provides a fixed credit amount with more predictable repayment terms suitable for short-term needs. Evaluating your spending habits and repayment capacity helps determine whether the adaptable credit line or the structured flex credit best aligns with your financial goals. Prioritizing factors such as interest rates, usage flexibility, and repayment timelines ensures you select the optimal credit solution tailored to your borrowing needs.

Related Important Terms

Dynamic Credit Limit

A dynamic credit limit in Credit Line offers borrowers flexible access to funds with adjustable borrowing capacity based on creditworthiness and repayment behavior. Flex credit provides preset, revolving credit but lacks the adaptive limit adjustments that optimize borrowing potential over time.

On-Demand Flex Credit

On-Demand Flex Credit offers borrowing flexibility by allowing users to draw funds instantly up to a preset limit without reapplying, unlike traditional Credit Lines that may require approval processes for each draw. This dynamic feature enables seamless cash flow management, catering to urgent financial needs with minimal processing time.

Revolving Flex Line

A Revolving Flex Line offers greater borrowing flexibility compared to traditional credit lines by allowing borrowers to repeatedly draw and repay funds up to a specified limit without reapplying. This dynamic structure improves cash flow management and reduces interest costs since interest accrues only on the utilized portion of the credit.

Real-Time Credit Adjustment

Credit lines provide real-time credit adjustment allowing borrowers immediate access to funds up to a pre-approved limit, ensuring flexible borrowing without repeated requalification. Flex credit offers dynamic borrowing capacity with adjustable terms based on spending behavior and creditworthiness, optimizing repayment options in real time.

Usage-Based Credit Line

Usage-Based Credit Lines offer dynamic borrowing flexibility by adjusting credit limits based on real-time spending patterns and repayment behavior, enabling tailored access to funds. Unlike traditional Flex Credit, which provides a fixed revolving limit, Usage-Based Credit Lines optimize liquidity management by aligning credit availability with actual financial needs and usage frequency.

Adaptive Borrowing Power

Adaptive borrowing power through a credit line offers continuous access to funds up to a preset limit, enabling flexible repayment and multiple withdrawals without reapplication. Flex credit, however, provides a fixed loan amount with structured repayments, limiting adaptability but ensuring predictable budgeting and interest costs.

Instant Line Extension

A Credit Line offers a preset borrowing limit with flexible repayment options, while Flex Credit provides adjustable limits based on real-time creditworthiness and spending patterns. Instant Line Extension enhances borrowing flexibility by allowing immediate access to additional funds without lengthy approval processes, optimizing liquidity management.

Elastic Credit Facility

Elastic Credit Facility offers enhanced borrowing flexibility by dynamically adjusting credit limits based on real-time borrower needs, unlike traditional credit lines that have fixed limits. This adaptive approach reduces the risk of over-borrowing while providing quick access to funds, optimizing financial agility for consumers and businesses.

Pay-As-You-Borrow Credit

Pay-As-You-Borrow credit offers enhanced flexibility by allowing borrowers to access funds on demand without pre-committing to a fixed credit line amount, reducing interest costs as interest accrues only on the borrowed sum. Unlike traditional credit lines with preset limits and recurring fees, Flex credit solutions leverage real-time borrowing tailored to cash flow needs, optimizing cost efficiency and credit utilization.

Smart Flex Utilization

Smart Flex Utilization enhances borrowing flexibility by allowing seamless shifts between a fixed credit line and flex credit, optimizing access to funds based on real-time financial needs and spending patterns. This dynamic approach minimizes interest costs and maximizes credit availability, supporting smarter debt management and improved cash flow control.

Credit line vs Flex credit for borrowing flexibility. Infographic

moneydiff.com

moneydiff.com