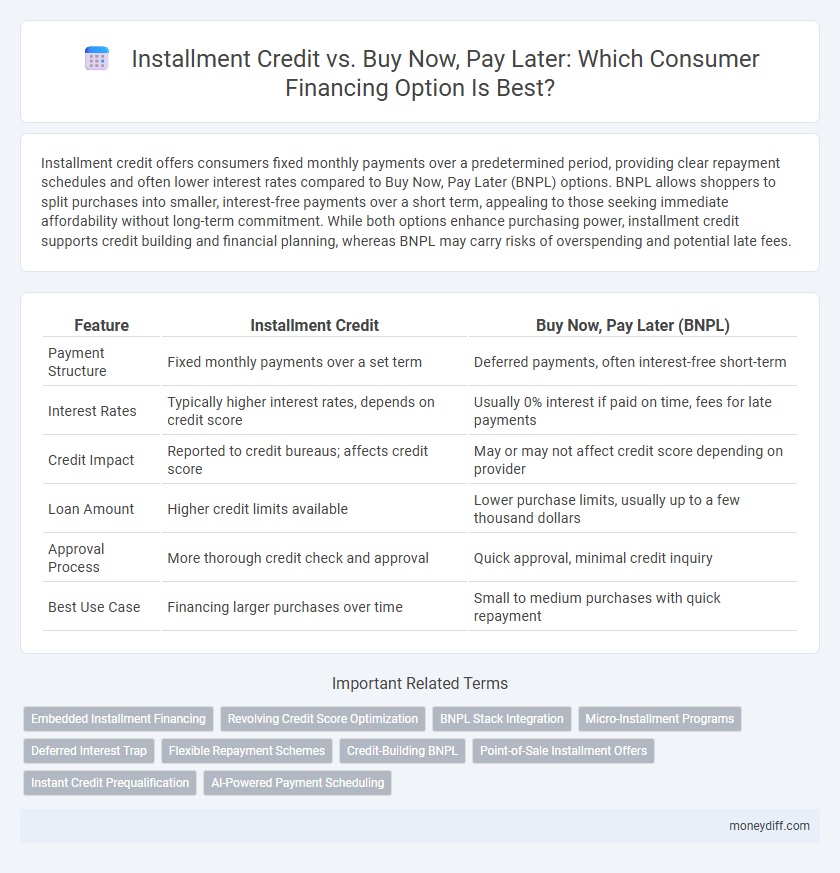

Installment credit offers consumers fixed monthly payments over a predetermined period, providing clear repayment schedules and often lower interest rates compared to Buy Now, Pay Later (BNPL) options. BNPL allows shoppers to split purchases into smaller, interest-free payments over a short term, appealing to those seeking immediate affordability without long-term commitment. While both options enhance purchasing power, installment credit supports credit building and financial planning, whereas BNPL may carry risks of overspending and potential late fees.

Table of Comparison

| Feature | Installment Credit | Buy Now, Pay Later (BNPL) |

|---|---|---|

| Payment Structure | Fixed monthly payments over a set term | Deferred payments, often interest-free short-term |

| Interest Rates | Typically higher interest rates, depends on credit score | Usually 0% interest if paid on time, fees for late payments |

| Credit Impact | Reported to credit bureaus; affects credit score | May or may not affect credit score depending on provider |

| Loan Amount | Higher credit limits available | Lower purchase limits, usually up to a few thousand dollars |

| Approval Process | More thorough credit check and approval | Quick approval, minimal credit inquiry |

| Best Use Case | Financing larger purchases over time | Small to medium purchases with quick repayment |

Understanding Installment Credit: Key Features

Installment credit allows consumers to borrow a fixed amount and repay it through scheduled payments over time, typically with interest, providing predictable monthly budgeting. This structured repayment differs from Buy Now, Pay Later (BNPL) plans, which often offer short-term, interest-free periods but may include fees or penalties for missed payments. Understanding installment credit's fixed terms, interest rates, and impact on credit scores is essential for making informed consumer financing decisions.

What Is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a consumer financing option that allows shoppers to purchase goods immediately and spread payments over a defined period without interest, often through digital platforms. Unlike traditional installment credit, BNPL typically involves shorter repayment schedules, no credit checks, and minimal fees, making it a popular choice for online purchases. This payment method improves affordability and budgeting flexibility while potentially impacting credit scores if payments are missed.

How Approval Processes Differ

Installment credit typically involves a thorough approval process that assesses credit scores, income stability, and debt-to-income ratios to determine eligibility and set loan terms. Buy Now, Pay Later (BNPL) options often offer faster approval with minimal credit checks, relying on real-time assessments of purchase data and payment history instead. This difference in approval rigor impacts consumer access, where BNPL provides quicker financing for smaller amounts while installment credit supports larger purchases with more comprehensive underwriting.

Credit Score Impact: Installment vs BNPL

Installment credit typically has a more significant positive impact on credit scores because payments are reported to credit bureaus, demonstrating consistent repayment behavior over time. Buy Now, Pay Later (BNPL) services often do not report to credit bureaus unless payments default, which means timely BNPL payments may not improve credit scores but missed payments can harm them. Consumers seeking to build or improve credit should prioritize installment credit for its potential to enhance credit history and score through regular, reported payments.

Interest Rates and Fees Comparison

Installment credit typically involves fixed interest rates and structured monthly payments over a set term, providing consumers predictable costs and total repayment amounts. Buy Now, Pay Later (BNPL) options often offer zero-interest periods but may charge late fees or higher rates after the promotional window, potentially increasing overall expenses. Comparing both, installment credit generally ensures transparent fees and consistent interest, while BNPL can be cost-effective short-term but riskier if payments are missed.

Repayment Flexibility and Terms

Installment credit offers structured repayment plans with fixed monthly payments over a set period, providing predictable budgeting for consumers. Buy Now, Pay Later services often feature shorter repayment terms with either interest-free periods or deferred payments, enhancing short-term flexibility but potentially increasing costs if not paid on time. Consumers seeking long-term repayment stability typically prefer installment credit, while those prioritizing immediate purchasing power may opt for Buy Now, Pay Later options.

Consumer Protections and Risks

Installment credit offers structured repayment plans with fixed interest rates and clear consumer protections regulated by federal laws like the Truth in Lending Act, providing transparency and dispute resolution. Buy Now, Pay Later (BNPL) services often lack comprehensive regulations, increasing risks such as unexpected fees, limited credit reporting, and potential negative impacts on credit scores. Consumers should evaluate the terms, fees, and protections of each option to avoid financial pitfalls and ensure responsible borrowing.

Effects on Spending Behavior

Installment credit encourages disciplined spending by dividing purchases into fixed monthly payments with interest, promoting budget management and long-term financial planning. Buy Now, Pay Later (BNPL) often leads to increased impulsive buying due to its short-term, interest-free payment models, which can obscure the true cost of purchases. Consumers using BNPL may accumulate multiple debts quickly, potentially resulting in higher default rates and financial strain compared to installment credit users.

Suitability for Different Purchases

Installment credit suits higher-value purchases such as electronics or furniture due to fixed monthly payments over an extended period, providing predictable budgeting. Buy Now, Pay Later (BNPL) works best for smaller, short-term expenses like clothing or accessories, offering interest-free periods that encourage quicker repayment. Assessing purchase size and repayment timeframe ensures optimal financing choice for consumer needs.

Choosing the Best Option for Your Financial Health

Installment credit typically involves fixed monthly payments over a set period, making it easier to budget and manage debt responsibly, whereas Buy Now, Pay Later offers short-term, interest-free repayment but may lead to impulsive spending and hidden fees if not carefully monitored. Evaluating your repayment capacity and spending habits helps ensure you select a financing method that aligns with your financial goals and avoids negative credit impacts. Prioritizing transparent terms and consistent payment schedules supports maintaining a healthy credit score and overall financial stability.

Related Important Terms

Embedded Installment Financing

Embedded installment financing integrates seamless repayment plans directly at the point of sale, enhancing consumer flexibility compared to traditional Buy Now, Pay Later models that often operate as separate payment options. This embedded approach improves credit options by providing structured installment schedules with transparent terms, reducing financial friction and promoting responsible borrowing.

Revolving Credit Score Optimization

Installment credit and Buy Now, Pay Later solutions impact revolving credit scores differently, with installment plans often providing consistent payment history that boosts credit utilization metrics. Managing Buy Now, Pay Later effectively requires careful monitoring of repayment timelines to avoid missed payments that can negatively affect revolving credit score optimization.

BNPL Stack Integration

Buy Now, Pay Later (BNPL) stack integration streamlines consumer financing by enabling seamless, real-time credit approval and payment decomposition within e-commerce platforms. Unlike traditional installment credit, BNPL offers flexible, interest-free short-term repayment options that drive higher conversion rates and increased average order values.

Micro-Installment Programs

Micro-installment programs offer consumers flexible repayment options with low monthly payments over an extended period, making them a cost-effective alternative to Buy Now, Pay Later (BNPL) services that often emphasize short-term deferrals without interest. These programs typically involve smaller loan amounts with fixed interest rates and structured payment schedules, enhancing credit building opportunities while reducing the risk of impulsive overspending common in BNPL transactions.

Deferred Interest Trap

Installment credit offers fixed monthly payments with clear interest terms, reducing the risk of the deferred interest trap common in Buy Now, Pay Later (BNPL) plans where accrued interest can be charged retroactively if full payment is not made on time. Consumers should carefully evaluate BNPL agreements to avoid unexpected high-interest charges that undermine the benefits of deferred payments.

Flexible Repayment Schemes

Installment credit offers structured, fixed payments over a set period, allowing consumers to budget with predictable monthly amounts. Buy Now, Pay Later provides flexible repayment schedules, often interest-free short-term plans that empower consumers to manage payments without immediate financial strain.

Credit-Building BNPL

Installment credit offers structured repayment plans that can positively impact credit scores when payments are reported to credit bureaus, whereas traditional Buy Now, Pay Later (BNPL) plans often lack credit reporting, limiting their role in credit building. Emerging credit-building BNPL options now provide consumers with both flexible payment terms and opportunities to improve credit profiles through consistent, reported on-time payments.

Point-of-Sale Installment Offers

Point-of-sale installment offers enable consumers to split purchases into fixed payments over time, often with low or zero interest, enhancing affordability and budgeting ease compared to traditional credit cards. Buy Now, Pay Later services typically provide shorter repayment windows and simpler approval processes but may lack flexibility and higher credit limits available through installment credit plans.

Instant Credit Prequalification

Instant credit prequalification enhances consumer financing by quickly assessing eligibility for installment credit or buy now, pay later options without impacting credit scores. This streamlined process allows consumers to compare financing terms efficiently, promoting informed purchasing decisions and improved cash flow management.

AI-Powered Payment Scheduling

AI-powered payment scheduling in installment credit systems optimizes repayment plans by analyzing consumer behavior and financial data to customize monthly payments, reducing default rates. Buy Now, Pay Later services leverage AI algorithms to assess real-time credit risk and dynamically adjust payment schedules, enhancing flexibility and improving user experience in consumer financing.

Installment Credit vs Buy Now, Pay Later for consumer financing. Infographic

moneydiff.com

moneydiff.com