Store credit offers customers flexibility by allowing direct use towards future purchases, typically without restrictions, whereas loyalty points often require accumulation and redemption under specific conditions, limiting immediate spending options. While store credit provides a tangible value equivalent to cash, loyalty points function as an incentive mechanism designed to encourage repeat purchases through rewards and exclusive benefits. Understanding the difference between these two spending tools helps consumers maximize their savings and merchants effectively boost customer retention.

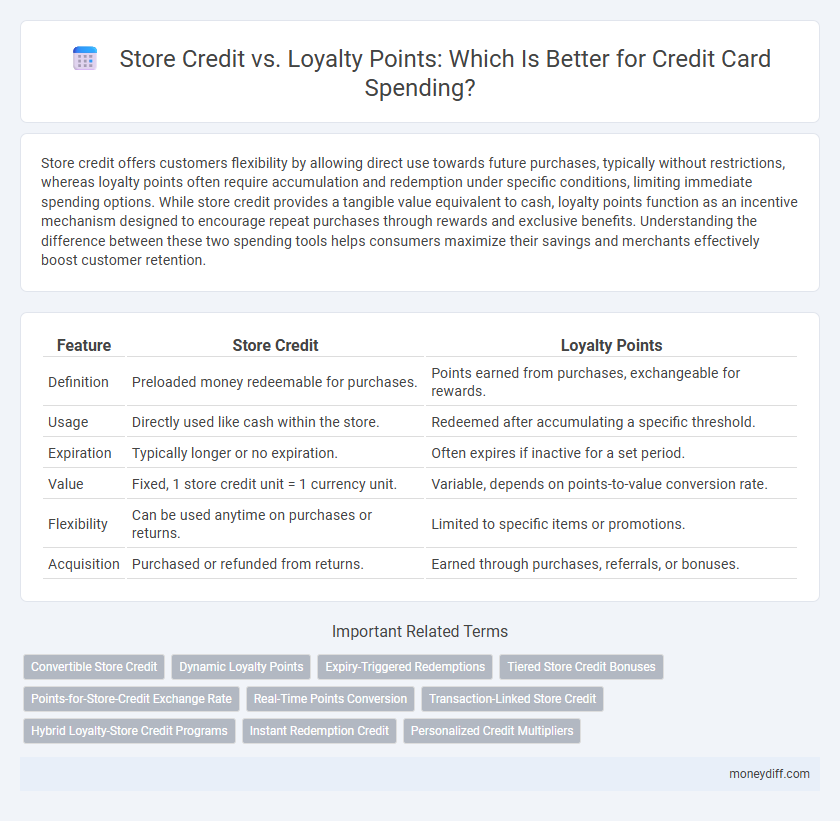

Table of Comparison

| Feature | Store Credit | Loyalty Points |

|---|---|---|

| Definition | Preloaded money redeemable for purchases. | Points earned from purchases, exchangeable for rewards. |

| Usage | Directly used like cash within the store. | Redeemed after accumulating a specific threshold. |

| Expiration | Typically longer or no expiration. | Often expires if inactive for a set period. |

| Value | Fixed, 1 store credit unit = 1 currency unit. | Variable, depends on points-to-value conversion rate. |

| Flexibility | Can be used anytime on purchases or returns. | Limited to specific items or promotions. |

| Acquisition | Purchased or refunded from returns. | Earned through purchases, referrals, or bonuses. |

Understanding Store Credit: Definition and Function

Store credit represents a monetary value issued by a retailer, allowing customers to make purchases within the same store or chain, functioning as a refund or exchange alternative to cash. Unlike loyalty points, which accumulate based on spending and can be redeemed for rewards or discounts, store credit provides immediate purchasing power equivalent to the returned or exchanged item's value. This direct applicability enhances customer flexibility and encourages repeat shopping by maintaining funds within the store's ecosystem.

What Are Loyalty Points and How Do They Work?

Loyalty points are a type of reward currency earned by customers through purchases or engagement with a specific brand, designed to incentivize repeat spending and foster customer retention. These points can typically be accumulated and redeemed for discounts, free products, or exclusive offers within the retailer's ecosystem, offering flexibility and tangible benefits tailored to consumer preferences. Unlike store credit, which is a fixed monetary value usually issued after returns or refunds, loyalty points function as a dynamic rewards system that enhances customer experience by providing ongoing incentives for continued patronage.

Store Credit vs Loyalty Points: Key Differences

Store credit offers direct monetary value redeemable like cash within a specific retailer, ensuring flexible spending options and immediate utility. Loyalty points accumulate based on purchase behavior and often require thresholds or specific conditions to convert into rewards, making them less liquid than store credit. The fundamental difference lies in store credit's guaranteed spending power versus the conditional and often tiered redemption structure of loyalty points.

Earning Store Credit: Methods and Limitations

Earning store credit typically involves returning products, participating in promotions, or using specific payment methods tied to the retailer's rewards program. Limitations often include expiration dates, restrictions on applicable products, and non-transferability, which can affect the overall usability of the credit. Understanding these terms helps consumers maximize value when choosing between store credit and loyalty points for future purchases.

How to Accumulate Loyalty Points Efficiently

Maximize loyalty points accumulation by consistently shopping with brands that offer high point rates per dollar spent, leveraging special promotions and bonus point events. Register for loyalty programs and link your credit or store cards to ensure every transaction earns points automatically. Monitor and utilize mobile apps or online portals to track points and redeem rewards strategically, increasing the overall value of your purchases.

Redemption Options: Store Credit vs Loyalty Points

Store credit offers versatile redemption options, allowing customers to use the full value toward any purchase without restrictions. Loyalty points typically have limited redemption options, often requiring accumulation to reach a threshold for discounts, gift cards, or specific products. Consumers benefit from store credit's immediate usability, while loyalty points encourage repeat spending through targeted rewards.

Expiration and Restrictions: What You Need to Know

Store credit often comes with a longer expiration period and fewer restrictions, allowing consumers greater flexibility in redeeming funds for purchases. Loyalty points typically have shorter validity and may be subject to specific usage limitations, such as product categories or minimum spend requirements. Understanding these differences helps maximize value and ensures timely redemption before expiration.

Value Comparison: Maximizing Benefits from Each

Store credit offers direct, flexible purchasing power equivalent to actual currency, making it ideal for maximizing value without restrictions on product categories. Loyalty points often require accumulation thresholds and redemption within specific program limits, potentially reducing immediate spending effectiveness. Evaluating the conversion rate and redemption conditions of loyalty points compared to store credit ensures optimal benefit extraction from customer rewards.

Which Is Better for Frequent Shoppers?

Store credit offers frequent shoppers greater flexibility by allowing direct cash value redemption on any purchase, while loyalty points often require accumulating thresholds before use. Loyalty programs typically encourage repeat engagement through bonus incentives and exclusive rewards, enhancing long-term customer value. For frequent shoppers prioritizing immediate savings, store credit delivers more straightforward benefits, whereas loyalty points cater to those invested in maximizing rewards over time.

Choosing the Right Program for Your Spending Habits

Store credit offers direct monetary value that can be used flexibly on future purchases, providing straightforward savings for frequent shoppers. Loyalty points often accumulate with each purchase, unlocking rewards or discounts tied to your spending patterns, ideal for customers who prefer gradual benefits. Evaluating your shopping frequency and preference for instant savings versus long-term rewards helps determine whether store credit or loyalty points better align with your spending habits.

Related Important Terms

Convertible Store Credit

Convertible store credit offers greater flexibility than loyalty points by allowing customers to redeem value directly towards any purchase, enhancing cash flow management for retailers. Unlike loyalty points restricted to specific promotions, convertible store credit acts as a real cash equivalent, driving higher conversion rates and customer satisfaction.

Dynamic Loyalty Points

Dynamic loyalty points adapt in real-time to customer behavior, offering personalized rewards that enhance engagement and increase spending more effectively than static store credit. This flexibility allows businesses to tailor incentives, driving higher conversion rates and fostering long-term customer loyalty through targeted, value-driven experiences.

Expiry-Triggered Redemptions

Store credit typically offers longer validity periods compared to loyalty points, reducing the urgency for customers to redeem funds before expiration. Loyalty points often have strict expiry dates that trigger faster redemption, encouraging quicker spending but risking value loss if unused.

Tiered Store Credit Bonuses

Tiered store credit bonuses incentivize higher spending by offering increasing rewards based on purchase amounts, enhancing customer retention more effectively than flat loyalty points. This system leverages tier structures to maximize customer lifetime value through scalable, redeemable credits that encourage continuous engagement and repeat purchases.

Points-for-Store-Credit Exchange Rate

The points-for-store-credit exchange rate directly impacts the value customers receive when redeeming loyalty points, with most programs offering between 100 to 500 points per dollar of store credit. Retailers optimizing this exchange rate can increase customer satisfaction and spending by making point redemptions more financially advantageous compared to standard store credit.

Real-Time Points Conversion

Real-time points conversion enhances customer experience by instantly translating loyalty points into store credit usable during the same transaction, increasing purchase flexibility and boosting engagement. This immediate conversion reduces friction at checkout, encouraging higher spending and reinforcing brand loyalty through seamless rewards redemption.

Transaction-Linked Store Credit

Transaction-linked store credit provides immediate purchasing power tied directly to recent returns or promotions, ensuring customers can quickly apply funds to new purchases within the same retailer. Unlike loyalty points, which accumulate over time and often have redemption restrictions, store credit offers a transparent and straightforward value that enhances seamless transaction experiences and encourages repeat spending.

Hybrid Loyalty-Store Credit Programs

Hybrid loyalty-store credit programs combine the flexibility of store credit with the incentivizing power of loyalty points, allowing customers to earn points that convert into credit for future purchases. This integration enhances customer retention by providing a seamless spending experience and maximizing the value of consumer rewards.

Instant Redemption Credit

Instant Redemption Credit offers immediate value by allowing consumers to apply earned rewards directly toward purchases, contrasting with traditional loyalty points that require accumulation before spending. This seamless spending experience enhances customer satisfaction and increases purchase frequency by reducing barriers often associated with delayed redemption.

Personalized Credit Multipliers

Personalized credit multipliers enhance store credit value by tailoring rewards based on individual spending habits, driving higher customer engagement and increased purchase frequency. Unlike static loyalty points, these multipliers dynamically adjust rewards, maximizing the financial benefit and incentivizing consistent store credit use.

Store credit vs loyalty points for spending. Infographic

moneydiff.com

moneydiff.com