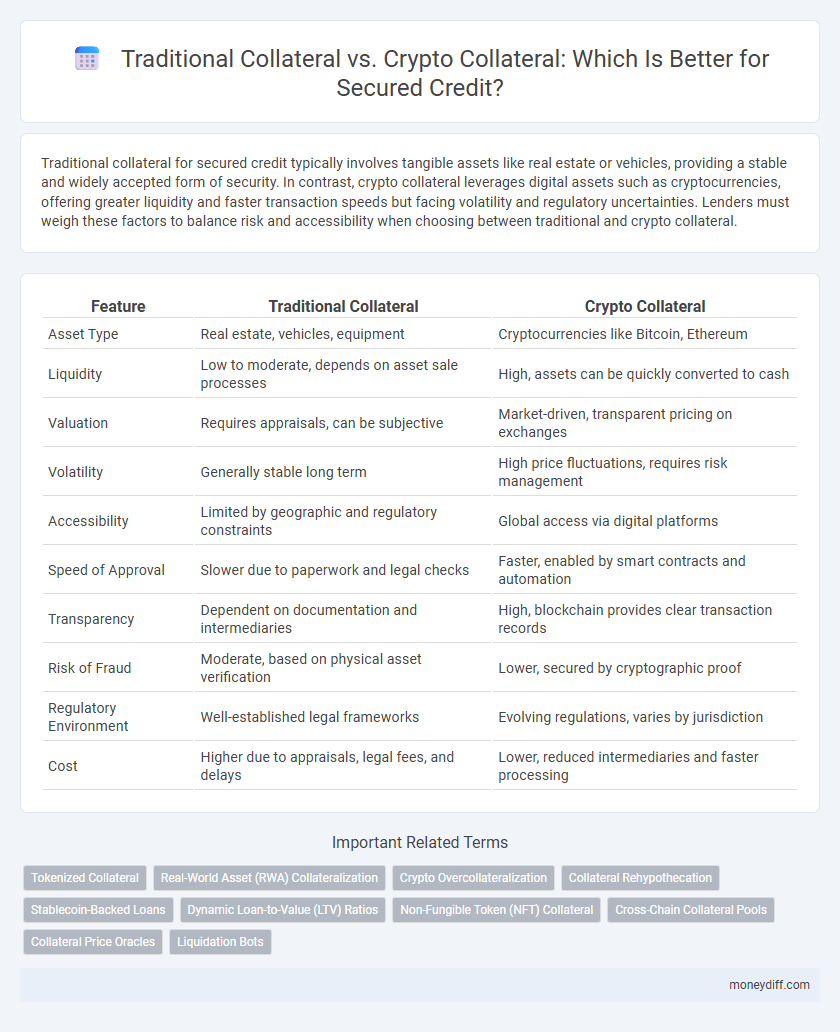

Traditional collateral for secured credit typically involves tangible assets like real estate or vehicles, providing a stable and widely accepted form of security. In contrast, crypto collateral leverages digital assets such as cryptocurrencies, offering greater liquidity and faster transaction speeds but facing volatility and regulatory uncertainties. Lenders must weigh these factors to balance risk and accessibility when choosing between traditional and crypto collateral.

Table of Comparison

| Feature | Traditional Collateral | Crypto Collateral |

|---|---|---|

| Asset Type | Real estate, vehicles, equipment | Cryptocurrencies like Bitcoin, Ethereum |

| Liquidity | Low to moderate, depends on asset sale processes | High, assets can be quickly converted to cash |

| Valuation | Requires appraisals, can be subjective | Market-driven, transparent pricing on exchanges |

| Volatility | Generally stable long term | High price fluctuations, requires risk management |

| Accessibility | Limited by geographic and regulatory constraints | Global access via digital platforms |

| Speed of Approval | Slower due to paperwork and legal checks | Faster, enabled by smart contracts and automation |

| Transparency | Dependent on documentation and intermediaries | High, blockchain provides clear transaction records |

| Risk of Fraud | Moderate, based on physical asset verification | Lower, secured by cryptographic proof |

| Regulatory Environment | Well-established legal frameworks | Evolving regulations, varies by jurisdiction |

| Cost | Higher due to appraisals, legal fees, and delays | Lower, reduced intermediaries and faster processing |

Introduction to Secured Credit

Secured credit involves loans backed by collateral to reduce lender risk and improve borrowing terms. Traditional collateral typically includes physical assets like real estate, vehicles, or equipment, valued for their stability and regulatory clarity. Crypto collateral leverages digital assets such as cryptocurrencies, offering faster liquidation and broader access but with higher volatility and evolving legal frameworks.

What Is Traditional Collateral?

Traditional collateral refers to tangible assets such as real estate, vehicles, or equipment pledged to secure a loan, reducing lender risk by providing a physical asset that can be liquidated if the borrower defaults. This type of collateral is deeply rooted in conventional finance, backed by well-established legal frameworks and appraisal methods to determine value. Its widespread acceptance ensures easier loan approval and often results in lower interest rates compared to unsecured credit options.

Understanding Crypto Collateral

Crypto collateral leverages blockchain-based digital assets like Bitcoin and Ethereum to secure credit, offering enhanced transparency and faster liquidation compared to traditional collateral such as real estate or vehicles. Its decentralized nature reduces counterparty risk, while smart contracts automate loan terms and repayment schedules, increasing efficiency and security. Volatility remains a challenge, prompting the use of stablecoins or over-collateralization in many crypto-backed lending platforms.

Key Differences Between Traditional and Crypto Collateral

Traditional collateral typically includes physical assets such as real estate, vehicles, or inventory, which hold intrinsic value and are subject to appraisal and regulatory oversight. Crypto collateral consists of digital assets like cryptocurrencies or tokens, offering higher liquidity and faster transferability but facing volatility and less established legal frameworks. Key differences lie in asset valuation methods, risk profiles, and the speed of collateral liquidation within secured credit transactions.

Pros and Cons of Traditional Collateral

Traditional collateral, such as real estate or vehicles, offers lenders tangible assets with established legal frameworks and valuation methods, providing stability and lower volatility in secured credit. However, these assets often involve lengthy appraisal and liquidation processes, reducing flexibility and increasing time-to-access during defaults. Limited accessibility and slower transferability can hinder borrowers seeking rapid or innovative financing solutions compared to emerging crypto collateral options.

Pros and Cons of Crypto Collateral

Crypto collateral offers faster liquidation and borderless accessibility compared to traditional collateral, enhancing credit flexibility and efficiency. However, its volatility poses significant risk, potentially affecting loan stability and requiring robust risk management strategies. Lack of widespread regulation and acceptance also limits its use, despite increasing adoption in decentralized finance (DeFi) platforms.

Risk Management in Collateralized Lending

Traditional collateral, such as real estate or vehicles, offers established valuation methods and legal frameworks that reduce credit risk through tangible asset backing. Crypto collateral introduces volatility and regulatory uncertainty, demanding advanced risk management techniques like over-collateralization and real-time asset monitoring to mitigate potential losses. Effective risk management in collateralized lending requires balancing asset liquidity, valuation accuracy, and market dynamics to secure borrower obligations and protect lender interests.

Accessibility and Inclusivity: Crypto vs Traditional Collateral

Traditional collateral such as real estate and vehicles often limits accessibility due to strict eligibility requirements and lengthy verification processes. Crypto collateral enables more inclusive access to secured credit by allowing users worldwide to leverage digital assets with faster approval and fewer intermediaries. This decentralized approach reduces barriers for unbanked and underbanked populations, expanding financial inclusion significantly.

Regulatory Considerations and Compliance

Traditional collateral such as real estate or vehicles benefits from well-established regulatory frameworks and clear legal precedents, ensuring predictable enforcement and compliance in secured credit agreements. Crypto collateral introduces challenges due to regulatory uncertainty, varying jurisdictional approaches, and evolving guidelines on asset classification, custody, and valuation. Lenders must navigate compliance risks by implementing robust due diligence, securing compliant smart contracts, and adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations specific to digital asset transactions.

Future Trends in Collateral for Secured Credit

The future of secured credit is shifting towards the integration of crypto collateral alongside traditional assets like real estate and automobiles, driven by increasing blockchain adoption and regulatory clarity. Tokenized assets enable fractional ownership and faster liquidation processes, enhancing liquidity and accessibility for both lenders and borrowers. Innovations in smart contracts will automate collateral management, reducing counterparty risk and operational costs in secured lending.

Related Important Terms

Tokenized Collateral

Tokenized collateral enables the digitization and fractionalization of traditional assets, improving liquidity and transparency in secured credit markets compared to conventional collateral such as real estate or machinery. Crypto collateral offers faster settlement, reduced counterparty risk, and programmable smart contracts that automate enforcement and reduce operational costs in lending agreements.

Real-World Asset (RWA) Collateralization

Traditional collateral such as real estate, vehicles, and equipment provides tangible asset-backed security that lenders rely on for secured credit, offering stable valuation but limited liquidity. Crypto collateral, particularly Real-World Asset (RWA) tokenization, bridges digital finance with physical assets, enhancing liquidity and enabling fractional ownership while maintaining asset-backed credit integrity.

Crypto Overcollateralization

Crypto collateral offers enhanced flexibility through overcollateralization, where borrowers provide assets exceeding the loan value to mitigate volatility risks inherent in digital currencies. This mechanism reduces lender exposure and enables faster liquidation processes compared to traditional collateral like real estate or vehicles, which often involve lengthy appraisal and legal procedures.

Collateral Rehypothecation

Traditional collateral rehypothecation involves banks reusing pledged assets like real estate or securities to secure their own borrowing, increasing liquidity but also raising counterparty risk. In contrast, crypto collateral rehypothecation leverages blockchain transparency and smart contracts to enable more secure, automated reuse of digital assets, enhancing efficiency and reducing settlement times.

Stablecoin-Backed Loans

Stablecoin-backed loans offer a highly liquid and transparent form of crypto collateral, reducing volatility risks commonly associated with traditional collateral such as real estate or vehicles. This innovation enables faster loan approvals and borderless access to credit while maintaining asset stability through blockchain technology.

Dynamic Loan-to-Value (LTV) Ratios

Dynamic Loan-to-Value (LTV) ratios in secured credit leverage flexible adjustments based on asset volatility, with traditional collateral like real estate typically maintaining stable LTVs around 70-80%, whereas crypto collateral requires more conservative, frequently updated LTVs often below 50% due to high price fluctuations. This dynamic approach mitigates lender risk by recalibrating credit exposure in real-time, reflecting rapid market changes inherent to digital assets compared to the relative stability of conventional assets.

Non-Fungible Token (NFT) Collateral

Non-Fungible Token (NFT) collateral revolutionizes secured credit by offering unique digital asset verification and immutable ownership records on blockchain, unlike traditional collateral which relies on physical asset appraisals and centralized registries. NFT collateral enables fractional ownership and global liquidity, enhancing credit accessibility and valuation transparency in decentralized finance (DeFi) ecosystems.

Cross-Chain Collateral Pools

Cross-chain collateral pools enable the utilization of crypto assets from multiple blockchains, enhancing liquidity and diversification compared to traditional collateral limited to physical assets like real estate or vehicles. This innovation in secured credit allows borrowers to tap into a broader asset base, reducing reliance on single-chain collateral constraints and improving credit accessibility and risk management.

Collateral Price Oracles

Traditional collateral relies on appraisals and market valuations updated infrequently, leading to potential delays and inaccuracies in credit risk assessment. Crypto collateral uses real-time price oracles that provide continuous, verifiable asset valuations, enhancing transparency and reducing the risk of under-collateralization in secured credit agreements.

Liquidation Bots

Liquidation bots in crypto collateralized credit markets automate the immediate sale of undercollateralized assets to maintain loan solvency, offering faster and more efficient risk management compared to traditional collateral, which relies on slower, manual liquidation processes such as asset repossession or legal enforcement. These bots leverage blockchain transparency and smart contracts to execute near-instant liquidations, reducing lender exposure and minimizing losses in volatile market conditions.

Traditional Collateral vs Crypto Collateral for secured credit. Infographic

moneydiff.com

moneydiff.com