Credit scores rely primarily on traditional financial data such as payment history, credit utilization, and length of credit history to assess personal lending risk. Alternative data scores incorporate non-traditional information like utility payments, rental history, and social behavior to provide a broader view of creditworthiness. Utilizing alternative data can enhance loan accessibility for individuals with limited or no credit history, offering lenders a more inclusive risk assessment.

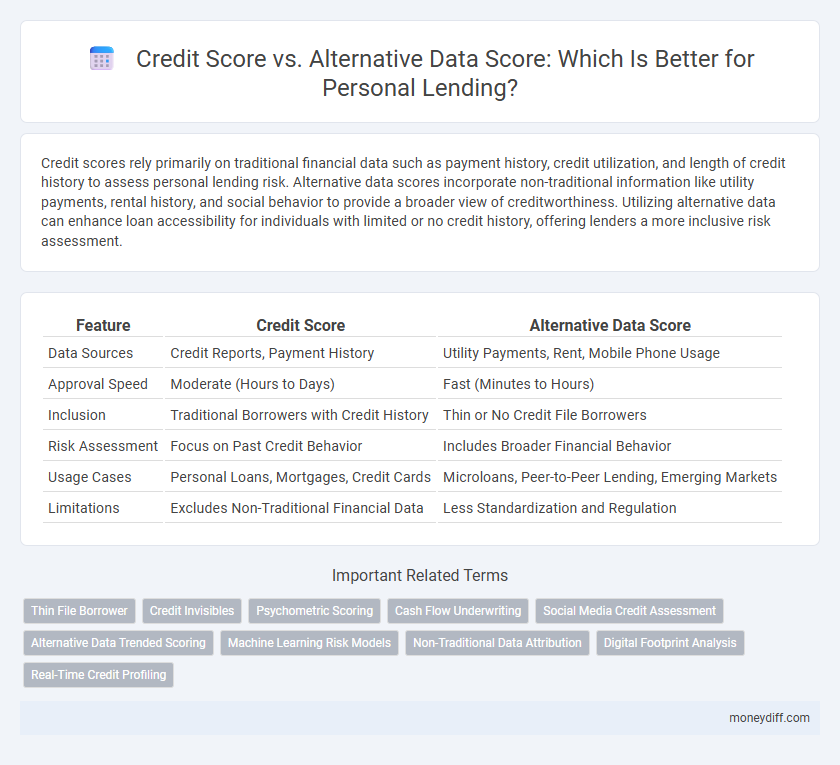

Table of Comparison

| Feature | Credit Score | Alternative Data Score |

|---|---|---|

| Data Sources | Credit Reports, Payment History | Utility Payments, Rent, Mobile Phone Usage |

| Approval Speed | Moderate (Hours to Days) | Fast (Minutes to Hours) |

| Inclusion | Traditional Borrowers with Credit History | Thin or No Credit File Borrowers |

| Risk Assessment | Focus on Past Credit Behavior | Includes Broader Financial Behavior |

| Usage Cases | Personal Loans, Mortgages, Credit Cards | Microloans, Peer-to-Peer Lending, Emerging Markets |

| Limitations | Excludes Non-Traditional Financial Data | Less Standardization and Regulation |

Understanding Traditional Credit Scores

Traditional credit scores primarily rely on data from credit bureaus, including payment history, credit utilization, and length of credit history. This data reflects past borrowing behavior, offering lenders a standardized metric to assess credit risk and predict repayment likelihood. However, reliance on traditional credit scores can exclude individuals with limited credit history, motivating the incorporation of alternative data sources for a more comprehensive evaluation.

What Is Alternative Data Scoring?

Alternative data scoring evaluates personal lending eligibility using non-traditional financial information such as utility payments, rental history, and phone bills. This approach provides a more comprehensive credit profile for individuals with limited or no conventional credit history. Lenders leverage alternative data to enhance risk assessment and expand credit access to underserved borrowers.

Key Differences Between Credit Score and Alternative Data Score

Credit scores predominantly rely on traditional financial data such as payment history, credit utilization, and length of credit history to evaluate creditworthiness. Alternative data scores incorporate non-traditional information like utility payments, rental history, employment records, and social behavior to assess risk, often capturing a broader financial profile. While credit scores are widely used and standardized, alternative data scores offer enhanced inclusivity for individuals with limited or no credit histories.

How Credit Scores Impact Personal Lending

Credit scores play a critical role in personal lending by providing lenders with a standardized measure of an individual's creditworthiness, influencing loan approval rates and interest terms. Traditional credit scores primarily assess past credit behavior using data from credit bureaus, which can exclude individuals with limited credit history. Alternative data scores incorporate non-traditional financial information such as utility payments, rental history, and digital transactions, enabling broader access to credit and more accurate risk assessment for underserved borrowers.

The Role of Alternative Data in Loan Approval

Alternative data plays a crucial role in loan approval by providing a more comprehensive view of an individual's creditworthiness beyond traditional credit scores. Information such as utility payments, rent history, and mobile phone bills can help lenders assess risk for borrowers with limited or no credit history. Incorporating alternative data improves access to credit for underserved populations and enhances predictive accuracy in personal lending decisions.

Benefits and Drawbacks of Credit Scores

Credit scores provide a standardized metric widely used by lenders to assess personal lending risk based on historical credit behavior, offering predictability and ease of comparison. However, credit scores may exclude borrowers with limited credit history or non-traditional financial activities, potentially leading to biased lending decisions. Incorporating alternative data can improve financial inclusion but requires robust validation to prevent inaccuracies that credit scores typically mitigate.

Advantages and Limitations of Alternative Data Scores

Alternative data scores enhance personal lending by incorporating non-traditional financial information such as utility payments, rental history, and social behavior, providing broader credit access for individuals with thin or no credit files. These scores improve risk assessment by capturing real-time financial behaviors often missed by conventional credit scores, allowing lenders to make more inclusive and accurate lending decisions. However, limitations include potential data privacy concerns, inconsistent data quality, and lack of standardization, which can lead to variability in scoring accuracy and regulatory challenges.

Which Scoring System Suits Your Financial Profile?

Traditional credit scores rely on credit history, payment timeliness, and debt levels, making them ideal for individuals with established credit records. Alternative data scores incorporate non-traditional information such as utility payments, rental history, and social behavior, providing a better assessment for those with limited or no credit history. Choosing the right scoring system depends on your financial profile: established credit users benefit from traditional scores, while newcomers or thin-file borrowers may find alternative data scoring more accurate and inclusive.

How Lenders Use Both Scores for Risk Assessment

Lenders integrate credit scores and alternative data scores to enhance risk assessment accuracy in personal lending. Traditional credit scores provide a standardized measure of creditworthiness based on payment history and credit utilization, while alternative data scores incorporate non-traditional information such as utility payments, rental history, and social behavior. Combining both scores enables lenders to achieve a more comprehensive risk profile, especially for individuals with limited credit histories or thin credit files.

The Future of Personal Lending: Credit vs. Alternative Data

The future of personal lending is shifting from traditional credit scores to incorporating alternative data scores, which utilize non-traditional information like utility payments, rental history, and social behavior to assess creditworthiness. Alternative data scoring models offer greater inclusion for individuals with thin or no credit files, potentially reducing default rates by providing a more holistic view of a borrower's financial reliability. Lenders leveraging machine learning algorithms to analyze alternative data can enhance risk prediction accuracy and expand credit access to underserved populations.

Related Important Terms

Thin File Borrower

Thin file borrowers often face challenges with traditional credit scores due to limited credit history, making alternative data scores, which incorporate utility payments, rental history, and other non-traditional financial behaviors, crucial for expanding access to personal lending. Utilizing alternative data scores can enhance credit risk assessment accuracy and improve loan approval rates for individuals with sparse credit files.

Credit Invisibles

Credit Invisibles often lack sufficient traditional credit history, making their credit scores unreliable or nonexistent, which limits access to personal lending. Alternative Data Scores incorporate non-traditional information such as utility payments, rental history, and mobile phone bills, enhancing credit assessment accuracy for these individuals by providing lenders with a more comprehensive financial profile.

Psychometric Scoring

Psychometric scoring evaluates personal lending risk by analyzing behavioral traits and personality factors, providing a complementary perspective to traditional credit scores that rely primarily on financial history. Incorporating psychometric data enhances credit assessment accuracy, particularly for individuals with limited credit history or low traditional credit scores, enabling broader financial inclusion.

Cash Flow Underwriting

Cash flow underwriting leverages alternative data such as bank transaction history and recurring income patterns, offering a more comprehensive view of creditworthiness compared to traditional credit scores, which rely primarily on past credit behavior. This approach enables lenders to better assess borrowers with limited or no credit history, improving access to personal loans and reducing default risks.

Social Media Credit Assessment

Social media credit assessment leverages alternative data, such as user behavior and social interactions, to complement traditional credit scores, providing a more comprehensive view of personal lending risk. This approach enhances credit accessibility for individuals with limited credit history by capturing real-time, non-financial indicators linked to creditworthiness.

Alternative Data Trended Scoring

Alternative Data Trended Scoring leverages dynamic financial behaviors and real-time payment patterns to provide a more comprehensive and predictive assessment of creditworthiness compared to traditional Credit Scores that rely heavily on static credit history. This approach enhances lending decisions by integrating trends in alternative data sources such as utility payments, rental history, and digital transaction activity, offering deeper insights for personal lending.

Machine Learning Risk Models

Machine learning risk models leverage both traditional credit scores and alternative data scores, integrating transaction history, utility payments, and social behavior to predict personal lending risk with higher accuracy. These models enhance credit decisioning by capturing nuanced borrower profiles beyond conventional credit bureaus, increasing financial inclusion and reducing default rates.

Non-Traditional Data Attribution

Non-traditional data attribution leverages alternative data sources such as utility payments, rental history, and mobile phone usage to enhance credit scoring models, providing a more comprehensive risk assessment than traditional credit scores. Integrating these alternative data points enables lenders to approve more personal lending applications by capturing financial behavior not reflected in conventional credit reports.

Digital Footprint Analysis

Credit score models traditionally rely on credit history and payment records, while alternative data scores incorporate digital footprint analysis, including social media behavior, online transactions, and smartphone usage patterns. Digital footprint analysis enhances personal lending decisions by providing deeper insights into borrower reliability and financial behavior, especially for individuals with limited or no credit history.

Real-Time Credit Profiling

Real-time credit profiling leverages both traditional credit scores and alternative data scores to provide a more comprehensive view of a borrower's creditworthiness, enabling lenders to make faster, more accurate personal lending decisions. Alternative data, such as utility payments, rental history, and digital transaction patterns, enhances the predictive power of credit models beyond conventional credit bureau data.

Credit Score vs Alternative Data Score for personal lending. Infographic

moneydiff.com

moneydiff.com