Lenders rely heavily on credit scores to assess a borrower's creditworthiness, but individuals labeled as credit invisibles often lack sufficient credit history to generate a score, making qualification more challenging. Alternatives like non-traditional data and alternative credit reporting agencies can provide these applicants with a way to demonstrate financial responsibility. Understanding the differences between credit scores and credit invisibles is crucial for improving access to loans and better financial opportunities.

Table of Comparison

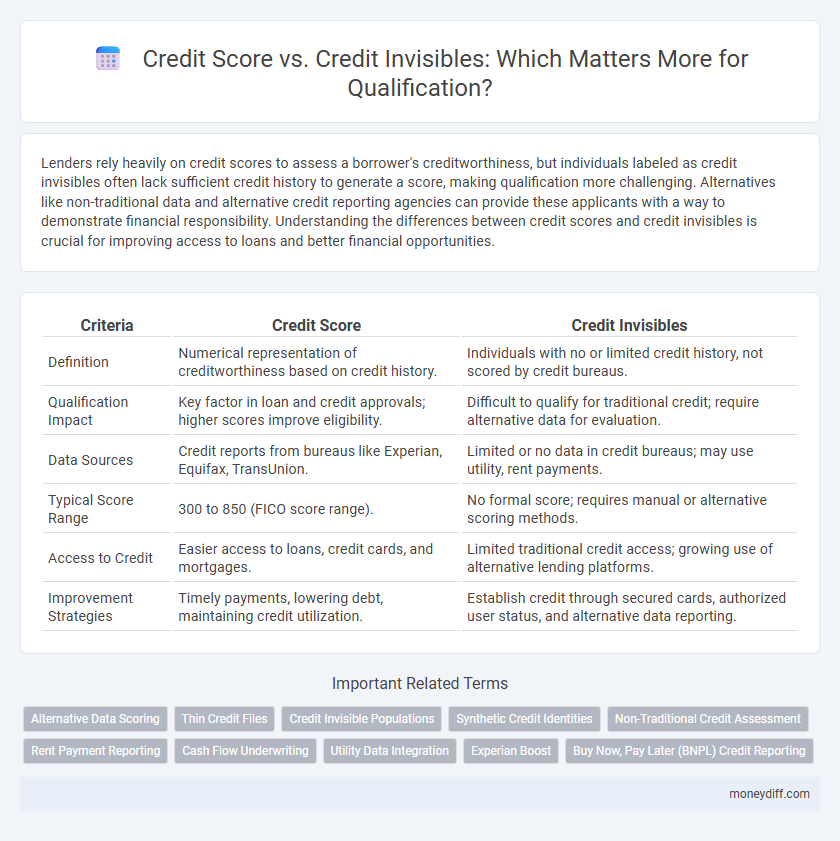

| Criteria | Credit Score | Credit Invisibles |

|---|---|---|

| Definition | Numerical representation of creditworthiness based on credit history. | Individuals with no or limited credit history, not scored by credit bureaus. |

| Qualification Impact | Key factor in loan and credit approvals; higher scores improve eligibility. | Difficult to qualify for traditional credit; require alternative data for evaluation. |

| Data Sources | Credit reports from bureaus like Experian, Equifax, TransUnion. | Limited or no data in credit bureaus; may use utility, rent payments. |

| Typical Score Range | 300 to 850 (FICO score range). | No formal score; requires manual or alternative scoring methods. |

| Access to Credit | Easier access to loans, credit cards, and mortgages. | Limited traditional credit access; growing use of alternative lending platforms. |

| Improvement Strategies | Timely payments, lowering debt, maintaining credit utilization. | Establish credit through secured cards, authorized user status, and alternative data reporting. |

Understanding Credit Scores: The Basics

Credit scores are numerical representations of creditworthiness, calculated using data such as payment history, credit utilization, length of credit history, and types of credit accounts, which lenders use to assess qualification for loans or credit cards. Credit invisibles, individuals with little to no credit history, do not have a traditional credit score, making it difficult for lenders to evaluate their risk. Understanding the components of credit scores and the challenges faced by credit invisibles is crucial for improving access to credit and financial opportunities.

Who Are the Credit Invisibles?

Credit invisibles are individuals who lack sufficient credit history to generate a credit score, often because they have never opened a credit account or used traditional financial services. This group includes millions of people, such as young adults, recent immigrants, and those relying mostly on cash transactions, making it difficult for lenders to assess their creditworthiness. Without a credit score, credit invisibles often face challenges qualifying for loans or credit products, necessitating alternative data assessments for accurate evaluation.

Criteria for Credit Qualification

Credit qualification relies heavily on credit scores, typically ranging from 300 to 850, with higher scores indicating lower risk to lenders. Credit invisibles, individuals without sufficient credit history, often fail traditional scoring models, necessitating alternative data like utility payments or rental history for assessment. Lenders increasingly adopt expanded criteria to evaluate creditworthiness beyond standard FICO scores, ensuring fairer access to credit for those with limited traditional credit records.

Traditional Scoring vs. Alternative Data

Traditional credit scoring models rely heavily on credit history from major bureaus, often excluding individuals classified as credit invisibles who lack sufficient conventional data. Alternative data sources, such as utility payments, rental history, and subscription services, offer a broader view of financial behavior, enhancing qualification opportunities for those outside traditional scoring parameters. Incorporating alternative data into credit assessments can improve credit access and enable lenders to evaluate risk more accurately.

Barriers Faced by Credit Invisibles

Credit invisibles face significant barriers in qualification due to the lack of a traditional credit score, as their credit activity is often unreported or minimal in mainstream credit bureaus. Without a credit score, lenders struggle to assess their creditworthiness, leading to higher rejection rates and difficulty accessing loans, credit cards, or affordable interest rates. Limited credit history means these individuals are excluded from conventional credit markets, reinforcing financial exclusion and perpetuating economic disparities.

Impact of Credit Scores on Loan Approval

Credit scores play a crucial role in loan approval decisions by providing lenders with a quantifiable measure of creditworthiness, often determining eligibility and interest rates. Credit invisibles, individuals without sufficient credit history, face challenges in qualification because traditional scoring models lack data to assess their risk accurately. Alternative data and innovative scoring models are increasingly used to evaluate credit invisibles, aiming to improve their access to loans and financial services.

Pathways to Establishing Credit History

Establishing credit history is crucial for improving credit scores and overcoming barriers faced by credit invisibles, individuals with little or no credit record. Pathways include secured credit cards, becoming an authorized user on a trusted account, and credit-builder loans, which provide timely payments to credit bureaus. These methods enable lenders to assess creditworthiness, enhancing qualification opportunities for loans and mortgages.

Lenders’ Perspectives on Credit Invisibles

Lenders view credit invisibles as a significant challenge because these individuals lack sufficient credit history to generate a reliable credit score, making risk assessment difficult. Without traditional credit data, lenders often rely on alternative data sources such as utility payments, rental history, or employment records to evaluate creditworthiness. This reliance on non-traditional metrics aims to expand qualification opportunities while managing potential default risk effectively.

Solutions for Bridging the Credit Gap

Traditional credit scores often exclude millions of credit invisibles, making it challenging for them to qualify for loans or credit products. Alternative data solutions, such as rental payments, utility bills, and employment history, provide lenders with a more comprehensive financial profile to bridge this credit gap. Integrating these alternative metrics into underwriting models enhances credit access and promotes financial inclusion for those without established credit scores.

Future Trends in Credit Qualification

Emerging trends in credit qualification increasingly emphasize alternative data and AI-driven models to assess credit invisibles--individuals lacking traditional credit history--enabling lenders to predict repayment behavior more accurately beyond conventional credit scores. Machine learning algorithms analyze utilities, rental payments, and digital footprints, fostering financial inclusion and expanding opportunities for those previously excluded from credit markets. This shift toward data diversification and predictive analytics signals a future where credit qualification becomes more personalized, equitable, and comprehensive.

Related Important Terms

Alternative Data Scoring

Alternative data scoring enhances credit qualification by incorporating non-traditional financial behaviors such as utility payments, rental history, and phone bills, allowing credit invisibles to establish creditworthiness beyond conventional credit scores. This innovative approach broadens access to credit for individuals lacking standard credit files, improving loan approval rates and promoting financial inclusion.

Thin Credit Files

Thin credit files often result in lower credit scores due to limited credit history, posing challenges for qualification on traditional lending criteria. Credit invisibles, representing individuals without sufficient credit data, require alternative scoring models to assess creditworthiness effectively.

Credit Invisible Populations

Credit invisible populations, lacking sufficient credit history, face significant challenges in qualifying for loans despite strong financial behavior, as traditional credit scores do not capture their creditworthiness effectively. Innovative alternative data sources and non-traditional credit models are increasingly vital to assess and include these individuals in the credit market.

Synthetic Credit Identities

Synthetic credit identities pose significant challenges in credit qualification by artificially inflating credit scores, often leading to misleading assessments compared to credit invisibles who lack sufficient credit history for scoring. Financial institutions must enhance their fraud detection systems to differentiate between legitimate credit profiles and synthetic identities, ensuring fair evaluation and reducing risks of erroneous approvals.

Non-Traditional Credit Assessment

Non-traditional credit assessment methods use alternative data such as utility payments, rental history, and cash flow patterns to evaluate creditworthiness for individuals with low or no credit scores, often referred to as credit invisibles. These methods provide lenders with a more inclusive and accurate financial profile, enabling better qualification opportunities beyond conventional credit score models.

Rent Payment Reporting

Rent payment reporting significantly enhances credit score accuracy by including timely rent payments in credit files, thereby reducing the number of credit invisibles who lack traditional credit data. Rent payment data bridges the qualification gap for renters, improving their eligibility for loans and credit products by demonstrating consistent financial responsibility.

Cash Flow Underwriting

Cash flow underwriting evaluates creditworthiness by analyzing real-time income and expense patterns rather than relying solely on traditional credit scores, which often exclude credit invisibles--individuals without extensive credit histories. This approach enables lenders to more accurately assess qualification potential for applicants who might be overlooked by conventional credit scoring models.

Utility Data Integration

Utility data integration enhances credit scoring models by incorporating payment history from essential services, improving the qualification prospects for credit invisibles who lack traditional credit records. This expanded data set allows lenders to assess creditworthiness more accurately, bridging gaps for individuals previously excluded from conventional credit evaluations.

Experian Boost

Experian Boost enables consumers with limited credit history, often classified as credit invisibles, to improve their credit scores instantly by incorporating utility and telecom payments into their Experian credit report. This service increases qualification chances for loans and credit products by enhancing credit profiles previously deemed insufficient by traditional scoring models.

Buy Now, Pay Later (BNPL) Credit Reporting

Credit scores primarily assess creditworthiness through traditional credit data, while credit invisibles lack sufficient credit history, making qualification challenging; Buy Now, Pay Later (BNPL) credit reporting is increasingly bridging this gap by reporting repayment behavior to credit bureaus, enhancing credit profiles for previously invisible consumers. Incorporating BNPL data into credit reports supports lenders in better evaluating risk and broadens access to credit for individuals without established credit scores.

Credit score vs credit invisibles for qualification. Infographic

moneydiff.com

moneydiff.com