Secured credit offers a reliable way to build or improve your credit score by using collateral, providing accessibility for individuals with limited credit history or lower creditworthiness. Experiential credit, on the other hand, leverages non-traditional data such as rent payments, utility bills, and other everyday financial behaviors to enhance credit accessibility for those without conventional credit records. Both types of credit expand opportunities for underserved consumers, fostering financial inclusion through alternative methods of credit evaluation.

Table of Comparison

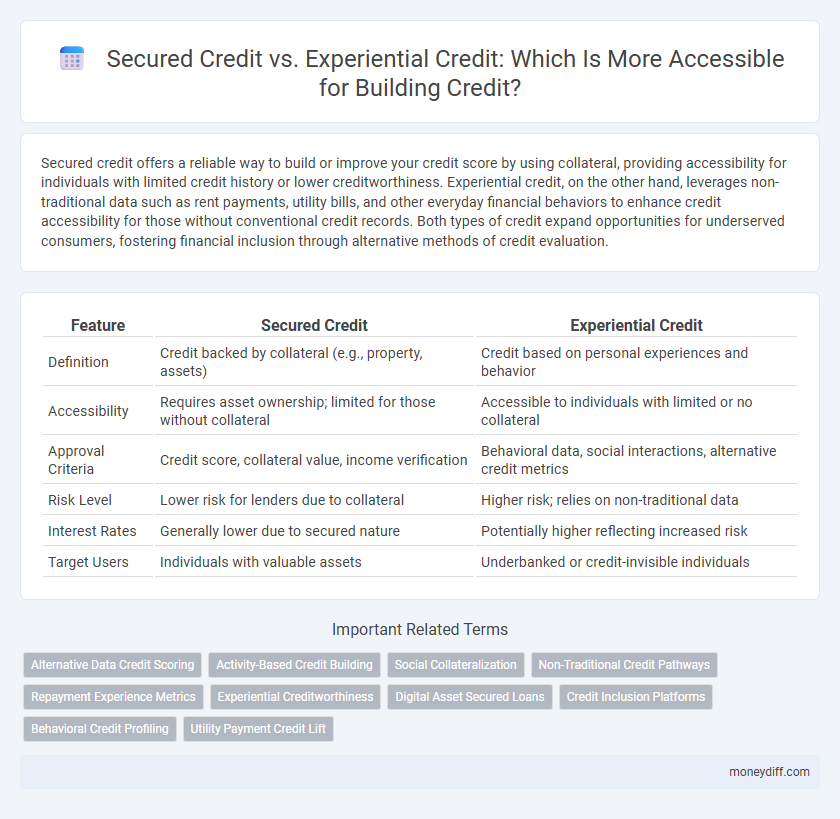

| Feature | Secured Credit | Experiential Credit |

|---|---|---|

| Definition | Credit backed by collateral (e.g., property, assets) | Credit based on personal experiences and behavior |

| Accessibility | Requires asset ownership; limited for those without collateral | Accessible to individuals with limited or no collateral |

| Approval Criteria | Credit score, collateral value, income verification | Behavioral data, social interactions, alternative credit metrics |

| Risk Level | Lower risk for lenders due to collateral | Higher risk; relies on non-traditional data |

| Interest Rates | Generally lower due to secured nature | Potentially higher reflecting increased risk |

| Target Users | Individuals with valuable assets | Underbanked or credit-invisible individuals |

Understanding Secured Credit: Basics and Accessibility

Secured credit requires collateral, such as a savings account or property, which reduces lender risk and often results in lower interest rates and easier approval compared to unsecured options. It provides an accessible starting point for individuals with limited or poor credit history, enabling them to build creditworthiness through consistent payments. Understanding secured credit's basics helps consumers leverage this tool to improve financial access and credit scores efficiently.

What Is Experiential Credit and How Does It Work?

Experiential credit refers to the recognition of skills and knowledge gained through life experiences, work, or informal learning rather than formal education or secured loans. It allows individuals to leverage practical expertise for credit approval, often enhancing access for those without traditional credit histories. By evaluating real-world experience, experiential credit provides a flexible alternative in credit accessibility, particularly benefiting underrepresented or non-traditional borrowers.

Comparing Entry Requirements: Secured vs Experiential Credit

Secured credit requires a deposit or collateral to establish creditworthiness, making it accessible to individuals with limited or poor credit history. Experiential credit relies on alternative data such as utility payments, rental history, or employment records, allowing users without traditional credit scores to build a credit profile. Comparing entry requirements, secured credit demands upfront financial commitment, while experiential credit emphasizes consistent, real-time financial behavior for accessibility.

Credit-Building Potential: Secured vs Experiential Approaches

Secured credit relies on collateral to minimize lender risk and build credit through consistent, on-time payments reported to credit bureaus, making it a reliable tool for credit-building potential. Experiential credit expands credit accessibility by including alternative data such as rent, utilities, and subscription payments, which can help individuals with limited traditional credit history improve their credit profiles. While secured credit offers a direct path with tangible pledged assets, experiential credit enhances credit diversity and accessibility for underserved populations by recognizing everyday financial behavior.

Accessibility for Low-Income Applicants

Secured credit offers low-income applicants a more accessible path to building credit by requiring a refundable security deposit, reducing the risk for lenders and enabling approval despite limited credit history. Experiential credit leverages alternative data such as rent and utility payments, expanding credit access to those without traditional credit records but may face challenges in universal acceptance and reporting consistency. Together, these approaches increase financial inclusion by providing scalable solutions tailored to the credit profiles of underserved populations.

Impact on Credit Scores: Secured vs Experiential Credit

Secured credit typically has a direct and significant impact on credit scores as timely payments and responsible usage demonstrate creditworthiness to lenders. Experiential credit, often derived from alternative data such as utility bills or rental payments, can enhance credit profiles for individuals with limited or no traditional credit history, improving accessibility to mainstream financial products. Both secured and experiential credit contribute to a more comprehensive credit assessment but secured credit usually influences scores more strongly due to its established presence in credit reporting agencies.

Fees, Deposits, and Hidden Costs

Secured credit typically requires a refundable security deposit, which acts as collateral and often results in lower fees and transparent cost structures, enhancing accessibility for users with limited credit history. Experiential credit products, such as those based on rental or utility payments, frequently avoid large upfront deposits but may include variable fees or hidden costs that affect overall affordability. Understanding the fee schedules and deposit requirements is essential for consumers seeking accessible credit options with minimal financial risk.

Approval Speed and Application Simplicity

Secured credit offers faster approval times due to collateral reducing lender risk, enabling streamlined application processes often requiring fewer documents. Experiential credit relies on alternative data like payment history and social behavior, which can slow approval while demanding extensive verification. Secured credit's simplicity makes it more accessible for applicants needing quick, straightforward approval.

Which Option Is Better for Beginners?

Secured credit cards offer beginners a straightforward way to build credit by requiring a refundable security deposit, minimizing risk for lenders and increasing approval chances for those with limited credit history. Experiential credit, such as pay-over-time options on purchases, provides flexibility but may carry higher fees and less impact on credit-building for novices. For accessibility and effective credit establishment, secured credit is generally the better choice for beginners aiming to build a strong financial foundation.

Choosing the Right Credit Tool for Accessibility

Choosing the right credit tool for accessibility depends on the individual's financial situation and credit goals, with secured credit offering a guaranteed option through collateral and experiential credit providing opportunities based on real-world financial behavior. Secured credit cards require a cash deposit that serves as collateral, making them accessible for those with limited or damaged credit history. Experiential credit, such as rent reporting or utility payment history, enhances credit profiles by demonstrating consistent financial responsibility without the need for upfront security.

Related Important Terms

Alternative Data Credit Scoring

Secured credit relies on collateral, providing traditional financial institutions with reduced risk, whereas experiential credit leverages alternative data such as utility payments and rental history to improve credit accessibility for underserved populations. Alternative data credit scoring enhances financial inclusion by evaluating non-traditional indicators of creditworthiness, enabling lenders to extend credit to individuals without conventional credit histories.

Activity-Based Credit Building

Activity-based credit building leverages experiential credit through consistent participation in essential activities like paying rent and utilities on time, enhancing credit accessibility for those lacking traditional secured credit history. This approach supplements secured credit by recognizing diverse financial behaviors, enabling broader inclusion in credit systems.

Social Collateralization

Secured credit relies on tangible assets as collateral, providing lenders with a safety net, whereas experiential credit leverages social collateralization by utilizing relationships and community trust to enhance credit accessibility. Social collateralization reduces barriers for underserved individuals by valuing social capital and reputation over traditional financial assets, fostering inclusive lending environments.

Non-Traditional Credit Pathways

Non-traditional credit pathways such as Experiential Credit leverage life experiences, skills, and activities outside conventional financial histories, enhancing accessibility for individuals lacking secured credit or traditional credit records. These alternative methods incorporate service credits, rental payments, and utility bills, enabling broader inclusion in credit systems while promoting financial empowerment for underserved populations.

Repayment Experience Metrics

Secured credit leverages collateral to reduce lender risk, influencing repayment experience metrics like timeliness and default rates, providing clearer indicators of creditworthiness. Experiential credit emphasizes data from alternative repayment behaviors such as utility payments or rental history, expanding accessibility by capturing reliable repayment patterns beyond traditional secured loans.

Experiential Creditworthiness

Experiential creditworthiness evaluates an individual's financial reliability based on non-traditional data such as utility payments, rent history, and digital transaction patterns, providing greater accessibility to those lacking conventional credit histories. This method enhances financial inclusion by leveraging real-time behavioral data to assess credit risk more accurately than secured credit alone.

Digital Asset Secured Loans

Digital asset secured loans offer a new form of secured credit that leverages cryptocurrencies or digital tokens as collateral, providing higher accessibility for borrowers with blockchain-based assets. Experiential credit, reliant on traditional credit history and borrower behavior, often limits access for those without established financial footprints, whereas digital asset loans prioritize asset valuation over credit scores, expanding credit opportunities in decentralized finance ecosystems.

Credit Inclusion Platforms

Credit inclusion platforms integrate secured credit and experiential credit to enhance accessibility for underserved populations, leveraging collateral-backed loans alongside transaction history and behavioral data to build comprehensive credit profiles. These platforms use alternative data sources such as utility payments and mobile money activity to expand credit access beyond traditional credit scoring, promoting financial inclusion and empowering users with limited formal financial records.

Behavioral Credit Profiling

Secured credit relies on collateral to mitigate lending risk, enhancing accessibility for individuals with limited credit history by providing a tangible asset. Experiential credit leverages behavioral credit profiling, analyzing real-time financial habits and payment behavior to offer more inclusive credit opportunities without traditional collateral requirements.

Utility Payment Credit Lift

Secured credit, backed by collateral such as a savings account, provides a reliable foundation for building credit, while experiential credit, including utility payment histories, offers an alternative method to boost credit scores without traditional borrowing. Utility payment credit lift enhances accessibility by incorporating consistent payment data, empowering consumers with limited credit history to demonstrate financial responsibility and improve creditworthiness.

Secured Credit vs Experiential Credit for accessibility. Infographic

moneydiff.com

moneydiff.com