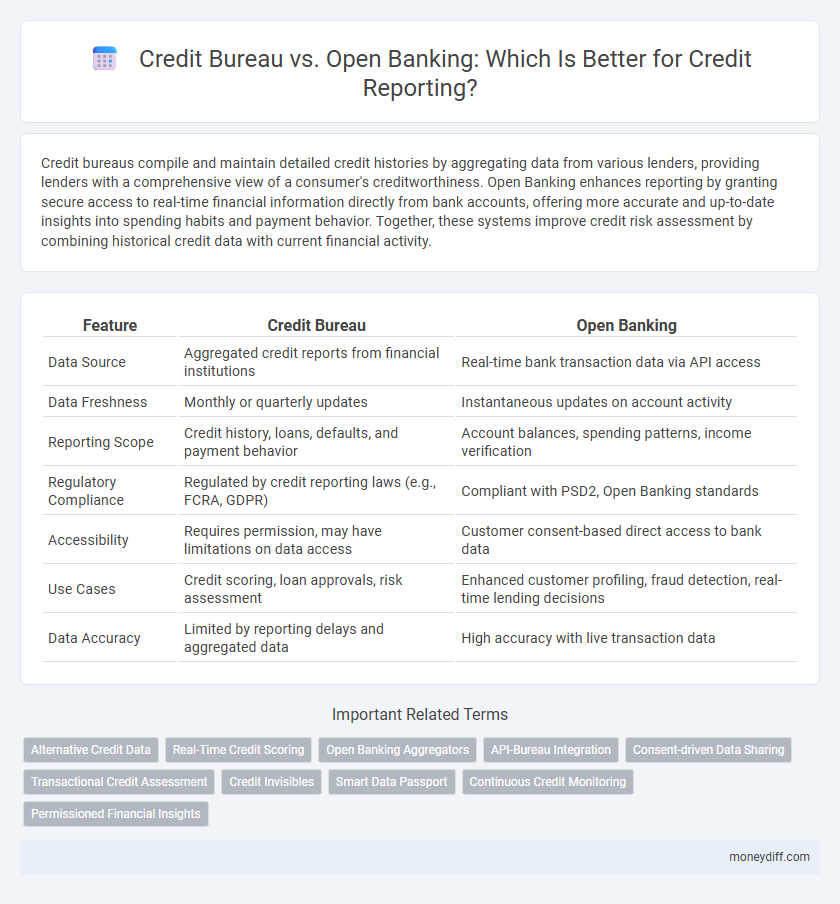

Credit bureaus compile and maintain detailed credit histories by aggregating data from various lenders, providing lenders with a comprehensive view of a consumer's creditworthiness. Open Banking enhances reporting by granting secure access to real-time financial information directly from bank accounts, offering more accurate and up-to-date insights into spending habits and payment behavior. Together, these systems improve credit risk assessment by combining historical credit data with current financial activity.

Table of Comparison

| Feature | Credit Bureau | Open Banking |

|---|---|---|

| Data Source | Aggregated credit reports from financial institutions | Real-time bank transaction data via API access |

| Data Freshness | Monthly or quarterly updates | Instantaneous updates on account activity |

| Reporting Scope | Credit history, loans, defaults, and payment behavior | Account balances, spending patterns, income verification |

| Regulatory Compliance | Regulated by credit reporting laws (e.g., FCRA, GDPR) | Compliant with PSD2, Open Banking standards |

| Accessibility | Requires permission, may have limitations on data access | Customer consent-based direct access to bank data |

| Use Cases | Credit scoring, loan approvals, risk assessment | Enhanced customer profiling, fraud detection, real-time lending decisions |

| Data Accuracy | Limited by reporting delays and aggregated data | High accuracy with live transaction data |

Understanding Credit Bureaus: Traditional Credit Reporting

Credit bureaus collect and maintain comprehensive credit histories from financial institutions to generate detailed credit reports used by lenders. Traditional credit reporting relies on historical financial data, including loan repayment records, credit card usage, and public records, to assess creditworthiness. This centralized approach provides standardized credit scores but may lag in reflecting real-time financial behavior compared to Open Banking alternatives.

What Is Open Banking? A New Approach to Financial Data

Open Banking is a revolutionary framework that allows consumers to securely share their financial data with third-party providers through application programming interfaces (APIs), enabling more personalized and efficient credit assessments. Unlike traditional Credit Bureaus that compile and report credit histories based on past borrowing and repayments, Open Banking provides real-time access to comprehensive financial data such as transaction history, income patterns, and spending behavior. This dynamic and transparent approach enhances credit reporting accuracy, reduces risk for lenders, and expands access to credit for underserved populations.

Key Differences Between Credit Bureaus and Open Banking

Credit bureaus aggregate historical credit data such as loan repayments, credit card usage, and delinquencies to generate credit scores that lenders rely on for assessing borrower risk. Open Banking provides real-time access to consumer financial data, including bank account transactions and spending patterns, enabling more dynamic and personalized credit assessments. Unlike the static reports from credit bureaus, Open Banking leverages granular data and APIs to offer lenders a comprehensive and timely view of a consumer's financial behavior.

How Credit Bureaus Collect and Use Data

Credit bureaus collect data primarily from banks, lenders, and financial institutions, aggregating credit histories, loan repayments, and credit utilization to create detailed credit reports. This data is analyzed to generate credit scores, which lenders use to assess an individual's creditworthiness and risk profile. Unlike open banking that provides real-time transactional data, credit bureaus rely on historical credit behaviors to influence lending decisions and risk management.

Open Banking: Real-Time Financial Insights

Open Banking offers real-time financial insights by securely sharing customers' transaction data directly from banks, enabling more accurate and up-to-date credit assessments. Unlike traditional Credit Bureaus that rely on historical credit reports and delayed updates, Open Banking provides lenders with immediate access to current account activity and income patterns. This transparency allows for enhanced risk evaluation and quicker decision-making in credit reporting and lending processes.

Accuracy and Transparency: Comparing Reporting Methods

Credit bureaus rely on standardized reporting from lenders, providing consistent credit data but sometimes facing delays and incomplete records. Open Banking enhances accuracy by granting direct access to real-time financial transactions, enabling more transparent and up-to-date credit assessments. Combining both methods can improve the precision of credit reports and increase consumer trust through greater data transparency.

Impact on Consumers’ Credit Scores and Access to Credit

Credit bureaus compile traditional financial data like loan repayment history, which heavily influences consumers' credit scores and access to credit through established scoring models. Open banking leverages real-time, granular financial transaction data, enabling a more comprehensive credit assessment, especially for thin-file or underbanked consumers. This expanded data access can improve credit inclusivity and provide more accurate risk profiles, potentially lowering borrowing costs and increasing credit availability.

Data Privacy and Security Concerns: Bureau vs. Open Banking

Credit bureaus aggregate extensive credit histories using standardized data collection, ensuring regulated compliance with data privacy laws like FCRA or GDPR to protect consumer information. Open banking enables direct sharing of real-time financial data between consumers and authorized third parties, relying on robust encryption and strict user consent protocols to enhance data security. While credit bureaus centralize sensitive data, raising risks of breaches, open banking's decentralized model offers greater transparency and user control, reducing potential privacy vulnerabilities.

The Role of Regulation in Credit Reporting Systems

Regulation plays a crucial role in shaping credit reporting systems by establishing standards for data accuracy, consumer privacy, and fair access to credit information. Credit bureaus operate under strict regulatory frameworks that govern the collection, storage, and sharing of consumer credit data, ensuring compliance with laws like the Fair Credit Reporting Act (FCRA). Open banking frameworks complement these regulations by enabling secure data sharing via APIs, promoting transparency and innovation while maintaining regulatory oversight to protect consumers and enhance credit-reporting accuracy.

The Future of Credit Assessment: Integrating Bureaus and Open Banking

Credit bureaus provide historical credit data essential for traditional credit scoring, while open banking offers real-time financial transaction insights, enhancing accuracy in credit assessment. Integrating bureau data with open banking information enables lenders to create a more comprehensive credit profile, improving risk evaluation and personalized lending decisions. This hybrid approach represents the future of credit reporting by combining verified historical data with dynamic financial behavior analysis.

Related Important Terms

Alternative Credit Data

Credit bureaus traditionally aggregate credit histories from loans, credit cards, and mortgages, while open banking leverages real-time financial transaction data, enabling a broader and more dynamic view of creditworthiness through alternative credit data like utility payments and rental histories. This integration of open banking with credit reporting enhances accuracy and inclusivity, especially for thin-file or credit-invisible consumers by incorporating non-traditional financial behaviors.

Real-Time Credit Scoring

Credit bureaus aggregate historical credit data from multiple lenders to generate comprehensive credit reports, while open banking enables real-time access to transactional and financial data directly from bank accounts for dynamic credit scoring. Real-time credit scoring leverages open banking's live data streams to provide instant, accurate assessments of creditworthiness, enhancing decision-making speed and accuracy compared to traditional credit bureau reports.

Open Banking Aggregators

Open Banking aggregators enable real-time access to comprehensive financial data, offering a more dynamic and transparent alternative to traditional credit bureau reporting. By aggregating diverse bank account information, these platforms enhance credit assessment accuracy and foster personalized lending decisions.

API-Bureau Integration

Credit bureaus aggregate extensive consumer credit data from diverse lenders to produce comprehensive credit reports, while open banking enables secure, direct access to real-time financial data through APIs. API-bureau integration streamlines credit reporting by combining traditional credit bureau insights with dynamic open banking data, enhancing accuracy, speed, and risk assessment in credit decision-making.

Consent-driven Data Sharing

Credit bureaus compile consumer credit information from various lenders to build comprehensive credit reports, relying on traditional data submission methods. Open Banking enables consent-driven data sharing by allowing consumers to directly authorize access to their real-time financial data from multiple sources, enhancing transparency and accuracy in credit reporting.

Transactional Credit Assessment

Credit bureaus aggregate historical credit data from multiple lenders to generate comprehensive credit reports, enabling transactional credit assessment based on past repayment behavior and credit utilization patterns. Open banking enhances this process by providing real-time access to granular transaction-level data, allowing more accurate and timely evaluation of creditworthiness for dynamic lending decisions.

Credit Invisibles

Credit invisibles often remain unreported in traditional credit bureau databases, limiting their access to formal credit. Open banking enables the sharing of alternative financial data, such as transaction histories and utility payments, improving credit assessment accuracy and financial inclusion for these underserved individuals.

Smart Data Passport

Smart Data Passport leverages Open Banking APIs to provide real-time, granular financial insights that enhance credit reporting accuracy beyond traditional Credit Bureau data aggregation. This innovative approach enables lenders to access a dynamic and comprehensive view of borrower behavior, improving risk assessment and personalized credit offerings.

Continuous Credit Monitoring

Continuous credit monitoring through Credit Bureaus provides comprehensive historical credit data and risk scores based on traditional lending behavior, while Open Banking leverages real-time transaction data to offer dynamic, up-to-date insights into a consumer's financial health. Integrating Open Banking with Credit Bureau reports enhances predictive accuracy and enables proactive credit risk management by capturing ongoing financial activities alongside established credit histories.

Permissioned Financial Insights

Credit bureaus aggregate historical credit data from various lenders to generate credit scores used for risk assessment, while open banking enables permissioned financial insights by allowing consumers to share real-time transaction data directly with authorized third parties. Permissioned access under open banking offers more dynamic, accurate, and comprehensive financial profiling compared to the static and often outdated reports from traditional credit bureaus.

Credit Bureau vs Open Banking for reporting. Infographic

moneydiff.com

moneydiff.com