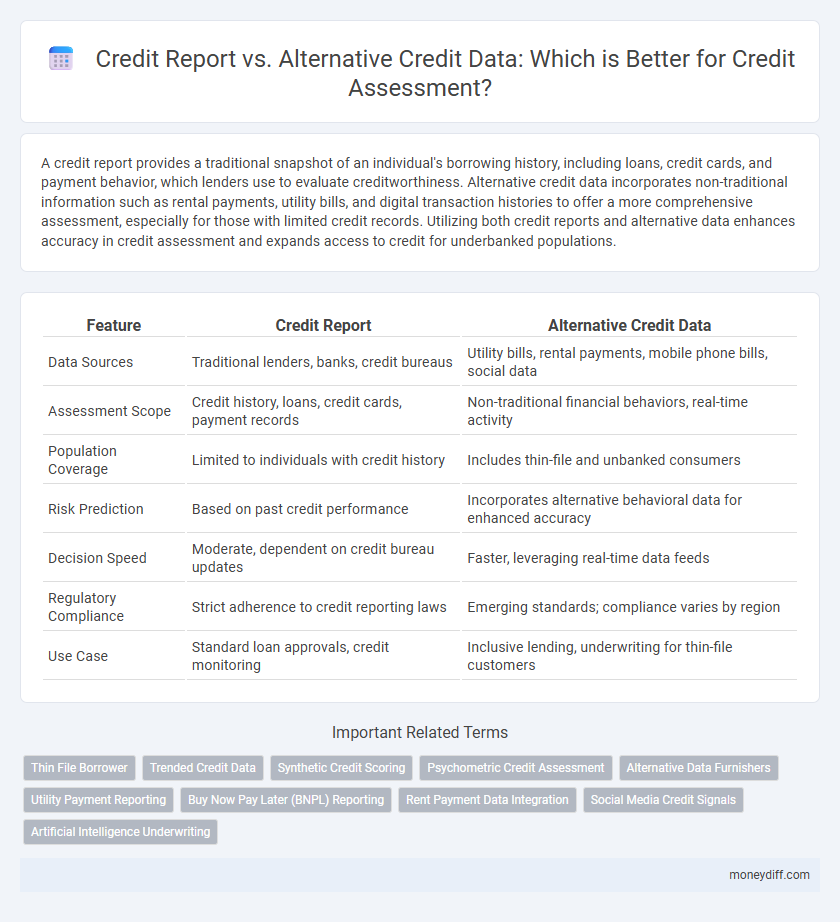

A credit report provides a traditional snapshot of an individual's borrowing history, including loans, credit cards, and payment behavior, which lenders use to evaluate creditworthiness. Alternative credit data incorporates non-traditional information such as rental payments, utility bills, and digital transaction histories to offer a more comprehensive assessment, especially for those with limited credit records. Utilizing both credit reports and alternative data enhances accuracy in credit assessment and expands access to credit for underbanked populations.

Table of Comparison

| Feature | Credit Report | Alternative Credit Data |

|---|---|---|

| Data Sources | Traditional lenders, banks, credit bureaus | Utility bills, rental payments, mobile phone bills, social data |

| Assessment Scope | Credit history, loans, credit cards, payment records | Non-traditional financial behaviors, real-time activity |

| Population Coverage | Limited to individuals with credit history | Includes thin-file and unbanked consumers |

| Risk Prediction | Based on past credit performance | Incorporates alternative behavioral data for enhanced accuracy |

| Decision Speed | Moderate, dependent on credit bureau updates | Faster, leveraging real-time data feeds |

| Regulatory Compliance | Strict adherence to credit reporting laws | Emerging standards; compliance varies by region |

| Use Case | Standard loan approvals, credit monitoring | Inclusive lending, underwriting for thin-file customers |

Understanding Traditional Credit Reports

Traditional credit reports compile detailed information on an individual's credit history, including loan repayment records, credit card usage, and outstanding debts, sourced from major credit bureaus like Experian, Equifax, and TransUnion. These reports provide lenders with standardized metrics such as credit scores, payment punctuality, and credit utilization ratios to assess credit risk. While conventional credit reports offer a comprehensive view of financial behavior, they often exclude individuals with limited credit history, necessitating the use of alternative credit data for broader credit assessment.

What Is Alternative Credit Data?

Alternative credit data encompasses non-traditional financial information, such as utility payments, rental history, and mobile phone bills, used to evaluate creditworthiness. This data supplements conventional credit reports, providing a more comprehensive view of a borrower's financial behavior, especially for those with limited or no credit history. Incorporating alternative credit data enables lenders to assess risk more accurately and expand access to credit for underserved populations.

Key Differences Between Credit Reports and Alternative Credit Data

Credit reports compile traditional financial data such as loan history, credit card usage, and payment timeliness from established credit bureaus, providing a standardized evaluation of creditworthiness. Alternative credit data incorporates non-traditional information like utility payments, rental history, and digital transaction behavior, offering insights for individuals with limited or no conventional credit records. The key differences lie in data sources, coverage breadth, and applicability for underserved populations, with alternative data enhancing inclusion in credit assessment processes.

The Role of Credit Reports in Credit Assessment

Credit reports play a critical role in credit assessment by providing detailed information on an individual's borrowing history, payment behavior, and outstanding debts, which lenders rely on to evaluate creditworthiness. Traditional credit reports offer standardized data from established financial institutions, enabling consistent risk analysis and decision-making. While alternative credit data can supplement this information, credit reports remain the foundational source for assessing financial reliability and credit risk.

How Alternative Credit Data Enhances Credit Evaluation

Alternative credit data includes utility payments, rental history, and mobile phone bills, providing a broader picture of a borrower's financial behavior. This data enhances credit evaluation by capturing payment patterns not reflected in traditional credit reports, enabling lenders to assess creditworthiness more accurately for individuals with limited credit history. Incorporating alternative data reduces default risk and increases access to credit for underserved populations.

Benefits of Using Alternative Credit Data

Alternative credit data enhances credit assessment by incorporating non-traditional financial behaviors, such as utility payments, rental history, and mobile phone bills, providing a more comprehensive view of a consumer's creditworthiness. This data expands access to credit for thin-file or no-file consumers who are often overlooked by conventional credit reports. Lenders benefit from reduced default rates and improved risk modeling by leveraging alternative credit data alongside traditional credit reports.

Limitations of Traditional Credit Reports

Traditional credit reports often suffer from limitations such as incomplete or outdated information, which can lead to inaccurate credit assessments. They typically exclude non-traditional financial behaviors like rent, utilities, and mobile payments, leaving many thin-file or no-file consumers unscored. Relying solely on these reports can perpetuate financial exclusion, especially for underserved populations lacking extensive credit history.

Impact on Consumers with Limited Credit History

Traditional credit reports often exclude consumers with limited credit history, restricting their access to loans and credit products. Alternative credit data, such as utility payments, rental history, and phone bills, provide a more comprehensive view of financial behavior, enabling better credit assessment for these individuals. Incorporating alternative data increases approval rates and promotes financial inclusion for underserved populations.

Lenders’ Perspective: Embracing Alternative Credit Data

Lenders increasingly integrate alternative credit data, such as utility payments, rental history, and mobile phone bills, to gain a more comprehensive view of potential borrowers' creditworthiness beyond traditional credit reports. This approach enhances risk assessment accuracy by capturing financial behavior absent from conventional credit bureaus, thus expanding credit access to underbanked populations. Leveraging alternative data empowers lenders to make informed decisions that reduce default rates and improve portfolio performance.

The Future of Credit Assessment Practices

The future of credit assessment practices is shifting from traditional credit reports to incorporating alternative credit data such as utility payments, rental history, and social media behavior, which enhance the accuracy of creditworthiness evaluations. Alternative credit data expands access to credit for underserved populations by providing a broader view of financial behavior beyond conventional credit scores. Advancements in artificial intelligence and data analytics enable lenders to integrate and analyze diverse data sources efficiently, leading to more inclusive and precise credit decisions.

Related Important Terms

Thin File Borrower

Traditional credit reports often lack sufficient information for thin file borrowers, making it difficult to accurately assess their creditworthiness. Alternative credit data, such as utility payments, rental history, and mobile phone bills, provides a more comprehensive view that enhances credit assessment for individuals with limited credit history.

Trended Credit Data

Trended credit data provides a detailed monthly view of a borrower's credit behavior over time, enhancing credit assessment accuracy beyond traditional credit reports that offer static snapshots. Using trended data, lenders can better predict repayment ability by analyzing patterns like payment consistency, credit utilization trends, and balance fluctuations.

Synthetic Credit Scoring

Synthetic credit scoring leverages a combination of traditional credit report data and alternative credit data, such as utility payments, rental history, and digital transaction records, to create a more comprehensive credit assessment. This hybrid approach enhances predictive accuracy by capturing a broader financial behavior spectrum, enabling lenders to extend credit to underbanked or thin-file consumers often overlooked by conventional credit reports.

Psychometric Credit Assessment

Psychometric credit assessment offers a nuanced approach to credit evaluation by analyzing behavioral and psychological patterns, extending beyond traditional credit report data such as payment history and credit scores. Incorporating alternative credit data like psychometrics improves credit accessibility for individuals with limited credit history by predicting creditworthiness through personality traits, cognitive skills, and financial attitudes.

Alternative Data Furnishers

Alternative Data Furnishers provide non-traditional credit information such as utility payments, rental history, and phone bills, enhancing credit assessment accuracy for consumers lacking extensive traditional credit reports. Incorporating alternative credit data helps lenders better evaluate creditworthiness, reducing bias and expanding access to credit for underserved populations.

Utility Payment Reporting

Utility payment reporting enhances credit assessments by incorporating consistent monthly bill payments such as electricity, water, and gas into credit reports, providing a broader view of consumer reliability beyond traditional credit data. This alternative credit data improves access to credit for thin-file or no-file consumers, increasing financial inclusion and reducing default risk by reflecting true payment behavior.

Buy Now Pay Later (BNPL) Reporting

Traditional credit reports offer detailed borrowing history but often miss buy now pay later (BNPL) transactions, while alternative credit data captures BNPL usage, providing a more comprehensive view of consumer credit behavior and payment reliability. Incorporating alternative data into credit assessments enhances risk evaluation by including timely BNPL payment records often absent from standard credit reporting agencies.

Rent Payment Data Integration

Rent payment data integration enhances credit assessment by supplementing traditional credit reports with consistent, timely rental payment histories, improving the accuracy of credit risk evaluation for individuals with limited credit files. Utilizing alternative credit data like rent payments increases lending inclusivity and helps lenders make informed decisions beyond conventional credit bureau records.

Social Media Credit Signals

Credit reports primarily rely on traditional financial data such as payment history, outstanding debt, and credit inquiries, while alternative credit data incorporates non-traditional sources like social media credit signals to evaluate creditworthiness. Social media credit signals analyze user behavior, network connections, and online activity patterns to provide lenders with deeper insights into a borrower's reliability and risk profile beyond standard credit metrics.

Artificial Intelligence Underwriting

Artificial Intelligence underwriting enhances credit assessment by integrating traditional credit reports with alternative credit data, capturing a broader financial behavior spectrum for more accurate risk prediction. Leveraging machine learning algorithms, this approach analyzes unconventional data such as utility payments, social media activity, and mobile phone usage, improving credit decisions for underserved consumers.

Credit report vs Alternative credit data for credit assessment. Infographic

moneydiff.com

moneydiff.com