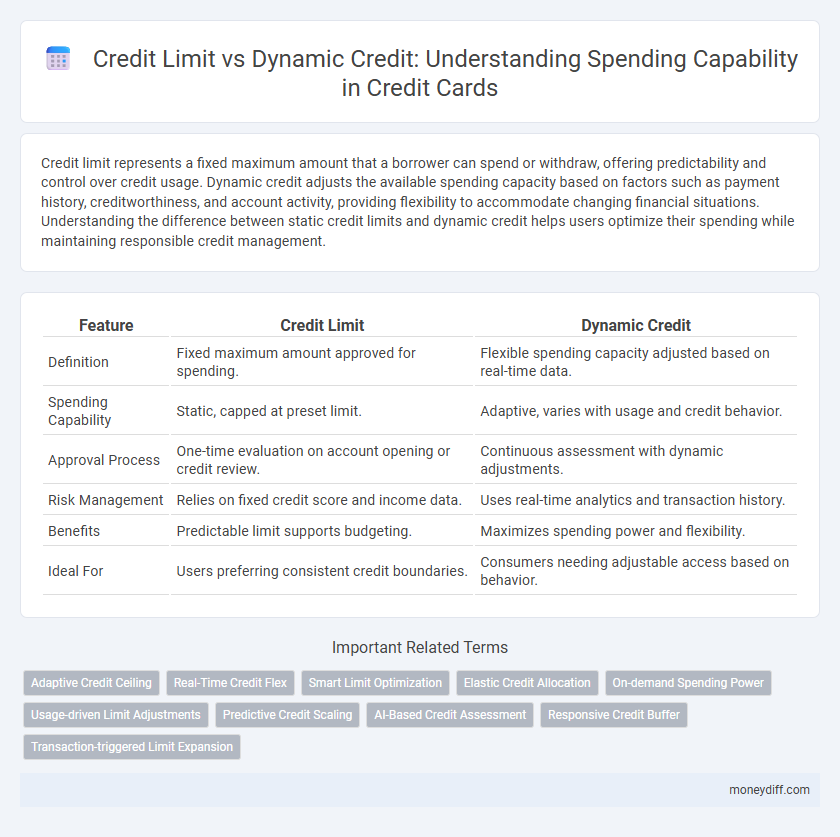

Credit limit represents a fixed maximum amount that a borrower can spend or withdraw, offering predictability and control over credit usage. Dynamic credit adjusts the available spending capacity based on factors such as payment history, creditworthiness, and account activity, providing flexibility to accommodate changing financial situations. Understanding the difference between static credit limits and dynamic credit helps users optimize their spending while maintaining responsible credit management.

Table of Comparison

| Feature | Credit Limit | Dynamic Credit |

|---|---|---|

| Definition | Fixed maximum amount approved for spending. | Flexible spending capacity adjusted based on real-time data. |

| Spending Capability | Static, capped at preset limit. | Adaptive, varies with usage and credit behavior. |

| Approval Process | One-time evaluation on account opening or credit review. | Continuous assessment with dynamic adjustments. |

| Risk Management | Relies on fixed credit score and income data. | Uses real-time analytics and transaction history. |

| Benefits | Predictable limit supports budgeting. | Maximizes spending power and flexibility. |

| Ideal For | Users preferring consistent credit boundaries. | Consumers needing adjustable access based on behavior. |

Understanding Traditional Credit Limits

Traditional credit limits define a fixed maximum amount a borrower can spend on a credit account, providing clear spending boundaries determined by lenders based on creditworthiness and income. Unlike dynamic credit, which adjusts spending capacity in real-time based on factors like payment behavior and account activity, traditional credit limits remain static until formally modified by the creditor. Understanding these limits helps consumers manage debt responsibly by preventing overspending and maintaining healthy credit utilization ratios.

What Is Dynamic Credit?

Dynamic credit is a flexible spending capability that adjusts automatically based on real-time financial behavior and creditworthiness, unlike a fixed credit limit that remains static regardless of changes in income or payment history. It allows for increased purchasing power during periods of improved financial health and reduces risk exposure by scaling back credit access when financial indicators decline. This adaptive mechanism enhances consumer experience by offering tailored credit options aligned with current financial status and spending needs.

Key Differences Between Credit Limit and Dynamic Credit

Credit limit represents a fixed maximum amount approved by a financial institution for borrowing or spending on a credit account, remaining constant unless officially adjusted. Dynamic credit, however, fluctuates based on real-time factors such as account usage, payment behavior, and credit score, allowing more flexible spending capabilities. Key differences include static versus variable borrowing capacity and adaptability to financial behavior, impacting how much credit is accessible at any moment.

How Credit Limit Affects Spending Power

A fixed credit limit sets a maximum borrowing threshold, directly capping spending power and influencing credit utilization ratio, which impacts credit scores. Dynamic credit adjusts in real-time based on factors like repayment behavior and income fluctuations, offering flexible spending capacity that can enhance or restrict purchasing ability. Understanding the differences helps consumers manage debt responsibly while maximizing credit utility.

The Flexibility of Dynamic Credit Systems

Dynamic credit systems offer enhanced flexibility by adjusting credit limits in real time based on spending behavior, payment history, and financial profile. Unlike fixed credit limits, dynamic credit adapts to changing financial circumstances, enabling consumers to access more funds when needed and reducing the risk of overextension. This adaptability improves cash flow management and supports more efficient credit utilization tailored to individual needs.

Credit Utilization: Static vs. Dynamic Models

Credit utilization rates differ significantly between static credit limits and dynamic credit models, impacting spending capability and credit scoring. Static credit limits impose a fixed cap on borrowing, often leading to higher utilization ratios if spending consistently approaches this threshold, potentially lowering credit scores. Dynamic credit models adjust borrowing capacity based on real-time financial behavior and payment history, enabling more flexible utilization that can optimize credit scores and improve overall financial health.

Pros and Cons of Credit Limits

Credit limits provide a fixed maximum amount a user can spend, offering predictability and helping control overspending but may restrict purchasing flexibility during unexpected needs. The fixed nature can lead to declined transactions if the limit is reached, potentially affecting credit scores due to utilization ratios. Unlike dynamic credit, static credit limits lack real-time adjustments based on spending behavior or financial capacity, which can be both a risk mitigation tool and a spending constraint.

Advantages of Dynamic Credit for Consumers

Dynamic credit adjusts spending limits in real-time based on consumer behavior, income fluctuations, and creditworthiness, offering greater flexibility compared to fixed credit limits. It enhances purchasing power by accommodating unexpected expenses and seasonal spending patterns without the need for manual credit limit increase requests. This adaptive approach reduces the risk of declined transactions and supports better credit management, ultimately improving consumers' financial agility and satisfaction.

Impact on Credit Scores: Credit Limit vs. Dynamic Credit

Credit limit establishes a fixed maximum borrowing capacity that directly influences credit utilization ratio, a key factor in credit score calculations. Dynamic credit adjusts the available credit based on factors like payment history and current income, potentially optimizing credit utilization and reducing credit risk. Maintaining a lower utilization ratio through dynamic credit can positively impact credit scores by signaling responsible borrowing behavior to lenders.

Choosing the Best Spending Capability Solution

Credit limit offers a fixed borrowing capacity determined by the lender, ensuring predictable spending boundaries and easier budget management, while dynamic credit adapts to fluctuating financial behavior, enabling flexible purchasing power based on real-time credit utilization and repayment patterns. Selecting the best spending capability solution depends on individual cash flow stability and financial discipline, with fixed credit limits favoring consistent usage and dynamic credit benefiting those with variable income and spending needs. Optimal credit management involves evaluating credit score impact, interest rates, and repayment terms to balance convenience, risk, and cost-effectiveness.

Related Important Terms

Adaptive Credit Ceiling

Adaptive Credit Ceiling adjusts the credit limit in real-time based on spending behavior, creditworthiness, and market conditions, providing a more flexible and personalized credit experience compared to static Credit Limits. This dynamic approach enhances spending capability by allowing users to leverage higher credit availability during periods of financial stability and reduce exposure during riskier times.

Real-Time Credit Flex

Real-Time Credit Flex enhances spending capability by dynamically adjusting the credit limit based on real-time transaction data and credit behavior, offering greater flexibility than static credit limits. This adaptive approach minimizes declined transactions and optimizes purchasing power by continuously evaluating risk and usage patterns.

Smart Limit Optimization

Smart Limit Optimization enhances spending capability by dynamically adjusting credit limits based on real-time transaction patterns and risk assessments, maximizing credit utilization without exceeding predefined thresholds. Unlike static credit limits, dynamic credit offers flexible borrowing power tailored to individual financial behavior, improving purchasing efficiency and reducing default risk.

Elastic Credit Allocation

Elastic Credit Allocation enables dynamic adjustment of credit limits based on real-time spending behaviors and financial conditions, enhancing flexibility compared to static credit limits. This approach optimizes purchasing power while mitigating risk by tailoring credit availability to evolving user needs and creditworthiness.

On-demand Spending Power

Dynamic credit offers on-demand spending power by adjusting limits based on real-time financial behavior and needs, unlike fixed credit limits that remain static regardless of changing circumstances. This flexibility enhances purchasing capacity and cash flow management, enabling users to optimize their credit utilization effectively.

Usage-driven Limit Adjustments

Dynamic credit adapts spending capability in real-time by analyzing usage patterns and payment behavior, offering a flexible alternative to fixed credit limits. This usage-driven limit adjustment enhances financial agility while reducing the risk of overspending compared to traditional static credit limits.

Predictive Credit Scaling

Predictive Credit Scaling leverages machine learning algorithms to dynamically adjust credit limits based on real-time spending patterns and financial behavior, enhancing spending capability beyond static credit limits. This approach optimizes risk management while providing consumers with flexible access to credit tailored to their evolving financial needs.

AI-Based Credit Assessment

AI-based credit assessment enhances spending capability by dynamically adjusting credit limits based on real-time financial behavior and risk analysis, surpassing static credit limits that often fail to reflect current customer creditworthiness. This technology leverages machine learning algorithms to provide personalized, flexible credit solutions that optimize borrowing capacity while minimizing default risk.

Responsive Credit Buffer

Responsive Credit Buffer adjusts the credit limit dynamically based on real-time spending patterns, providing flexible purchasing power beyond the static credit limit. This adaptive mechanism ensures optimal financial flexibility while mitigating risks associated with overspending.

Transaction-triggered Limit Expansion

Transaction-triggered limit expansion under dynamic credit adjusts spending capability in real-time based on transaction patterns and risk assessment, offering greater flexibility than static credit limits. This adaptive approach enhances purchasing power by temporarily increasing credit limits during high-value or recurring transactions while maintaining risk controls.

Credit Limit vs Dynamic Credit for spending capability. Infographic

moneydiff.com

moneydiff.com