A credit line offers a predetermined borrowing limit that can be accessed as needed, making it ideal for managing cash flow fluctuations. A flexible credit facility provides more adaptable repayment terms and can adjust limits based on the borrower's financial situation, catering to dynamic funding needs. Both options improve liquidity but differ in structure, with credit lines being more rigid and flexible credit facilities offering greater customization.

Table of Comparison

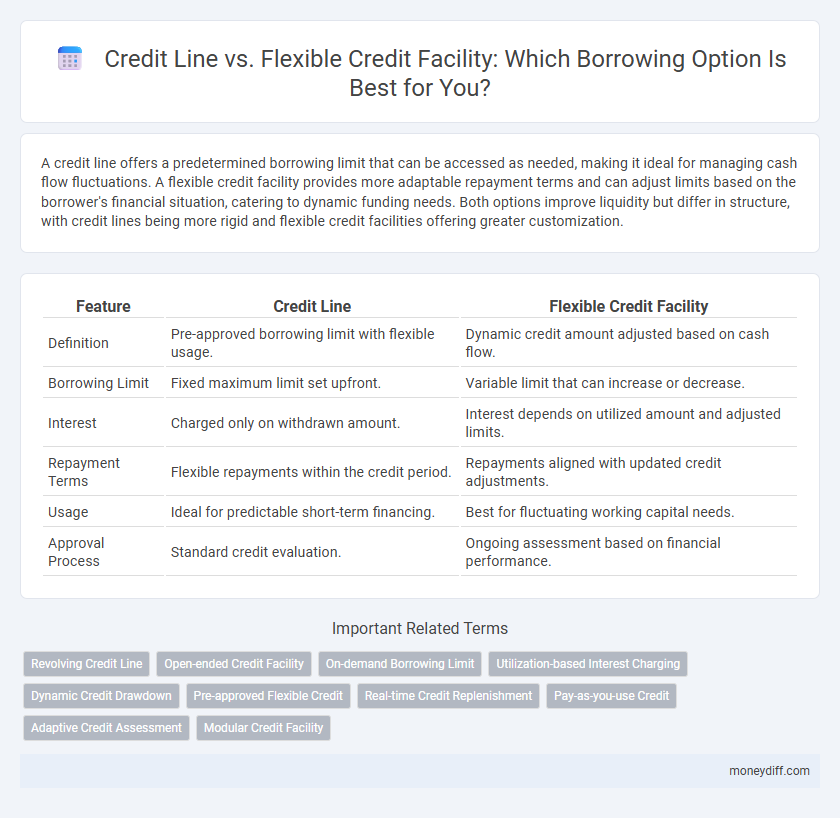

| Feature | Credit Line | Flexible Credit Facility |

|---|---|---|

| Definition | Pre-approved borrowing limit with flexible usage. | Dynamic credit amount adjusted based on cash flow. |

| Borrowing Limit | Fixed maximum limit set upfront. | Variable limit that can increase or decrease. |

| Interest | Charged only on withdrawn amount. | Interest depends on utilized amount and adjusted limits. |

| Repayment Terms | Flexible repayments within the credit period. | Repayments aligned with updated credit adjustments. |

| Usage | Ideal for predictable short-term financing. | Best for fluctuating working capital needs. |

| Approval Process | Standard credit evaluation. | Ongoing assessment based on financial performance. |

Overview of Credit Line and Flexible Credit Facility

A credit line offers borrowers a predetermined limit to access funds as needed, with interest charged only on the amount utilized, providing flexibility for short-term financing. A flexible credit facility allows borrowers to adjust their borrowing limit or repayment schedule based on changing financial needs, often featuring revolving terms and variable interest rates. Both options enhance liquidity management, but flexible credit facilities typically offer greater adaptability for fluctuating cash flow requirements.

Key Differences Between Credit Line and Flexible Credit Facility

Credit lines provide a predetermined borrowing limit that borrowers can access repeatedly as long as the outstanding balance does not exceed the credit limit, often with fixed repayment terms. Flexible credit facilities offer more adaptable borrowing options, allowing borrowers to withdraw variable amounts and adjust repayment schedules based on their financial needs. Key differences include credit line's structured limits and repayment versus flexible credit facility's customizable access and terms, impacting interest rates and borrowing costs.

Eligibility Criteria for Credit Line vs Flexible Credit Facility

Eligibility for a Credit Line typically requires a strong credit score, stable income, and a history of timely repayments, making it accessible to individuals or businesses with proven financial reliability. Flexible Credit Facilities often have broader eligibility criteria, accommodating borrowers with varied credit profiles by assessing overall cash flow and business potential rather than solely credit history. Lenders offering Flexible Credit Facilities may also consider shorter tenure and purpose-specific borrowing needs, providing more adaptable borrowing options compared to traditional Credit Lines.

Application Process Comparison

The application process for a credit line typically involves a detailed credit assessment, verification of income, and reviewing the borrower's credit history to determine eligibility and credit limits. Flexible credit facilities often require a similar evaluation but offer a faster approval process due to pre-approved limits and streamlined documentation. Borrowers seeking quick access to funds may prefer flexible credit facilities, while those needing higher borrowing capacity might opt for a traditional credit line despite a more intensive application procedure.

Interest Rates: Credit Line vs Flexible Credit Facility

Interest rates on a credit line typically vary based on the borrower's creditworthiness and outstanding balance, often featuring variable rates that adjust with market conditions. Flexible credit facilities may offer more competitive or fixed interest rates, providing greater predictability in repayment costs. Borrowers should compare annual percentage rates (APR) and fee structures when choosing between credit lines and flexible credit facilities to optimize borrowing costs.

Repayment Terms and Flexibility

A credit line offers borrowers a preset borrowing limit with flexible repayment terms, allowing repayment of the principal and interest at their convenience within the agreed period. In contrast, a flexible credit facility provides even greater adaptability by permitting borrowers to draw, repay, and redraw funds multiple times, often with no fixed repayment schedule but subject to minimum payments. Both options enhance liquidity management, but the flexible credit facility typically offers superior repayment flexibility tailored to fluctuating cash flow needs.

Credit Limits and Accessibility

Credit lines typically offer a predetermined credit limit that borrowers can access repeatedly within the approved amount, providing consistent and predictable borrowing capacity. Flexible credit facilities often allow adjustments to the credit limit based on the borrower's financial situation, enabling more adaptable access to funds when needed. Accessibility in credit lines is straightforward with fixed terms, while flexible credit facilities provide dynamic borrowing options but may require periodic reviews and approvals.

Pros and Cons of Credit Lines

Credit lines offer borrowers revolving access to funds up to a predetermined limit, providing flexibility and convenience for managing cash flow and unexpected expenses. They typically feature variable interest rates and require periodic payments, which may cause uncertainty in budgeting. However, credit lines can lead to higher interest costs if not managed prudently and often come with fees or strict eligibility criteria.

Advantages and Disadvantages of Flexible Credit Facilities

Flexible credit facilities offer borrowers the advantage of adjustable borrowing limits, allowing for easier management of fluctuating cash flow needs compared to fixed credit lines. These facilities typically feature interest charged only on the amount drawn, enhancing cost-efficiency, but higher interest rates and stricter eligibility criteria can pose disadvantages. The adaptability of repayment schedules supports financial flexibility, yet potential for over-borrowing and variable fees requires careful budget discipline and credit monitoring.

Which Option is Best for Your Borrowing Needs?

A credit line offers a predetermined borrowing limit with the flexibility to draw funds as needed, ideal for managing cash flow and short-term expenses. Flexible credit facilities provide adjustable terms and borrowing limits, catering to businesses with fluctuating capital requirements and long-term projects. Evaluating your borrowing frequency, repayment capacity, and financial goals helps determine whether a fixed credit line or a flexible credit facility best suits your specific credit needs.

Related Important Terms

Revolving Credit Line

A Revolving Credit Line offers borrowers a pre-approved credit limit they can draw from, repay, and reuse repeatedly without reapplying, providing continuous access to funds for fluctuating cash flow needs. In contrast, a Flexible Credit Facility may have adjustable terms and repayment schedules but often lacks the seamless reuse characteristic inherent to revolving credit structures.

Open-ended Credit Facility

Open-ended credit facilities offer a flexible credit line allowing borrowers to access funds up to a predetermined limit without reapplying for credit each time. Unlike traditional credit lines with fixed terms, flexible credit facilities provide ongoing access to funds, making them ideal for managing cash flow and unexpected expenses.

On-demand Borrowing Limit

A credit line offers a predetermined borrowing limit that can be accessed on demand, providing immediate liquidity without the need for repeated approvals. A flexible credit facility adjusts the borrowing limit based on the borrower's creditworthiness and usage patterns, allowing dynamic access to funds up to a variable threshold.

Utilization-based Interest Charging

Credit lines charge interest solely on the amount utilized, ensuring borrowers pay only for funds accessed, whereas flexible credit facilities often apply interest on the entire approved limit, increasing borrowing costs. Utilization-based interest charging in credit lines enhances cost efficiency and financial control by aligning expenses directly with actual borrowing needs.

Dynamic Credit Drawdown

Credit lines offer a pre-approved borrowing limit with the flexibility to draw funds multiple times up to the credit limit, allowing dynamic credit drawdown tailored to cash flow needs. Flexible credit facilities provide adjustable terms and variable limits, enabling borrowers to optimize liquidity by scaling credit usage dynamically based on changing financial requirements.

Pre-approved Flexible Credit

A pre-approved flexible credit facility offers borrowers a revolving line of credit with preset limits that can be accessed and repaid repeatedly, providing greater borrowing agility compared to a standard credit line which typically disburses a lump sum. This flexibility optimizes cash flow management and reduces interest costs by allowing users to borrow only what they need when they need it, backed by a pre-approval process that ensures quicker access to funds.

Real-time Credit Replenishment

A Credit Line offers real-time credit replenishment, allowing borrowers immediate access to funds as repayments are made, enhancing financial flexibility. In contrast, a Flexible Credit Facility may have delayed fund availability due to processing times, limiting instant borrowing capacity.

Pay-as-you-use Credit

Pay-as-you-use credit lines offer borrowers the flexibility to access funds only when needed, optimizing interest costs compared to traditional flexible credit facilities that often involve pre-approved limits but may incur fees regardless of usage. This model enhances cash flow management by aligning borrowing precisely with expenditure, minimizing unused credit charges and improving financial efficiency.

Adaptive Credit Assessment

Adaptive credit assessment evaluates borrower risk dynamically, enhancing decision accuracy for both credit lines and flexible credit facilities. This process allows lenders to adjust credit limits in real-time based on updated borrower financial behaviors and market conditions, optimizing borrowing capacity and mitigating risk.

Modular Credit Facility

A modular credit facility offers a tailored borrowing solution by integrating multiple credit lines with customizable limits and terms to suit diverse financial needs. Unlike traditional credit lines or flexible credit facilities, this approach enhances liquidity management by providing segmented access to funds with specific repayment schedules and interest rates.

Credit Line vs Flexible Credit Facility for Borrowing Infographic

moneydiff.com

moneydiff.com