Credit cards offer revolving credit with flexible payment options and often include rewards, fraud protection, and credit-building benefits. Buy Now Pay Later (BNPL) services provide short-term installment plans with fixed payments and may appeal to consumers seeking interest-free or low-interest alternatives without traditional credit checks. Choosing between credit cards and BNPL depends on spending habits, payment discipline, and the potential impact on credit scores.

Table of Comparison

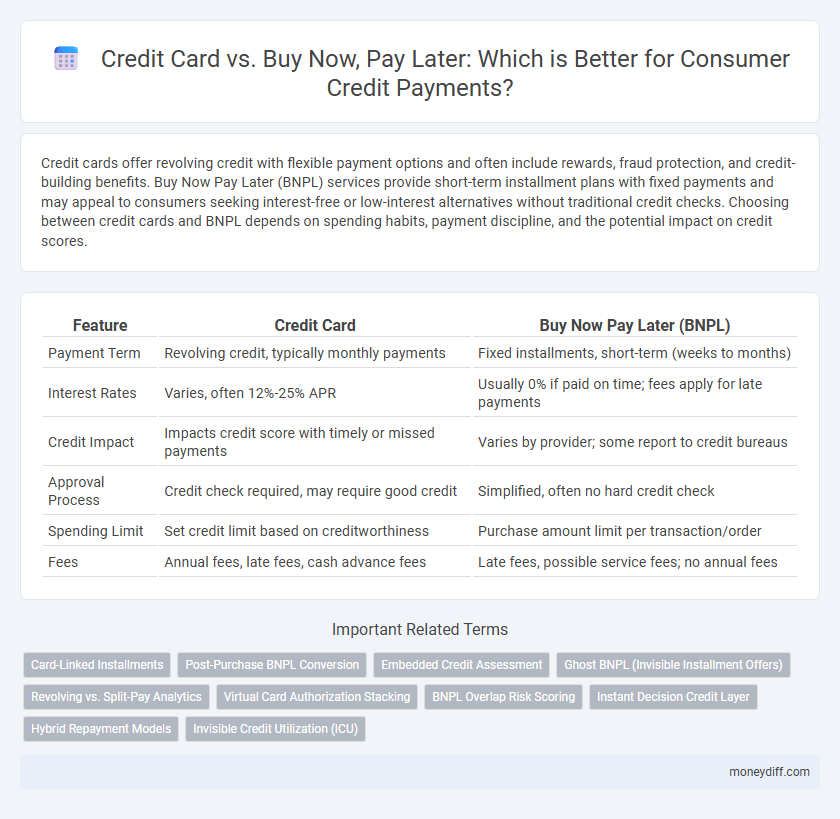

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Payment Term | Revolving credit, typically monthly payments | Fixed installments, short-term (weeks to months) |

| Interest Rates | Varies, often 12%-25% APR | Usually 0% if paid on time; fees apply for late payments |

| Credit Impact | Impacts credit score with timely or missed payments | Varies by provider; some report to credit bureaus |

| Approval Process | Credit check required, may require good credit | Simplified, often no hard credit check |

| Spending Limit | Set credit limit based on creditworthiness | Purchase amount limit per transaction/order |

| Fees | Annual fees, late fees, cash advance fees | Late fees, possible service fees; no annual fees |

Understanding Credit Cards and Buy Now Pay Later: A Brief Overview

Credit cards provide consumers with a revolving line of credit that can be used for purchases, offering benefits like rewards, fraud protection, and credit score improvement when used responsibly. Buy Now Pay Later (BNPL) services allow consumers to split payments into fixed installments over a short period without traditional interest rates, attracting users seeking flexible, interest-free financing options. Understanding the differences in credit impact, fees, and repayment terms is essential for making informed decisions between credit cards and BNPL options.

Key Differences Between Credit Cards and BNPL Services

Credit cards offer revolving credit with interest charges on unpaid balances, while Buy Now Pay Later (BNPL) services provide interest-free installment plans for short-term purchases. Credit cards typically include benefits like rewards programs and fraud protection, whereas BNPL services emphasize simplicity and immediate purchase approval without impacting credit scores. Consumers must weigh credit card flexibility and long-term credit building against BNPL's convenience and potential fees for missed payments.

Interest Rates and Fees: Comparing Costs

Credit cards typically charge interest rates ranging from 15% to 25% APR, along with potential annual fees and late payment penalties. Buy Now Pay Later (BNPL) services often offer interest-free periods but may impose late fees or high interest rates if payments are missed. Evaluating the total cost of borrowing requires careful consideration of these variable fees and rates to determine the most economical payment option for consumers.

Consumer Eligibility and Approval Processes

Consumer eligibility for credit cards typically requires a thorough credit check, proof of steady income, and a minimum credit score, reflecting a more stringent approval process. Buy Now Pay Later (BNPL) services often feature simpler and faster approval mechanisms, relying on real-time spending behavior and sometimes foregoing hard credit inquiries. BNPL platforms cater to a broader range of consumers, including those with limited credit history, while credit cards demand stronger financial credentials for approval.

Impact on Credit Score and Financial Health

Credit cards typically impact credit scores through timely payments and credit utilization rates, positively influencing credit history when managed responsibly. Buy Now Pay Later (BNPL) services may not always report to credit bureaus, limiting their direct effect on credit scores but potentially risking financial health if users accumulate debt across multiple platforms. Consumers should weigh BNPL's short-term convenience against credit cards' longer-term credit-building benefits to maintain strong financial health and creditworthiness.

Flexibility and Repayment Options

Credit cards offer flexible spending limits and a variety of repayment options, including minimum payments and revolving balances, allowing consumers to manage cash flow at their convenience. Buy Now Pay Later (BNPL) services typically provide fixed installment plans with predetermined repayment schedules, promoting budgeting discipline but limiting flexibility. Consumers seeking adjustable repayment terms may prefer credit cards, while those prioritizing predictable payments often opt for BNPL solutions.

Security and Fraud Protection Considerations

Credit cards offer robust security features such as EMV chip technology, fraud monitoring, and zero-liability policies that protect consumers from unauthorized transactions. Buy Now Pay Later (BNPL) services often have less comprehensive fraud protection, relying more on identity verification and less on real-time transaction monitoring. Consumers should assess the security protocols and fraud recovery options of BNPL providers compared to credit card issuers to ensure adequate protection of their financial information.

Rewards, Perks, and Cashback: What Consumers Gain

Credit cards often offer robust rewards programs, including cashback, travel points, and exclusive perks that enhance consumer value during purchases. Buy Now Pay Later (BNPL) services typically lack extensive rewards or cashback incentives but provide the benefit of interest-free installment payments, improving short-term affordability. Consumers seeking long-term financial benefits tend to gain more from credit card rewards, while BNPL appeals to those prioritizing payment flexibility without upfront costs.

Risks and Responsible Usage Tips

Credit cards offer flexible payment options but carry risks such as high-interest rates and potential debt accumulation if balances are not paid in full. Buy Now Pay Later (BNPL) services can lead to overspending due to easy approval and staggered payments, often lacking clear interest fees but possibly incurring late charges. Consumers should monitor spending habits, ensure timely payments, and understand terms to avoid financial pitfalls with both credit options.

Which Payment Method Suits Your Financial Lifestyle?

Credit cards offer flexible credit limits, rewards programs, and widespread acceptance, ideal for consumers seeking long-term credit management and cashback benefits. Buy Now Pay Later (BNPL) services provide interest-free installments, appealing to those prioritizing short-term budgeting without accumulating interest. Choosing between credit cards and BNPL depends on your spending habits, financial discipline, and the importance of credit-building versus immediate payment convenience.

Related Important Terms

Card-Linked Installments

Card-linked installments combine the flexibility of credit cards with the convenience of Buy Now Pay Later (BNPL) services, allowing consumers to split purchases into fixed payments without applying for separate BNPL accounts. This payment method leverages credit card networks for seamless transactions, enhances approval rates by utilizing existing credit profiles, and often provides rewards and fraud protection not typically available with standalone BNPL options.

Post-Purchase BNPL Conversion

Post-purchase Buy Now Pay Later (BNPL) options enable consumers to split payments after receiving goods, enhancing affordability and increasing conversion rates by reducing cart abandonment compared to traditional credit cards. BNPL services like Klarna and Afterpay offer interest-free installments, appealing to budget-conscious shoppers wary of credit card debt and high-interest rates.

Embedded Credit Assessment

Embedded credit assessment in credit cards enables real-time evaluation of a consumer's creditworthiness, allowing instant credit limits and transaction approvals. Buy Now Pay Later (BNPL) platforms often use simplified or delayed credit checks, potentially increasing accessibility but also raising risks of missed payments and higher default rates.

Ghost BNPL (Invisible Installment Offers)

Ghost BNPL (Invisible Installment Offers) enables consumers to spread payments without the traditional visibility of installment options, contrasting with credit cards that typically present clear interest rates and payment schedules. This invisible approach can increase impulsive purchases but may obscure financial commitment, impacting consumers' ability to manage debt compared to the transparent terms of credit cards.

Revolving vs. Split-Pay Analytics

Credit card payments offer revolving credit, allowing consumers to carry balances with interest rates typically ranging from 15% to 25%, while Buy Now Pay Later (BNPL) services use split-pay models that divide purchases into interest-free installments over weeks or months. Revolving credit provides flexible repayment but may lead to higher debt costs, whereas split-pay analytics highlight improved short-term budgeting without interest accumulation, appealing to credit-averse consumers seeking manageable, fixed payments.

Virtual Card Authorization Stacking

Virtual card authorization stacking enables simultaneous holds on multiple transactions, offering consumers enhanced flexibility compared to traditional credit cards or Buy Now Pay Later (BNPL) options, which typically authorize payments sequentially. This feature reduces declined transactions and improves cash flow management by allowing consumers to optimize spending limits across different merchants in real-time.

BNPL Overlap Risk Scoring

Credit card transactions rely on comprehensive credit scoring that incorporates historical credit behavior and payment capacity, whereas Buy Now Pay Later (BNPL) services often assess consumer risk through alternative data points such as recent purchase activity and payment consistency. BNPL overlap risk scoring algorithms evaluate simultaneous usage of multiple BNPL providers to identify overextension risks, providing real-time insights distinct from traditional credit bureau models.

Instant Decision Credit Layer

Buy Now Pay Later (BNPL) offers an instant decision credit layer that enhances consumer payment flexibility by providing real-time approval without affecting traditional credit limits. Credit cards, while widely accepted, often involve slower approval processes and impact credit utilization rates, making BNPL a seamless alternative for immediate, short-term financing.

Hybrid Repayment Models

Hybrid repayment models blend credit card convenience with Buy Now Pay Later (BNPL) flexibility, offering consumers staggered payments with interest-free periods followed by traditional credit repayments. These models optimize cash flow management and enhance purchasing power by combining the immediate approvals of BNPL with the revolving credit features of credit cards.

Invisible Credit Utilization (ICU)

Invisible Credit Utilization (ICU) allows Buy Now Pay Later (BNPL) transactions to bypass traditional credit card utilization metrics, potentially preserving credit scores by not reflecting on credit reports, whereas credit cards report utilization rates directly to credit bureaus, influencing credit scores based on the percentage of credit used. Consumers leveraging BNPL can manage payments without immediate impact on credit utilization ratios, but lack of reporting may also hinder building a positive credit history compared to regular credit card use.

Credit Card vs Buy Now Pay Later for Consumer Payments Infographic

moneydiff.com

moneydiff.com