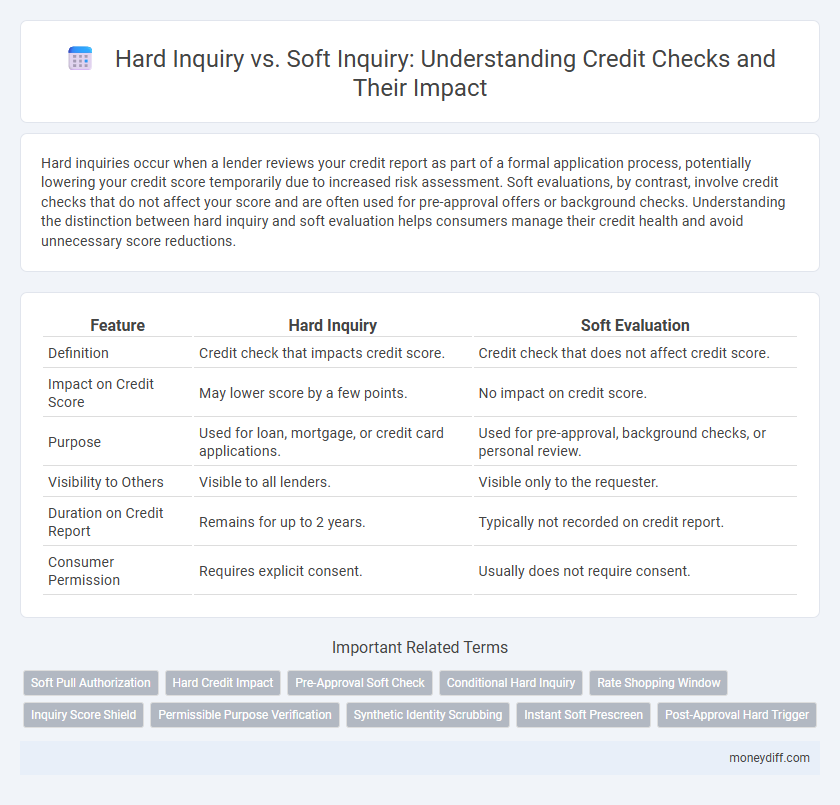

Hard inquiries occur when a lender reviews your credit report as part of a formal application process, potentially lowering your credit score temporarily due to increased risk assessment. Soft evaluations, by contrast, involve credit checks that do not affect your score and are often used for pre-approval offers or background checks. Understanding the distinction between hard inquiry and soft evaluation helps consumers manage their credit health and avoid unnecessary score reductions.

Table of Comparison

| Feature | Hard Inquiry | Soft Evaluation |

|---|---|---|

| Definition | Credit check that impacts credit score. | Credit check that does not affect credit score. |

| Impact on Credit Score | May lower score by a few points. | No impact on credit score. |

| Purpose | Used for loan, mortgage, or credit card applications. | Used for pre-approval, background checks, or personal review. |

| Visibility to Others | Visible to all lenders. | Visible only to the requester. |

| Duration on Credit Report | Remains for up to 2 years. | Typically not recorded on credit report. |

| Consumer Permission | Requires explicit consent. | Usually does not require consent. |

Understanding Hard Inquiries: Impact on Your Credit

Hard inquiries occur when a lender or creditor reviews your credit report as part of a credit application, which can temporarily lower your credit score by a few points. These inquiries remain on your credit report for up to two years and indicate active credit-seeking behavior, potentially affecting your creditworthiness. Understanding the impact of hard inquiries helps in managing credit applications strategically to minimize negative effects on your credit score.

What Is a Soft Credit Evaluation?

A soft credit evaluation, also known as a soft inquiry, occurs when a lender or company checks your credit report without impacting your credit score. This type of check is commonly used for pre-approvals, background checks, or by consumers reviewing their own credit. Soft evaluations provide insight into credit history without generating a visible inquiry on credit reports viewed by potential future lenders.

Key Differences Between Hard and Soft Credit Checks

Hard inquiries impact credit scores by temporarily lowering them and appear on credit reports, signaling lenders about recent credit-seeking activity, while soft inquiries do not affect scores and remain hidden from lenders. Hard credit checks are conducted during applications for new credit like loans or credit cards, whereas soft evaluations occur during background checks or pre-approved offers without explicit borrower consent. Understanding these distinctions is vital for managing credit health and maintaining a strong credit profile.

When Do Lenders Perform Hard Inquiries?

Lenders perform hard inquiries when evaluating a borrower's credit application for loans, credit cards, or mortgages to assess creditworthiness. These inquiries occur typically during formal credit approval processes, such as applying for a new credit card, personal loan, auto loan, or mortgage. Hard inquiries can impact credit scores slightly and remain on credit reports for up to two years.

Common Situations for Soft Credit Evaluations

Soft credit evaluations typically occur during pre-approval offers, account reviews by existing creditors, and employment background checks where no explicit permission for a hard inquiry is required. These evaluations do not impact the applicant's credit score and allow lenders to assess creditworthiness without signaling a new loan application. Common situations include checking eligibility for credit card pre-approvals, tenant screening, or identity verification.

How Hard Inquiries Affect Your Credit Score

Hard inquiries occur when lenders conduct a thorough credit check during applications for loans, credit cards, or mortgages, typically lowering your credit score by a few points. These inquiries remain on your credit report for up to two years, with the most significant impact felt within the first 12 months. Multiple hard inquiries in a short period can signal increased risk to lenders, further reducing your creditworthiness.

Advantages of Soft Credit Checks for Consumers

Soft credit checks allow consumers to monitor their credit without impacting their credit score, providing an advantage over hard inquiries that can temporarily lower scores. These non-intrusive evaluations help individuals stay informed about their credit status and identify potential issues early while maintaining credit health. Financial institutions often use soft checks for pre-approval offers, enabling consumers to explore credit options confidently without risk.

Limiting Negative Impact from Hard Credit Checks

Hard inquiries on credit reports can lower credit scores by a few points, impacting loan approval chances and interest rates. Limiting hard inquiries by spacing out credit applications or checking pre-qualification offers through soft evaluations helps maintain credit health. Soft credit checks do not affect credit scores and provide lenders with basic credit information without negative consequences.

Monitoring Your Credit: Hard vs Soft Inquiries

Monitoring your credit involves understanding the difference between hard and soft inquiries: hard inquiries occur when lenders review your credit report during loan or credit card applications, potentially impacting your credit score, while soft inquiries happen during background checks or pre-approved offers and do not affect your score. Frequent hard inquiries within a short timeframe can signal higher credit risk to lenders, making it essential to limit unnecessary credit applications. Reviewing your credit report regularly helps track both types of inquiries and maintain healthy credit monitoring habits.

Best Practices for Managing Credit Inquiries

Effective management of credit inquiries involves distinguishing between hard inquiries, which may temporarily lower credit scores, and soft evaluations that do not impact credit ratings. Consumers should limit the frequency of hard credit checks by consolidating loan applications and reviewing credit reports through soft inquiries to maintain optimal credit health. Financial institutions recommend monitoring inquiry activity regularly to prevent unnecessary hard inquiries and safeguard credit score stability.

Related Important Terms

Soft Pull Authorization

Soft pull authorization allows lenders to check a consumer's credit report without impacting their credit score, making it ideal for pre-approval and background checks. Unlike hard inquiries, soft evaluations do not appear on credit reports viewed by other lenders, preserving the applicant's credit standing during initial credit assessments.

Hard Credit Impact

Hard credit inquiries typically occur when applying for loans or credit cards, causing a temporary dip in your credit score that can last up to 12 months. This impact signals lenders that you are actively seeking new credit, which may increase perceived risk and influence credit approval decisions.

Pre-Approval Soft Check

A pre-approval soft check for credit allows lenders to assess a consumer's creditworthiness without impacting their credit score, unlike a hard inquiry which can slightly lower it. Soft evaluations provide a non-intrusive method for obtaining conditional offers, helping consumers explore financing options while preserving their credit profile.

Conditional Hard Inquiry

Conditional Hard Inquiry occurs when a lender initiates a credit check that may turn into a hard inquiry only if specific criteria are met, impacting credit scores more significantly than a soft evaluation. This type of inquiry balances the need for a thorough credit assessment with the potential future effect on credit ratings, differing from soft evaluations that do not affect credit scores.

Rate Shopping Window

The Rate Shopping Window allows borrowers to make multiple hard inquiries for the same type of loan, such as mortgages or auto loans, within a short period--typically 14 to 45 days--counting as a single inquiry to minimize credit score impact. Soft evaluations, unlike hard inquiries, do not affect credit scores and are often used for pre-approvals or background checks during rate shopping to assess creditworthiness without lowering the score.

Inquiry Score Shield

Hard inquiries impact credit scores by signaling new credit applications, often lowering the score temporarily, whereas soft evaluations do not affect credit ratings and are typically used for pre-approval or background checks. Inquiry Score Shield helps consumers monitor and manage hard inquiry impacts by providing alerts and strategies to minimize score declines during credit reviews.

Permissible Purpose Verification

Permissible Purpose Verification ensures that both hard inquiries, which impact credit scores and require explicit consumer authorization, and soft evaluations, which do not affect scores and can be conducted without direct consent, comply with the Fair Credit Reporting Act regulations. Lenders and employers must verify valid permissible purposes such as credit applications, account reviews, or background checks to lawfully access consumer credit reports.

Synthetic Identity Scrubbing

Hard inquiries impact credit scores by signaling new credit applications, while soft evaluations do not affect scores and are typically used for pre-approval or background checks. Synthetic identity scrubbing helps differentiate genuine credit inquiries from fraudulent ones by analyzing patterns in hard and soft credit checks to prevent identity theft and credit abuse.

Instant Soft Prescreen

Instant Soft Prescreen allows lenders to evaluate a borrower's creditworthiness without impacting their credit score, as it involves a soft evaluation that does not trigger a hard inquiry on credit reports. This method enables faster pre-approval decisions while preserving the consumer's credit profile and maintaining a seamless application process.

Post-Approval Hard Trigger

A post-approval hard inquiry occurs when a lender performs a credit check after approving a loan or credit card application, impacting the borrower's credit score by potentially lowering it temporarily. In contrast, soft evaluations, commonly used for pre-approval or background checks, do not affect the credit score and are typically invisible to other lenders.

Hard Inquiry vs Soft Evaluation for credit checks. Infographic

moneydiff.com

moneydiff.com