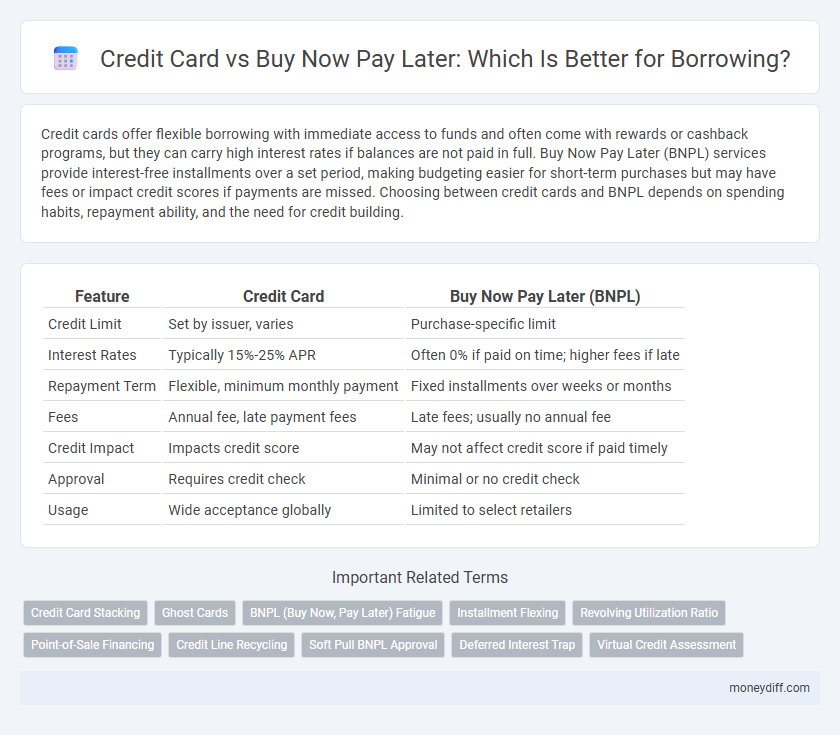

Credit cards offer flexible borrowing with immediate access to funds and often come with rewards or cashback programs, but they can carry high interest rates if balances are not paid in full. Buy Now Pay Later (BNPL) services provide interest-free installments over a set period, making budgeting easier for short-term purchases but may have fees or impact credit scores if payments are missed. Choosing between credit cards and BNPL depends on spending habits, repayment ability, and the need for credit building.

Table of Comparison

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Credit Limit | Set by issuer, varies | Purchase-specific limit |

| Interest Rates | Typically 15%-25% APR | Often 0% if paid on time; higher fees if late |

| Repayment Term | Flexible, minimum monthly payment | Fixed installments over weeks or months |

| Fees | Annual fee, late payment fees | Late fees; usually no annual fee |

| Credit Impact | Impacts credit score | May not affect credit score if paid timely |

| Approval | Requires credit check | Minimal or no credit check |

| Usage | Wide acceptance globally | Limited to select retailers |

Understanding Credit Cards and Buy Now Pay Later

Credit cards offer revolving credit with interest charges on unpaid balances, enabling flexible borrowing and reward points accumulation, while Buy Now Pay Later (BNPL) services provide short-term, installment-based financing with zero or low interest if paid on time, primarily targeting point-of-sale purchases. Credit cards impact credit scores through utilization and payment history, whereas BNPL usage may have limited or variable effects on credit reports depending on the provider's reporting practices. Understanding these distinctions helps consumers choose borrowing methods aligned with their financial habits and repayment capabilities.

Key Differences Between Credit Cards and BNPL

Credit cards offer revolving credit with interest applied to outstanding balances, while Buy Now Pay Later (BNPL) provides short-term installment plans often with no interest if payments are made on time. Credit cards typically report to credit bureaus and affect credit scores, whereas many BNPL services have limited impact on credit reports. Furthermore, credit cards provide broader acceptance and additional benefits like rewards and fraud protection, contrasting with BNPL's restricted merchant partnerships and simpler approval processes.

Eligibility Requirements for Credit Cards vs BNPL

Credit cards typically require a strong credit score, steady income, and a thorough credit history to qualify, reflecting lenders' emphasis on financial reliability and risk assessment. Buy Now Pay Later (BNPL) services often have more lenient eligibility criteria, sometimes approving users with minimal credit checks, making them accessible to individuals with limited or no credit history. The difference in eligibility requirements impacts overall borrowing accessibility, with credit cards demanding more rigorous vetting compared to the streamlined approval process of BNPL options.

Interest Rates and Fees Comparison

Credit cards typically charge interest rates ranging from 15% to 25% APR, with potential fees including annual fees, late payments, and cash advance charges, making borrowing potentially costly if balances are not paid in full. Buy Now Pay Later (BNPL) services often offer interest-free periods or lower fees but may impose late fees or higher interest rates after the promotional window ends. Comparing these options requires evaluating the effective interest rate, fee structure, and repayment terms to determine the most cost-efficient borrowing method.

Repayment Terms: Flexibility and Structure

Credit card repayment terms typically offer ongoing flexibility with minimum monthly payments and the option to pay in full, affecting interest accrual and credit utilization. Buy Now Pay Later (BNPL) provides more structured repayment schedules, often with equal installments over a set period and little to no interest if paid on time. Understanding these differences is crucial for managing cash flow and avoiding late fees or high-interest charges.

Impact on Credit Score: Credit Cards vs BNPL

Credit cards typically impact credit scores positively when payments are made on time, as they contribute to credit history length, credit utilization ratio, and payment history, which are key factors in credit scoring models like FICO. Buy Now Pay Later (BNPL) services often do not report to major credit bureaus unless the account becomes delinquent, resulting in minimal impact on credit scores for timely payments but potential negative effects if payments are missed. Managing credit cards responsibly can build credit over time, whereas BNPL offers short-term borrowing convenience with limited credit score benefits unless defaults occur.

Rewards, Perks, and Promotions

Credit cards often offer extensive rewards programs, including cash back, travel points, and exclusive discounts, which can increase the value of everyday spending. Buy Now Pay Later (BNPL) services typically lack such perks, focusing instead on flexible repayment schedules without interest or fees if paid on time. Promotions tied to credit cards frequently include sign-up bonuses and merchant partnerships, giving cardholders access to unique deals that BNPL providers rarely match.

Consumer Protections and Security

Credit cards offer robust consumer protections such as fraud liability limits, dispute resolution processes, and secure encryption technologies that safeguard transactions. Buy Now Pay Later (BNPL) services often have less stringent regulatory oversight, leading to fewer formal protections against fraud or billing errors. Consumers should weigh the security features and dispute rights provided by credit cards against the typically simpler but less protected BNPL agreements when choosing a borrowing method.

Risks and Responsible Usage

Credit cards involve revolving credit with interest charges on unpaid balances, increasing the risk of debt accumulation if not managed carefully. Buy Now Pay Later (BNPL) offers short-term installment plans that may lead to overspending due to deferred payments and lack of traditional credit checks. Responsible usage of both options requires budgeting, timely payments, and awareness of fees to avoid damaging credit scores and financial health.

Choosing the Right Borrowing Option

Choosing the right borrowing option depends on your financial situation and repayment discipline. Credit cards offer revolving credit with flexible spending limits and possible rewards, but high interest rates can accumulate if balances are not paid on time. Buy Now Pay Later solutions provide interest-free installments for short-term purchases, ideal for managing cash flow without incurring debt interest, yet they may limit credit-building opportunities compared to credit cards.

Related Important Terms

Credit Card Stacking

Credit card stacking involves applying for multiple credit cards simultaneously to maximize available credit limits, offering flexible borrowing and immediate purchasing power. Unlike Buy Now Pay Later services that split payments over time with fixed plans, credit card stacking can increase overall credit utilization but carries risks of higher interest rates and potential impact on credit scores if not managed carefully.

Ghost Cards

Ghost Cards, virtual credit card numbers linked to primary credit accounts, provide enhanced security and control for borrowers compared to Buy Now Pay Later (BNPL) services by minimizing fraud risk and enabling flexible spending limits. Unlike BNPL, which often entails strict repayment schedules and potential late fees, Ghost Cards allow users to manage credit usage discreetly while maintaining the benefits of traditional credit card rewards and protection.

BNPL (Buy Now, Pay Later) Fatigue

Buy Now Pay Later (BNPL) services offer short-term interest-free installment plans but often lead to BNPL fatigue due to multiple overlapping payments and lack of comprehensive credit reporting, increasing the risk of overspending. In contrast, credit cards provide a unified credit line with clear credit score impact and reward programs, making them a more transparent borrowing option for managing debt responsibly.

Installment Flexing

Credit cards offer flexible installment options that allow consumers to repay purchases over time with variable interest rates, while Buy Now Pay Later (BNPL) services provide fixed, short-term installment plans often without interest if payments are made on schedule. The installment flexing feature of credit cards enables users to adjust payment amounts and schedules based on their financial situation, whereas BNPL typically enforces stricter repayment terms with limited flexibility.

Revolving Utilization Ratio

Credit cards impact the revolving utilization ratio by reflecting the amount of revolving credit used relative to the total available credit, which directly influences credit scores and borrowing capacity. Buy Now Pay Later (BNPL) services typically do not affect revolving utilization ratios since they are often treated as installment loans or separate accounts, potentially resulting in a lesser impact on credit scoring models.

Point-of-Sale Financing

Credit cards offer revolving credit with flexible repayment options and typically higher interest rates, making them suitable for ongoing purchases and cash advances. Buy Now Pay Later (BNPL) provides interest-free installment plans at point-of-sale, promoting easier budgeting for specific purchases but often lacks the broad credit-building benefits of credit cards.

Credit Line Recycling

Credit card credit line recycling allows borrowers to reuse their available credit limit as they repay balances, providing continuous access to funds without reapplying, unlike Buy Now Pay Later (BNPL) services which offer fixed, one-time borrowing amounts for specific purchases. This recycling feature supports greater financial flexibility and credit management efficiency for users leveraging revolving credit products.

Soft Pull BNPL Approval

Soft pull BNPL approval enhances credit accessibility by allowing consumers to borrow without impacting their credit score, unlike traditional credit cards that often require hard inquiries. This frictionless process encourages responsible borrowing and improves approval rates for individuals with limited or no credit history.

Deferred Interest Trap

Credit cards and Buy Now Pay Later (BNPL) services both offer borrowing options but differ significantly in cost structures, particularly regarding deferred interest traps. Credit cards may impose high-interest rates immediately on unpaid balances, while BNPL plans often attract consumers with no upfront interest but can trigger deferred interest charges if payments are missed or not completed within the promotional period, leading to unexpectedly high debt burdens.

Virtual Credit Assessment

Virtual credit assessment leverages AI algorithms to evaluate borrower risk more efficiently for both credit cards and Buy Now Pay Later (BNPL) services, analyzing transaction history, income patterns, and digital footprints in real-time. This technology reduces default rates by providing lenders with instant, data-driven insights to tailor borrowing limits and repayment terms according to individual creditworthiness.

Credit Card vs Buy Now Pay Later for borrowing. Infographic

moneydiff.com

moneydiff.com