A credit limit defines the maximum amount a borrower can spend on a credit card or loan, providing a fixed borrowing cap that helps manage debt and spending. A flexible credit line offers adjustable borrowing capacity based on the borrower's creditworthiness and repayment history, allowing for more adaptable access to funds. Choosing between the two depends on financial discipline and the need for access to variable funding.

Table of Comparison

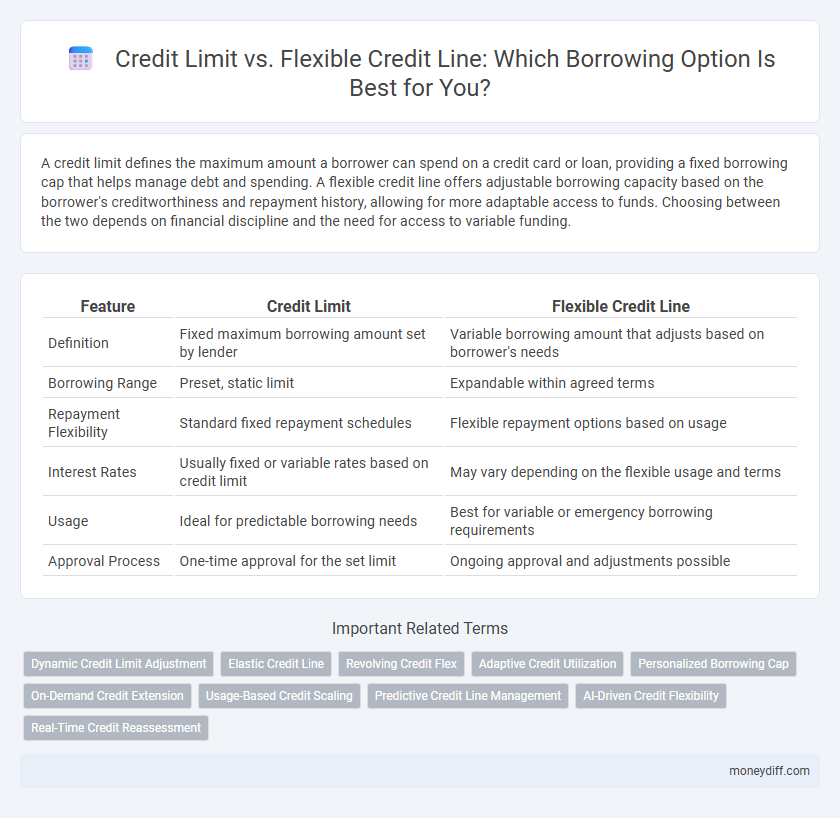

| Feature | Credit Limit | Flexible Credit Line |

|---|---|---|

| Definition | Fixed maximum borrowing amount set by lender | Variable borrowing amount that adjusts based on borrower's needs |

| Borrowing Range | Preset, static limit | Expandable within agreed terms |

| Repayment Flexibility | Standard fixed repayment schedules | Flexible repayment options based on usage |

| Interest Rates | Usually fixed or variable rates based on credit limit | May vary depending on the flexible usage and terms |

| Usage | Ideal for predictable borrowing needs | Best for variable or emergency borrowing requirements |

| Approval Process | One-time approval for the set limit | Ongoing approval and adjustments possible |

Understanding Credit Limits: Definition and Importance

A credit limit is the maximum amount a lender allows a borrower to charge on a credit account, defining the borrowing boundary and impacting credit utilization ratio. Flexible credit lines offer adjustable borrowing limits based on creditworthiness and repayment behavior, providing adaptability for changing financial needs. Understanding credit limits is crucial for managing debt responsibly, maintaining a healthy credit score, and avoiding over-limit fees.

What is a Flexible Credit Line? Key Features Explained

A flexible credit line offers borrowers adjustable borrowing limits that can be increased or decreased based on creditworthiness and repayment behavior, unlike a fixed credit limit that remains constant. Key features include revolving access to funds, variable interest rates, and the ability to draw and repay funds multiple times within the approved limit. This flexibility supports better cash flow management and personalized credit utilization compared to traditional fixed credit limit products.

Credit Limit vs Flexible Credit Line: Core Differences

A credit limit is a fixed maximum amount a borrower can access on a credit card or loan, set by the lender based on creditworthiness and income. In contrast, a flexible credit line offers variable borrowing capacity that adjusts according to the borrower's repayment behavior and changing financial needs. Core differences include fixed versus dynamic borrowing caps, repayment flexibility, and usage adaptability to match fluctuating cash flow requirements.

Eligibility Criteria for Traditional Credit Limits

Traditional credit limits typically require a strong credit score, steady income, and a low debt-to-income ratio to qualify. Lenders evaluate credit history, employment stability, and existing financial obligations to determine eligibility. These stringent criteria contrast with flexible credit lines, which often offer more adaptable borrowing terms but may require higher interest rates or different qualification factors.

Qualifying for a Flexible Credit Line: What Lenders Seek

Lenders evaluate creditworthiness for a flexible credit line by analyzing factors such as credit score, income stability, and existing debt levels to ensure responsible borrowing capacity. Unlike fixed credit limits, flexible credit lines require a strong financial profile and consistent repayment history to qualify for adjustable borrowing amounts. Risk assessment models and debt-to-income ratios play crucial roles in determining eligibility and the maximum flexible credit line offered.

Pros and Cons of Fixed Credit Limits for Borrowers

Fixed credit limits provide borrowers with a clear maximum borrowing amount, promoting disciplined spending and easier budget management. However, this rigid cap may restrict access to additional funds during emergencies or unexpected expenses, limiting financial flexibility. Borrowers face the trade-off between predictable debt control and potential inconvenience due to lack of credit adaptability.

Advantages and Drawbacks of Flexible Credit Lines

Flexible credit lines offer borrowers the advantage of accessing funds up to a predefined limit with the ability to borrow, repay, and borrow again, providing enhanced liquidity and adaptability compared to fixed credit limits. Drawbacks include variable interest rates that can increase borrowing costs and the potential for overspending due to the ease of access, leading to financial mismanagement if not carefully monitored. Unlike static credit limits, flexible lines of credit require disciplined repayment strategies to avoid fluctuating debt burdens and fees.

Impact on Credit Score: Fixed vs Flexible Credit Options

A fixed credit limit provides a clear borrowing cap that helps maintain stable credit utilization, positively influencing credit score consistency. Flexible credit lines allow variable borrowing amounts, which can lead to fluctuating credit utilization ratios and potentially impact credit scores unpredictably. Managing utilization within recommended thresholds is crucial for both options to support favorable credit score outcomes.

Cost Comparison: Interest Rates and Fees

Credit limits typically come with fixed interest rates and predetermined fees, which can make borrowing costs more predictable but less adaptable to changing financial needs. Flexible credit lines offer variable interest rates and may charge fees based on utilization, potentially leading to higher overall costs if usage fluctuates frequently. Comparing both options, borrowers can save on interest by choosing fixed-rate credit limits when consistent usage is expected, while flexible credit lines might be cost-effective for sporadic borrowing but often carry higher fees and rate variability.

Choosing the Right Borrowing Option for Your Financial Needs

Credit limits provide a fixed borrowing ceiling set by lenders based on creditworthiness, offering predictable financial boundaries ideal for disciplined budgeting. Flexible credit lines adapt to changing financial needs, allowing borrowers to access varying amounts up to a maximum limit and repay with variable terms, suitable for irregular expenses or cash flow fluctuations. Evaluating spending habits, repayment capacity, and financial goals helps determine whether a fixed credit limit's stability or a flexible credit line's adaptability better aligns with your borrowing strategy.

Related Important Terms

Dynamic Credit Limit Adjustment

Dynamic credit limit adjustment allows borrowers to have flexible credit lines that automatically increase or decrease based on real-time credit behavior and market conditions. Unlike fixed credit limits, this system optimizes borrowing capacity while managing risk by analyzing spending patterns, payment history, and credit score changes.

Elastic Credit Line

Elastic Credit Line offers a dynamic borrowing option that adjusts your credit limit based on real-time financial behavior and repayment patterns, unlike traditional fixed credit limits. This flexibility enhances borrowing capacity while reducing the risk of overextension, promoting smarter credit management and improved financial agility.

Revolving Credit Flex

Revolving Credit Flex offers a flexible credit line that adjusts based on the borrower's repayment behavior, unlike a fixed credit limit which remains static regardless of usage. This adaptive feature enhances borrowing capacity and credit availability, allowing users to better manage cash flow and avoid over-limit penalties.

Adaptive Credit Utilization

Credit limits provide a fixed borrowing cap that can restrict financial flexibility, whereas a flexible credit line adjusts based on spending patterns and creditworthiness, enhancing adaptive credit utilization. This dynamic approach optimizes borrowing capacity by aligning credit availability with real-time financial behavior and repayment ability.

Personalized Borrowing Cap

A personalized borrowing cap in credit limits provides a fixed maximum amount tailored to an individual's creditworthiness, ensuring predictable repayment terms and controlled spending. Flexible credit lines adjust dynamically based on usage patterns and financial behavior, offering more adaptable borrowing options but with potentially variable limits and interest rates.

On-Demand Credit Extension

Credit limits define a fixed maximum amount borrowers can access, while flexible credit lines offer on-demand credit extension that adjusts based on borrower needs and creditworthiness. This dynamic borrowing option enhances liquidity by allowing users to draw funds as required without preset restrictions, optimizing cash flow management.

Usage-Based Credit Scaling

Usage-based credit scaling adjusts the credit limit dynamically according to real-time spending patterns and repayment behavior, providing personalized borrowing capacity that reduces risk for lenders. Unlike fixed credit limits, flexible credit lines enable borrowers to access additional funds as their creditworthiness evolves, optimizing liquidity while maintaining control over debt exposure.

Predictive Credit Line Management

Predictive Credit Line Management leverages advanced algorithms to dynamically adjust credit limits based on real-time borrower behavior and financial data, enhancing risk assessment accuracy compared to static credit limits. This approach enables a flexible credit line that optimizes borrowing capacity while minimizing default risk through proactive credit limit recalibration.

AI-Driven Credit Flexibility

AI-driven credit flexibility enhances borrowing by dynamically adjusting credit limits based on real-time financial behavior and risk assessment, offering more personalized and adaptive credit lines compared to traditional fixed credit limits. This technology enables lenders to optimize credit utilization, reduce default rates, and provide borrowers with seamless access to funds aligned with their evolving financial needs.

Real-Time Credit Reassessment

Credit limit sets a fixed maximum borrowing amount, restricting flexibility in dynamic financial situations. Flexible credit lines allow real-time credit reassessment, enabling borrowers to access varying amounts based on updated creditworthiness and spending behavior.

Credit limit vs flexible credit line for borrowing Infographic

moneydiff.com

moneydiff.com