Credit cards offer widespread acceptance and often come with rewards, purchase protections, and the ability to build credit history, making them ideal for everyday spending and larger purchases. Virtual cards provide enhanced security for online transactions by generating unique card numbers, reducing the risk of fraud and unauthorized charges. Choosing between credit cards and virtual cards depends on the need for physical use versus prioritized online security and temporary use cases.

Table of Comparison

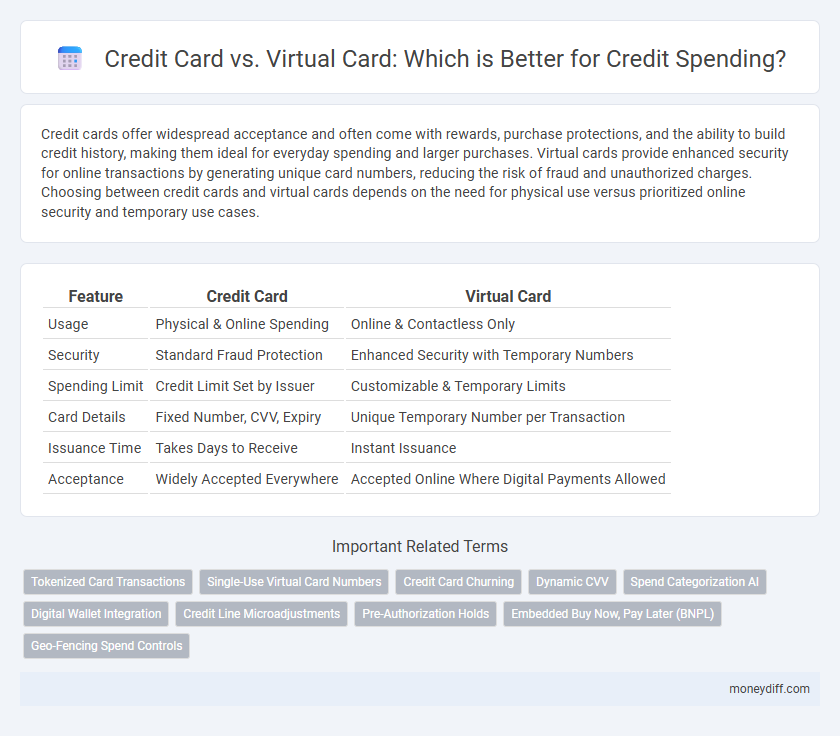

| Feature | Credit Card | Virtual Card |

|---|---|---|

| Usage | Physical & Online Spending | Online & Contactless Only |

| Security | Standard Fraud Protection | Enhanced Security with Temporary Numbers |

| Spending Limit | Credit Limit Set by Issuer | Customizable & Temporary Limits |

| Card Details | Fixed Number, CVV, Expiry | Unique Temporary Number per Transaction |

| Issuance Time | Takes Days to Receive | Instant Issuance |

| Acceptance | Widely Accepted Everywhere | Accepted Online Where Digital Payments Allowed |

Understanding Credit Cards and Virtual Cards

Credit cards offer physical cards linked to a credit line for in-store and online spending, providing rewards, fraud protection, and the ability to build credit history. Virtual cards generate temporary, digital card numbers tied to your main account, enhancing security for online purchases by minimizing exposure to fraud and unauthorized charges. Both credit and virtual cards facilitate flexible spending, but virtual cards are specifically designed to reduce risks associated with digital transactions.

Key Differences Between Credit Cards and Virtual Cards

Credit cards offer physical plastic cards linked to a credit line, enabling in-person and online spending with rewards and credit building benefits. Virtual cards consist of digital card numbers generated for online transactions, enhancing security by reducing fraud risks and enabling better spending controls through temporary or single-use numbers. Key differences include the physical presence, fraud protection features, and specific usage scenarios tailored to either broad acceptance or focused online security.

Security Features: Credit Card vs Virtual Card

Credit cards offer built-in fraud protection with zero-liability policies and EMV chip technology, but virtual cards provide enhanced security through single-use or limited-use numbers, minimizing exposure to theft during online transactions. Virtual cards reduce the risk of unauthorized charges since they can be easily canceled or regenerated without affecting the primary credit card account. Both options support encrypted payments and real-time monitoring, yet virtual cards stand out for their ability to isolate transactions and limit the impact of potential data breaches.

Ease of Use: Physical Card vs Digital Card

Physical credit cards offer straightforward usability for in-store purchases, allowing instant swiping or tapping without the need for device setup. Virtual cards provide enhanced convenience for online transactions, generating unique card numbers that improve security and reduce fraud risk. Both options cater to different spending environments, with physical cards excelling in face-to-face interactions and virtual cards optimizing digital payment experiences.

Purchase Protection and Fraud Prevention

Credit cards typically offer robust purchase protection policies, including extended warranties, price protection, and dispute resolution services, making them ideal for high-value or essential purchases. Virtual cards enhance fraud prevention by generating unique, single-use numbers for each transaction, reducing the risk of unauthorized charges and data breaches. Combining credit card benefits with virtual card security features provides consumers optimal protection against fraud while maintaining strong purchase safeguards.

Accessibility and Application Process

Credit cards offer widespread accessibility through physical use at retailers and ATMs, with an application process typically involving credit checks and income verification. Virtual cards provide instant issuance and use via mobile apps or online platforms, bypassing physical distribution but often requiring an existing credit account or digital wallet setup. Both options facilitate secure spending, yet virtual cards enhance accessibility for online transactions with faster approval times and reduced paperwork.

Managing Spending Limits and Controls

Credit cards offer flexible spending limits set by issuers, allowing users to make large or recurring purchases with built-in fraud protection and alerts. Virtual cards provide enhanced control by enabling users to generate unique card numbers with customizable spending limits and expiration dates for specific transactions. Managing spending controls is more precise with virtual cards, reducing the risk of overspending and unauthorized charges while maintaining convenience for online purchases.

International Use and Acceptance

Credit cards offer widespread international acceptance, enabling seamless transactions at millions of merchants worldwide, often providing robust fraud protection and rewards programs. Virtual cards, while increasingly supported for international use, excel in enhancing security for online purchases by generating unique card numbers, though their acceptance may be limited at physical point-of-sale terminals abroad. Choosing between the two depends on balancing the need for global merchant acceptance with enhanced security features tailored to international online spending.

Rewards, Fees, and Hidden Costs

Credit cards often offer higher rewards such as cash back, travel points, and exclusive discounts, whereas virtual cards focus more on security with limited reward programs. Fees on traditional credit cards can include annual charges, foreign transaction fees, and interest rates which may be higher compared to virtual cards that typically have fewer fees or none at all. Hidden costs in credit cards may involve penalty fees for late payments and balance transfers, while virtual cards usually minimize these risks by restricting spending limits and usage duration.

Choosing the Right Option for Your Spending Needs

Credit cards offer widespread acceptance and rewards programs ideal for frequent purchases and larger expenses, while virtual cards provide enhanced security features and controlled spending limits perfect for online transactions and subscription management. Evaluating your spending patterns, security concerns, and convenience needs helps determine whether a physical credit card or a virtual card aligns better with your financial habits. Prioritize virtual cards if minimizing fraud risk and managing specific expenses are crucial, whereas traditional credit cards offer flexibility and benefits for everyday spending.

Related Important Terms

Tokenized Card Transactions

Tokenized card transactions enhance security by replacing sensitive credit card information with unique digital tokens, reducing fraud risks during both credit card and virtual card spending. Virtual cards further improve protection by generating single-use numbers tied to tokenized data, enabling safer online and contactless transactions compared to traditional credit cards.

Single-Use Virtual Card Numbers

Single-use virtual card numbers provide enhanced security by generating a unique number for each transaction, reducing the risk of fraud compared to traditional credit cards which use a fixed card number. These virtual cards streamline online spending by limiting exposure to theft and unauthorized charges, making them ideal for one-time purchases and subscription services.

Credit Card Churning

Credit card churning involves frequently opening and closing credit card accounts to maximize rewards and bonuses, which is typically more effective with physical credit cards due to their broader acceptance and detailed transaction tracking. Virtual cards offer enhanced security and convenience for online spending but generally lack the extensive rewards programs and credit-building benefits crucial for successful credit card churning strategies.

Dynamic CVV

Credit cards offer a fixed CVV code that can be susceptible to fraud during online transactions, while virtual cards provide enhanced security with a dynamic CVV that changes regularly. This dynamic CVV feature reduces the risk of unauthorized purchases by ensuring that each transaction uses a unique, time-sensitive security code.

Spend Categorization AI

Credit cards provide detailed spend categorization powered by advanced AI algorithms that analyze transaction data to automatically classify expenses into categories like dining, travel, and utilities. Virtual cards enhance security and simplify expense tracking by generating unique card numbers for specific vendors, enabling precise AI-driven spend categorization and streamlined budget management.

Digital Wallet Integration

Credit cards offer widespread acceptance and seamless integration with most digital wallets, enabling easy in-store and online payments through devices like smartphones and smartwatches. Virtual cards enhance security by generating unique, temporary card numbers for each transaction while also integrating smoothly with digital wallets for convenient, contactless spending.

Credit Line Microadjustments

Credit cards offer dynamic credit line microadjustments based on spending patterns and credit utilization, enhancing purchasing power flexibility on physical and online transactions. Virtual cards provide controlled spending limits with customizable credit line adjustments for secure, targeted online purchases, minimizing fraud risk and optimizing budget management.

Pre-Authorization Holds

Credit cards often place pre-authorization holds on transactions to verify available funds, which can temporarily reduce the cardholder's available credit, while virtual cards typically offer real-time transaction authorization, minimizing or eliminating extended holds. Virtual cards provide enhanced security and immediate fund allocation, making them ideal for online purchases and reducing the impact of pre-authorization holds on spending limits.

Embedded Buy Now, Pay Later (BNPL)

Embedded Buy Now, Pay Later (BNPL) solutions integrated with virtual cards offer seamless, interest-free installment payments directly at checkout, enhancing user convenience without impacting credit scores. Unlike traditional credit cards, virtual cards paired with BNPL reduce fraud risk and provide increased control over spending limits, making them a preferred choice for responsible digital purchasing.

Geo-Fencing Spend Controls

Credit cards with Geo-Fencing spend controls allow users to restrict transactions to specific geographic locations, enhancing security and reducing fraud risk during in-person spending. Virtual cards offer similar geo-restriction features for online and mobile payments, providing flexible, location-based spend management without the need for a physical card.

Credit card vs virtual card for spending Infographic

moneydiff.com

moneydiff.com