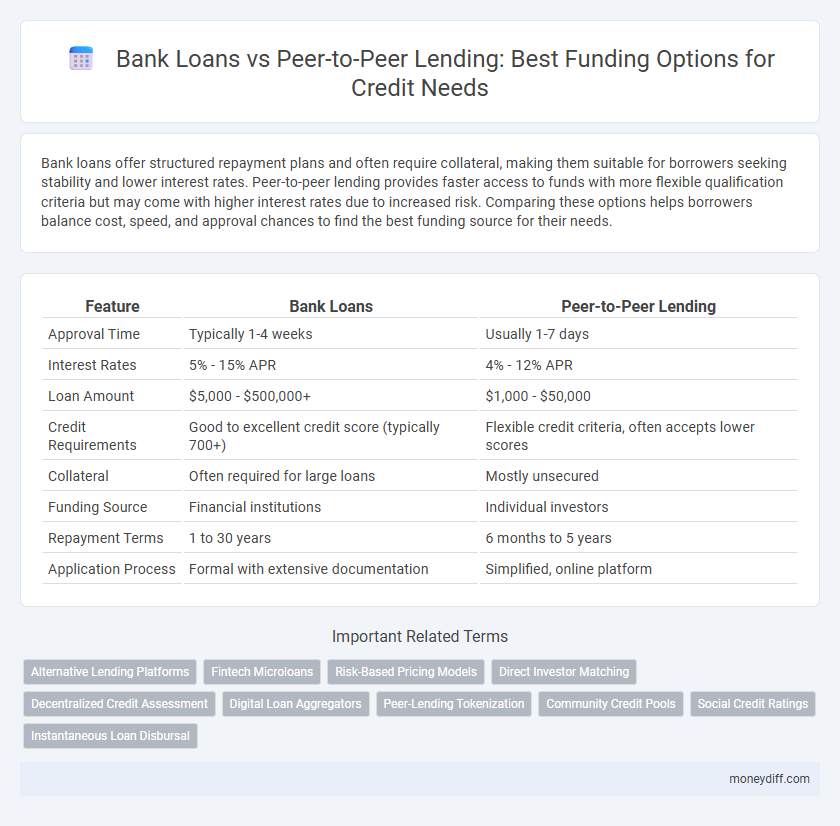

Bank loans offer structured repayment plans and often require collateral, making them suitable for borrowers seeking stability and lower interest rates. Peer-to-peer lending provides faster access to funds with more flexible qualification criteria but may come with higher interest rates due to increased risk. Comparing these options helps borrowers balance cost, speed, and approval chances to find the best funding source for their needs.

Table of Comparison

| Feature | Bank Loans | Peer-to-Peer Lending |

|---|---|---|

| Approval Time | Typically 1-4 weeks | Usually 1-7 days |

| Interest Rates | 5% - 15% APR | 4% - 12% APR |

| Loan Amount | $5,000 - $500,000+ | $1,000 - $50,000 |

| Credit Requirements | Good to excellent credit score (typically 700+) | Flexible credit criteria, often accepts lower scores |

| Collateral | Often required for large loans | Mostly unsecured |

| Funding Source | Financial institutions | Individual investors |

| Repayment Terms | 1 to 30 years | 6 months to 5 years |

| Application Process | Formal with extensive documentation | Simplified, online platform |

Understanding Traditional Bank Loans

Traditional bank loans offer fixed interest rates, structured repayment schedules, and require thorough credit evaluations, making them a reliable funding option for established businesses and individuals with strong credit profiles. Banks provide various loan types, including term loans, lines of credit, and mortgages, each designed to suit specific financial needs and ensure predictable cash flow management. The stringent approval process often involves collateral requirements, detailed financial documentation, and longer processing times compared to alternative financing methods.

Peer-to-Peer Lending: A Modern Alternative

Peer-to-peer lending offers a modern alternative to traditional bank loans by directly connecting borrowers with individual investors through online platforms, reducing approval times and often providing more flexible credit criteria. This funding option leverages technology to enable competitive interest rates that can be lower than those of conventional banks, making it attractive for small businesses and individuals with varied credit profiles. The decentralized nature of peer-to-peer lending also democratizes access to credit, bypassing the stringent regulatory hurdles typical of bank loans.

Eligibility Criteria: Bank Loans vs P2P Lending

Bank loans typically require stringent eligibility criteria, including a strong credit score, proof of stable income, and collateral, to minimize lender risk. Peer-to-peer (P2P) lending platforms offer more flexible requirements, often approving borrowers with lower credit scores and less documentation by assessing alternative data points. The difference in eligibility criteria makes P2P lending accessible to a broader range of borrowers who may not qualify for traditional bank loans.

Application Process Comparison

Bank loans typically require extensive documentation including credit checks, income verification, and collateral assessment, resulting in a longer and more stringent application process. Peer-to-peer lending platforms offer a streamlined online application with faster approvals by leveraging automated credit scoring and reducing the need for physical paperwork. This digital approach often lowers barriers for borrowers with moderate credit histories compared to traditional bank evaluations.

Interest Rates and Fees

Bank loans typically offer fixed or variable interest rates determined by credit scores and collateral, often accompanied by origination and processing fees. Peer-to-peer lending usually features competitive interest rates influenced by borrower risk profiles, with platform fees that vary but can be lower than traditional bank charges. Comparing both, peer-to-peer lending may provide more flexible terms and potentially lower overall costs, especially for borrowers with strong credit.

Speed of Funding and Approval

Bank loans typically involve a lengthy approval process, often taking several weeks due to thorough credit checks and document verification, whereas peer-to-peer lending platforms offer faster funding times, frequently within days, by leveraging streamlined online applications and alternative credit assessments. The speed of funding through P2P lending makes it an attractive option for borrowers needing quick access to capital without the traditional banking bureaucracy. However, bank loans may provide larger funding amounts and more favorable interest rates despite slower approval timelines.

Credit Score Requirements

Bank loans typically require a minimum credit score of 620 to qualify, with higher scores improving interest rates and loan terms. Peer-to-peer lending platforms often have more flexible credit score requirements, sometimes accepting scores as low as 580, making them accessible to borrowers with less-than-perfect credit. Both funding options assess creditworthiness, but peer-to-peer lending emphasizes alternative data and borrower profiles beyond traditional credit scores.

Flexibility and Repayment Terms

Bank loans typically offer fixed repayment schedules with set interest rates, which provide stability but limited flexibility for borrowers seeking tailored payment plans. Peer-to-peer lending platforms allow for more customizable repayment options, often enabling negotiated terms between borrower and individual lenders, which can accommodate fluctuating cash flows. Flexibility in peer-to-peer lending can result in varied interest rates and repayment durations, making it essential for borrowers to carefully evaluate the terms before committing.

Risks and Security Concerns

Bank loans typically offer higher security due to regulatory oversight and established collateral requirements, reducing default risk for lenders. Peer-to-peer lending carries increased credit risk as it lacks traditional banking safeguards, making investors more vulnerable to borrower defaults and fraud. Assessing risk tolerance and security measures is critical when choosing between these funding options.

Which Option Suits Your Funding Needs?

Bank loans offer structured repayment schedules and lower interest rates, making them ideal for borrowers with strong credit history and stable income seeking predictable financing. Peer-to-peer lending provides flexible borrowing terms and faster approval, suitable for individuals or small businesses with limited access to traditional credit sources. Evaluating your credit score, funding urgency, and loan amount helps determine whether conventional bank loans or peer-to-peer lending better align with your funding needs.

Related Important Terms

Alternative Lending Platforms

Alternative lending platforms, such as peer-to-peer lending, provide borrowers with faster approval processes and often lower interest rates compared to traditional bank loans, making them attractive for those who may not qualify for conventional credit. These platforms use technology to connect individual lenders with borrowers directly, increasing accessibility to funding and offering more flexible terms than standard bank financing options.

Fintech Microloans

Fintech microloans offer faster approval and more flexible terms compared to traditional bank loans, leveraging technology to provide accessible funding to underserved borrowers. Peer-to-peer lending platforms connect individual investors directly with borrowers, often resulting in competitive interest rates and streamlined application processes that bypass conventional bank requirements.

Risk-Based Pricing Models

Bank loans utilize risk-based pricing models that assess credit scores, income stability, and collateral to determine interest rates, ensuring lenders are compensated for borrower risk. Peer-to-peer lending platforms apply similar models but often incorporate alternative data and social profiles, enabling more personalized risk assessment and flexible pricing structures.

Direct Investor Matching

Direct investor matching in peer-to-peer lending connects borrowers with individual investors, often reducing loan approval time and offering competitive interest rates compared to traditional bank loans. Unlike bank loans, which involve institutional underwriting and stricter credit requirements, peer-to-peer platforms use algorithms to match creditworthy borrowers with suitable lenders, increasing funding accessibility.

Decentralized Credit Assessment

Peer-to-peer lending leverages decentralized credit assessment by utilizing blockchain technology and AI-driven analytics to evaluate borrower risk without traditional banking intermediaries, enhancing transparency and inclusivity. Bank loans rely on centralized credit scoring systems that may limit access for borrowers with unconventional credit histories, while decentralized platforms offer dynamic, data-rich evaluations that can improve funding opportunities.

Digital Loan Aggregators

Digital loan aggregators streamline the comparison of bank loans and peer-to-peer lending by providing real-time access to diverse funding options, interest rates, and repayment terms. Leveraging advanced algorithms, these platforms enhance transparency and speed, enabling borrowers to make informed credit decisions efficiently.

Peer-Lending Tokenization

Peer-to-peer lending tokenization leverages blockchain technology to fractionalize loans into digital tokens, enhancing transparency, liquidity, and accessibility compared to traditional bank loans. This innovative funding method reduces reliance on centralized banks by enabling investors to directly fund borrowers while benefiting from automated smart contract enforcement and reduced intermediaries.

Community Credit Pools

Community credit pools leverage collective resources from peer-to-peer lending platforms to offer borrowers competitive rates and flexible terms compared to traditional bank loans, which often require stringent credit checks and collateral. These decentralized funding options enhance access to capital by fostering trust and accountability within local or interest-based communities, reducing reliance on conventional banking institutions.

Social Credit Ratings

Bank loans rely heavily on traditional credit scores and financial history maintained by centralized credit bureaus, whereas peer-to-peer lending platforms often incorporate social credit ratings derived from social media behavior, online transactions, and peer reviews to assess creditworthiness. This integration of social credit scores in P2P lending enables more inclusive access to funds for individuals with limited credit history, while bank loans typically offer larger amounts with lower interest rates based on established credit profiles.

Instantaneous Loan Disbursal

Bank loans typically involve lengthy approval processes, delaying fund disbursal by days or weeks, whereas peer-to-peer lending platforms leverage automated algorithms and digital verification to enable instantaneous loan disbursal within hours. Rapid access to funds through P2P lending offers borrowers an efficient alternative for urgent financial needs compared to traditional banking institutions.

Bank Loans vs Peer-to-Peer Lending for funding options. Infographic

moneydiff.com

moneydiff.com