Credit cards allow users to borrow up to a preset limit and carry a balance with interest charges, providing flexibility in repayment. Charge cards require full payment of the balance each month, offering no option to carry debt but often reward disciplined spending. Understanding the differences helps consumers choose the best borrowing tool based on their financial habits and goals.

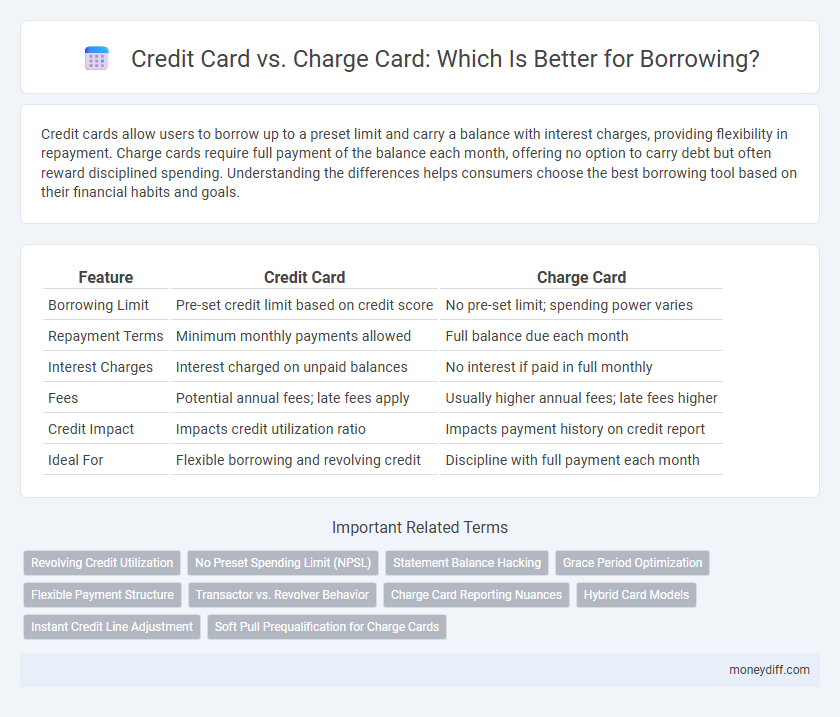

Table of Comparison

| Feature | Credit Card | Charge Card |

|---|---|---|

| Borrowing Limit | Pre-set credit limit based on credit score | No pre-set limit; spending power varies |

| Repayment Terms | Minimum monthly payments allowed | Full balance due each month |

| Interest Charges | Interest charged on unpaid balances | No interest if paid in full monthly |

| Fees | Potential annual fees; late fees apply | Usually higher annual fees; late fees higher |

| Credit Impact | Impacts credit utilization ratio | Impacts payment history on credit report |

| Ideal For | Flexible borrowing and revolving credit | Discipline with full payment each month |

Understanding Credit Cards and Charge Cards

Credit cards offer revolving credit with a preset limit, allowing cardholders to carry a balance and make minimum monthly payments, while charge cards require full payment of the balance each billing cycle without interest charges. Charge cards typically lack a preset spending limit, providing flexibility but demanding disciplined repayment, whereas credit cards charge interest on unpaid balances. Understanding these differences helps consumers choose the best borrowing option based on spending habits and repayment ability.

Key Differences Between Credit Cards and Charge Cards

Credit cards allow users to carry a revolving balance and pay interest on borrowed amounts, providing flexible repayment options. Charge cards require full payment of the balance each month, with no option to carry debt, promoting disciplined spending. Credit cards often have lower spending limits, while charge cards usually offer higher or no preset limits, catering to different borrowing needs.

Borrowing Limits: Credit vs. Charge Cards

Credit cards offer predefined borrowing limits based on creditworthiness, allowing cardholders to carry balances and make minimum monthly payments. Charge cards, in contrast, typically have no preset spending limits but require full payment of the balance each billing cycle, limiting borrowing flexibility. Understanding these differences is crucial for managing debt and avoiding interest charges effectively.

Interest Rates and Fees: A Comparative Analysis

Credit cards typically charge interest on carried balances, with rates ranging from 15% to 25% APR, and may include annual fees varying between $0 and $95 or more depending on the card type and credit tier. Charge cards require full payment each month to avoid late fees, generally do not carry interest because balances cannot be revolved, but often impose higher annual fees, typically $95 to $550, reflecting premium benefits. Borrowers seeking flexible repayment may prefer credit cards for manageable interest costs, while those prioritizing avoidance of interest charges and higher spending limits might opt for charge cards despite steeper fees.

Payment Flexibility: Which Card Offers More?

Credit cards provide greater payment flexibility by allowing cardholders to carry a balance and make minimum monthly payments, effectively borrowing over time with interest. Charge cards require the full balance to be paid each billing cycle, limiting the ability to finance purchases long-term but avoiding interest charges. Therefore, credit cards are generally more suitable for users seeking flexible repayment options, while charge cards emphasize disciplined, regular payment.

Impact on Credit Score: Credit Card vs. Charge Card

Credit cards impact credit scores by utilizing a revolving credit line that affects credit utilization ratio, a key factor in credit scoring models, while charge cards typically require full monthly repayment, which often results in lower reported credit utilization. Responsible use of credit cards can improve credit scores by demonstrating manageable credit usage and timely payments, whereas charge cards may enhance scores through consistent on-time payments but provide less influence on credit utilization metrics. Both credit and charge cards report payment history to credit bureaus, making timely repayment crucial for maintaining or boosting credit scores.

Eligibility and Approval Process Explained

Credit cards typically require a minimum credit score of around 620 and involve a soft or hard credit inquiry during the approval process, making them accessible to a broader range of applicants. Charge cards often demand a higher credit score, excellent credit history, and sometimes an invitation, reflecting stricter eligibility criteria and a more rigorous approval process. Understanding these differences helps consumers select the appropriate borrowing tool based on creditworthiness and application ease.

Rewards, Perks, and Incentives Comparison

Credit cards typically offer rewards programs that include cashback, points, or travel miles, providing flexible redemption options for purchases. Charge cards often feature premium perks such as access to exclusive events, concierge services, and no preset spending limit, catering to high spenders seeking luxury benefits. Incentives on credit cards generally emphasize earning on everyday expenses, while charge cards focus on enhanced lifestyle rewards and elevated customer service experiences.

Pros and Cons of Using Credit Cards for Borrowing

Credit cards offer flexible borrowing with revolving credit and the ability to carry a balance, but interest rates can be high if balances are not paid in full each month. They provide rewards, fraud protection, and widespread acceptance, yet risks include potential debt accumulation and negative impact on credit scores from high utilization. Charge cards require full payment monthly without interest charges but lack revolving credit and may have stricter spending limits, making credit cards preferable for long-term borrowing flexibility.

When to Choose a Charge Card Over a Credit Card

Choose a charge card over a credit card when you need to manage expenses without revolving debt, as charge cards require full payment each billing cycle, preventing interest accumulation. High spenders benefit from charge cards due to their higher or no preset spending limits and premium rewards tailored for frequent users. Individuals aiming to improve credit discipline and avoid debt reliance find charge cards ideal for responsible borrowing.

Related Important Terms

Revolving Credit Utilization

Credit cards offer revolving credit utilization, allowing borrowers to carry balances month-to-month with interest applied only to the unpaid amount, optimizing cash flow flexibility. Charge cards require full payment each billing cycle, eliminating revolving utilization but providing no ongoing credit balance to leverage for borrowing needs.

No Preset Spending Limit (NPSL)

Charge cards offer No Preset Spending Limit (NPSL), allowing flexible borrowing based on factors like payment history and creditworthiness, unlike traditional credit cards which have fixed credit limits. This feature provides cardholders with dynamic purchasing power without a capped spending threshold, improving financial adaptability.

Statement Balance Hacking

Statement Balance Hacking leverages credit cards by paying off the full statement balance before the due date, minimizing interest charges while optimizing credit utilization. Charge cards, requiring full payment each cycle, lack this flexibility, making statement balance hacking less effective for borrowing cost control.

Grace Period Optimization

Credit cards typically offer a grace period of 21 to 25 days on purchases, allowing borrowers to avoid interest charges if the balance is paid in full by the due date; charge cards often require full payment each month without interest-free periods, optimizing cash flow management for users who pay promptly. Maximizing grace period utilization on credit cards can reduce borrowing costs significantly compared to charge cards, which prioritize spending control over deferred payments.

Flexible Payment Structure

Credit cards offer a flexible payment structure allowing users to carry a balance and make minimum monthly payments, whereas charge cards require full payment of the balance each billing cycle without the option to carry debt. This difference significantly impacts cash flow management and borrowing convenience for cardholders.

Transactor vs. Revolver Behavior

Credit card holders exhibiting revolver behavior carry a balance from month to month, accruing interest on unpaid amounts, while transactors pay their full balance each statement cycle, avoiding interest charges altogether. Charge card users typically behave as transactors, required to settle the entire balance monthly, which contrasts with credit cards' flexibility for revolvers to carry debt over time.

Charge Card Reporting Nuances

Charge cards require full balance repayment each month, resulting in no revolving debt reported to credit bureaus; this lack of reported carried balance can impact credit utilization metrics differently than credit cards, which report ongoing balances and contribute to credit utilization ratios. Credit scoring models may treat charge card activity uniquely, emphasizing timely payment history over utilization, influencing creditworthiness assessments distinctively compared to traditional credit card borrowing.

Hybrid Card Models

Hybrid card models combine features of credit cards and charge cards, allowing cardholders to carry a balance like a credit card while requiring full payment each billing cycle similar to charge cards. These cards offer flexible borrowing options with controlled spending limits and varying interest rates that optimize user credit utilization and repayment behavior.

Instant Credit Line Adjustment

Credit cards offer instant credit line adjustments based on real-time spending patterns and credit utilization, providing flexibility and immediate borrowing capacity changes. Charge cards typically require full payment each month and do not provide a revolving credit line, limiting the possibility of instant credit line increases.

Soft Pull Prequalification for Charge Cards

Charge cards typically require a soft pull prequalification, allowing consumers to check eligibility without impacting their credit score, unlike many credit cards that perform hard inquiries during application. This soft pull process benefits borrowers by providing a risk-free way to assess borrowing options and manage credit without immediate score penalties.

Credit card vs charge card for borrowing. Infographic

moneydiff.com

moneydiff.com