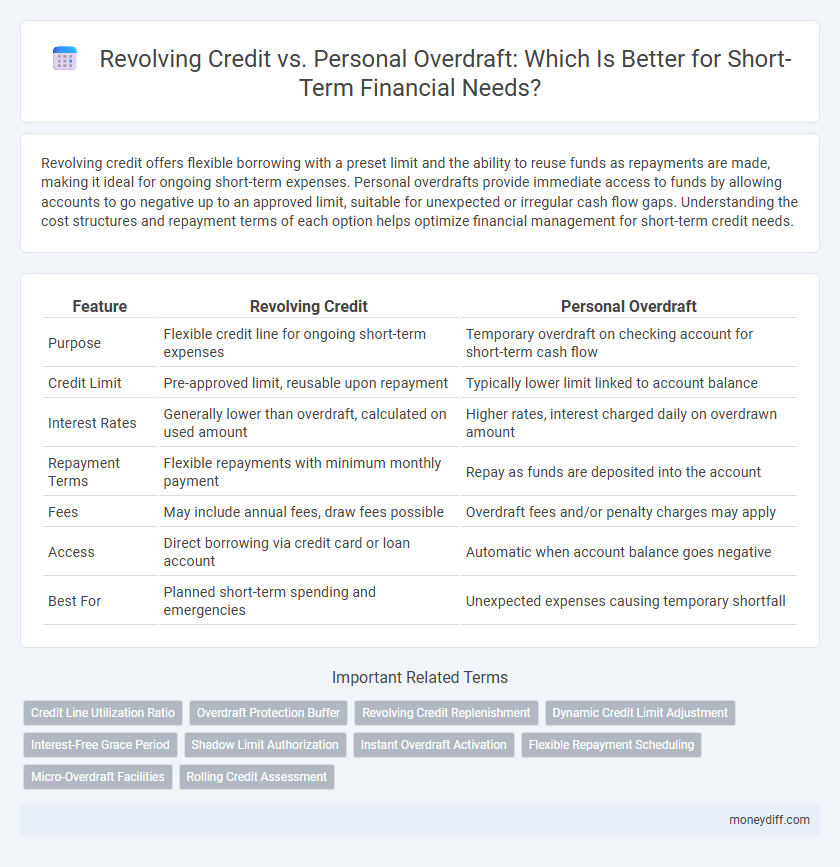

Revolving credit offers flexible borrowing with a preset limit and the ability to reuse funds as repayments are made, making it ideal for ongoing short-term expenses. Personal overdrafts provide immediate access to funds by allowing accounts to go negative up to an approved limit, suitable for unexpected or irregular cash flow gaps. Understanding the cost structures and repayment terms of each option helps optimize financial management for short-term credit needs.

Table of Comparison

| Feature | Revolving Credit | Personal Overdraft |

|---|---|---|

| Purpose | Flexible credit line for ongoing short-term expenses | Temporary overdraft on checking account for short-term cash flow |

| Credit Limit | Pre-approved limit, reusable upon repayment | Typically lower limit linked to account balance |

| Interest Rates | Generally lower than overdraft, calculated on used amount | Higher rates, interest charged daily on overdrawn amount |

| Repayment Terms | Flexible repayments with minimum monthly payment | Repay as funds are deposited into the account |

| Fees | May include annual fees, draw fees possible | Overdraft fees and/or penalty charges may apply |

| Access | Direct borrowing via credit card or loan account | Automatic when account balance goes negative |

| Best For | Planned short-term spending and emergencies | Unexpected expenses causing temporary shortfall |

Understanding Revolving Credit and Personal Overdraft

Revolving credit is a flexible borrowing option that allows borrowers to access a preset credit limit repeatedly as they repay the balance, making it ideal for ongoing short-term financial needs. Personal overdrafts provide immediate access to extra funds by allowing accounts to go below zero, typically with lower limits and higher interest rates than revolving credit. Understanding the differences in interest rates, fees, and repayment structures is crucial when choosing between revolving credit and personal overdrafts for managing cash flow gaps effectively.

Key Differences Between Revolving Credit and Overdrafts

Revolving credit offers a preset credit limit that borrowers can use, repay, and reuse over time, providing flexible borrowing for ongoing short-term needs, while a personal overdraft allows temporary overspending of a linked bank account up to an authorized limit. Interest on revolving credit is typically charged only on the outstanding balance, whereas overdraft interest applies on the overdrawn amount, often with higher rates and fees. Unlike overdrafts, revolving credit agreements usually involve fixed repayment terms and structured approval processes, making them suitable for planned short-term financing.

Eligibility Criteria for Revolving Credit vs Personal Overdraft

Revolving credit eligibility typically requires a good credit score, stable income, and proof of repayment capacity, making it suitable for individuals with established financial histories. Personal overdrafts often have more flexible eligibility criteria, relying primarily on the existing bank account relationship and average monthly income to determine credit limits. Understanding these differences helps consumers choose the best short-term credit option based on their creditworthiness and immediate financial needs.

Interest Rates: Comparing Revolving Credit and Overdraft Fees

Revolving credit typically charges lower interest rates than personal overdrafts, making it more cost-effective for managing short-term financial needs. Personal overdraft fees can accumulate quickly due to higher daily interest rates and additional penalty charges on exceeded limits. Comparing the annual percentage rates (APR) of revolving credit versus overdraft fees reveals significant savings potential with revolving credit for ongoing short-term borrowing.

Credit Limits and Accessibility for Short-Term Borrowing

Revolving credit offers flexible credit limits that can be adjusted based on the borrower's creditworthiness and repayment history, making it ideal for managing ongoing short-term borrowing needs. Personal overdrafts provide immediate access to funds up to a predetermined limit linked to the checking account, suitable for unexpected expenses but often with higher interest rates and fees. Accessibility in revolving credit depends on credit approvals, while overdrafts offer instant liquidity without additional approval, enhancing convenience for urgent short-term financial demands.

Flexibility and Usage of Revolving Credit vs Overdraft

Revolving credit offers greater flexibility than personal overdrafts by allowing borrowers to access funds repeatedly up to a preset limit without the need for reapplication, making it ideal for ongoing short-term financial needs. Personal overdrafts provide a quick cash buffer linked to a checking account but often come with stricter limits and higher fees, restricting their usage for extended or multiple expenses. The revolving credit structure supports better cash flow management by enabling controlled borrowing and repayment cycles, whereas overdrafts serve as an emergency fund with less predictable costs.

Impact on Credit Score: Revolving Credit vs Overdraft

Revolving credit utilization directly influences credit scores, with high balances potentially lowering scores due to increased credit utilization ratios. Personal overdrafts, while linked to checking accounts, typically do not appear on credit reports unless defaults occur, thus having minimal direct impact on credit scores. Managing revolving credit responsibly by maintaining low balances and timely payments fosters positive credit score effects, unlike overdraft usage which can lead to fees but generally does not improve credit history.

Repayment Terms and Structures Explained

Revolving credit offers flexible repayment terms with a minimum monthly payment based on outstanding balances, allowing borrowers to carry debt over multiple billing cycles with varying interest rates. Personal overdrafts typically require repayment within a shorter period, often tied to the next deposit cycle, with interest charged only on the overdrawn amount and potentially higher fees. Understanding these differences helps in choosing the right short-term credit option based on cash flow and repayment capability.

Pros and Cons: Choosing the Right Option

Revolving credit offers flexible borrowing with a preset limit, allowing multiple withdrawals and repayments, ideal for managing ongoing short-term expenses but may have higher interest rates if not repaid quickly. Personal overdrafts provide immediate access to funds tied to a bank account, convenient for occasional shortfalls but often come with fees and limited credit amounts. Evaluating the cost of interest, fees, repayment terms, and your specific cash flow needs helps determine whether revolving credit or a personal overdraft best suits short-term financial demands.

Tips for Managing Short-Term Credit Responsibly

Prioritize timely payments to avoid high interest rates associated with revolving credit and personal overdrafts. Regularly monitor your account balances and credit utilization ratios to maintain financial control and prevent unnecessary fees. Establish a repayment plan that targets reducing outstanding balances quickly, minimizing the risk of debt accumulation.

Related Important Terms

Credit Line Utilization Ratio

Revolving credit and personal overdrafts both affect the credit line utilization ratio, a key factor in credit scoring models that compares the amount of credit used to the total available credit limit. Maintaining a low utilization ratio below 30% on revolving credit or overdraft facilities helps improve creditworthiness and reduces the cost of borrowing for short-term financial needs.

Overdraft Protection Buffer

Overdraft protection buffers provide a crucial safety net for personal overdrafts by preventing declined transactions and excessive fees, making them ideal for short-term liquidity needs. Revolving credit offers a pre-approved credit limit with flexible repayment options but often involves higher interest rates and stricter qualification criteria compared to overdraft protection.

Revolving Credit Replenishment

Revolving credit offers an automatic replenishment feature that allows borrowers to reuse the available credit limit as they repay their balance, providing continuous access to funds for short-term needs without reapplying. In contrast, personal overdrafts typically do not replenish automatically, requiring explicit bank approval or repayment before further usage.

Dynamic Credit Limit Adjustment

Revolving credit offers flexible borrowing with dynamically adjustable credit limits based on repayment behavior and creditworthiness, allowing users to access varying amounts as short-term financial needs fluctuate. Personal overdrafts provide a preset credit limit linked to the bank account, offering immediate access to funds but with less flexibility in limit adjustments compared to revolving credit options.

Interest-Free Grace Period

Revolving credit typically offers an interest-free grace period of up to 55 days, allowing users to manage short-term cash flow without immediate finance charges, while personal overdrafts usually incur interest from the day the overdraft is utilized. Choosing revolving credit can minimize interest costs during short-term borrowing when payments are made within the grace period, whereas personal overdrafts provide more flexible access but often with higher ongoing interest expenses.

Shadow Limit Authorization

Shadow limit authorization in revolving credit offers enhanced flexibility by allowing users to exceed their preset credit limits temporarily without immediate penalties, which contrasts with personal overdrafts that typically impose stricter limits and fees for surpassing authorized amounts. This feature ensures short-term liquidity needs are met efficiently while maintaining better control over credit utilization and minimizing unexpected costs.

Instant Overdraft Activation

Revolving credit offers flexible borrowing with preset limits and interest applied only to the utilized amount, enabling quick access to funds without repeated approvals. Personal overdraft provides instant overdraft activation linked to your current account, allowing immediate coverage of short-term expenses up to a predetermined limit.

Flexible Repayment Scheduling

Revolving credit offers flexible repayment scheduling with the ability to borrow, repay, and borrow again up to a set limit, ideal for managing ongoing short-term cash flow needs. Personal overdrafts provide variable repayment options based on the overdraft limit linked to a checking account, allowing users to cover immediate expenses without fixed repayment dates.

Micro-Overdraft Facilities

Micro-overdraft facilities offer a flexible, short-term borrowing option with lower limits compared to traditional revolving credit, tailored for immediate cash flow needs. Unlike personal overdrafts, these micro-overdrafts often feature reduced fees and simpler approval processes, making them ideal for small transactions and emergency expenses.

Rolling Credit Assessment

Revolving credit offers flexible borrowing with a preset credit limit, allowing users to carry balances and make minimum payments, ideal for managing short-term financial needs without frequent credit assessments. Personal overdrafts provide immediate access to funds linked to a checking account but typically involve stricter rolling credit assessments and higher interest rates, making them less flexible for ongoing short-term borrowing.

Revolving Credit vs Personal Overdraft for Short-Term Needs Infographic

moneydiff.com

moneydiff.com