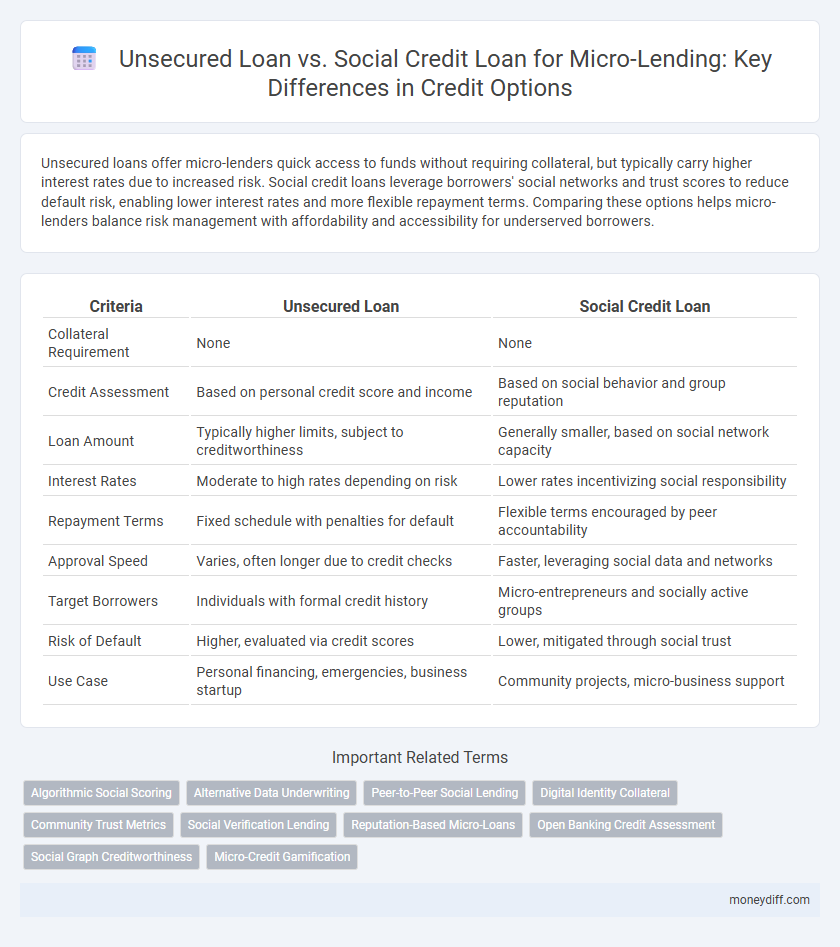

Unsecured loans offer micro-lenders quick access to funds without requiring collateral, but typically carry higher interest rates due to increased risk. Social credit loans leverage borrowers' social networks and trust scores to reduce default risk, enabling lower interest rates and more flexible repayment terms. Comparing these options helps micro-lenders balance risk management with affordability and accessibility for underserved borrowers.

Table of Comparison

| Criteria | Unsecured Loan | Social Credit Loan |

|---|---|---|

| Collateral Requirement | None | None |

| Credit Assessment | Based on personal credit score and income | Based on social behavior and group reputation |

| Loan Amount | Typically higher limits, subject to creditworthiness | Generally smaller, based on social network capacity |

| Interest Rates | Moderate to high rates depending on risk | Lower rates incentivizing social responsibility |

| Repayment Terms | Fixed schedule with penalties for default | Flexible terms encouraged by peer accountability |

| Approval Speed | Varies, often longer due to credit checks | Faster, leveraging social data and networks |

| Target Borrowers | Individuals with formal credit history | Micro-entrepreneurs and socially active groups |

| Risk of Default | Higher, evaluated via credit scores | Lower, mitigated through social trust |

| Use Case | Personal financing, emergencies, business startup | Community projects, micro-business support |

Understanding Unsecured Loans: Key Features

Unsecured loans for micro-lending provide borrowers access to funds without requiring collateral, relying primarily on creditworthiness and income verification. These loans typically feature higher interest rates to compensate for the increased lender risk and often have flexible repayment terms suitable for small-scale entrepreneurs. Understanding the risks and benefits associated with unsecured loans is crucial for borrowers seeking immediate capital without asset pledges compared to social credit loans that may include community-based guarantees.

What is a Social Credit Loan?

A Social Credit Loan in micro-lending is a financial product that leverages an individual's social behavior and community reputation as collateral instead of traditional credit history or physical assets. This type of loan assesses trustworthiness through social networks, peer endorsements, and repayment behaviors within the community, enabling access to credit for those lacking formal credit records. Unlike unsecured loans that rely solely on credit scores and financial statements, Social Credit Loans focus on social capital to reduce lending risk and promote financial inclusion.

Eligibility Criteria for Unsecured vs Social Credit Loans

Eligibility criteria for unsecured loans typically require a stable income, good credit history, and minimal existing debt, making them accessible to individuals with reliable financial backgrounds. Social credit loans leverage community reputation and social behavior data, allowing borrowers with limited formal credit history to qualify through peer endorsements and social trust scores. Micro-lending platforms often compare these criteria to tailor loan products, balancing risk assessment with inclusive financial access.

Interest Rates: Comparing Unsecured and Social Credit Loans

Unsecured loans typically carry higher interest rates due to the absence of collateral, reflecting greater risk for lenders in micro-lending scenarios. Social credit loans often benefit from more favorable interest rates as they leverage community trust and borrower reputation, reducing the lender's risk exposure. Analyzing these rates is crucial for micro-lenders aiming to balance affordability for borrowers with sustainable lending practices.

Application Process: Steps and Requirements

Unsecured loan applications for micro-lending primarily require proof of income, identification, and a credit history check, enabling faster approval without collateral. Social credit loans involve a more detailed eligibility assessment, including social behavior data, community standing, and sometimes digital footprint analysis to verify trustworthiness. Both processes demand accurate documentation, but social credit loans emphasize social reliability metrics alongside financial records.

Credit Assessment: Traditional vs Social Credit Approaches

Credit assessment for unsecured loans primarily relies on traditional financial metrics such as credit scores, income verification, and debt-to-income ratios, which often exclude micro-entrepreneurs with limited formal credit history. Social credit loans leverage alternative data sources, including social behavior, transaction history, and peer interactions, to evaluate trustworthiness and repayment capacity within micro-lending communities. This innovative approach enhances credit accessibility by incorporating non-traditional indicators that reflect real-time social and economic engagement.

Risks and Benefits of Unsecured Loans

Unsecured loans for micro-lending pose higher default risks due to the absence of collateral, driving lenders to impose higher interest rates to mitigate potential losses. Benefits of unsecured loans include quicker approval processes and broader accessibility for borrowers lacking assets, facilitating financial inclusion. However, the increased lender risk necessitates stringent credit assessments and often results in limited loan amounts compared to social credit loans that leverage social trust to reduce default probability.

Social Credit Loans: Potential Advantages for Micro-Borrowers

Social credit loans offer micro-borrowers access to credit based on their social behaviors and repayment histories rather than traditional collateral, reducing entry barriers. These loans can encourage financial inclusion by extending credit to underserved populations who lack conventional credit profiles. Enhanced trust and community-based assessments often lead to lower default rates and better loan terms for micro-borrowers.

Repayment Terms and Flexibility

Unsecured loans for micro-lending typically feature fixed repayment schedules with less flexibility, requiring borrowers to meet predetermined installment amounts and due dates regardless of cash flow fluctuations. In contrast, social credit loans often offer adaptable repayment terms that adjust based on borrowers' social behaviors or community support, enabling greater flexibility in payment timing and amounts. This flexibility in social credit loans can reduce default risk and improve borrower satisfaction by aligning repayment obligations with real-time financial capabilities.

Choosing the Right Micro-Lending Option for Your Needs

Unsecured loans offer quick access to funds without collateral, ideal for borrowers with solid credit histories seeking flexibility. Social credit loans leverage community reputation and social trust, enabling those with limited credit profiles to obtain microloans through peer endorsements. Evaluating creditworthiness, repayment capacity, and available social networks helps determine the most suitable micro-lending solution for individual financial needs.

Related Important Terms

Algorithmic Social Scoring

Unsecured loans rely primarily on credit history and income verification, whereas social credit loans use algorithmic social scoring to evaluate a borrower's trustworthiness based on social behavior, transaction patterns, and network data. This algorithmic approach enables micro-lending platforms to extend credit more inclusively by assessing real-time social interactions and alternative data points beyond traditional financial metrics.

Alternative Data Underwriting

Unsecured loans rely heavily on traditional credit scores, while social credit loans utilize alternative data such as social behavior and community interactions for underwriting, enabling micro-lenders to assess creditworthiness beyond conventional metrics. This alternative data approach increases financial inclusion by providing loans to individuals lacking formal credit history.

Peer-to-Peer Social Lending

Peer-to-peer social lending leverages community trust and social connections to offer unsecured loans with lower interest rates compared to traditional unsecured loans that rely solely on individual creditworthiness. This social credit loan model reduces default risk through collective accountability and transparent peer assessments, enhancing access to capital for micro-borrowers often excluded from conventional credit systems.

Digital Identity Collateral

Unsecured loans rely solely on borrower creditworthiness without collateral, often limiting access for micro-entrepreneurs lacking formal credit history, while social credit loans utilize digital identity collateral derived from social behavior and online activity to assess trustworthiness. Leveraging biometric verification, social media data, and transaction records strengthens risk assessment and enables more inclusive micro-lending by reducing reliance on traditional credit scoring.

Community Trust Metrics

Unsecured loans for micro-lending rely heavily on individual credit scores and financial history, whereas social credit loans prioritize community trust metrics such as peer evaluations, social network reputation, and collective repayment behavior. This approach leverages decentralized trust systems to reduce default risks and increase access to credit for borrowers lacking formal financial records.

Social Verification Lending

Social Credit Loans leverage social verification networks to assess borrower reliability, providing micro-lenders with a more accurate risk profile compared to traditional Unsecured Loans that rely solely on credit scores and financial history. This innovative approach enhances access to credit for underserved populations by utilizing social trust metrics and behavioral data, reducing default rates in micro-lending markets.

Reputation-Based Micro-Loans

Unsecured loans rely solely on borrower creditworthiness without collateral, often leading to higher interest rates and stricter eligibility criteria, whereas social credit loans utilize reputation-based assessments within community networks to enable micro-lending access for individuals lacking traditional credit history. Reputation-based micro-loans leverage peer evaluations, social data, and trust metrics to facilitate financial inclusion, reduce default risks, and promote sustainable lending practices among underserved populations.

Open Banking Credit Assessment

Unsecured loans for micro-lending typically rely on traditional credit scoring models, whereas social credit loans leverage alternative data such as social media behavior and transaction histories enabled by open banking credit assessment frameworks. Open banking integration enhances risk profiling accuracy by aggregating real-time financial data, improving access to credit for underserved micro-entrepreneurs.

Social Graph Creditworthiness

Social Credit Loans leverage the social graph creditworthiness by analyzing borrowers' peer networks and transaction histories to assess repayment risk more dynamically than traditional unsecured loans. This method enhances micro-lending accuracy by incorporating social trust signals, reducing default rates compared to standard unsecured loan models.

Micro-Credit Gamification

Unsecured loans provide micro-entrepreneurs immediate access to credit without collateral, while social credit loans leverage peer networks and trust-based scoring systems to enhance repayment reliability through gamified incentives. Micro-credit gamification integrates reward mechanisms and social challenges to motivate timely repayments and promote financial literacy among borrowers.

Unsecured Loan vs Social Credit Loan for micro-lending. Infographic

moneydiff.com

moneydiff.com