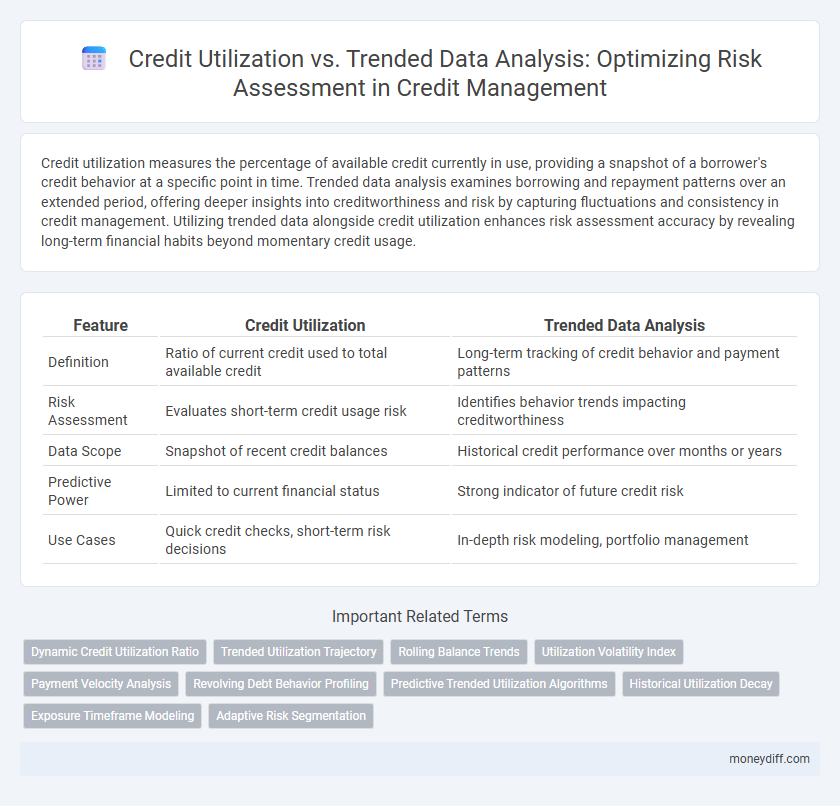

Credit utilization measures the percentage of available credit currently in use, providing a snapshot of a borrower's credit behavior at a specific point in time. Trended data analysis examines borrowing and repayment patterns over an extended period, offering deeper insights into creditworthiness and risk by capturing fluctuations and consistency in credit management. Utilizing trended data alongside credit utilization enhances risk assessment accuracy by revealing long-term financial habits beyond momentary credit usage.

Table of Comparison

| Feature | Credit Utilization | Trended Data Analysis |

|---|---|---|

| Definition | Ratio of current credit used to total available credit | Long-term tracking of credit behavior and payment patterns |

| Risk Assessment | Evaluates short-term credit usage risk | Identifies behavior trends impacting creditworthiness |

| Data Scope | Snapshot of recent credit balances | Historical credit performance over months or years |

| Predictive Power | Limited to current financial status | Strong indicator of future credit risk |

| Use Cases | Quick credit checks, short-term risk decisions | In-depth risk modeling, portfolio management |

Understanding Credit Utilization: Key Concepts

Credit utilization, the ratio of current credit balances to total available credit, serves as a critical indicator in risk assessment by directly reflecting borrowing behavior and payment capacity. Trended data analysis enhances this insight by examining utilization patterns over time, allowing lenders to identify consistent financial habits rather than isolated fluctuations. Understanding these concepts enables more accurate prediction of credit risk, improving decision-making in lending and credit management strategies.

Introduction to Trended Data Analysis in Credit Risk

Trended Data Analysis in credit risk examines credit behavior over time by tracking monthly data points like balances, payments, and credit limits, offering a dynamic view beyond static credit utilization ratios. This method provides deeper insights into a borrower's repayment patterns and financial habits, enabling more accurate risk assessment compared to single-point utilization metrics. Lenders leverage trended data to predict future credit behavior, improve decision-making, and reduce default risks with a comprehensive evaluation of credit trends.

Credit Utilization vs. Trended Data: Primary Differences

Credit utilization measures the percentage of available credit currently used, reflecting short-term borrower behavior, while trended data analysis examines patterns of credit usage over time to identify consistent habits and risk trends. Credit utilization provides a snapshot of credit risk at a specific moment, whereas trended data offers a dynamic view by incorporating fluctuations, repayment trends, and credit limits over several months. Lenders prioritize trended data analysis for a more comprehensive risk assessment, as it reduces volatility and better predicts future credit performance compared to single-point credit utilization ratios.

Impact of Credit Utilization on Risk Assessment

Credit utilization, representing the ratio of revolving credit balances to credit limits, plays a critical role in risk assessment by directly influencing credit scores and indicating borrower behavior under financial stress. Trended data analysis provides a comprehensive view by evaluating credit utilization patterns over time, capturing fluctuations that single-point-in-time measurements might miss. Higher or increasing credit utilization trends often signal elevated credit risk, prompting lenders to adjust credit limits or interest rates accordingly.

How Trended Data Enhances Credit Decisioning

Trended data analysis provides a dynamic view of credit behavior by tracking credit utilization patterns over time rather than relying on a single snapshot, enabling more accurate risk assessment. This temporal insight helps lenders identify consistent payment habits and emerging financial stress signals, improving predictive accuracy. By incorporating trended data, credit decisioning models better differentiate between transient credit issues and chronic problems, leading to more informed lending decisions.

Limitations of Traditional Credit Utilization Metrics

Traditional credit utilization metrics often provide a limited snapshot by focusing solely on the ratio of current balances to credit limits, ignoring historical spending and repayment patterns that reveal true credit behavior. This narrow view can lead to inaccurate risk assessment, as it fails to account for fluctuations over time and the consumer's ability to manage credit responsibly during different periods. Trended data analysis overcomes these limitations by offering a comprehensive, time-based perspective on credit usage, enabling more precise prediction of default risk.

Benefits of Integrating Trended Data in Credit Evaluations

Integrating trended data in credit evaluations enhances risk assessment by providing a dynamic view of consumer credit behavior over time rather than relying solely on static credit utilization snapshots. Trended data captures patterns such as payment regularity, credit limit fluctuations, and month-to-month balance changes, enabling more accurate prediction of future credit risk. This comprehensive analysis reduces default rates and improves lending decisions by identifying creditworthiness through behavioral trends rather than isolated data points.

Case Studies: Risk Prediction with Trended Data vs. Credit Utilization

Case studies reveal that trended data analysis offers superior risk prediction compared to traditional credit utilization metrics by capturing long-term payment behaviors and spending patterns. Financial institutions leveraging trended data achieve higher accuracy in identifying potential defaults, enabling more precise credit risk management. Integrating trended data into credit assessments enhances predictive power beyond static credit utilization ratios, reducing losses and improving lending decisions.

The Future of Credit Risk Assessment Methodologies

Credit utilization remains a critical factor in traditional credit risk assessment, reflecting borrowers' current debt levels relative to their credit limits. Trended data analysis, which examines historical patterns of credit usage and repayment behavior over time, provides deeper insights into creditworthiness and financial stability. Future credit risk methodologies will increasingly incorporate machine learning models that leverage both credit utilization metrics and trended data to enhance predictive accuracy and identify potential risks earlier.

Best Practices for Lenders Using Credit Utilization and Trended Data

Lenders enhance risk assessment accuracy by integrating credit utilization ratios with trended data analysis, enabling a comprehensive view of borrower behavior over time. Best practices include monitoring monthly credit utilization fluctuations alongside payment patterns, which reveal financial discipline beyond static credit scores. Leveraging trended data helps identify emerging risks and opportunities, allowing lenders to make more informed credit decisions and improve portfolio performance.

Related Important Terms

Dynamic Credit Utilization Ratio

Dynamic Credit Utilization Ratio offers a more accurate risk assessment by capturing fluctuations in credit usage over time rather than relying on static credit utilization snapshots. Integrating trended data analysis reveals patterns in repayment behavior and credit management, enabling lenders to predict creditworthiness with greater precision.

Trended Utilization Trajectory

Trended Utilization Trajectory provides a dynamic view of credit usage patterns over time, offering deeper insights into borrower behavior compared to static Credit Utilization metrics. This longitudinal analysis enhances risk assessment accuracy by identifying consistent credit management trends and potential future credit stress.

Rolling Balance Trends

Rolling balance trends in credit utilization provide a dynamic view of a borrower's debt patterns, revealing fluctuations that trended data analysis captures over time for more precise risk assessment. By examining these continuous balances rather than static snapshots, lenders can identify potential risk indicators such as persistent high utilization or sudden spikes, leading to more informed credit decisions and improved default prediction.

Utilization Volatility Index

Credit utilization directly impacts risk assessment by indicating how much available credit a borrower uses, while trended data analysis offers a longitudinal view of spending and payment patterns. The Utilization Volatility Index measures fluctuations in credit usage, providing enhanced predictive power for default risk beyond static utilization ratios.

Payment Velocity Analysis

Payment velocity analysis provides deeper insights into credit risk by examining the frequency and speed of payments rather than just credit utilization ratios. Trended data analysis complements this by tracking payment behaviors over time, enabling lenders to identify patterns that predict default risk more accurately than static credit utilization metrics alone.

Revolving Debt Behavior Profiling

Revolving debt behavior profiling leverages credit utilization ratios and trended data analysis to deliver a comprehensive risk assessment by tracking patterns in balance fluctuations and payment consistency over time. This approach enhances predictive accuracy by combining static credit utilization metrics with dynamic insights from historical spending and repayment trends.

Predictive Trended Utilization Algorithms

Predictive Trended Utilization Algorithms analyze credit utilization patterns over time, providing a dynamic risk assessment by detecting subtle changes in consumer behavior that static credit utilization ratios might miss. This approach enhances traditional credit scoring models by integrating temporal data trends, resulting in more accurate predictions of credit risk and potential default probability.

Historical Utilization Decay

Historical utilization decay in credit risk assessment highlights the diminishing impact of past credit utilization patterns on current credit scores, enabling more accurate predictions by integrating trended data analysis. Unlike traditional credit utilization metrics that focus on static snapshot ratios, trended data considers the trajectory and decay of utilization over time, providing a nuanced view of borrower behavior and improving risk differentiation.

Exposure Timeframe Modeling

Credit utilization ratios provide a snapshot of borrower behavior but may not capture fluctuations over time, whereas trended data analysis incorporates exposure timeframe modeling to evaluate credit risk more accurately by tracking payment patterns and credit usage longitudinally. Incorporating exposure timeframe modeling enhances risk assessment by revealing short-term spikes or gradual increases in credit utilization that static metrics might overlook.

Adaptive Risk Segmentation

Credit utilization offers a snapshot of a borrower's current debt relative to their credit limits, while trended data analysis examines patterns over time, providing deeper insights for risk assessment. Adaptive risk segmentation leverages both metrics to dynamically categorize borrowers, enhancing the precision of credit risk models and enabling proactive management strategies.

Credit Utilization vs Trended Data Analysis for risk assessment. Infographic

moneydiff.com

moneydiff.com