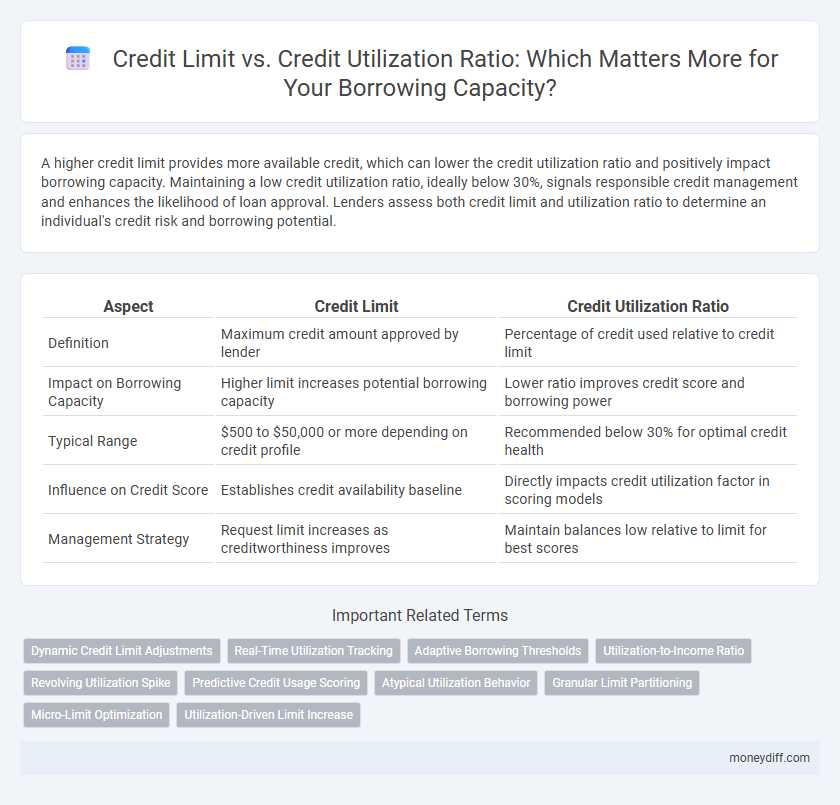

A higher credit limit provides more available credit, which can lower the credit utilization ratio and positively impact borrowing capacity. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management and enhances the likelihood of loan approval. Lenders assess both credit limit and utilization ratio to determine an individual's credit risk and borrowing potential.

Table of Comparison

| Aspect | Credit Limit | Credit Utilization Ratio |

|---|---|---|

| Definition | Maximum credit amount approved by lender | Percentage of credit used relative to credit limit |

| Impact on Borrowing Capacity | Higher limit increases potential borrowing capacity | Lower ratio improves credit score and borrowing power |

| Typical Range | $500 to $50,000 or more depending on credit profile | Recommended below 30% for optimal credit health |

| Influence on Credit Score | Establishes credit availability baseline | Directly impacts credit utilization factor in scoring models |

| Management Strategy | Request limit increases as creditworthiness improves | Maintain balances low relative to limit for best scores |

Understanding Credit Limit and Credit Utilization Ratio

Credit limit represents the maximum amount of credit a lender extends to a borrower, serving as a key indicator of borrowing capacity. Credit utilization ratio measures the percentage of the credit limit currently being used, directly impacting credit scores and borrowing potential. Maintaining a low credit utilization ratio relative to the credit limit enhances creditworthiness and increases access to additional credit.

Credit Limit: Definition and Importance

Credit limit is the maximum amount a lender allows a borrower to charge on a credit account, directly impacting borrowing capacity and financial flexibility. A higher credit limit can improve credit utilization ratio, which is calculated by dividing current credit card balances by the credit limit, influencing credit scores and loan eligibility. Maintaining a low credit utilization ratio relative to the credit limit signals responsible credit management, enhancing the potential to access larger loans or credit lines.

What Is Credit Utilization Ratio?

Credit utilization ratio is the percentage of a borrower's available credit limit currently being used and is calculated by dividing total credit balances by total credit limits. Maintaining a low credit utilization ratio, ideally below 30%, positively impacts credit scores and increases borrowing capacity. Lenders assess credit utilization to evaluate credit risk and determine the maximum credit a borrower can responsibly manage.

How Credit Limits Impact Borrowing Capacity

Credit limits directly influence borrowing capacity by defining the maximum amount of credit available to a borrower, thereby setting the upper boundary for potential debt. A higher credit limit can enhance credit utilization ratio management, allowing individuals to maintain a lower ratio, which positively affects credit scores and increases borrowing potential. Lenders often assess both credit limits and utilization ratios to evaluate risk and determine eligibility for additional credit or loans.

Credit Utilization Ratio’s Effect on Your Credit Score

Credit utilization ratio, calculated by dividing total credit card balances by total credit limits, plays a crucial role in determining your credit score and borrowing capacity. Maintaining a low credit utilization ratio, ideally below 30%, signals responsible credit management to lenders and positively impacts your credit rating. High credit utilization ratios can lower your credit score, reducing your chances of qualifying for higher credit limits and favorable loan terms.

Comparing Credit Limit vs. Credit Utilization Ratio

Comparing credit limit and credit utilization ratio reveals crucial insights into borrowing capacity, where credit limit denotes the maximum amount a lender permits, and credit utilization ratio measures the percentage of that limit currently used. Maintaining a low credit utilization ratio, ideally below 30%, enhances credit scores and borrowing power, while a high credit limit alone does not guarantee increased capacity if utilization is excessive. Lenders prioritize utilization metrics over credit limits when assessing risk, making effective management of usage vital for optimizing credit potential.

Strategies to Increase Your Credit Limit

Increasing your credit limit effectively boosts your borrowing capacity by lowering your credit utilization ratio, a key factor in credit scoring models. Strategies to raise your credit limit include requesting increases from your current creditor after demonstrating responsible repayment history, reducing existing debt to improve creditworthiness, and maintaining a steady income to support higher limits. Ensuring timely payments and limiting new credit inquiries also enhances your profile, encouraging lenders to approve higher credit limits and expand your borrowing power.

Tips to Maintain a Healthy Credit Utilization Ratio

Maintain a credit utilization ratio below 30% to optimize your borrowing capacity and avoid negatively impacting your credit score. Regularly monitor your credit card balances and pay down debts before the statement closing date to keep utilization low. Utilizing multiple credit cards responsibly can help distribute the balance and maintain a healthier overall utilization ratio.

Common Mistakes with Credit Limits and Utilization

Misunderstanding the distinction between credit limit and credit utilization ratio often leads to borrowing capacity errors, as credit limit represents the maximum available credit, while utilization ratio indicates the percentage of that credit currently in use. Overextending the credit utilization ratio above 30% can negatively impact credit scores, reducing borrowing capacity even when the credit limit is high. Failure to monitor these metrics frequently results in missed opportunities for improving credit health and obtaining favorable loan terms.

Maximizing Borrowing Capacity: Practical Recommendations

Maintaining a credit utilization ratio below 30% relative to the credit limit significantly enhances borrowing capacity by signaling responsible credit management to lenders. Regularly increasing your credit limit while keeping balances low improves credit scores, thereby maximizing available credit for future loans. Monitoring and adjusting these factors strategically ensures optimal borrowing potential without increasing debt risk.

Related Important Terms

Dynamic Credit Limit Adjustments

Dynamic credit limit adjustments optimize borrowing capacity by automatically increasing or decreasing the credit limit based on real-time spending patterns, payment history, and credit risk assessment. Maintaining a low credit utilization ratio within these adjusted limits improves credit scores and enhances eligibility for larger loans.

Real-Time Utilization Tracking

Real-time utilization tracking provides immediate insights into the credit utilization ratio, enabling more accurate assessment of borrowing capacity based on current credit limit usage. Monitoring this dynamic data helps lenders and borrowers optimize credit management, preventing overextension while maximizing available credit potential.

Adaptive Borrowing Thresholds

Credit utilization ratio, the percentage of available credit used, directly impacts borrowing capacity by influencing lenders' risk assessment models, while credit limit sets the maximum borrowing ceiling. Adaptive borrowing thresholds adjust these limits dynamically based on utilization patterns and credit behavior to optimize borrowing power without increasing default risk.

Utilization-to-Income Ratio

The utilization-to-income ratio measures the portion of available credit a borrower uses relative to their income, directly impacting borrowing capacity by indicating credit management efficiency. Lower utilization ratios signal responsible credit use, enhancing credit scores and increasing the likelihood of higher credit limits and favorable loan terms.

Revolving Utilization Spike

A sudden spike in revolving credit utilization ratio significantly impacts borrowing capacity by indicating higher credit risk to lenders despite an unchanged credit limit. Maintaining a low credit utilization ratio below 30% is crucial for optimal credit health and maximizing available credit without triggering adverse effects on credit scores.

Predictive Credit Usage Scoring

Credit limit establishes the maximum credit available to a borrower, while the credit utilization ratio measures the percentage of that limit currently used, serving as a critical metric in Predictive Credit Usage Scoring. High utilization ratios relative to the credit limit often indicate increased risk, impacting borrowing capacity assessments and creditworthiness evaluations by predictive models.

Atypical Utilization Behavior

Atypical credit utilization behavior, such as consistently maxing out credit limits or maintaining unusually low utilization, can distort borrowing capacity assessments by creditors who rely on standard utilization ratios to gauge risk. Lenders may view erratic credit utilization patterns as potential indicators of financial instability, leading to stricter credit limit adjustments or reduced loan approval chances.

Granular Limit Partitioning

Granular limit partitioning enhances borrowing capacity analysis by dividing the overall credit limit into detailed segments, allowing precise monitoring of credit utilization ratios within each partition. This approach improves risk assessment accuracy and optimizes credit allocation by identifying underutilized segments and preventing overextension in specific credit categories.

Micro-Limit Optimization

Micro-limit optimization improves borrowing capacity by precisely calibrating the credit limit to maintain an optimal credit utilization ratio, typically below 30%, thereby enhancing creditworthiness. Efficient management of credit limits in relation to utilization ratios reduces credit risk and maximizes access to available credit without increasing debt exposure.

Utilization-Driven Limit Increase

Credit utilization ratio directly impacts borrowing capacity by indicating the percentage of the credit limit currently in use, influencing lenders' decisions on credit limit adjustments. Consistently low utilization can trigger utilization-driven limit increases, enhancing available credit without a hard inquiry, thereby improving overall credit health and borrowing potential.

Credit limit vs Credit utilization ratio for borrowing capacity. Infographic

moneydiff.com

moneydiff.com